Any Help would be greatly appriecated. I am a little confused at the moment.

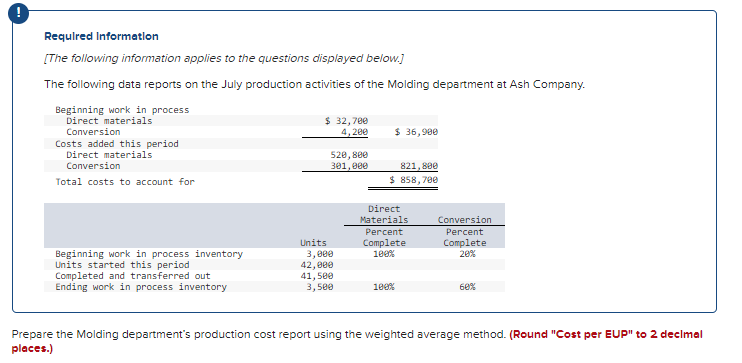

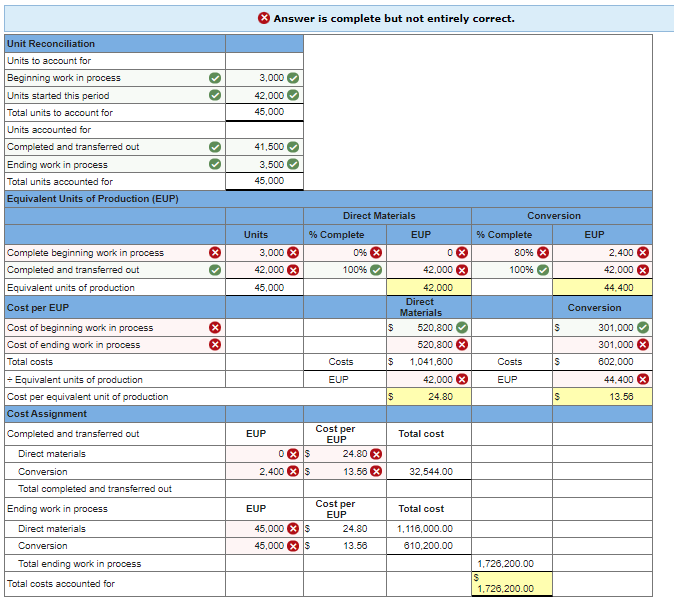

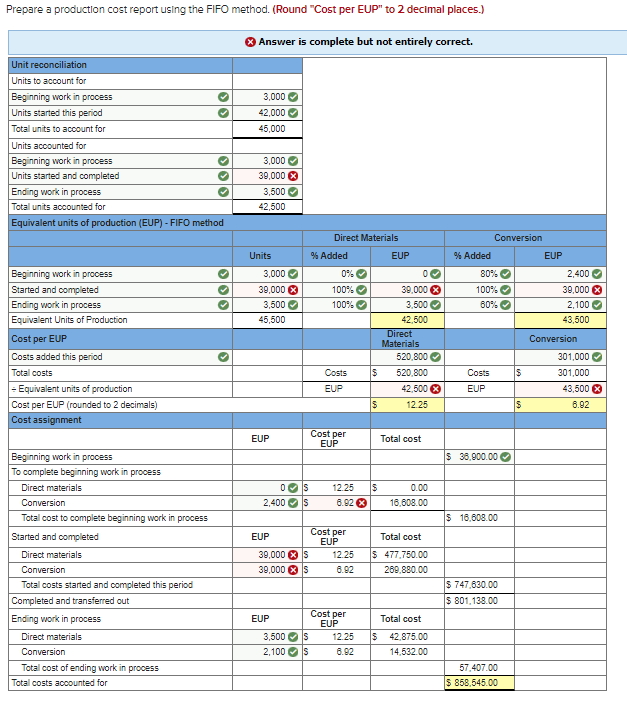

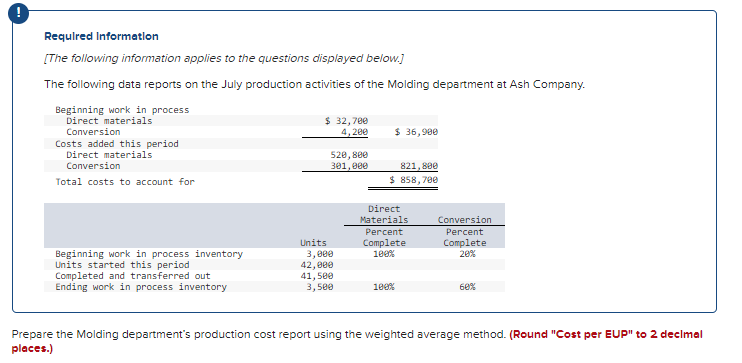

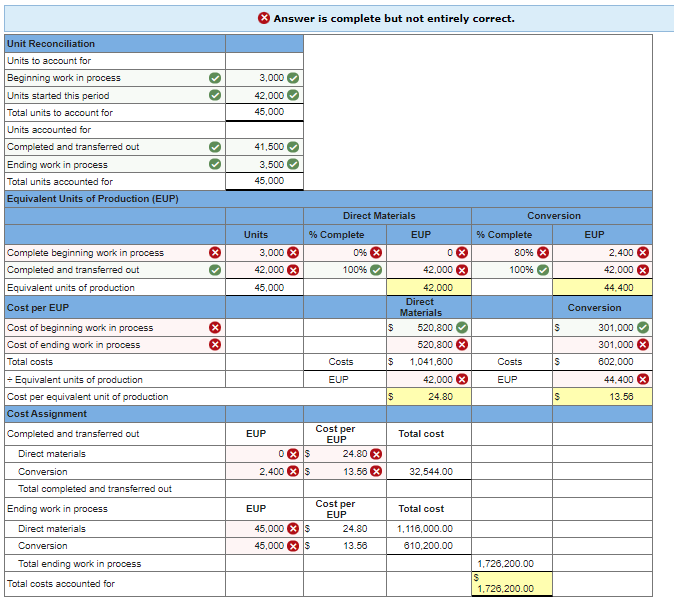

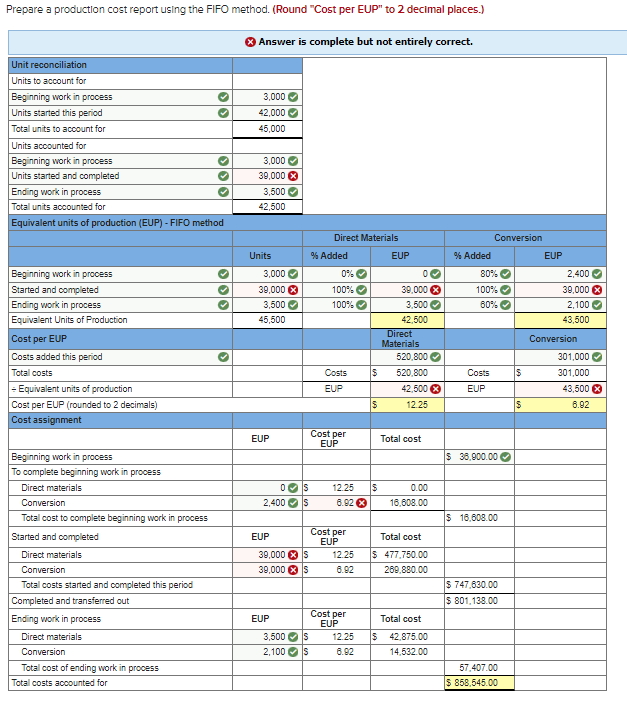

! Required Information [The following information applies to the questions displayed below.] The following data reports on the July production activities of the Molding department at Ash Company. Beginning work in process Direct materials $ 32,780 Conversion 4,200 $36,900 Costs added this period Direct materials 520, 8ee Conversion 301, eee 821,899 Total costs to account for $ 858,780 Direct Materials Percent Complete 100% Conversion Percent Complete 2ex Beginning work in process inventory Units started this period Completed and transferred out Ending work in process inventory Units 3,880 42,eee 41,500 3,5ee 100% 60% Prepare the Molding department's production cost report using the weighted average method. (Round "Cost per EUP" to 2 decimal places.) Answer is complete but not entirely correct. olo 3,000 42,000 45,000 Unit Reconciliation Units to account for Beginning work in process Units started this period Total units to account for Units accounted for Completed and transferred out Ending work in process Total units accounted for Equivalent Units of Production (EUP) 41,500 3,500 45,000 Units 3,000 X X Conversion % Complete EUP 80% 2.400 X 100% 42,000 X 44.400 Conversion Direct Materials % Complete EUP 0% % 0 X 100% 42.000 x 42,000 Direct Materials s 520.800 520,800 X Costs s 1.041.800 EUP 42.000 x $ 24.80 42,000 X 45,000 S X % 301.000 301.000 602.000 44.400 x Costs S EUP S 13.58 Complete beginning work in process Completed and transferred out Equivalent units of production Cost per EUP Cost of beginning work in process Cost of ending work in process Total costs - Equivalent units of production Cost per equivalent unit of production Cost Assignment