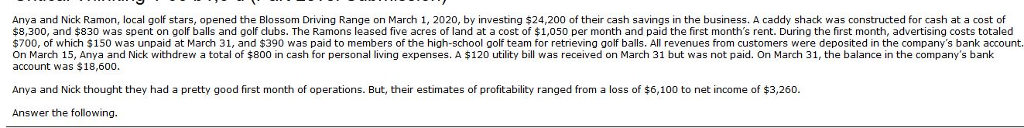

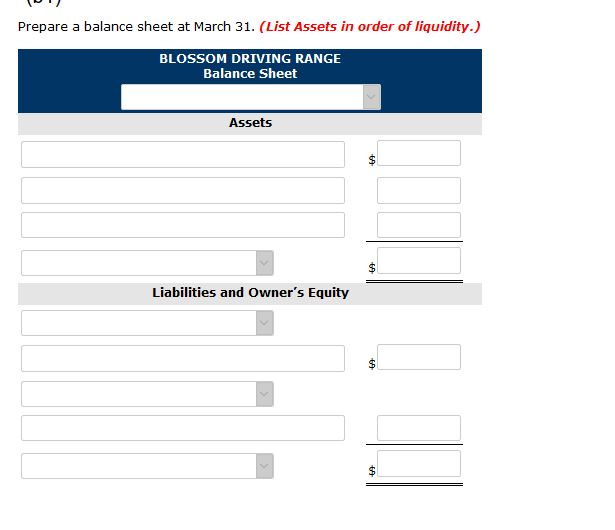

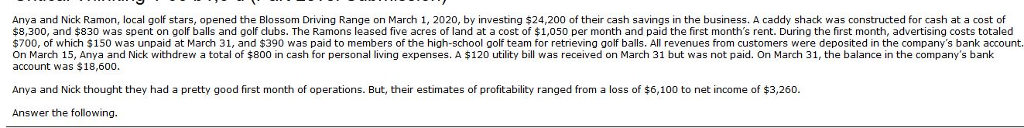

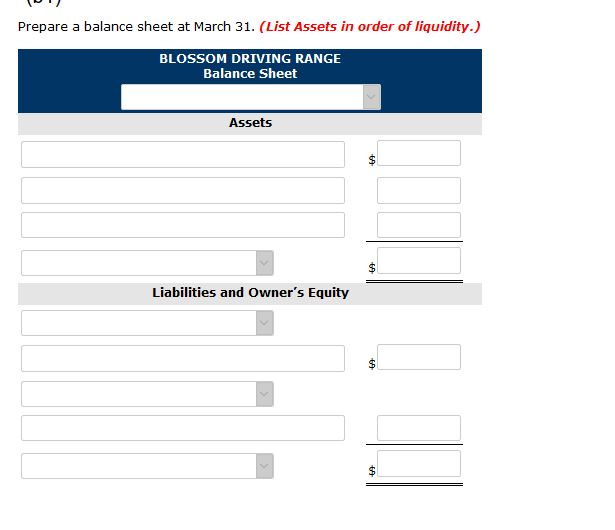

Anya and Nick Ramon, local golf stars, opened the Blossom Driving Range on March 1, 2020, by investing $24,200 of their cash savings in the business. A caddy shack was constructed for cash at a cost of $8,300, and $830 was spent on golf balls and golf clubs. The Ramons leased five acres of land at a cost of $1,050 per month and paid the first month's rent. During the first month, advertising costs totaled $700, of which $150 was unpaid at March 31, and $390 was paid to members of the high-school golf team for retrieving golf balls. All revenues from customers were deposited in the company's bank account On March 15, Anya and Nick withdrew a total of $800 in cash for personal living expenses. A $120 utility bill was received on March 31 but was not paid. On March 31, the balance in the company's bank account was $18,600 0 was unpaid at March 31, and Anya and Nick thought they had a pretty good first month of operations. But, their estimates of profitability ranged from a loss of $6,100 to net income of $3,260 Answer the following. Prepare a balance sheet at March 31. (List Assets in order of liquidity.) BLOSSOM DRIVING RANGE Balance Sheet Assets Liabilities and Owner's Equity 13 Anya and Nick Ramon, local golf stars, opened the Blossom Driving Range on March 1, 2020, by investing $24,200 of their cash savings in the business. A caddy shack was constructed for cash at a cost of $8,300, and $830 was spent on golf balls and golf clubs. The Ramons leased five acres of land at a cost of $1,050 per month and paid the first month's rent. During the first month, advertising costs totaled $700, of which $150 was unpaid at March 31, and $390 was paid to members of the high-school golf team for retrieving golf balls. All revenues from customers were deposited in the company's bank account On March 15, Anya and Nick withdrew a total of $800 in cash for personal living expenses. A $120 utility bill was received on March 31 but was not paid. On March 31, the balance in the company's bank account was $18,600 0 was unpaid at March 31, and Anya and Nick thought they had a pretty good first month of operations. But, their estimates of profitability ranged from a loss of $6,100 to net income of $3,260 Answer the following. Prepare a balance sheet at March 31. (List Assets in order of liquidity.) BLOSSOM DRIVING RANGE Balance Sheet Assets Liabilities and Owner's Equity 13