Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Any help would be appreciated! All required for answer is there. These transactions need to be journalized in the following accounts: Cash, Accounts Receivable, Inventory,

Any help would be appreciated! All required for answer is there.

These transactions need to be journalized in the following accounts: Cash, Accounts Receivable, Inventory, Store Supplies, Office Supplies, Office Equipment, Notes Payable, Accounts Payable, F. Stone, Capital, Sales, Sales Discounts, Costs of Goods Sold, and Sales Salaries Expense.

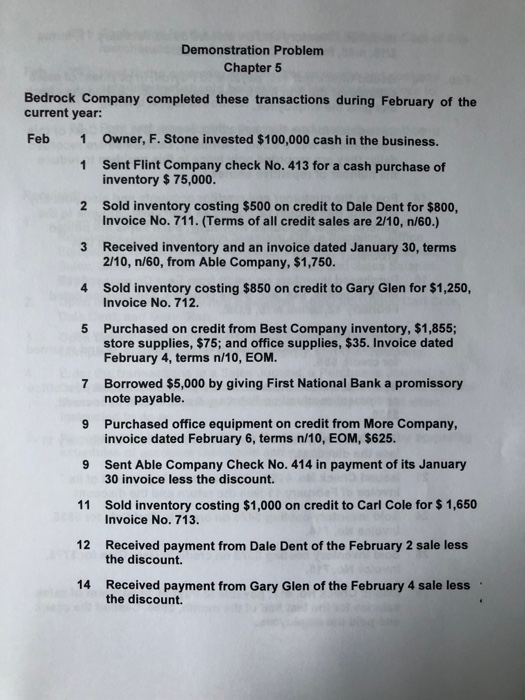

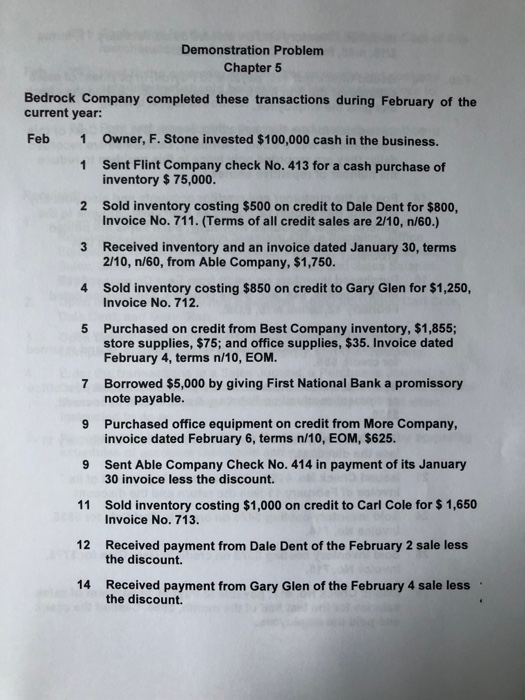

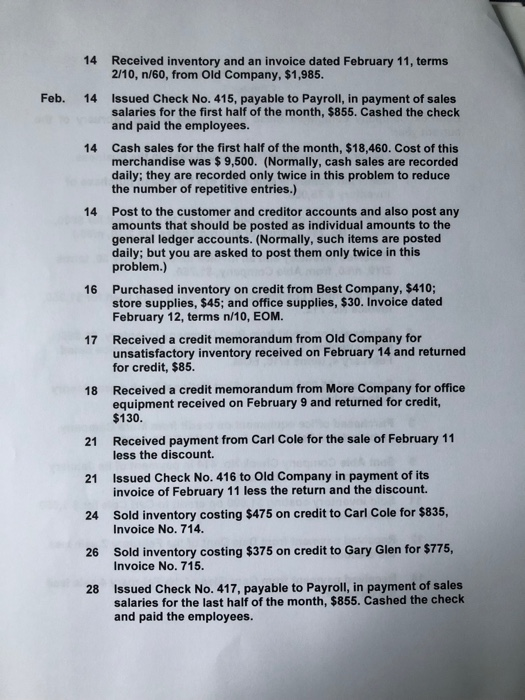

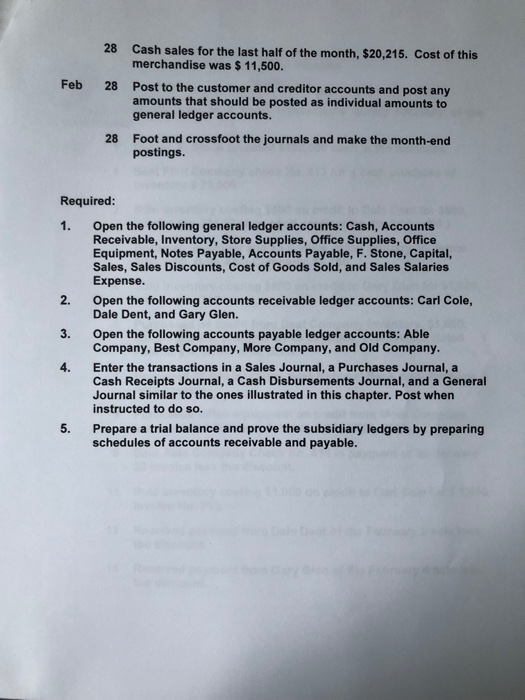

Demonstration Problem Chapter 5 Bedrock Company completed these transactions during February of the current year: Owner, F. Stone invested $100,000 cash in the business. Feb 1 Sent Flint Company check No. 413 for a cash purchase of inventory $ 75,000. 1 2 Sold inventory costing $500 on credit to Dale Dent for $800, Invoice No. 711. (Terms of all credit sales are 2/10, n/60.) 3 Received inventory and an invoice dated January 30, terms 2/10, n/60, from Able Company, $1,750. Sold inventory costing $850 on credit to Gary Glen for $1,250, Invoice No. 712. 4 Purchased on credit from Best Company inventory, $1,855; store supplies, $75; and office supplies, $35. Invoice dated February 4, terms n/10, EOM. 5 7 Borrowed $5,000 by giving First National Bank a promissory 9 Purchased office equipment on credit from More Company, 9 Sent Able Company Check No. 414 in payment of its January 11 Sold inventory costing $1,000 on credit to Carl Cole for $1,650 12 Received payment from Dale Dent of the February 2 sale less 14 Received payment from Gary Glen of the February 4 sale less note payable. invoice dated February 6, terms n/10, EOM, $625. 30 invoice less the discount. Invoice No. 713. the discount. the discount. 14 Received inventory and an invoice dated February 11, terms 2/10, n/60, from Old Company, $1,985. Feb. 14 Issued Check No. 415, payable to Payroll, in payment of sales salaries for the first half of the month, $855. Cashed the check and paid the employees. 14 Cash sales for the first half of the month, $18,460. Cost of this merchandise was $9,500. (Normally, cash sales are recorded daily; they are recorded only twice in this problem to reduce the number of repetitive entries.) 