Completed and transferred out Direct materials Conversion Total completed and transferred out Ending work in process Direct materials Conversion Total ending work in process Total costs accounted for EUP Total cost Cost per EUP 24.80 X 0 X $ 2.400 X s 13.58 X 32,544.00 EUP Total cost 45,000 $ 45,000 X $ Cost per EUP 24.80 13.56 1,116,000.00 610,200.00 1,726,200.00 S 1,726,200.00 Prepare a production cost report using the FIFO method. (Round "Cost per EUP" to 2 decimal places.) Answer is complete but not entirely correct. Oo 3,000 42,000 45,000 Unit reconciliation Units to account for Beginning work in process Units started this period Total units to account for Units accounted for Beginning work in process Units started and completed Ending work in process Total units accounted for Equivalent units of production (EUP) - FIFO method OOO 3,000 39,000 3,500 42,500 Direct Materials % Added EUP Conversion % Added EUP Units 3,000 Beginning work in process Started and completed Ending work in process Equivalent Units of Production Solo 39,000 3,500 45,500 0% 100% 100% 80% 100% 60% 2.400 39,000 X 2,100 43,500 Cost per EUP 0 39,000 3.500 42,500 Direct Materials 520.800 520.800 42.500 X 12.25 > S S Costs added this period Total costs = Equivalent units of production Cost per EUP (rounded to 2 decimals) Cost assignment Costs EUP Costs EUP Conversion 301,000 301.000 43,500 x 8.92 S $ EUP Cost per EUP Total cost $ 38,900.00 $ OS 2.400$ 12.25 8.92 0.00 16,608.00 $ 16,608.00 EUP Total cost Beginning work in process To complete beginning work in process Direct materials Conversion Total cost to complete beginning work in process Started and completed Direct materials Conversion Total costs started and completed this period Completed and transferred out Ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for Cost per EUP 39,000 XS 12.25 39,000 XS 6.92 $ 477.750.00 269,880.00 $ 747.630.00 $ 801.138.00 EUP Cost per EUP 3,500S 12.25 2,100S 8.92 Total cost $ 42.875.00 14,532.00 57,407.00 $ 858,545.00