Answered step by step

Verified Expert Solution

Question

1 Approved Answer

any gelp is greatly appreciated! Tried to get it as clear as possible. (50 points) 1. The annual (56) returns for years 2007-2021 (15-years) for

any gelp is greatly appreciated!

Tried to get it as clear as possible.

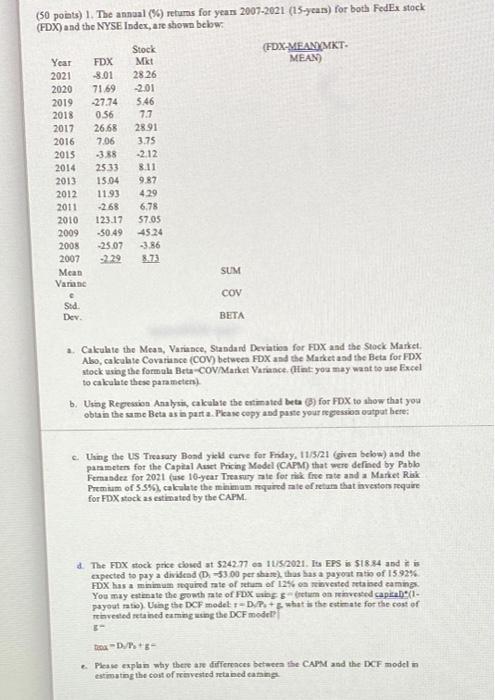

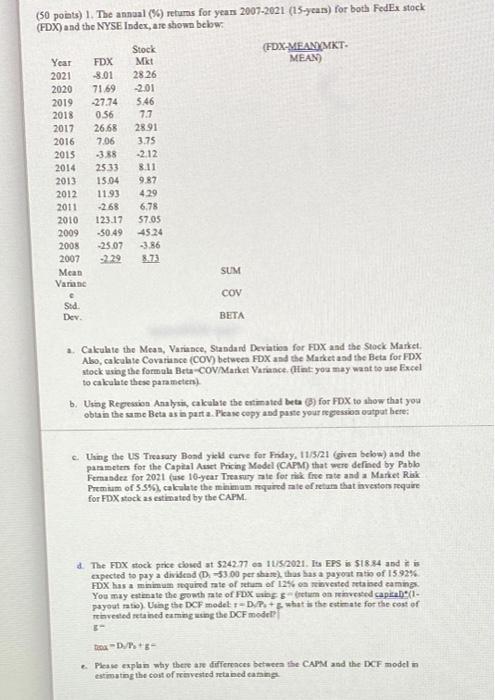

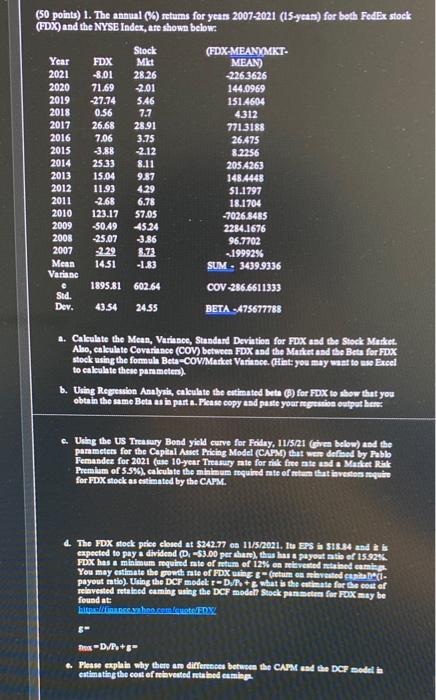

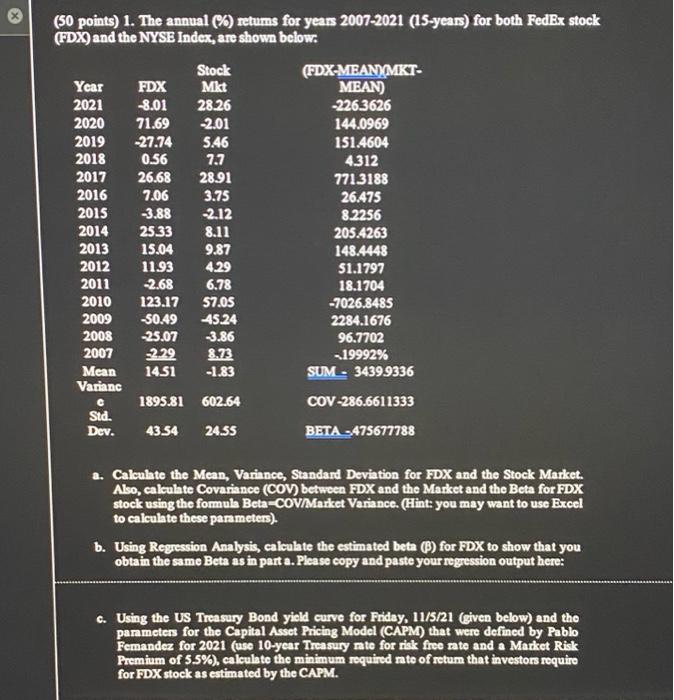

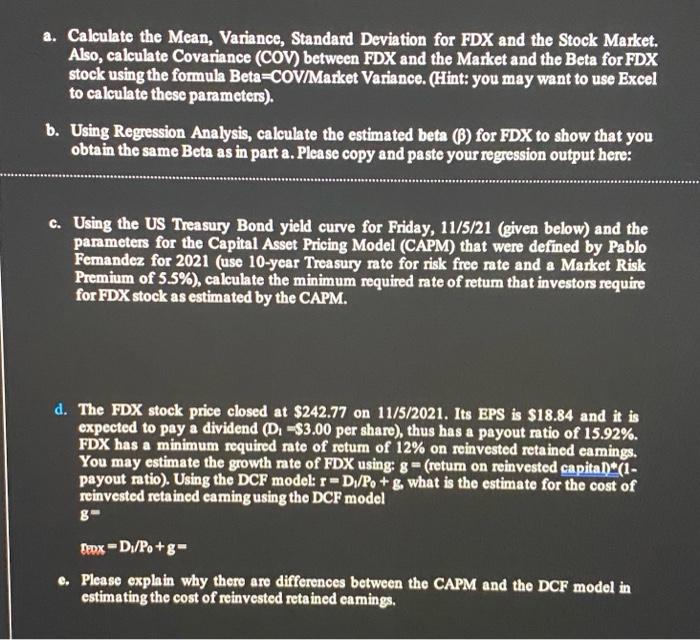

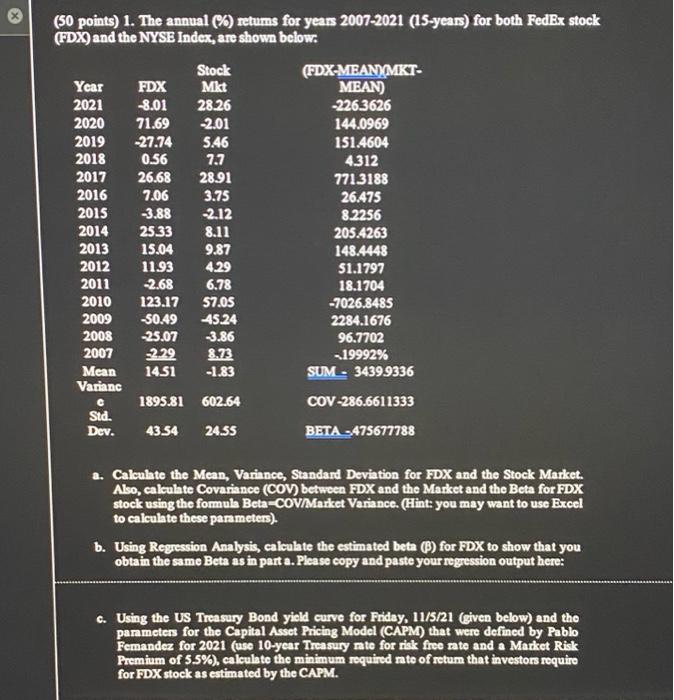

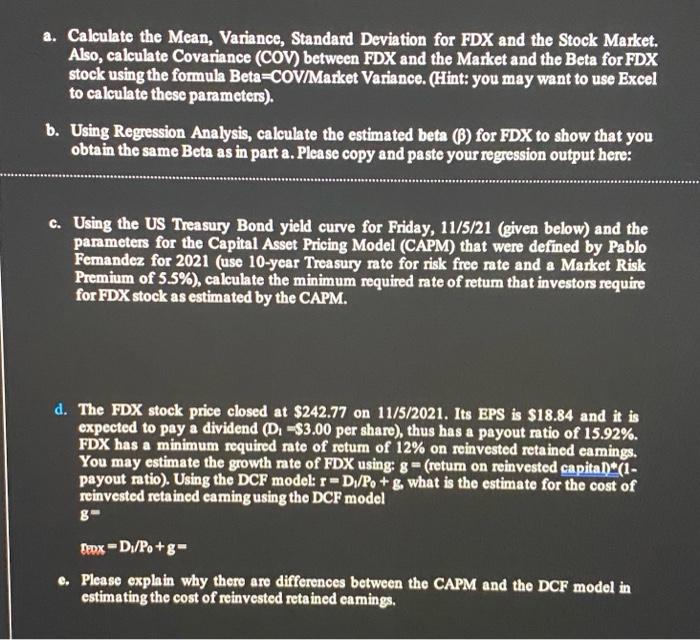

(50 points) 1. The annual (56) returns for years 2007-2021 (15-years) for both FedEx stock (FDX) and the NYSE Index, are shown below. Stock (FDX-MEANYMKT Year FDX Mkt MEAN) 2021 -8.01 2826 2020 71.69 -2.01 2019 -27.74 5.46 2018 0.56 7.7 2017 26.68 28.91 2016 7.06 3.75 2015 -3.88 2.12 2014 2533 8.11 2013 15.04 9.87 2012 1193 4.29 2011 -2.68 6.78 2010 123.17 57.05 2009 -30.49 45.24 2008 -25.07 -3.86 2007 -229 8.73 Mean SUM Varne COV Sid. Dev. BETA a. Calculate the Meas, Variance, Standard Deviation for FDX and the Stock Market Also, calculate Covariance (COV) between FDX and the Market and the Beta for FDX stock using the formula Beta-COV/Market Variance. (Hints you may want to use Excel to calculate these parameter) b. Using Repression Analysa, cakulate the estimated beta) for FDX to show that you obtain the same Beta as in parte. Please copy and paste your regression output here: c. Using the US Treasury Bond yield curve for Friday, 11/5/21 (given below) and the parameters for the Capital Asset Pricing Model (CAPM) that were defined by Pablo Femander for 2021 (use 16-year Treasury sate for risk frenate and a Market Rok Premium of 5.5%), calculate the minimum equired te ofrem that investors require for FDX stock as estimated by the CAPM The FDX stock price closed at $242.77 on 10/52021. Its EPS is $18.84 and is expected to pay a dividend (D). -$3.00 per share thus bas a payout ratio of 1592% FDX has a minimum required rate of team of 125 Vested retained aming You may estimate the growth rate of FDX in stream on invested capabi. payout ratio) Using the DCF model == D... what is the estimate for the cost of invested retained enging the DCF model toa= % = Please explain why there are differences between the CAPM and the DXF model in