Any help is appreciated!

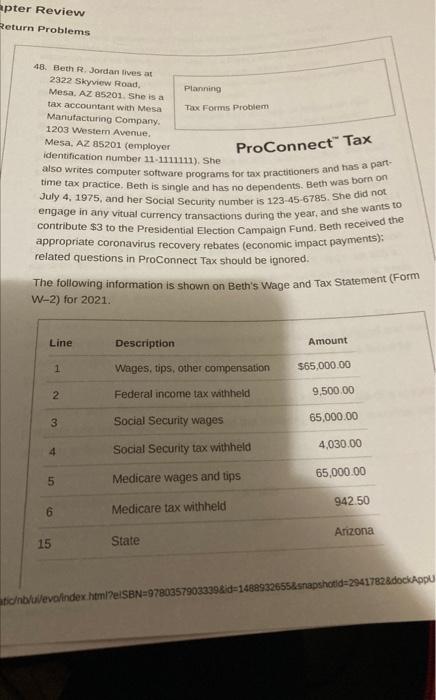

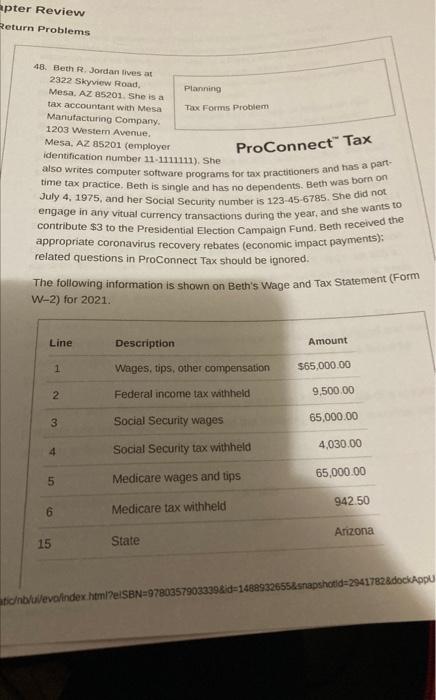

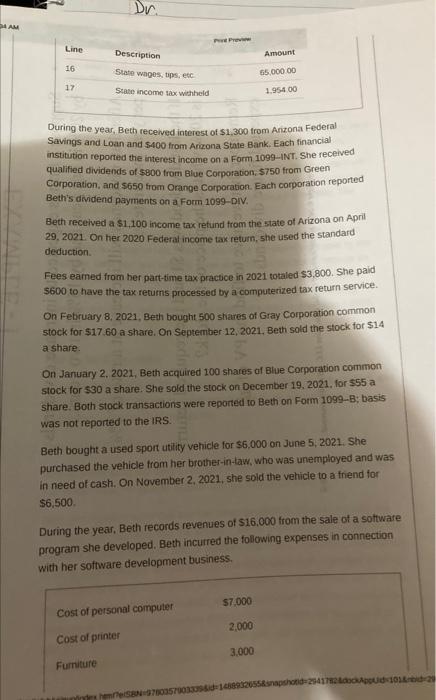

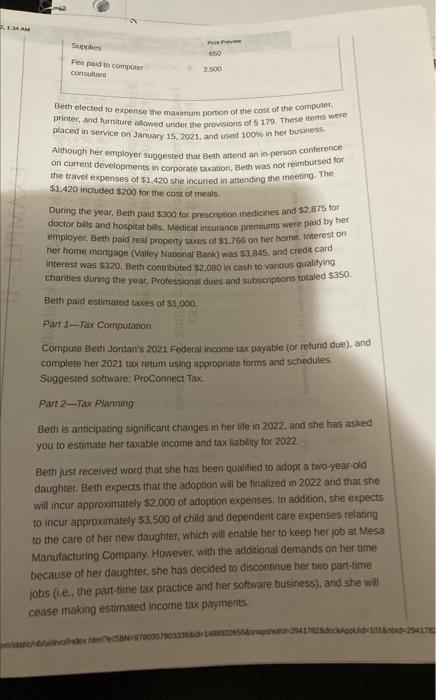

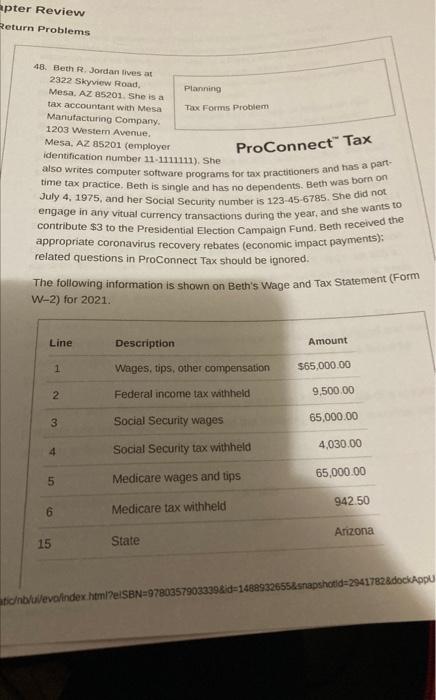

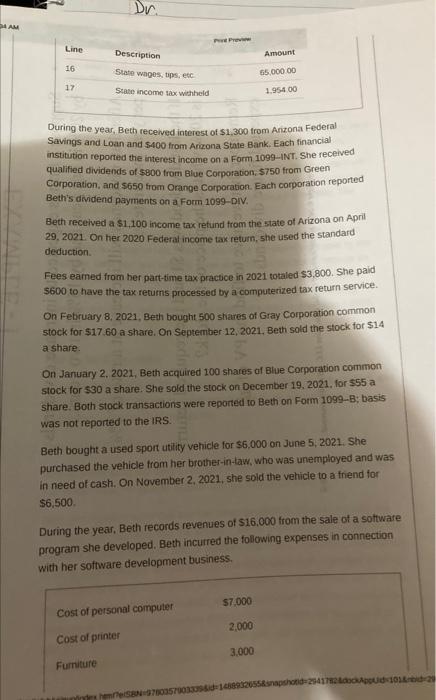

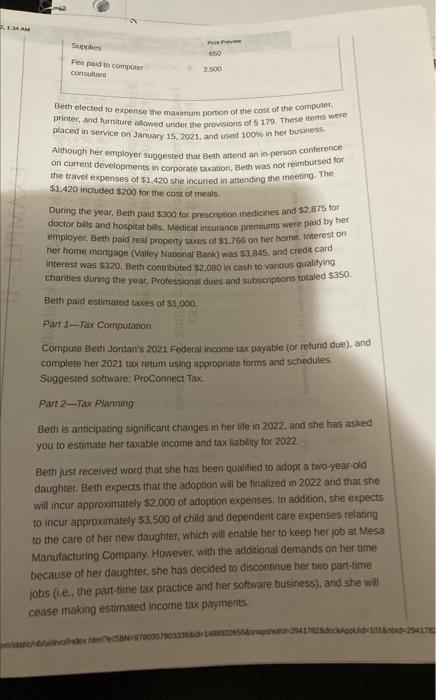

48. Beth R. Jordan thes at 2322 skyview Road. Mesa. AZ 85201, She is a tax accountant with Mesa Tax Forms Problem Manutacturing Company. 1203 Western Avenue, Mesa, Az 85201 (employer identification number 11-1111111). She. also writes computer software programs tor tax practitioners and has a parttime tax practice. Beth is single and has no dependents. Beth was born on July 4,1975, and her Social Secunty number is 123-45-6785. She did not. engage in any vitual currency transactions during the year, and she wants to contribute $3 to the Presidential Election Campaign Fund. Beth received the appropriate coronavirus recovery rebates (economic impact payments); related questions in Proconnect Tax should be ignored. The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2021. During the year, Beth recelved interest of $1,300 trom Anzona Federal Savings and Loan and $400 from Arzzona State Bank. Each financial institution reported the interest income on a Form 1099-INT. She received qualified dividends of $800 trom Blue Corporation, $750 from Green Corporation, and $650 from Orange Corporation. Each corporation reported Beth's dividend payments on a Form 1099-DIV. Beth recelved a $1,100 income tax refund from the state of Arizona on April 29. 2021. On her 2020 Federal income tax retum, she used the standard deduction. Fees earned from her part-time tax practice in 2021 totaled $3,800. She paid $600 to have the tax retums processed by a computerized tax return service. On February 8, 2021, Beth bought 500 stares of Gray Corporation common stock for $17.60 a share. On September 12, 2021, Beth sold the stock for $14 a share. On January 2, 2021, Beth acquired 100 shares of Blue Corporation common stock for $30 a share. She sold the stock on December 19, 2021, for 555 a share. Both stock transactions ware reported to Beth on Fotm 1099-B; basis was not reported to the IRS. Beth bought a used sport utitity vehicle for $6,000 on June 5,2021 . She purchased the vehicle from her brother-in-taw, who was unemployed and was in need of cash. On November 2,2021 , she sold the vehicle to a friend for $6,500 During the year, Beth records revenues of $16.000 from the sale of a sottware program she developed. Beth incurred the following expenses in connection with her software development business. Beth elected to expense the maxumum portion of the cost of the computer. printer, and hurniture allowed under the provisions of 5179 . These terns were placed in service on January 15. 