Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Any help with these five would be greatly appreciated Question 1 On November 1,2023 , Malcolm Corporation borrowed $4,000 by issuing a 3 -month, 5%

Any help with these five would be greatly appreciated

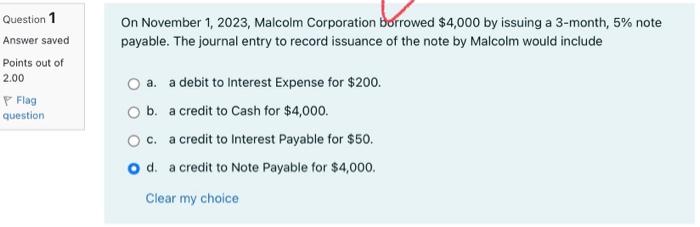

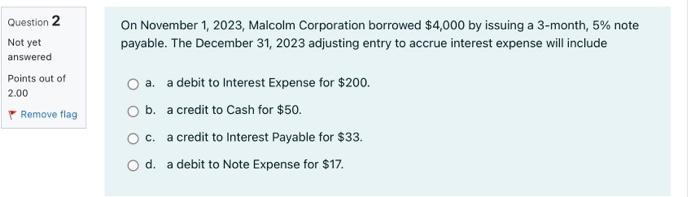

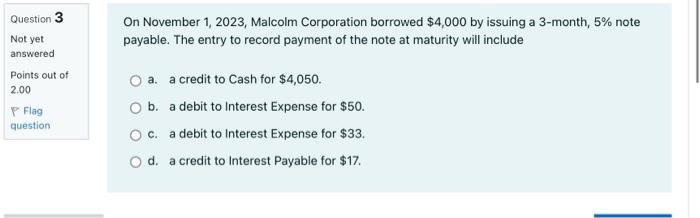

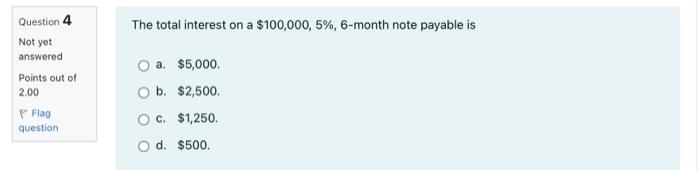

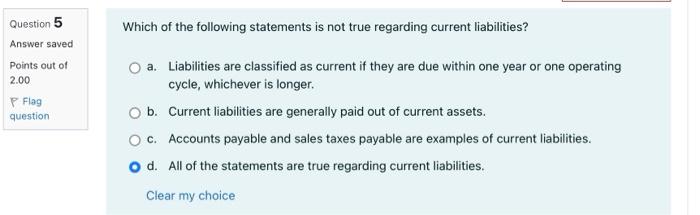

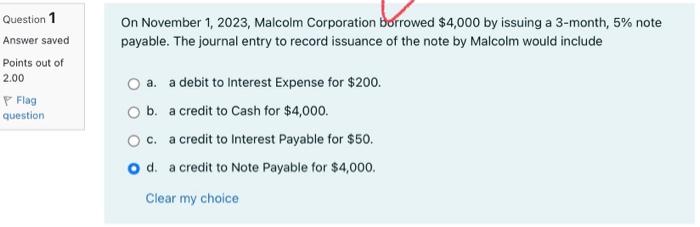

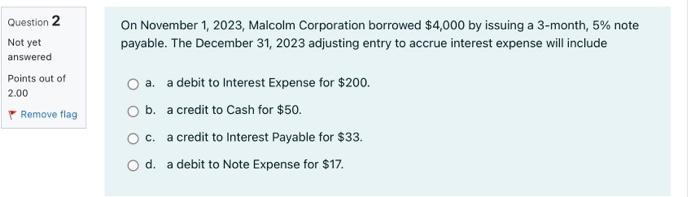

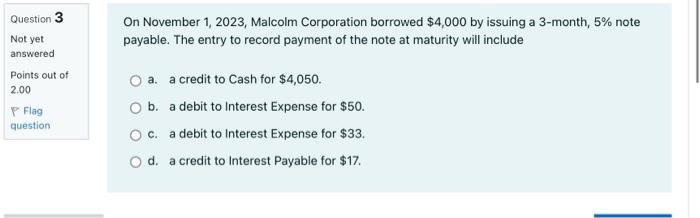

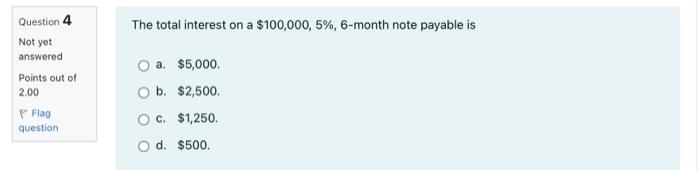

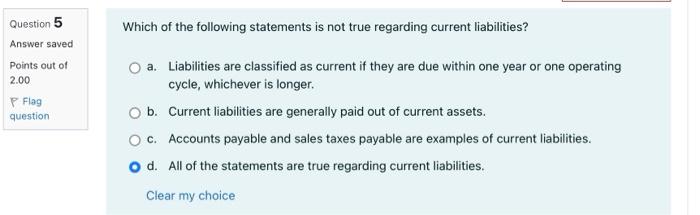

Question 1 On November 1,2023 , Malcolm Corporation borrowed $4,000 by issuing a 3 -month, 5% note Answer saved payable. The journal entry to record issuance of the note by Malcolm would include Points out of a. a debit to Interest Expense for $200. b. a credit to Cash for $4,000. c. a credit to Interest Payable for $50. d. a credit to Note Payable for $4,000. Clear my choice On November 1,2023, Malcolm Corporation borrowed $4,000 by issuing a 3 -month, 5% note payable. The December 31,2023 adjusting entry to accrue interest expense will include a. a debit to Interest Expense for $200. b. a credit to Cash for $50. c. a credit to Interest Payable for $33. d. a debit to Note Expense for $17. On November 1,2023 , Malcolm Corporation borrowed $4,000 by issuing a 3 -month, 5% note payable. The entry to record payment of the note at maturity will include a. a credit to Cash for $4,050. b. a debit to Interest Expense for $50. c. a debit to Interest Expense for $33. d. a credit to Interest Payable for $17. The total interest on a $100,000,5%,6-month note payable is a. $5,000. b. $2,500. c. $1,250. d. $500. Which of the following statements is not true regarding current liabilities? a. Liabilities are classified as current if they are due within one year or one operating cycle, whichever is longer. b. Current liabilities are generally paid out of current assets. c. Accounts payable and sales taxes payable are examples of current liabilities. d. All of the statements are true regarding current liabilities. Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started