Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Any help on this would be appreciated. Problem 4: (10 pts) You are looking to retire on your 65th birthday (It is your 23-4 birthday

Any help on this would be appreciated.

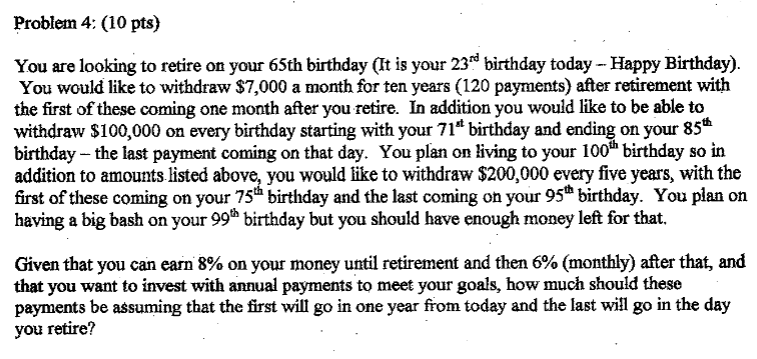

Problem 4: (10 pts) You are looking to retire on your 65th birthday (It is your 23-4 birthday today - Happy Birthday). You would like to withdraw $7,000 a month for ten years (120 payments) after retirement with the first of these coming one month after you retire. In addition you would like to be able to withdraw $100,000 on every birthday starting with your 71" birthday and ending on your 85th birthday - the last payment coming on that day. You plan on living to your 100h birthday so in addition to amounts listed above, you would like to withdraw $200,000 every five years, with the first of these coming on your 75 birthday and the last coming on your 95 birthday. You plan on having a big bash on your 996 birthday but you should have enough money left for that, Given that you can earn 8% on your money until retirement and then 6% (monthly) after that, and that you want to invest with annual payments to meet your goals, how much should these payments be assuming that the first will go in one year from today and the last will go in the day you retire? Problem 4: (10 pts) You are looking to retire on your 65th birthday (It is your 23-4 birthday today - Happy Birthday). You would like to withdraw $7,000 a month for ten years (120 payments) after retirement with the first of these coming one month after you retire. In addition you would like to be able to withdraw $100,000 on every birthday starting with your 71" birthday and ending on your 85th birthday - the last payment coming on that day. You plan on living to your 100h birthday so in addition to amounts listed above, you would like to withdraw $200,000 every five years, with the first of these coming on your 75 birthday and the last coming on your 95 birthday. You plan on having a big bash on your 996 birthday but you should have enough money left for that, Given that you can earn 8% on your money until retirement and then 6% (monthly) after that, and that you want to invest with annual payments to meet your goals, how much should these payments be assuming that the first will go in one year from today and the last will go in the day you retireStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started