2021, and used 100% in her business. Although her employer suggested that Beth attend an in person conference on current developments in corporate taoation, Beth was not reiribursed for the travel expenses of $1,420 she incuered in attending the meeting. The $1,420 inchualed $200 for the cost of meais. During the year, Beth paid 3200 for grescritaion medicines and 97,875 tor doctor bills and hospitat bills. Medical insurance premiums were paid by ther employer. Beth pain real property taxes of 91, 765 on her home. interest on her tiome inortgoge (Valley National Bnak) was $3,845, and credit card interest was $320. Beth contributed 52,080 in cash to various qualifying charitus during the year. Professionti dues and subscriptions totaled 5350. Beth paid Estimated taxes of 51,000 . Part 1-Tax Computation Compute Beth Jordan's'2021 Federal incorme tax payable (or refund due), and compiete her 2021 tax refum using appropriate forms and schedules. Suggested software: Proconnect Tax. Part 2-Tax Planning Beth is anticipating significant changes in her life in 2022, and she has asked you to estimate her taxable income and tax finbility for 202?. Beth just received word that sthe has been quailied to adopt a two-year-old daughter, Beth expects that the-adoption will be firtalized in 2022 and that she: will incur approximately $2,000 of adoption expensers. In addition, she expects to incur approximately 53,500 of child and dependent care expenses relating to the care of her new daughter, which wil enable her to keep her job at Mesa Manufacturing Company. However, with the additional deinands on her time because of her daughter, she has decided to discontinue fier two part-time jobs (t.e., the part-time tax practice and her sotware busincss), and sha whil cense making estimated incothe tax payments. 48. Beth R. Jordan thes at 2322 skyview Road. Mesa. AZ 85201, She is a tax accountant with Mesa Tax Forms Problem Manutacturing Company. 1203 Western Avenue, Mesa, Az 85201 (employer identification number 11-1111111). She. also writes computer software programs tor tax practitioners and has a parttime tax practice. Beth is single and has no dependents. Beth was born on July 4,1975, and her Social Secunty number is 123-45-6785. She did not. engage in any vitual currency transactions during the year, and she wants to contribute $3 to the Presidential Election Campaign Fund. Beth received the appropriate coronavirus recovery rebates (economic impact payments); related questions in Proconnect Tax should be ignored. The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2021. During the year, Beth recelved interest of $1,300 trom Anzona Federal Savings and Loan and $400 from Arzzona State Bank. Each financial institution reported the interest income on a Form 1099-INT. She received qualified dividends of $800 trom Blue Corporation, $750 from Green Corporation, and $650 from Orange Corporation. Each corporation reported Beth's dividend payments on a Form 1099-DIV. Beth recelved a $1,100 income tax refund from the state of Arizona on April 29. 