Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Any help would be appreciated! Exercise 3: Hydrogen production In this exercise, we look at the impacts of H2 Hubs from the point of view

Any help would be appreciated!

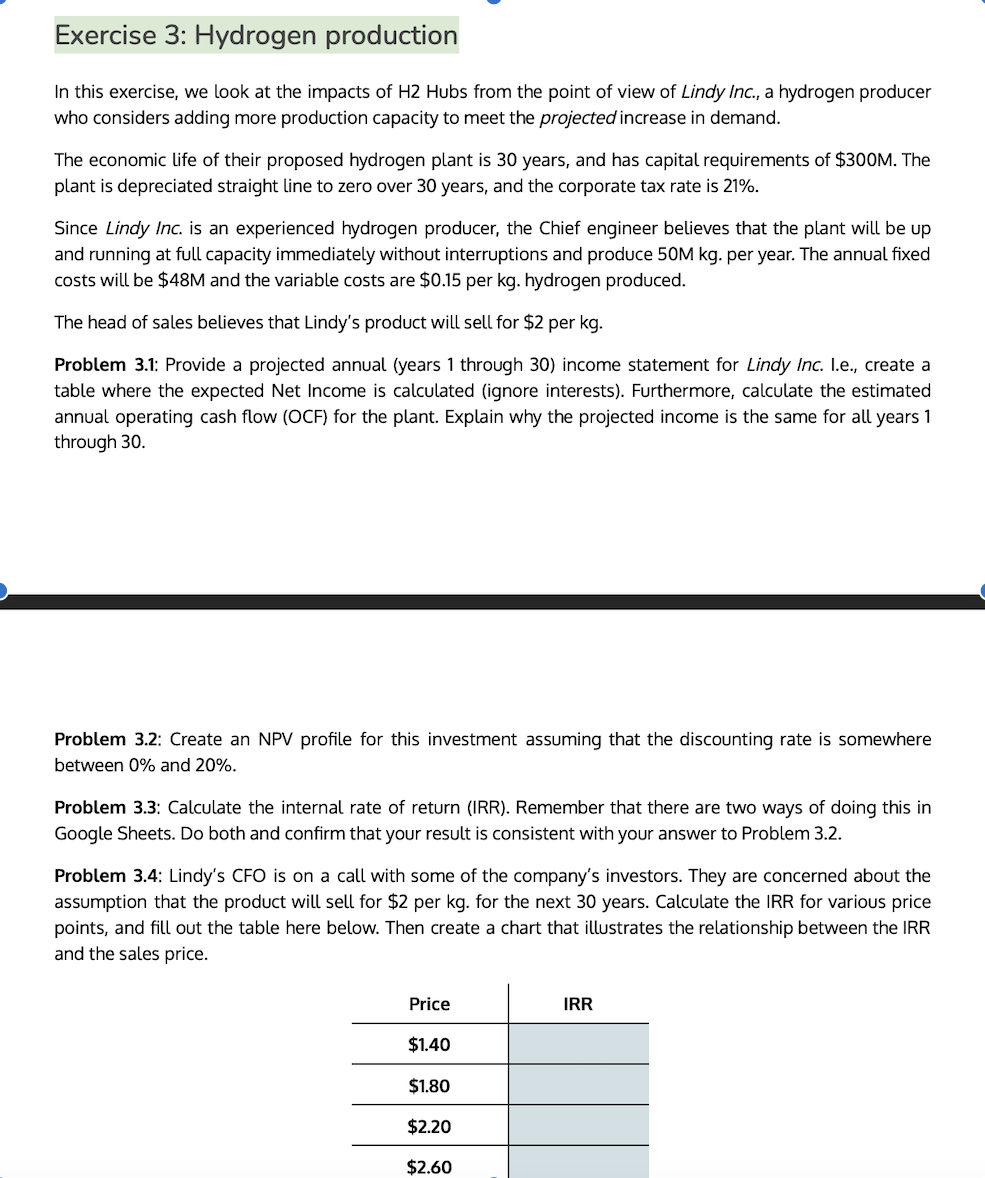

Exercise 3: Hydrogen production In this exercise, we look at the impacts of H2 Hubs from the point of view of Lindy Inc., a hydrogen producer who considers adding more production capacity to meet the projected increase in demand. The economic life of their proposed hydrogen plant is 30 years, and has capital requirements of \$300M. The plant is depreciated straight line to zero over 30 years, and the corporate tax rate is 21%. Since Lindy Inc. is an experienced hydrogen producer, the Chief engineer believes that the plant will be up and running at full capacity immediately without interruptions and produce 50Mkg. per year. The annual fixed costs will be $48M and the variable costs are $0.15 per kg. hydrogen produced. The head of sales believes that Lindy's product will sell for $2 per kg. Problem 3.1: Provide a projected annual (years 1 through 30) income statement for Lindy Inc. I.e., create a table where the expected Net Income is calculated (ignore interests). Furthermore, calculate the estimated annual operating cash flow (OCF) for the plant. Explain why the projected income is the same for all years 1 through 30 . Problem 3.2: Create an NPV profile for this investment assuming that the discounting rate is somewhere between 0% and 20%. Problem 3.3: Calculate the internal rate of return (IRR). Remember that there are two ways of doing this in Google Sheets. Do both and confirm that your result is consistent with your answer to Problem 3.2. Problem 3.4: Lindy's CFO is on a call with some of the company's investors. They are concerned about the assumption that the product will sell for $2 per kg. for the next 30 years. Calculate the IRR for various price points, and fill out the table here below. Then create a chart that illustrates the relationship between the IRR and the sales price

Exercise 3: Hydrogen production In this exercise, we look at the impacts of H2 Hubs from the point of view of Lindy Inc., a hydrogen producer who considers adding more production capacity to meet the projected increase in demand. The economic life of their proposed hydrogen plant is 30 years, and has capital requirements of \$300M. The plant is depreciated straight line to zero over 30 years, and the corporate tax rate is 21%. Since Lindy Inc. is an experienced hydrogen producer, the Chief engineer believes that the plant will be up and running at full capacity immediately without interruptions and produce 50Mkg. per year. The annual fixed costs will be $48M and the variable costs are $0.15 per kg. hydrogen produced. The head of sales believes that Lindy's product will sell for $2 per kg. Problem 3.1: Provide a projected annual (years 1 through 30) income statement for Lindy Inc. I.e., create a table where the expected Net Income is calculated (ignore interests). Furthermore, calculate the estimated annual operating cash flow (OCF) for the plant. Explain why the projected income is the same for all years 1 through 30 . Problem 3.2: Create an NPV profile for this investment assuming that the discounting rate is somewhere between 0% and 20%. Problem 3.3: Calculate the internal rate of return (IRR). Remember that there are two ways of doing this in Google Sheets. Do both and confirm that your result is consistent with your answer to Problem 3.2. Problem 3.4: Lindy's CFO is on a call with some of the company's investors. They are concerned about the assumption that the product will sell for $2 per kg. for the next 30 years. Calculate the IRR for various price points, and fill out the table here below. Then create a chart that illustrates the relationship between the IRR and the sales price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started