Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Any kind of help is appreciated! The following information has been provided for Abbott Company. Standard Costs Direct Materials Direct Manufacturing Labor Variable Manufacturing Overhead

Any kind of help is appreciated!

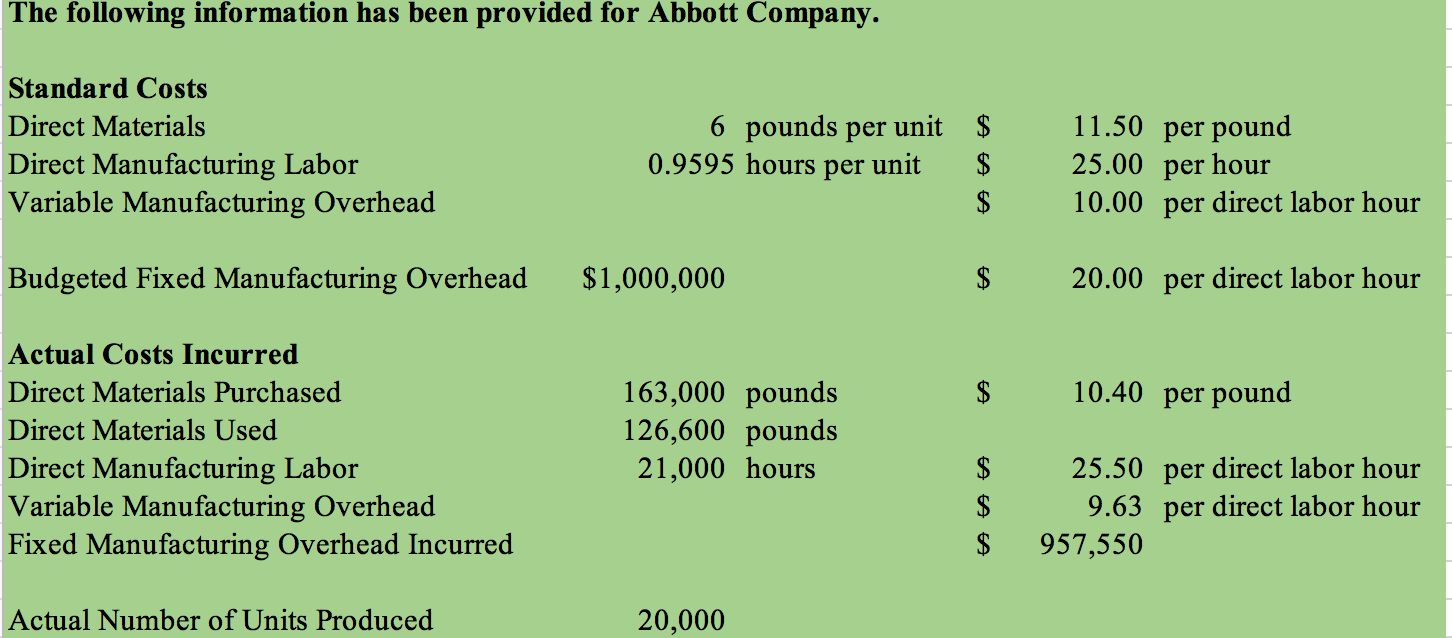

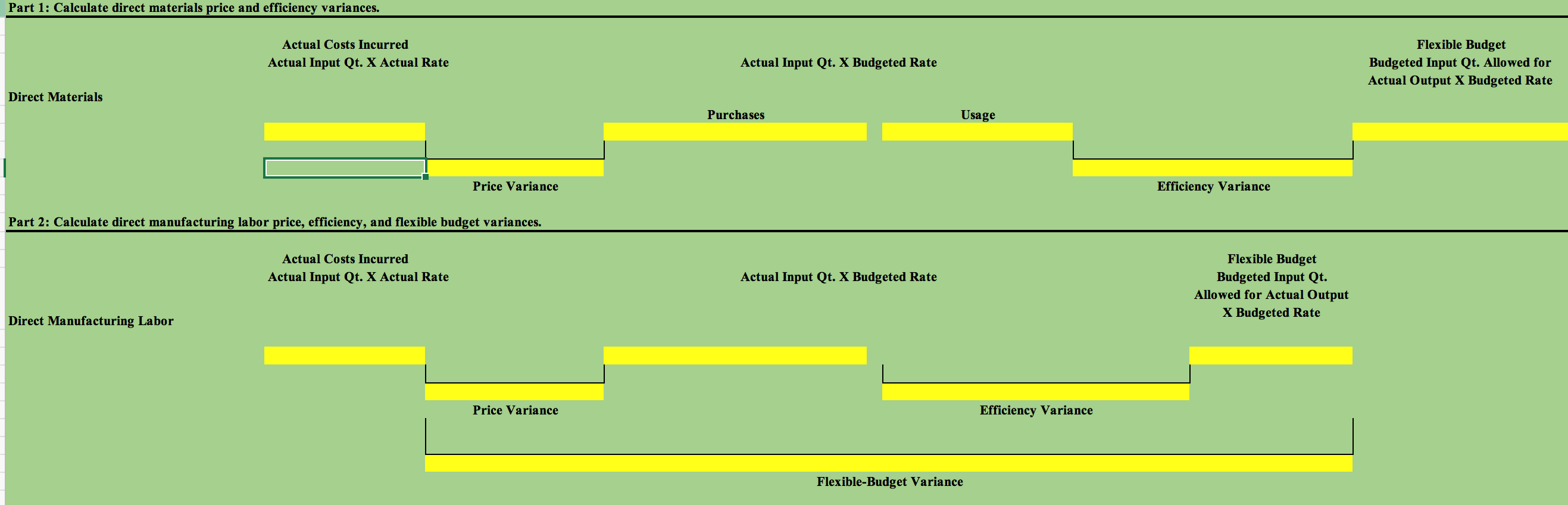

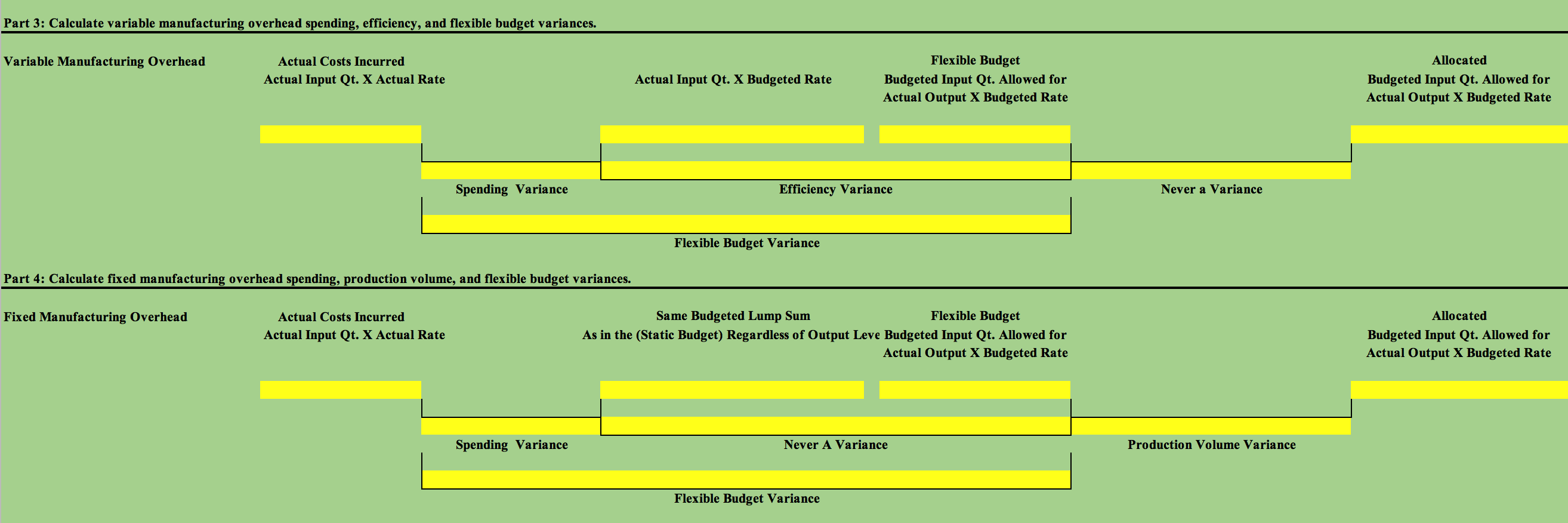

The following information has been provided for Abbott Company. Standard Costs Direct Materials Direct Manufacturing Labor Variable Manufacturing Overhead 6 pounds per unit $ 0.9595 hours per unit $ 11.50 per pound 25.00 per hour 10.00 per direct labor hour Budgeted Fixed Manufacturing Overhead $1,000,000 20.00 per direct labor hour $ 10.40 per pound Actual Costs Incurred Direct Materials Purchased Direct Materials Used Direct Manufacturing Labor Variable Manufacturing Overhead Fixed Manufacturing Overhead Incurred 163,000 pounds 126,600 pounds 21,000 hours $ $ $ 25.50 per direct labor hour 9.63 per direct labor hour 957,550 Actual Number of Units Produced 20,000 Part 1: Calculate direct materials price and efficiency variances. Actual Costs Incurred Actual Input Qt. X Actual Rate Actual Input Qt. X Budgeted Rate Flexible Budget Budgeted Input Qt. Allowed for Actual Output X Budgeted Rate Direct Materials Purchases Usage Price Variance Efficiency