Answered step by step

Verified Expert Solution

Question

1 Approved Answer

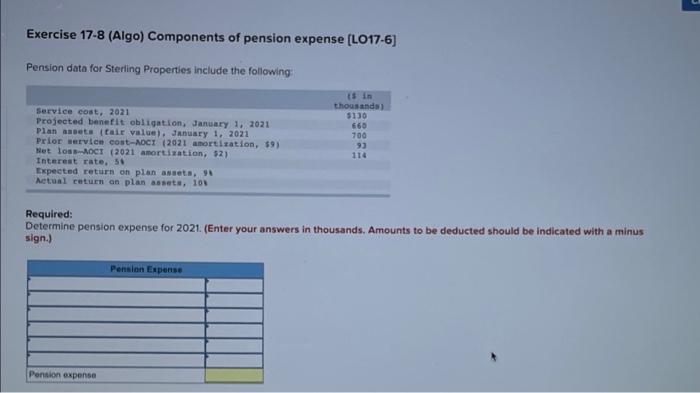

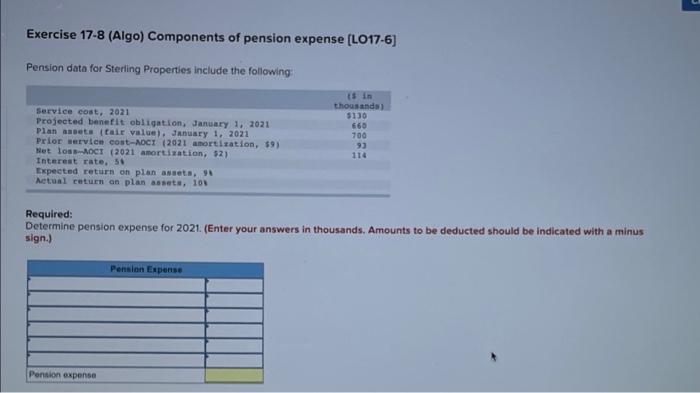

any help is appreciated Exercise 17-8 (Algo) Components of pension expense (L017-6) Pension data for Sterling Properties include the following: Service cost, 2021 Projected benefit

