Answered step by step

Verified Expert Solution

Question

1 Approved Answer

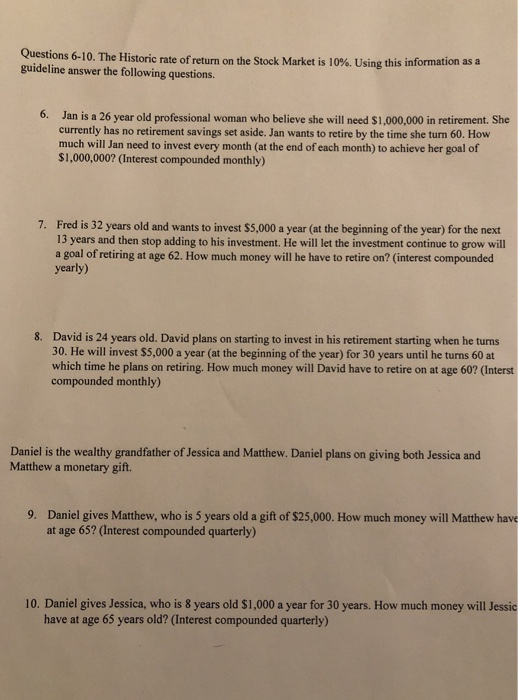

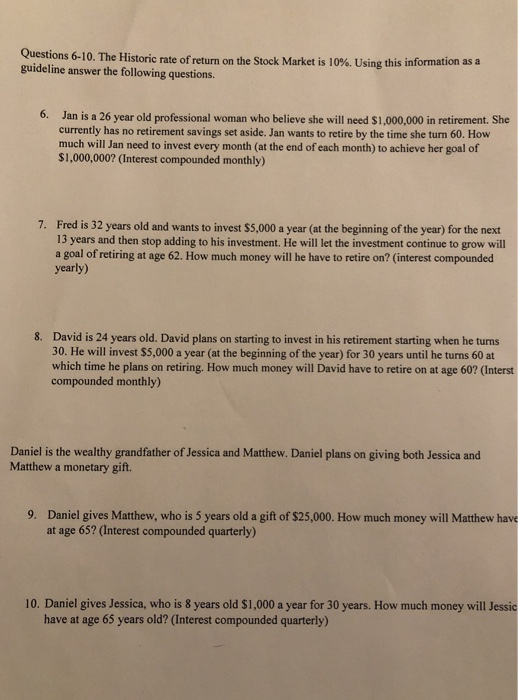

Any help on these would be awesome. Questions guideline answer the following questions. 6-10. The Historic rate of return on the Stock Market is 10%.

Any help on these would be awesome.

Questions guideline answer the following questions. 6-10. The Historic rate of return on the Stock Market is 10%. Using this information as a 6. Jan is a 26 year old professional woman who believe she will need $1,000,000 in retirement. She currently has no retirement savings set aside. Jan wants to retire by the time she turn 60. How much will Jan need to invest every month (at the end of each month) to achieve her goal of $1,000,000? (Interest compounded monthly) 7. Fred is 32 years old and wants to invest $5,000 a year (at the beginning of the year) for the next 13 years and then stop adding to his investment. He will let the investment continue to grow wil a goal of retiring at age 62. How much money will he have to retire on? (interest compounded yearly) 8. David is 24 years old. David plans on starting to invest in his retirement starting when he turns 30. He will invest $5,000 a year (at the beginning of the year) for 30 years until he turns 60 at which time he plans on retiring. How much money will David have to retire on at age 60? (Interst compounded monthly) Daniel is the wealthy grandfather of Jessica and Matthew. Daniel plans on giving both Jessica and Matthew a monetary gift. Daniel gives Matthew, who is 5 years old a gift of $25,000. How much money will Matthew have at age 65? (Interest compounded quarterly) 9. 10. Daniel gives Jessica, who is 8 years old $1,000 a year for 30 years. How much money will Jessic have at age 65 years old? (Interest compounded quarterly)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started