Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Any email i can send for a clearer image ? i think it has to do with your phone Student instructionsThis worstel is for protere

Any email i can send for a clearer image ?

i think it has to do with your phone

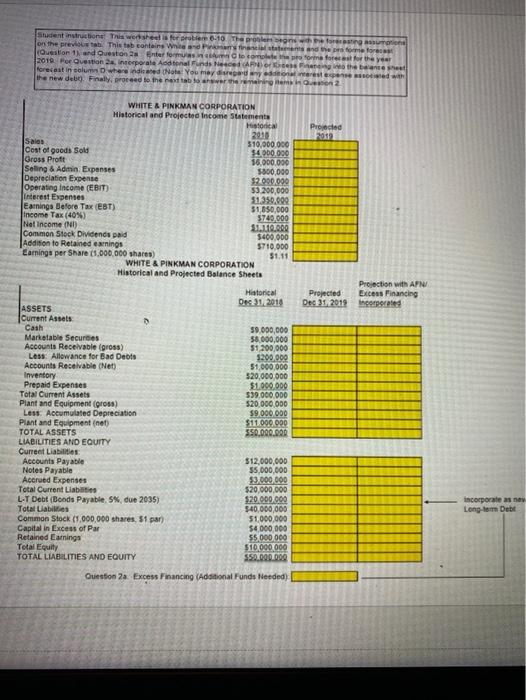

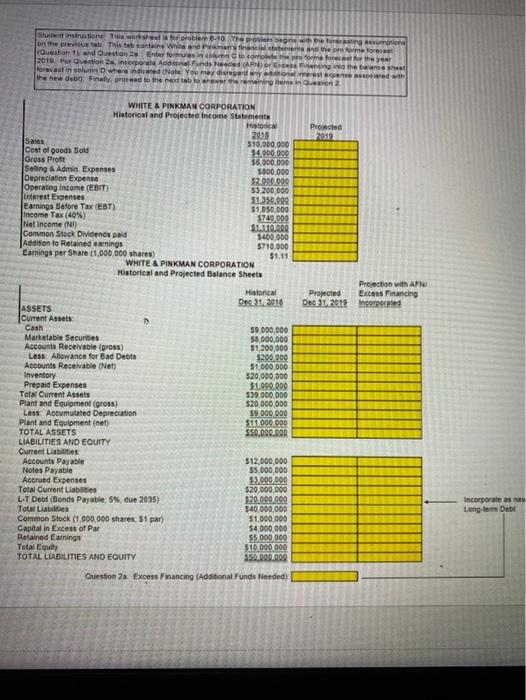

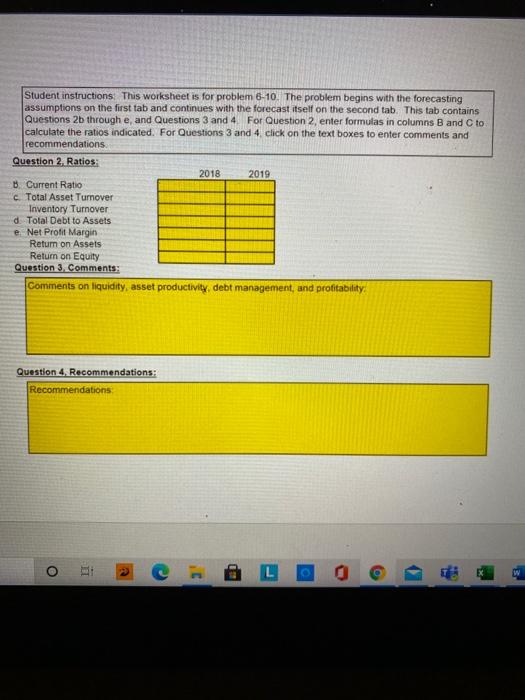

Student instructionsThis worstel is for protere 0.10 The prone we are so on the prevista This tab contains With the form forecast Questor 1) and Questions for formas form forecast for the year 2012 For Question 2 Interporale Add tonal Funds CARE the enteret forecast in solum where indicated Note: You may dead rested with the new debe Finally, proceed to the above the ring 2 Proced FO Projection with AFN Projected Excess Financing Dec 31, 2012 aporated WHITE & PINKMAN CORPORATION Historical and Projected Income Statements Historia 2935 Sales 310,000,000 Cost of goods Sold 5.4.200.000 Gross Pratt 16.000.000 Seling & Admin Expenses 5300,000 Depreciation Expense 52.000.000 Operating income (EBIT) $3.200,000 interest Expenses 31.350.000 Earnings Before Tax (EST) 31650,000 Income Tax (40%) 3740.000 Net Income (ND) S2.110.000 Common Stock Dividends paid $400.000 Addition to Retained earnings 5710,000 Earnings per Share 1,000,000 shares) 51.11 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets Historical Dec 31, 2016 ASSETS Current Assets Cash 59.000,000 Marketable Secundes 58.000,000 Accounts Receivable (gross) $1,200,000 Los Allowance for Bad Debts 5200,000 Accounts Receivable Net) 51,000,000 Inventory 520,000,000 Prepaid Expenses $1.000.000 Total Current Assets 539,000,000 Plant and Equipment (rosa) $20.000.000 Less Accumulated Depreciation 59000 000 Plant and Equipment (net) $11.000.000 TOTAL ASSETS 550.000.000 LIABILITIES AND EQUITY Current Liabilities Accounts Payable $12,000,000 Notes Payable 55.000.000 Accrued Expenses $3.000.000 Total Current Liabiti $20,000,000 L-T Debt (Bonds Payable. 5%, due 2035) $20.000.000 Total Liabilities 540,000,000 Common Stock (1,000,000 shares, 51 par 51,000,000 Capital in Excess of Par $4,000,000 Retained Earnings 55.000000 Total Equity $10.000000 TOTAL LIABILITIES AND EQUITY SS2.000.000 incorporate a new Long term Debt Question 2a Excess Financing (Additional Funds Needed) ile Preview Page 3 > of 3 ZOOM + Student instructions. This worksheet is for problem 6-10. This tab contains forecasting assumptions. The next tab contains White & Pinkman Corporation's financial statements and the pro forma forecast (Question 1.) The final tab contains questions 2 a-e, 3, and 4. Review the forecasting assumptions below and then proceed to the next tab to complete the forecast PROBLEM 6-10 White & Pinkman Corporation Forecasting Assumptions: Sales growth 20% given Cost of Goods Sold Selling & Admin Expenses Cash These items are projected to remain the same Marketable Securities Accounts Receivable percentage of sales in 