Any help would be much appreciated! If you help me, I'll make sure to leave a good review and a thumbs up. Thanks in advance!

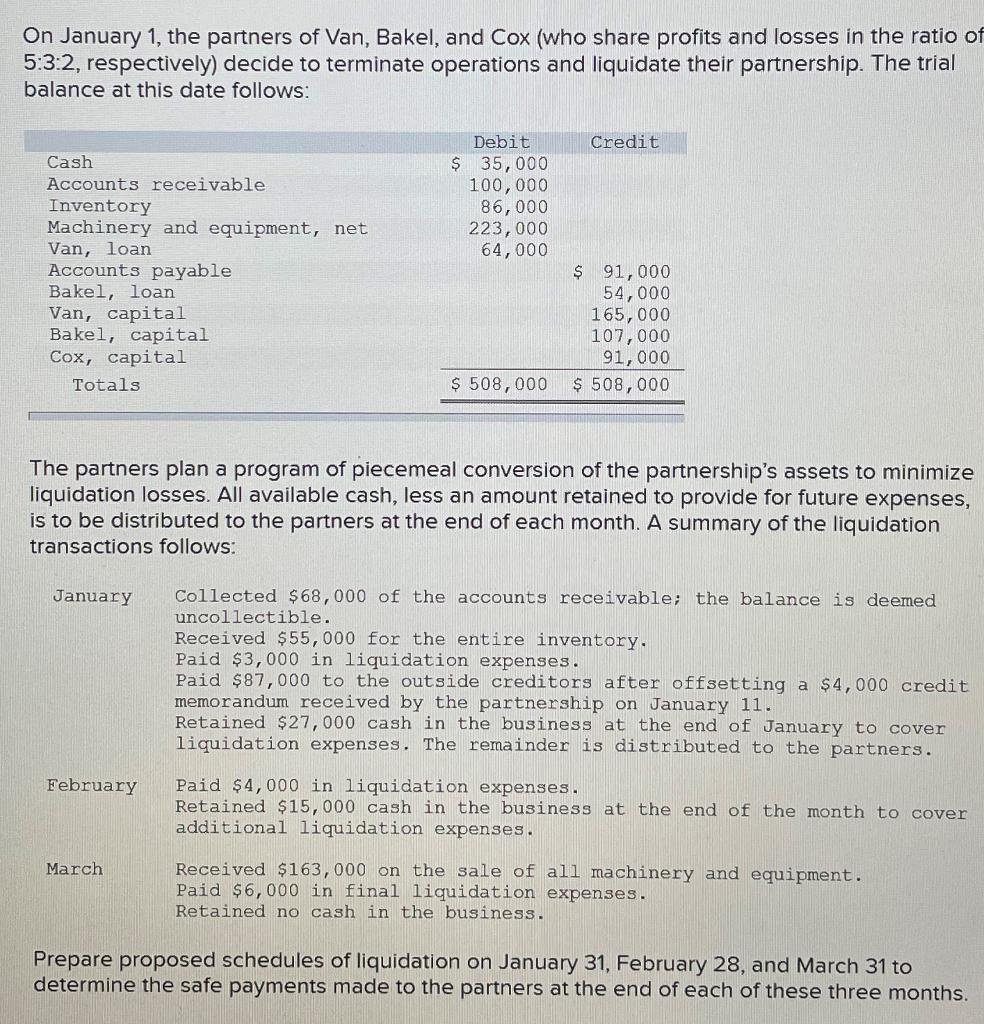

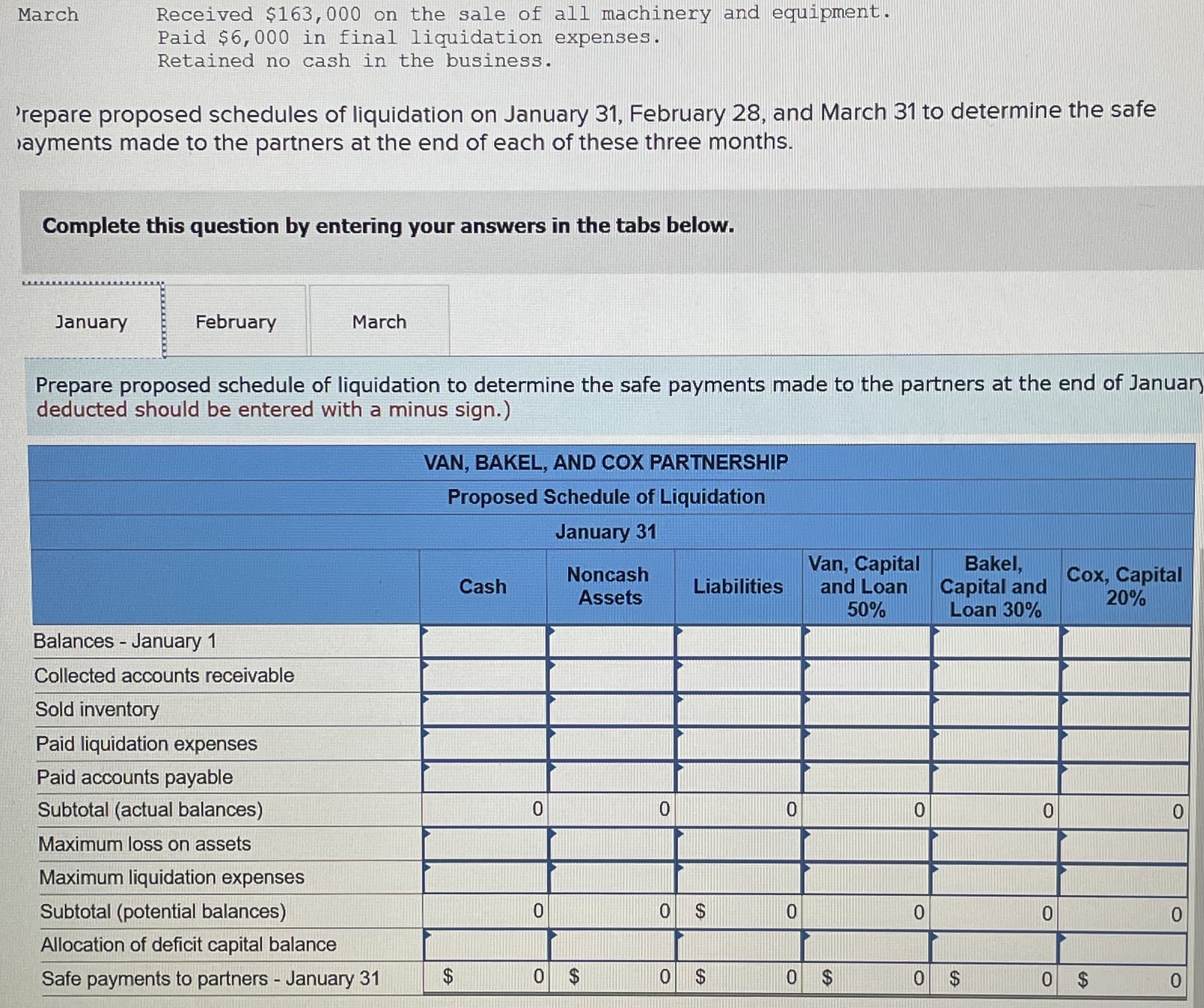

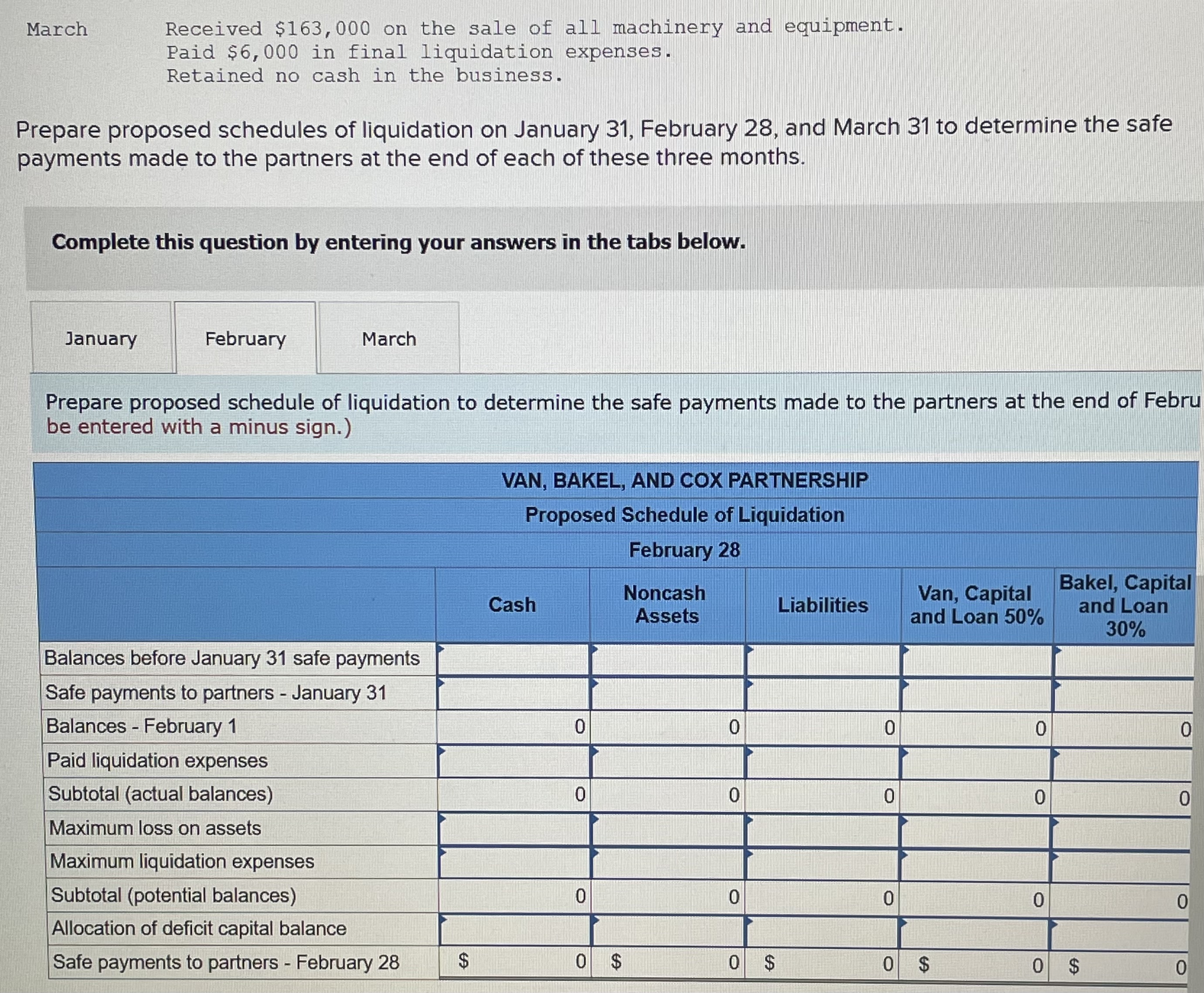

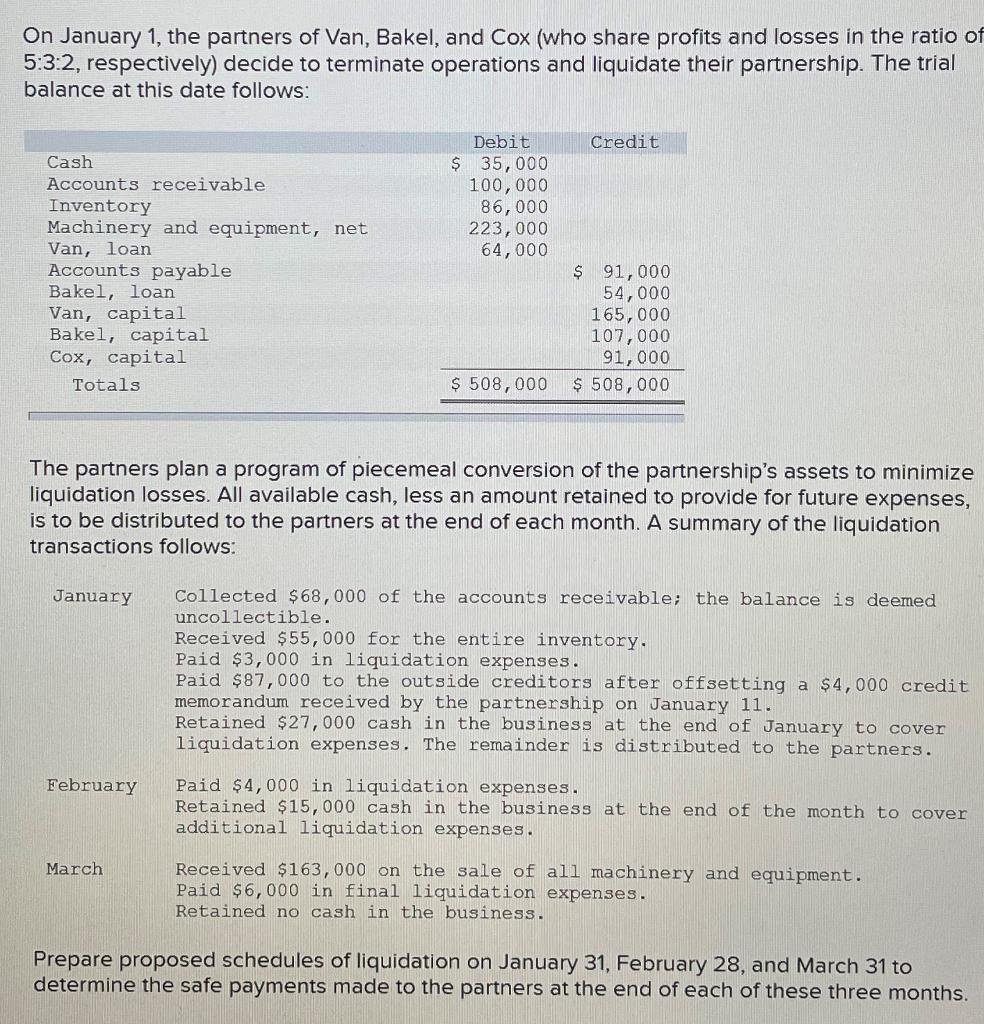

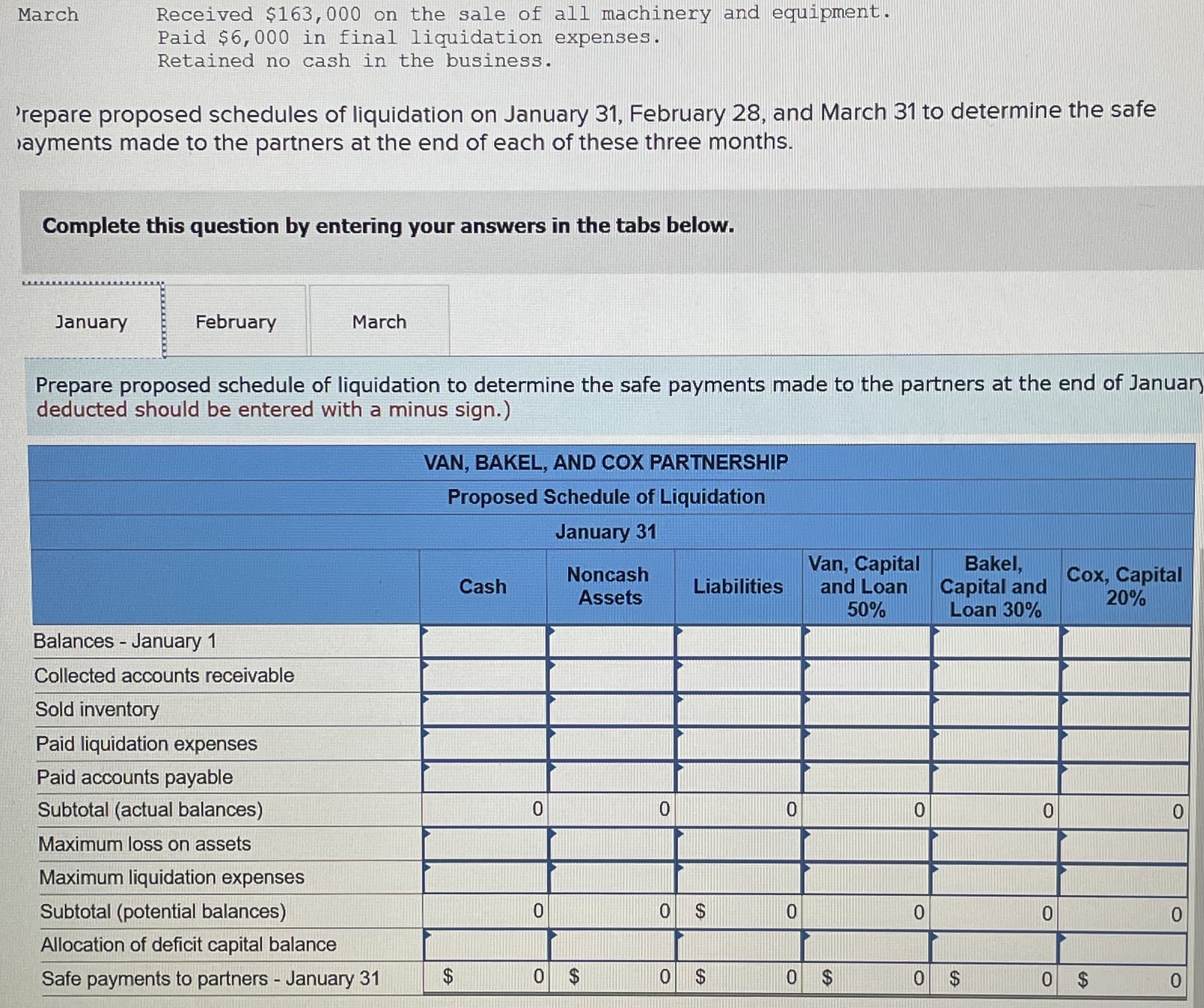

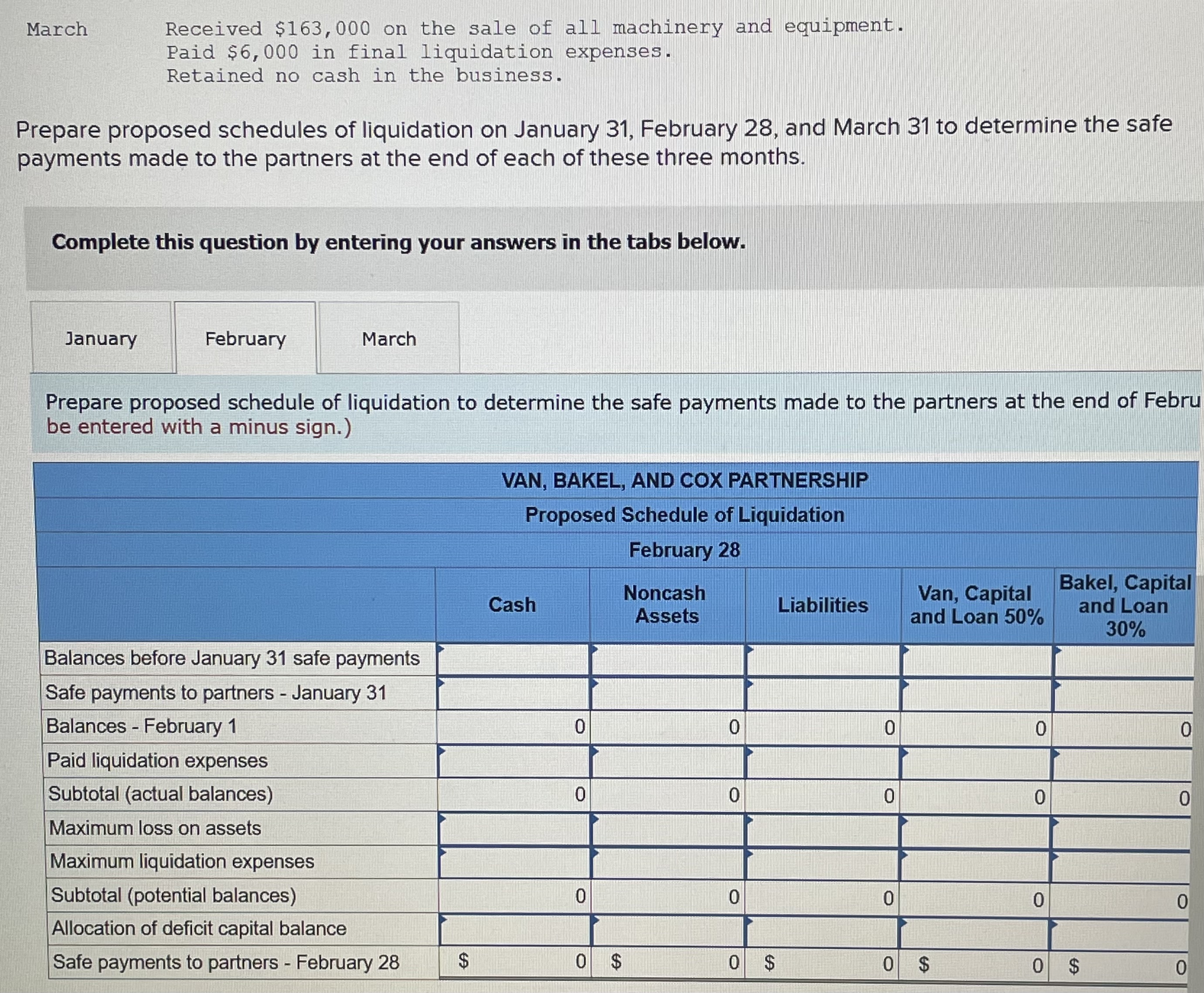

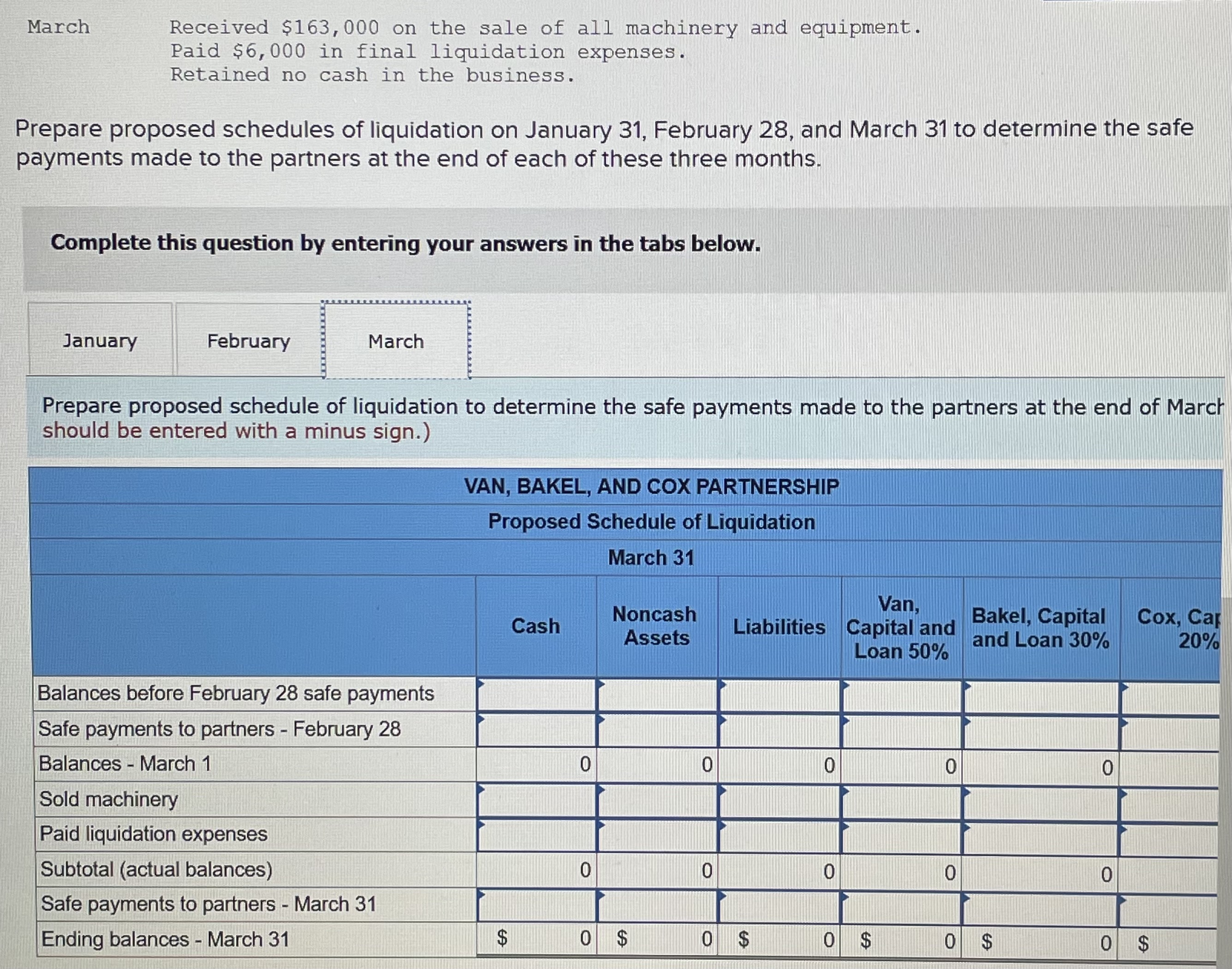

On January 1, the partners of Van, Bakel, and Cox (who share profits and losses in the ratio of 5:3:2, respectively) decide to terminate operations and liquidate their partnership. The trial balance at this date follows: Credit Debit $ 35,000 100,000 86,000 223,000 64,000 Cash Accounts receivable Inventory Machinery and