Answered step by step

Verified Expert Solution

Question

1 Approved Answer

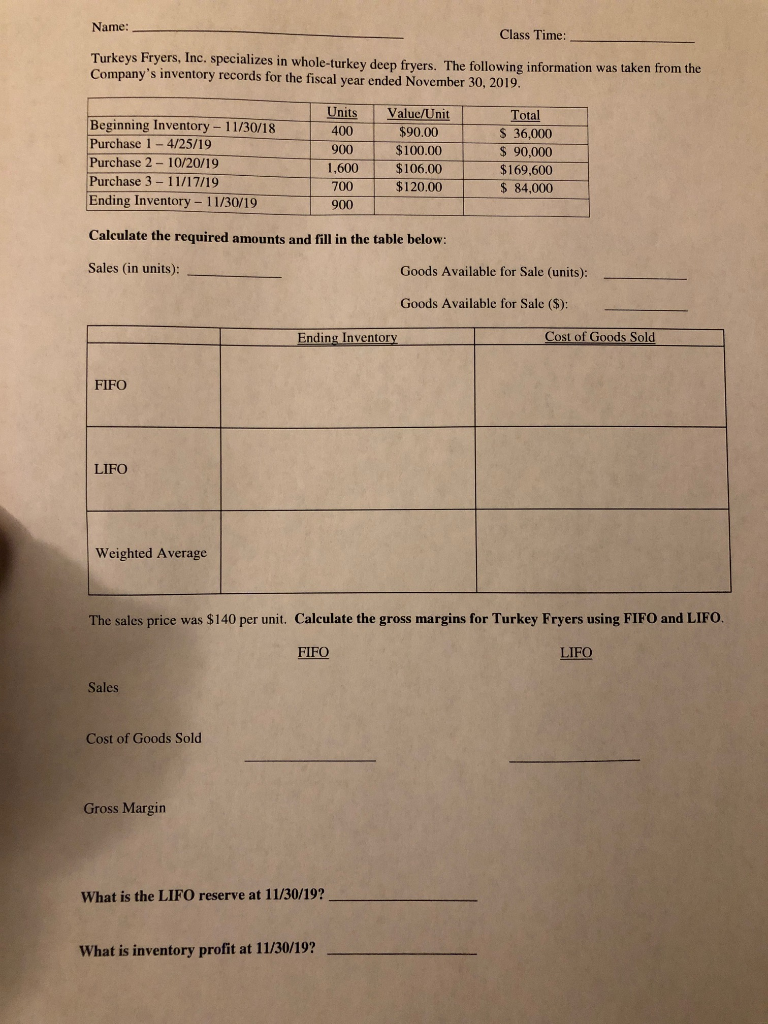

any help with this is greatly appreciated Name: Class Time: Turkeys Fryers, Inc. specializes in whole-turkey deep fryers. The following information was taken from the

any help with this is greatly appreciated

Name: Class Time: Turkeys Fryers, Inc. specializes in whole-turkey deep fryers. The following information was taken from the Company's inventory records for the fiscal year ended November 30, 2019. Units Value/Unit Total $ 36,000 Beginning Inventory Purchase 1-4/25/19 Purchase 2-10/20/19 Purchase 3-11/17/19 Ending Inventory - 11/30/19 11/30/18 400 $90.00 $100,00 900 $90,000 $169,600 $ 84,000 1,600 $106.00 $120.00 700 900 Calculate the required amounts and fill in the table below: Sales (in units): Goods Available for Sale (units): Goods Available for Sale ($): Cost of Goods Sold Ending Inventory FIFO LIFO Weighted Average The sales price was $140 per unit. Calculate the gross margins for Turkey Fryers using FIFO and LIFO. FIFO LIFO Sales Cost of Goods Sold Gross Margin What is the LIFO reserve at 11/30/19? What is inventory profit at 11/30/19Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started