14 Post to the customer and creditor accounts and also post any amounts that should be posted as individual amounts to the general ledger accounts. (Normally, such items are posted daily; but you are asked to post them only twice in this problem.) Purchased inventory on credit from Best Company, $410; store supplies, $45; and office supplies, $30. Invoice dated February 12, terms n/10, EOM. 16 Received a credit memorandum from Old Company for unsatisfactory inventory received on February 14 and returned for credit, $85. 17 Received a credit memorandum from More Company for office equipment received on February 9 and returned for credit, $130. 18 Received payment from Carl Cole for the sale of February 11 less the discount. 21 Issued Check No. 416 to Old Company in payment of its invoice of February 11 less the return and the discount 21 Sold inventory costing $475 on credit to Carl Cole for $835, Invoice No. 714. 24 Sold inventory costing $375 on credit to Gary Glen for $775, Invoice No. 715. 26 Issued Check No. 417, payable to Payroll, in payment of sales salaries for the last half of the month, $855. Cashed the check and paid the employees. 28 28 Cash sales for the last half of the month, $20,215. Cost of this merchandise was $ 11,500. Post to the customer and creditor accounts and post any amounts that should be posted as individual amounts to general ledger accounts. Foot and crossfoot the journals and make the month-end postings Feb 28 28 Required: 1. Open the following general ledger accounts: Cash, Accounts Receivable, Inventory, Store Supplies, Office Supplies, Office Equipment, Notes Payable, Accounts Payable, F. Stone, Capital, Sales, Sales Discounts, Cost of Goods Sold, and Sales Salaries Expense 2. Open the following accounts receivable ledger accounts: Carl Cole, 3. Open the following accounts payable ledger accounts: Able 4. Enter the transactions in a Sales Journal, a Purchases Journal, a Dale Dent, and Gary Glen. Company, Best Company, More Company, and Old Company. Cash Receipts Journal, a Cash Disbursements Journal, and a General Journal similar to the ones illustrated in this chapter. Post when instructed to do so. 5. Prepare a trial balance and prove the subsidiary ledgers by preparing schedules of accounts receivable and payable - Also need the following accounts receivable ledger accounts: Carl Cole, Dale Dent, and Gary Glen.

- Open the following accounts payable ledger accounts: Able Company, Best Company, More Company, and Old Company.

- Enter transactions in a Sales Journal, a Purchase Journal, a Cash Receipts Journal, a Cash Disbursements Journal, and a General Journal.

- Prepare trial balance and prove the subsidiary by preparing schedules of accounts receivable and payable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started