2019 as they were in 2018. That Inventory is the same as saying that in 2019 the items will grow at the same rate as sales Prepaid Expenses Accounts Payable Accrued Expenses Depreciation Expense interest Expense Gross Plant & Equipment These items are projected to remain the Notes Payable same value in 2019 as they were in 2018 Long Term Debt Common Stock Capital in Excess of Par Tax rate 40% Dividends pay same dollar amount in 2019 as in 2018 Bad Debt Allowance 17% of accounts receivable > O 2 Student instructionsThis worstel is for protere 0.10 The prone we are so on the prevista This tab contains With the form forecast Questor 1) and Questions for formas form forecast for the year 2012 For Question 2 Interporale Add tonal Funds CARE the enteret forecast in solum where indicated Note: You may dead rested with the new debe Finally, proceed to the above the ring 2 Proced FO Projection with AFN Projected Excess Financing Dec 31, 2012 aporated WHITE & PINKMAN CORPORATION Historical and Projected Income Statements Historia 2935 Sales 310,000,000 Cost of goods Sold 5.4.200.000 Gross Pratt 16.000.000 Seling & Admin Expenses 5300,000 Depreciation Expense 52.000.000 Operating income (EBIT) $3.200,000 interest Expenses 31.350.000 Earnings Before Tax (EST) 31650,000 Income Tax (40%) 3740.000 Net Income (ND) S2.110.000 Common Stock Dividends paid $400.000 Addition to Retained earnings 5710,000 Earnings per Share 1,000,000 shares) 51.11 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets Historical Dec 31, 2016 ASSETS Current Assets Cash 59.000,000 Marketable Secundes 58.000,000 Accounts Receivable (gross) $1,200,000 Los Allowance for Bad Debts 5200,000 Accounts Receivable Net) 51,000,000 Inventory 520,000,000 Prepaid Expenses $1.000.000 Total Current Assets 539,000,000 Plant and Equipment (rosa) $20.000.000 Less Accumulated Depreciation 59000 000 Plant and Equipment (net) $11.000.000 TOTAL ASSETS 550.000.000 LIABILITIES AND EQUITY Current Liabilities Accounts Payable $12,000,000 Notes Payable 55.000.000 Accrued Expenses $3.000.000 Total Current Liabiti $20,000,000 L-T Debt (Bonds Payable. 5%, due 2035) $20.000.000 Total Liabilities 540,000,000 Common Stock (1,000,000 shares, 51 par 51,000,000 Capital in Excess of Par $4,000,000 Retained Earnings 55.000000 Total Equity $10.000000 TOTAL LIABILITIES AND EQUITY SS2.000.000 incorporate a new Long term Debt Question 2a Excess Financing (Additional Funds Needed) Student instructions. This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on the first tab and continues with the forecast itself on the second tab. This tab contains Questions 2b through e, and Questions 3 and 4 For Question 2, enter formulas in columns B and C to calculate the ratios indicated. For Questions 3 and 4 click on the text boxes to enter comments and recommendations Question 2 Ratios 2018 2019 B. Current Ratio c. Total Asset Turnover Inventory Turnover d. Total Debt to Assets e Net Profit Margin Return on Assets