2021. On her 2020 Federal income tax retum, she used the standard deduction. Fees earned from her part-time tax practice in 2021 totaled $3,800. She paid $600 to have the tax retums processed by a computerized tax return service. On February 8, 2021, Beth bought 500 stares of Gray Corporation common stock for $17.60 a share. On September 12, 2021, Beth sold the stock for $14 a share. On January 2, 2021, Beth acquired 100 shares of Blue Corporation common stock for $30 a share. She sold the stock on December 19, 2021, for 555 a share. Both stock transactions ware reported to Beth on Fotm 1099-B; basis was not reported to the IRS. Beth bought a used sport utitity vehicle for $6,000 on June 5,2021 . She purchased the vehicle from her brother-in-taw, who was unemployed and was in need of cash. On November 2,2021 , she sold the vehicle to a friend for $6,500 During the year, Beth records revenues of $16.000 from the sale of a sottware program she developed. Beth incurred the following expenses in connection with her software development business. Beth elected to expense the maxumum portion of the cost of the computer. printer, and hurniture allowed under the provisions of 5179 . These terns were placed in service on January 15. 2021, and used 100% in her business. Although her employer suggested that Beth attend an in person conference on current developments in corporate taoation, Beth was not reiribursed for the travel expenses of $1,420 she incuered in attending the meeting. The $1,420 inchualed $200 for the cost of meais. During the year, Beth paid 3200 for grescritaion medicines and 97,875 tor doctor bills and hospitat bills. Medical insurance premiums were paid by ther employer. Beth pain real property taxes of 91, 765 on her home. interest on her tiome inortgoge (Valley National Bnak) was $3,845, and credit card interest was $320. Beth contributed 52,080 in cash to various qualifying charitus during the year. Professionti dues and subscriptions totaled 5350. Beth paid Estimated taxes of 51,000 . Part 1-Tax Computation Compute Beth Jordan's'2021 Federal incorme tax payable (or refund due), and compiete her 2021 tax refum using appropriate forms and schedules. Suggested software: Proconnect Tax. Part 2-Tax Planning Beth is anticipating significant changes in her life in 2022, and she has asked you to estimate her taxable income and tax finbility for 202?. Beth just received word that sthe has been quailied to adopt a two-year-old daughter, Beth expects that the-adoption will be firtalized in 2022 and that she: will incur approximately $2,000 of adoption expensers. In addition, she expects to incur approximately 53,500 of child and dependent care expenses relating to the care of her new daughter, which wil enable her to keep her job at Mesa Manufacturing Company. However, with the additional deinands on her time because of her daughter, she has decided to discontinue fier two part-time jobs (t.e., the part-time tax practice and her sotware busincss), and sha whil cense making estimated incothe tax payments