any help is appreciated

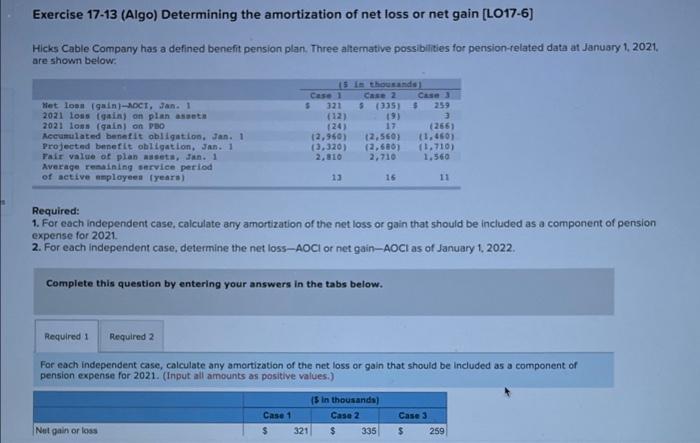

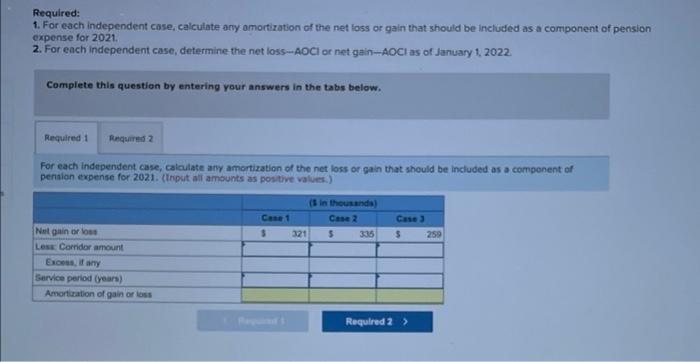

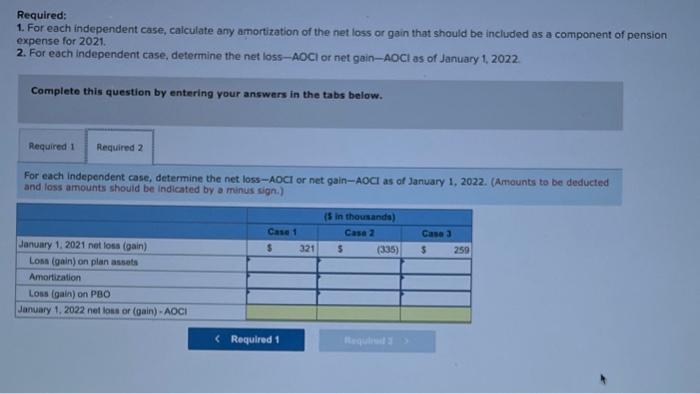

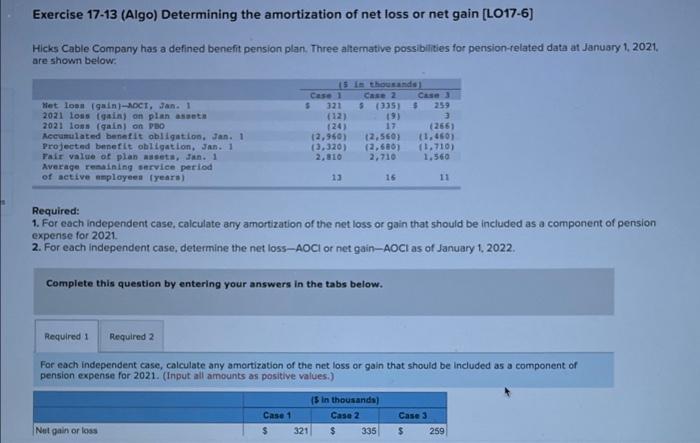

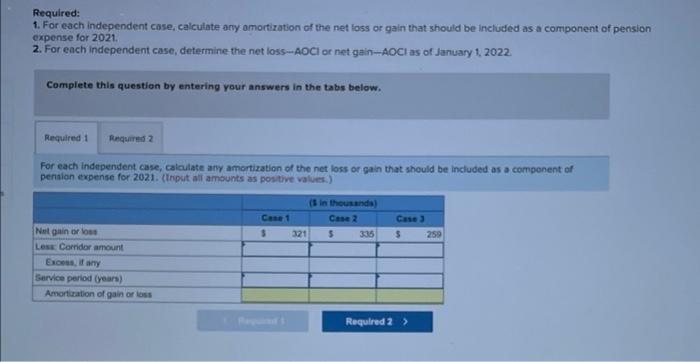

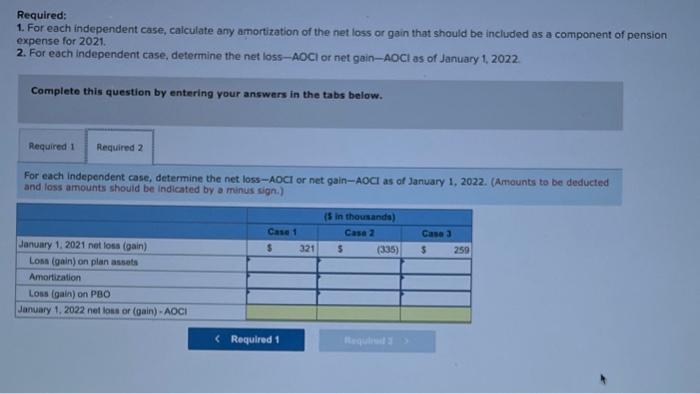

Exercise 17-8 (Algo) Components of pension expense (L017-6) Pension data for Sterling Properties include the following: Service cost, 2021 Projected benefit obligation, January 1, 2021 Plan assets (tair value). January 1, 2021 Prior service cost-AOCI (2021 amortization, $9) Net loss.AOCI (2021 amortization, $21 Interest rate, 56 Expected return on plan assets, 91 hetual return an plan assets, 10 sin thousands $130 660 700 93 114 Required: Determine pension expense for 2021. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign.) Pension Expense Pension expense Exercise 17-13 (Algo) Determining the amortization of net loss or net gain (L017-6) Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021 are shown below: Het loon gain)-ACT, Jan. 1 2021 loss gain) on plan aseta 2021 loss (gain) on PBO Accumulated benefit obligation. Jan. 1 Projected benefit obligation, Jan. 1 Tait value of plan set, Jan. 1 Average remaining service period of active employees (years) 13 Is thousands Case Case 2 Case 3 $ 321 S (335) (12) 3 124) 17 (266) 12,960) (2.560) (1,460) (3,320) (2,686) 1.710) 2,810 2,710 1.560 13 16 11 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension experise for 2021 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022. Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. (Input all amounts as positive values.) 15 in thousands) Case 1 Case 2 Net gain or loss 321 335 Case 3 $ 259 expense for 2021, Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension 2. For each independent case, determine the net loss.-AOCI or net gain-AOCI as of January 1, 2022. Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. (triput all amounts as positive values.) (in thousands) Case 1 Case 2 $ 321 5 335 Case $ 259 Net gain or los Les Corridor amount Excess, if any Service period (years) Amortization of gain or loss Required 2 > Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021 2. For each Independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022 Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022. (Amounts to be deducted and loss amounts should be indicated by a minus sign) Casat $ 321 (5 in thousanda) Casa 2 5 (335) Casa 3 $ 250 January 1, 2021 net losa (gain) Lonn (gain) on plan assets Amortization Loss (gain) on PBO January 1, 2022 nel loss or (gain) - AOCI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started