Return on Equity Question 3. Comments: Comments on liquidity, asset productivity, debt management, and profitability Question 4. Recommendations: Recommendations o 1 Student instructionsThis worstel is for protere 0.10 The prone we are so on the prevista This tab contains With the form forecast Questor 1) and Questions for formas form forecast for the year 2012 For Question 2 Interporale Add tonal Funds CARE the enteret forecast in solum where indicated Note: You may dead rested with the new debe Finally, proceed to the above the ring 2 Proced FO Projection with AFN Projected Excess Financing Dec 31, 2012 aporated WHITE & PINKMAN CORPORATION Historical and Projected Income Statements Historia 2935 Sales 310,000,000 Cost of goods Sold 5.4.200.000 Gross Pratt 16.000.000 Seling & Admin Expenses 5300,000 Depreciation Expense 52.000.000 Operating income (EBIT) $3.200,000 interest Expenses 31.350.000 Earnings Before Tax (EST) 31650,000 Income Tax (40%) 3740.000 Net Income (ND) S2.110.000 Common Stock Dividends paid $400.000 Addition to Retained earnings 5710,000 Earnings per Share 1,000,000 shares) 51.11 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets Historical Dec 31, 2016 ASSETS Current Assets Cash 59.000,000 Marketable Secundes 58.000,000 Accounts Receivable (gross) $1,200,000 Los Allowance for Bad Debts 5200,000 Accounts Receivable Net) 51,000,000 Inventory 520,000,000 Prepaid Expenses $1.000.000 Total Current Assets 539,000,000 Plant and Equipment (rosa) $20.000.000 Less Accumulated Depreciation 59000 000 Plant and Equipment (net) $11.000.000 TOTAL ASSETS 550.000.000 LIABILITIES AND EQUITY Current Liabilities Accounts Payable $12,000,000 Notes Payable 55.000.000 Accrued Expenses $3.000.000 Total Current Liabiti $20,000,000 L-T Debt (Bonds Payable. 5%, due 2035) $20.000.000 Total Liabilities 540,000,000 Common Stock (1,000,000 shares, 51 par 51,000,000 Capital in Excess of Par $4,000,000 Retained Earnings 55.000000 Total Equity $10.000000 TOTAL LIABILITIES AND EQUITY SS2.000.000 incorporate a new Long term Debt Question 2a Excess Financing (Additional Funds Needed) ile Preview Page 3 > of 3 ZOOM + Student instructions. This worksheet is for problem 6-10. This tab contains forecasting assumptions. The next tab contains White & Pinkman Corporation's financial statements and the pro forma forecast (Question 1.) The final tab contains questions 2 a-e, 3, and 4. Review the forecasting assumptions below and then proceed to the next tab to complete the forecast PROBLEM 6-10 White & Pinkman Corporation Forecasting Assumptions: Sales growth 20% given Cost of Goods Sold Selling & Admin Expenses Cash These items are projected to remain the same Marketable Securities Accounts Receivable percentage of sales in 2019 as they were in 2018. That Inventory is the same as saying that in 2019 the items will grow at the same rate as sales Prepaid Expenses Accounts Payable Accrued Expenses Depreciation Expense interest Expense Gross Plant & Equipment These items are projected to remain the Notes Payable same value in 2019 as they were in 2018 Long Term Debt Common Stock Capital in Excess of Par Tax rate 40% Dividends pay same dollar amount in 2019 as in 2018 Bad Debt Allowance 17% of accounts receivable > O 2 Student instructionsThis worstel is for protere 0.10 The prone we are so on the prevista This tab contains With the form forecast Questor 1) and Questions for formas form forecast for the year 2012 For Question 2 Interporale Add tonal Funds CARE the enteret forecast in solum where indicated Note: You may dead rested with the new debe Finally, proceed to the above the ring 2 Proced FO Projection with AFN Projected Excess Financing Dec 31, 2012 aporated WHITE & PINKMAN CORPORATION Historical and Projected Income Statements Historia 2935 Sales 310,000,000 Cost of goods Sold 5.4.200.000 Gross Pratt 16.000.000 Seling & Admin Expenses 5300,000 Depreciation Expense 52.000.000 Operating income (EBIT) $3.200,000 interest Expenses 31.350.000 Earnings Before Tax (EST) 31650,000 Income Tax (40%) 3740.000 Net Income (ND) S2.110.000 Common Stock Dividends paid $400.000 Addition to Retained earnings 5710,000 Earnings per Share 1,000,000 shares) 51.11 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets Historical Dec 31, 2016 ASSETS Current Assets Cash 59.000,000 Marketable Secundes 58.000,000 Accounts Receivable (gross) $1,200,000 Los Allowance for Bad Debts 5200,000 Accounts Receivable Net) 51,000,000 Inventory 520,000,000 Prepaid Expenses $1.000.000 Total Current Assets 539,000,000 Plant and Equipment (rosa) $20.000.000 Less Accumulated Depreciation 59000 000 Plant and Equipment (net) $11.000.000 TOTAL ASSETS 550.000.000 LIABILITIES AND EQUITY Current Liabilities Accounts Payable $12,000,000 Notes Payable 55.000.000 Accrued Expenses $3.000.000 Total Current Liabiti $20,000,000 L-T Debt (Bonds Payable. 5%, due 2035) $20.000.000 Total Liabilities 540,000,000 Common Stock (1,000,000 shares, 51 par 51,000,000 Capital in Excess of Par $4,000,000 Retained Earnings 55.000000 Total Equity $10.000000 TOTAL LIABILITIES AND EQUITY SS2.000.000 incorporate a new Long term Debt Question 2a Excess Financing (Additional Funds Needed) Student instructions. This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on the first tab and continues with the forecast itself on the second tab. This tab contains Questions 2b through e, and Questions 3 and 4 For Question 2, enter formulas in columns B and C to calculate the ratios indicated. For Questions 3 and 4 click on the text boxes to enter comments and recommendations Question 2 Ratios 2018 2019 B. Current Ratio c. Total Asset Turnover Inventory Turnover d. Total Debt to Assets e Net Profit Margin Return on Assets Return on Equity Question 3. Comments: Comments on liquidity, asset productivity, debt management, and profitability Question 4. Recommendations: Recommendations o 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started