equipment, net Van, loan Accounts payable Bakel, loan Van, capital Bakel, capital Cox, capital Totals $ 91,000 54,000 165,000 107,000 91,000 $ 508,000 $ 508,000 The partners plan a program of piecemeal conversion of the partnership's assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month. A summary of the liquidation transactions follows: January Collected $68,000 of the accounts receivable; the balance is deemed uncollectible. Received $55,000 for the entire inventory. Paid $3,000 in liquidation expenses. Paid $87,000 to the outside creditors after offsetting a $4,000 credit memorandum received by the partnership on January 11. Retained $27,000 cash in the business at the end of January to cover liquidation expenses. The remainder is distributed to the partners. February Paid $4,000 in liquidation expenses. Retained $15,000 cash in the business at the end of the month to cover additional liquidation expenses. March Received $163,000 on the sale of all machinery and equipment. Paid $6,000 in final liquidation expenses. Retained no cash in the business. Prepare proposed schedules of liquidation on January 31, February 28, and March 31 to determine the safe payments made to the partners at the end of each of these three months. March Received $163,000 on the sale of all machinery and equipment. Paid $6,000 in final liquidation expenses. Retained no cash in the business. . Prepare proposed schedules of liquidation on January 31, February 28, and March 31 to determine the safe ayments made to the partners at the end of each of these three months. Complete this question by entering your answers in the tabs below. January February March Prepare proposed schedule of liquidation to determine the safe payments made to the partners at the end of January deducted should be entered with a minus sign.) VAN, BAKEL, AND COX PARTNERSHIP Proposed Schedule of Liquidation January 31 Cash Noncash Assets Liabilities Van, Capital and Loan 50% Bakel, Capital and Loan 30% Cox, Capital 20% Balances - January 1 - Collected accounts receivable Sold inventory Paid liquidation expenses Paid accounts payable Subtotal (actual balances) 0 0 0 0 0 0 Maximum loss on assets 0 0 $ 0 0 0 0 Maximum liquidation expenses