estimating the cost of revested and caring (50 points) 1. The annual (%) retums for years 2007-2021 (15-yeass) for both FedEx stock (FDX) and the NYSE Index, are shown below Year 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 Mean Varisc FDX -8.01 71.69 -27.74 0.56 26.68 7.06 3.88 25.33 15.04 11.93 2.68 123.17 -S0.49 25.07 2.29 14.51 Stock Mit 28.26 2.01 SA6 7.7 28.91 3.75 2.12 8.11 9.87 4.29 6.78 57.05 4524 -3.86 8.72 -1.83 (FDX-MEANIMKT- MEAN) 2263626 144.0969 151.4604 4312 7713188 26.475 8.2256 2054263 148.4448 51.1797 18.1704 -7026.8485 2284.1676 96.7702 19992% SUM. 3439.9336 1895.81 602.64 COV-286.6611333 Sid. Dev. 43.54 24.55 BETA 475677788 a. Caleulate the Mean, Variance, Standard Deviation for FDX and the Stock Market Also, calculate Covariance (COV) between FDX and the Market and the Bets for FDX stock using the formula Beta-COV/Market Variance. (Hint: you may want to use Excel to calculate these parameters) b. Using Regression Analysis, caleulate the estimated bels) for FDX to show that you obtain the same Beta as in parts. Please copy and paste your regression output here c. Using the US Treasury Bond yield curve for Friday, 11/5/21 (given below) and the parameters for the Capital Asset Pricing Model (CAPM) that were defined by Pablo Femandes for 2021 (use 10-year Treasury rate for risk free site and a Market Rik Premium of 5.5%), calculate the minimum mquired me of metam that investos quire for FDX stock as estimated by the CAPM. d. The FDX stock price closed at $242.77 on 11/5/2021. Its EPS 518.84 and expected to pay & dividend. -$3.00 per share), thus has a payout aatio of 1592% FDX has a minimum required sale of retum of 12% on relevested ained cames You may estimate the powth rate of FDX using scretums Vested (1- payout into). Using the DCF moder-what is the estimate for the cost of Reinvested retained caming using the DCF model? Stock permeten for FOX may be found at: hins://t.com Box DP.5 Please explain why there are differences between the CAPM and the DCF modella estimating the cost of revested retained eaming $ X (50 points) 1. The annual (%) retums for years 2007-2021 (15-years) for both FedEx stock (FDX) and the NYSE Index, are shown below. Year 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 Mean Varianc c Std. Dev. FDX 8.01 71.69 27.74 0.56 26.68 7.06 -3.88 25 33 15.04 11.93 -2.68 123.17 -50.49 25.07 229 1451 Stock Mkt 28.26 2.01 5.46 7.7 28.91 3.75 2.12 8.11 9.87 429 6.78 57.05 45.24 3.86 8.73 -1.83 (FDX-MEAN) (MKT- MEAN) -226.3626 144.0969 151.4604 4.312 7713188 26.475 8.2256 205.4263 148.4448 51.1797 18.1704 -7026.8485 2284.1676 96.7702 19992% SUM - 3439.9336 1895.81 602.64 COV-286.6611333 43.54 24.55 BETA 3475677788 a. Calculate the Mean, Variance, Standard Deviation for FDX and the Stock Market. Also, calculate Covariance (COV) between FDX and the Market and the Beta for FDX stock using the formula Beta-COV/Market Variance. (Hint: you may want to use Excel to calculate these parameters) b. Using Regression Analysis, calculate the estimated beta (B) for FDX to show that you obtain the same Beta as in part a. Please copy and paste your regression output here: c. Using the US Treasury Bond yield curve for Friday, 11/5/21 (given below) and the parameters for the Capital Asset Pricing Model (CAPM) that were defined by Pablo Femandez for 2021 (use 10-year Treasury rate for risk free rate and a Market Risk Premium of 5.5%), calculate the minimum required rate of retum that investors require for FDX stock as estimated by the CAPM. a. Calculate the Mean, Variance, Standard Deviation for FDX and the Stock Market. Also, calculate Covariance (COV) between FDX and the Market and the Beta for FDX stock using the formula Beta-COV/Market Variance. (Hint: you may want to use Excel to calculate these parameters). b. Using Regression Analysis, calculate the estimated beta (6) for FDX to show that you obtain the same Beta as in part a. Please copy and paste your regression output here: c. Using the US Treasury Bond yield curve for Friday, 11/5/21 (given below) and the parameters for the Capital Asset Pricing Model (CAPM) that were defined by Pablo Fernandez for 2021 (use 10-year Treasury rate for risk free rate and a Market Risk Premium of 5.5%), calculate the minimum required rate of retum that investors require for FDX stock as estimated by the CAPM. d. The FDX stock price closed at $242.77 on 11/5/2021. Its EPS is $18.84 and it is expected to pay a dividend (D. -$3.00 per share), thus has a payout ratio of 15.92%. FDX has a minimum required rate of rotum of 12% on reinvested retained camings. You may estimate the growth rate of FDX using: 8 - (retum on reinvested capita1*(1- payout ratio). Using