Question

Anya and Nick Ramon, local golf stars, opened the Crane Driving Range on March 1, 2020, by investing $24,700 of their cash savings in the

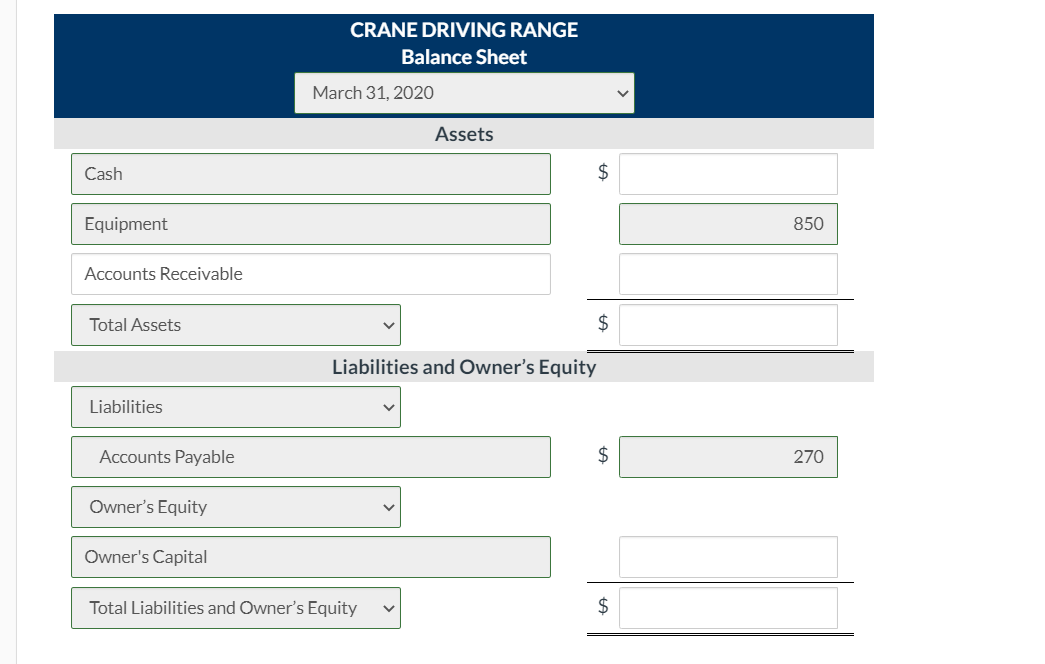

Anya and Nick Ramon, local golf stars, opened the Crane Driving Range on March 1, 2020, by investing $24,700 of their cash savings in the business. A caddy shack was constructed for cash at a cost of $8,500, and $850 was spent on golf balls and golf clubs. The Ramons leased five acres of land at a cost of $1,150 per month and paid the first months rent. During the first month, advertising costs totaled $750, of which $150 was unpaid at March 31, and $410 was paid to members of the high-school golf team for retrieving golf balls. All revenues from customers were deposited in the companys bank account. On March 15, Anya and Nick withdrew a total of $1,200 in cash for personal living expenses. A $120 utility bill was received on March 31 but was not paid. On March 31, the balance in the companys bank account was $18,300. Anya and Nick thought they had a pretty good first month of operations. But, their estimates of profitability ranged from a loss of $6,100 to net income of $2,680. Answer the following.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started