Any help would be greatly appreciated

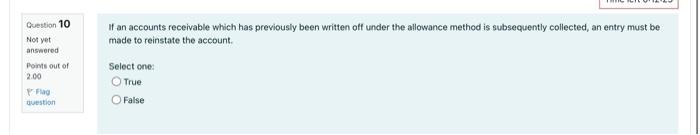

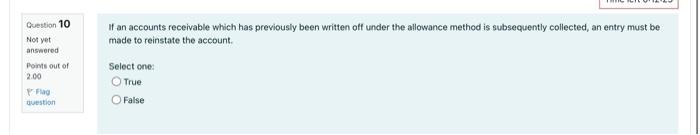

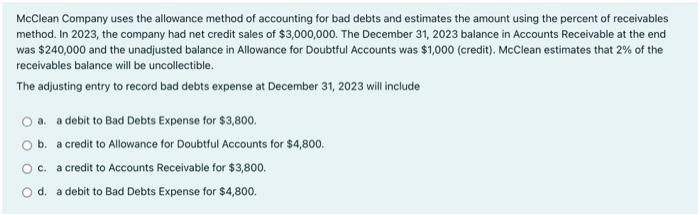

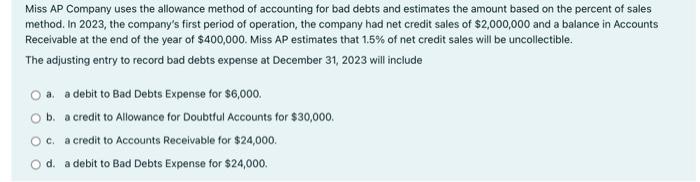

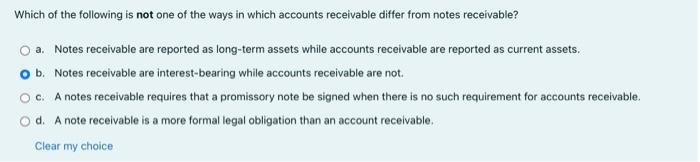

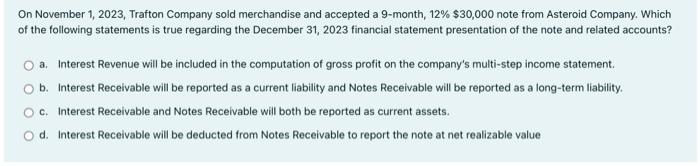

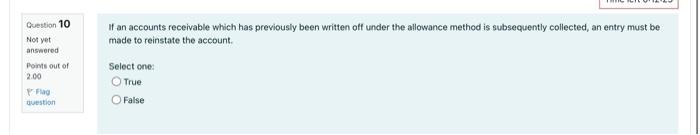

If an accounts receivable which has previously been written off under the allowance method is subsequently collected, an entry must be made to reinstate the account. Select one: True False McClean Company uses the allowance method of accounting for bad debts and estimates the amount using the percent of receivables method. In 2023, the company had net credit sales of $3,000,000. The December 31,2023 balance in Accounts Receivable at the end was $240,000 and the unadjusted balance in Allowance for Doubtful Accounts was $1,000 (credit). McClean estimates that 2% of the receivables balance will be uncollectible. The adjusting entry to record bad debts expense at December 31, 2023 will include a. a debit to Bad Debts Expense for $3,800. b. a credit to Allowance for Doubtful Accounts for $4,800. c. a credit to Accounts Receivable for $3,800. d. a debit to Bad Debts Expense for $4,800. Miss AP Company uses the allowance method of accounting for bad debts and estimates the amount based on the percent of sales method. In 2023, the company's first period of operation, the company had net credit sales of $2,000,000 and a balance in Accounts Receivable at the end of the year of $400,000. Miss AP estimates that 1.5% of net credit sales will be uncollectible. The adjusting entry to record bad debts expense at December 31,2023 will include a. a debit to Bad Debts Expense for $6,000. b. a credit to Allowance for Doubtful Accounts for $30,000. c. a credit to Accounts Receivable for $24,000. d. a debit to Bad Debts Expense for $24,000. Which of the following is not one of the ways in which accounts receivable differ from notes receivable? a. Notes receivable are reported as long-term assets while accounts receivable are reported as current assets. b. Notes receivable are interest-bearing while accounts receivable are not. c. A notes receivable requires that a promissory note be signed when there is no such requirement for accounts receivable. d. A note receivable is a more formal legal obligation than an account receivable. Clear my choice On November 1, 2023, Trafton Company sold merchandise and accepted a 9-month, 12%$30,000 note from Asteroid Company. Which of the following statements is true regarding the December 31, 2023 financial statement presentation of the note and related accounts? a. Interest Revenue will be included in the computation of gross profit on the company's multi-step income statement. b. Interest Receivable will be reported as a current liability and Notes Receivable will be reported as a long-term liability. c. Interest Receivable and Notes Receivable will both be reported as current assets. d. Interest Receivable will be deducted from Notes Receivable to report the note at net realizable value