the DCF model: r-D./P. + 8 what is the estimate for the cost of reinvested retained caming using the DCF model 8- Dedx =D./Po+g- e. Please explain why there are differences between the CAPM and the DCF model in estimating the cost of reinvested retained eamings. (50 points) 1. The annual (56) returns for years 2007-2021 (15-years) for both FedEx stock (FDX) and the NYSE Index, are shown below. Stock (FDX-MEANYMKT Year FDX Mkt MEAN) 2021 -8.01 2826 2020 71.69 -2.01 2019 -27.74 5.46 2018 0.56 7.7 2017 26.68 28.91 2016 7.06 3.75 2015 -3.88 2.12 2014 2533 8.11 2013 15.04 9.87 2012 1193 4.29 2011 -2.68 6.78 2010 123.17 57.05 2009 -30.49 45.24 2008 -25.07 -3.86 2007 -229 8.73 Mean SUM Varne COV Sid. Dev. BETA a. Calculate the Meas, Variance, Standard Deviation for FDX and the Stock Market Also, calculate Covariance (COV) between FDX and the Market and the Beta for FDX stock using the formula Beta-COV/Market Variance. (Hints you may want to use Excel to calculate these parameter) b. Using Repression Analysa, cakulate the estimated beta) for FDX to show that you obtain the same Beta as in parte. Please copy and paste your regression output here: c. Using the US Treasury Bond yield curve for Friday, 11/5/21 (given below) and the parameters for the Capital Asset Pricing Model (CAPM) that were defined by Pablo Femander for 2021 (use 16-year Treasury sate for risk frenate and a Market Rok Premium of 5.5%), calculate the minimum equired te ofrem that investors require for FDX stock as estimated by the CAPM The FDX stock price closed at $242.77 on 10/52021. Its EPS is $18.84 and is expected to pay a dividend (D). -$3.00 per share thus bas a payout ratio of 1592% FDX has a minimum required rate of team of 125 Vested retained aming You may estimate the growth rate of FDX in stream on invested capabi. payout ratio) Using the DCF model == D... what is the estimate for the cost of invested retained enging the DCF model toa= % = Please explain why there are differences between the CAPM and the DXF model in estimating the cost of revested and caring (50 points) 1. The annual (%) retums for years 2007-2021 (15-yeass) for both FedEx stock (FDX) and the NYSE Index, are shown below Year 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 Mean Varisc FDX -8.01 71.69 -27.74 0.56 26.68 7.06 3.88 25.33 15.04 11.93 2.68 123.17 -S0.49 