Variance Part 2: Calculate direct manufacturing labor price, efficiency, and flexible budget variances. Actual Costs Incurred Actual Input Qt. X Actual Rate Actual Input Qt. X Budgeted Rate Flexible Budget Budgeted Input Qt. Allowed for Actual Output X Budgeted Rate Direct Manufacturing Labor Price Variance Efficiency Variance Flexible-Budget Variance Part 3: Calculate variable manufacturing overhead spending, efficiency, and flexible budget variances. Variable Manufacturing Overhead Actual Costs Incurred Actual Input Qt. X Actual Rate Actual Input Qt. X Budgeted Rate Flexible Budget Budgeted Input Qt. Allowed for Actual Output X Budgeted Rate Allocated Budgeted Input Qt. Allowed for Actual Output X Budgeted Rate Spending Variance Efficiency Variance Never a Variance Flexible Budget Variance Part 4: Calculate fixed manufacturing overhead spending, production volume, and flexible budget variances. Fixed Manufacturing Overhead Actual Costs Incurred Actual Input Qt. X Actual Rate Same Budgeted Lump Sum Flexible Budget As in the (Static Budget) Regardless of Output Leve Budgeted Input Qt. Allowed for Actual Output X Budgeted Rate Allocated Budgeted Input Qt. Allowed for Actual Output X Budgeted Rate Spending Variance Never A Variance Production Volume Variance Flexible Budget VarianceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started