Any help would be greatly appreciated!

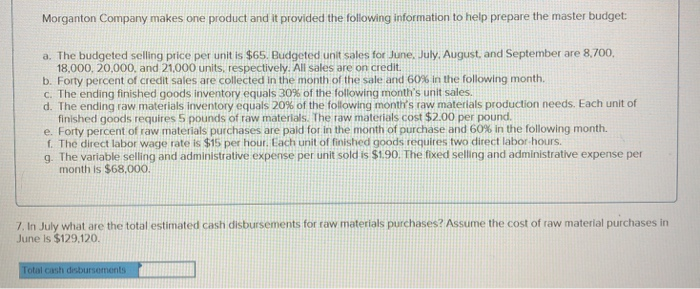

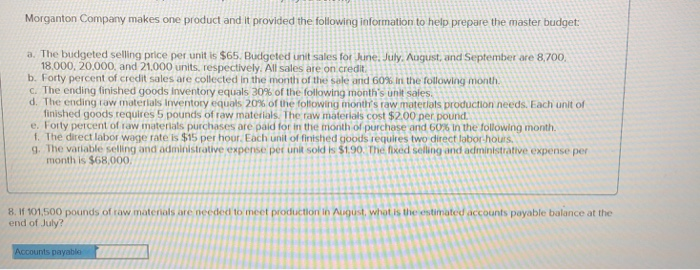

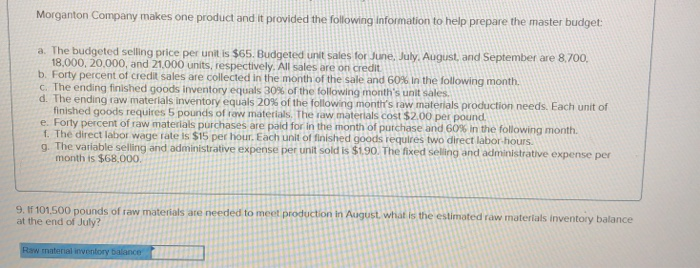

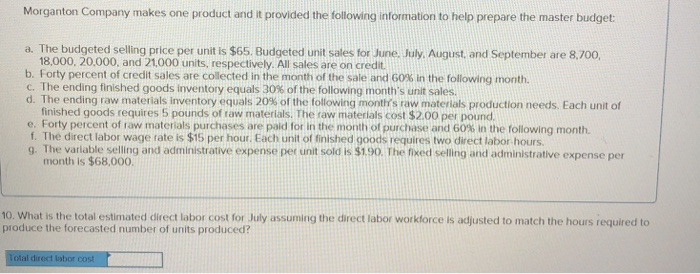

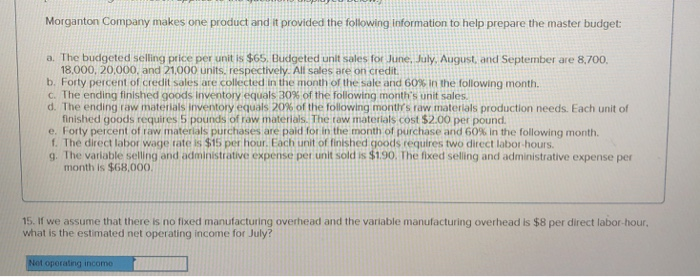

Morganton Company makes one product and it provided the following information to help prepare the master budget a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July. August, and September are 8,700, 18,000, 20,000, and 21,000 units, respectively. All sales are on credit b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 30% of the following month's unit sales. d The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor-hours. g. The variable selling and administrative expense per unit sold is $190. The fixed selling and administrative expense per month is $68.000. 7. In July what are the total estimated cash disbursements for raw materials purchases? Assume the cost of raw material purchases in June is $129,120 Total cash desbursements Morganton Company makes one product and it provided the following ioformation to help prepare the master budget a. The budgeted selling price per unit is $65. Budgeted unit sales for June. July, August, and September are 8,700, 18.000, 20.000, and 21.000 units, respectively. All sales are on credit b. Forty percent of credit sales are collected in the month of the sole and 60% in the following month. C. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following months raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound e. I orty percent of law materials purchases are paid for irthe month or purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour Each unit of finished goods requires two direct labor-hours g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $68,000 8. If 101,500 pounds of taw matenials are needed to meet productin end of July? in August, what is the estimated accounts payable balance at the Morganton Company makes one product and t provided the following information to help prepare the master budget a. The budgeted selling price per unit is $65. Budgeted unit sales for une, July. August and September are 8700. 18.000, 20.000, and 21,000 units, respectively. All sales are on credit b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. C. Theending finished goods inventory equals 30% of the following month's unit sales. he ending raw materials imvertory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of row materials. The raw materials cost $2.00 per pound e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requlres two direct labor-hours g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $68,000. 9. If 101,500 pounds at the end of July? 1f raw materials ane needetomeet odcionin Aest ut i the elinuded w utertuts iventoy blance raw in August. whiat is the estimated raw materials inventory balance organton Co a. The budgeted selling price per unit is $65. Budgeted unit sales for June. July. August, and September are 8,700, mpany makes one product and it provided the following information to help prepare the master budget: 18,000, 20,000, and 21,000 units, respectively. All sales are on credit b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following months raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor hours g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $68,000. 10. What is the total estimated direct labor cost for July assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced? Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July. August, and September are 8,700, 18,000, 20,000, and 21,000 units, respectively. All sales are on credit b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor-hours g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $68,000. 11. If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $8 per direct labor-hour, what is the estimated unit product cost? (Round your answer to 2 decimal places.) Jnit product cost Morganton Company makes one product and it provided the following information to help prepare the master budget a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July. August, and September are 8,700, 18,000, 20,000, and 21,000 units, respectively. All sales are on credit. b Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor-hours. g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $68,000. 12. If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $8 per direct labor-hour what is the estimated finished goods inventory balance at the end of July? Ending finished goods inventory Morganton Company makes one product and it provided the following information to help prepare the master budget a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July,. August, and September are 8,700 18.000. 20.000, and 21,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 30% of the following month's unit sales. d The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor-hours. g. The variable seling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $68,000. 13. If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $8 per direct labor-hour, what is the estimated cost of goods sold and gross margin for July? Estimated cost of goods sold Estimated gross margin Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July. August, and September are 8,700, 18,000, 20,000, and 21,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 30% of the following month's unit sales. d The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit o finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor-hours g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $68,000. 14. What is the estimated total selling and administrative expense for July? Morganton Company makes one product and it provided the following information to help prepare the master budget a. The budgeted selling price per unit is $65. Budgeted unit sales for June, July, August, and September are 8,700. 18,000,20,000, and 21,000 units. respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c. The ending finished goods inventory equals 30% of the following month's unit sales. d. The ending raw materials inventory equals 20% of the following monts raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound e Forty percent of raw materials purchases are paid for in the month of purchase and 60% n the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor hours g. The variable selling and administrative expense per unit sold is $1.90. The fixed selling and administrative expense per month is $68,000. 15. If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $8 per direct labor-hour. what is the estimated net operating income for July? Not oporating