25.07 2.29 14.51 Stock Mit 28.26 2.01 SA6 7.7 28.91 3.75 2.12 8.11 9.87 4.29 6.78 57.05 4524 -3.86 8.72 -1.83 (FDX-MEANIMKT- MEAN) 2263626 144.0969 151.4604 4312 7713188 26.475 8.2256 2054263 148.4448 51.1797 18.1704 -7026.8485 2284.1676 96.7702 19992% SUM. 3439.9336 1895.81 602.64 COV-286.6611333 Sid. Dev. 43.54 24.55 BETA 475677788 a. Caleulate the Mean, Variance, Standard Deviation for FDX and the Stock Market Also, calculate Covariance (COV) between FDX and the Market and the Bets for FDX stock using the formula Beta-COV/Market Variance. (Hint: you may want to use Excel to calculate these parameters) b. Using Regression Analysis, caleulate the estimated bels) for FDX to show that you obtain the same Beta as in parts. Please copy and paste your regression output here c. Using the US Treasury Bond yield curve for Friday, 11/5/21 (given below) and the parameters for the Capital Asset Pricing Model (CAPM) that were defined by Pablo Femandes for 2021 (use 10-year Treasury rate for risk free site and a Market Rik Premium of 5.5%), calculate the minimum mquired me of metam that investos quire for FDX stock as estimated by the CAPM. d. The FDX stock price closed at $242.77 on 11/5/2021. Its EPS 518.84 and expected to pay & dividend. -$3.00 per share), thus has a payout aatio of 1592% FDX has a minimum required sale of retum of 12% on relevested ained cames You may estimate the powth rate of FDX using scretums Vested (1- payout into). Using the DCF moder-what is the estimate for the cost of Reinvested retained caming using the DCF model? Stock permeten for FOX may be found at: hins://t.com Box DP.5 Please explain why there are differences between the CAPM and the DCF modella estimating the cost of revested retained eaming $ X (50 points) 1. The annual (%) retums for years 2007-2021 (15-years) for both FedEx stock (FDX) and the NYSE Index, are shown below. Year 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 Mean Varianc c Std. Dev. FDX 8.01 71.69 27.74 0.56 26.68 7.06 -3.88 25 33 15.04 11.93 -2.68 123.17 -50.49 25.07 229 1451 Stock Mkt 28.26 2.01 5.46 7.7 28.91 3.75 2.12 8.11 9.87 429 6.78 57.05 45.24 3.86 8.73 -1.83 (FDX-MEAN) (MKT- MEAN) -226.3626 144.0969 151.4604 4.312 7713188 26.475 8.2256 205.4263 148.4448 51.1797 18.1704 -7026.8485 2284.1676 96.7702 19992% SUM - 3439.9336 1895.81 602.64 COV-286.6611333 