Subtotal (potential balances) Allocation of deficit capital balance Safe payments to partners - January 31 $ 0 $ 0 0 $ 0 $ O $ 0 $ 0 March Received $163,000 on the sale of all machinery and equipment. Paid $6,000 in final liquidation expenses. Retained no cash in the business. Prepare proposed schedules of liquidation on January 31, February 28, and March 31 to determine the safe payments made to the partners at the end of each of these three months. Complete this question by entering your answers in the tabs below. January February March Prepare proposed schedule of liquidation to determine the safe payments made to the partners at the end of Febru be entered with a minus sign.) VAN, BAKEL, AND COX PARTNERSHIP Proposed Schedule of Liquidation February 28 Cash Noncash Assets Liabilities Van, Capital and Loan 50% Bakel, Capital and Loan 30% - Balances before January 31 safe payments Safe payments to partners - January 31 Balances - February 1 Paid liquidation expenses Subtotal (actual balances) 0 0 0 0 0 0 0 0 0 0 Maximum loss on assets 0 0 0 0 0 Maximum liquidation expenses Subtotal (potential balances) Allocation of deficit capital balance Safe payments to partners - February 28 $ 0 $ 0 $ 0 $ 0 $ 0 March Received $163,000 on the sale of all machinery and equipment. Paid $6,000 in final liquidation expenses. Retained no cash in the business. Prepare proposed schedules of liquidation on January 31, February 28, and March 31 to determine the safe payments made to the partners at the end of each of these three months. Complete this question by entering your answers in the tabs below. January February March Prepare proposed schedule of liquidation to determine the safe payments made to the partners at the end of March should be entered with a minus sign.) VAN, BAKEL, AND COX PARTNERSHIP Proposed Schedule of Liquidation March 31 Cash Noncash Assets Van, Liabilities Capital and Loan 50% Bakel, Capital and Loan 30% , 20% - - 0 0 0 0 0 Balances before February 28 safe payments Safe payments to partners - February 28 Balances - March 1 Sold machinery Paid liquidation expenses Subtotal (actual balances) Safe payments to partners - March 31 Ending balances - March 31 0 0 0 0 0 $ 0 $ 0 $ 0 $ 0 $ 0 $