43.54 24.55 BETA 3475677788 a. Calculate the Mean, Variance, Standard Deviation for FDX and the Stock Market. Also, calculate Covariance (COV) between FDX and the Market and the Beta for FDX stock using the formula Beta-COV/Market Variance. (Hint: you may want to use Excel to calculate these parameters) b. Using Regression Analysis, calculate the estimated beta (B) for FDX to show that you obtain the same Beta as in part a. Please copy and paste your regression output here: c. Using the US Treasury Bond yield curve for Friday, 11/5/21 (given below) and the parameters for the Capital Asset Pricing Model (CAPM) that were defined by Pablo Femandez for 2021 (use 10-year Treasury rate for risk free rate and a Market Risk Premium of 5.5%), calculate the minimum required rate of retum that investors require for FDX stock as estimated by the CAPM. a. Calculate the Mean, Variance, Standard Deviation for FDX and the Stock Market. Also, calculate Covariance (COV) between FDX and the Market and the Beta for FDX stock using the formula Beta-COV/Market Variance. (Hint: you may want to use Excel to calculate these parameters). b. Using Regression Analysis, calculate the estimated beta (6) for FDX to show that you obtain the same Beta as in part a. Please copy and paste your regression output here: c. Using the US Treasury Bond yield curve for Friday, 11/5/21 (given below) and the parameters for the Capital Asset Pricing Model (CAPM) that were defined by Pablo Fernandez for 2021 (use 10-year Treasury rate for risk free rate and a Market Risk Premium of 5.5%), calculate the minimum required rate of retum that investors require for FDX stock as estimated by the CAPM. d. The FDX stock price closed at $242.77 on 11/5/2021. Its EPS is $18.84 and it is expected to pay a dividend (D. -$3.00 per share), thus has a payout ratio of 15.92%. FDX has a minimum required rate of rotum of 12% on reinvested retained camings. You may estimate the growth rate of FDX using: 8 - (retum on reinvested capita1*(1- payout ratio). Using the DCF model: r-D./P. + 8 what is the estimate for the cost of reinvested retained caming using the DCF model 8- Dedx =D./Po+g- e. Please explain why there are differences between the CAPM and the DCF model in estimating the cost of reinvested retained eamings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started