Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anybody can help and explain. Thxs Question 2 After a long confinement period, you are looking for a tour around the world. To finance your

Anybody can help and explain. Thxs

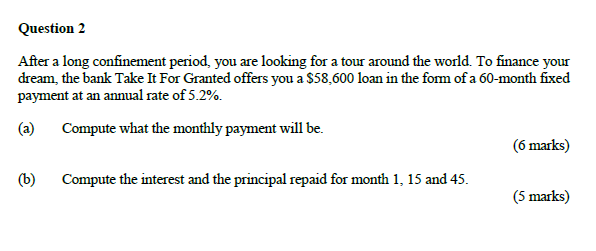

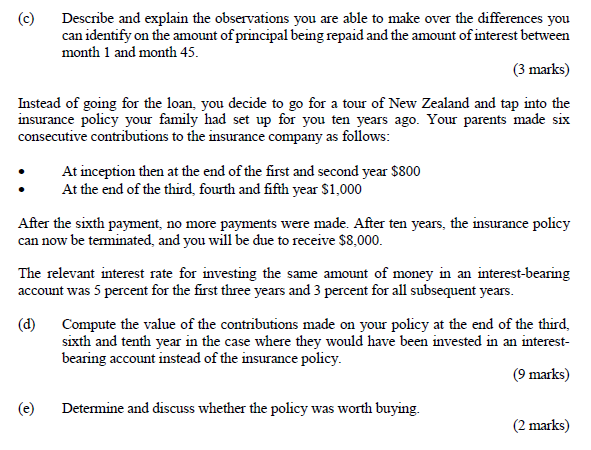

Question 2 After a long confinement period, you are looking for a tour around the world. To finance your dream, the bank Take It For Granted offers you a $58,600 loan in the form of a 60-month fixed payment at an annual rate of 5.2%. (a) Compute what the monthly payment will be. (6 marks) (b) Compute the interest and the principal repaid for month 1, 15 and 45. (5 marks) (c) Describe and explain the observations you are able to make over the differences you can identify on the amount of principal being repaid and the amount of interest between month 1 and month 45. (3 marks) Instead of going for the loan, you decide to go for a tour of New Zealand and tap into the insurance policy your family had set up for you ten years ago. Your parents made six consecutive contributions to the insurance company as follows: At inception then at the end of the first and second year $800 At the end of the third, fourth and fifth year $1,000 After the sixth payment, no more payments were made. After ten years, the insurance policy can now be terminated, and you will be due to receive $8,000. The relevant interest rate for investing the same amount of money in an interest-bearing account was 5 percent for the first three years and 3 percent for all subsequent years. (d) Compute the value of the contributions made on your policy at the end of the third, sixth and tenth year in the case where they would have been invested in an interest- bearing account instead of the insurance policy. (9 marks) Determine and discuss whether the policy was worth buying. (2 marks) Question 2 After a long confinement period, you are looking for a tour around the world. To finance your dream, the bank Take It For Granted offers you a $58,600 loan in the form of a 60-month fixed payment at an annual rate of 5.2%. (a) Compute what the monthly payment will be. (6 marks) (b) Compute the interest and the principal repaid for month 1, 15 and 45. (5 marks) (c) Describe and explain the observations you are able to make over the differences you can identify on the amount of principal being repaid and the amount of interest between month 1 and month 45. (3 marks) Instead of going for the loan, you decide to go for a tour of New Zealand and tap into the insurance policy your family had set up for you ten years ago. Your parents made six consecutive contributions to the insurance company as follows: At inception then at the end of the first and second year $800 At the end of the third, fourth and fifth year $1,000 After the sixth payment, no more payments were made. After ten years, the insurance policy can now be terminated, and you will be due to receive $8,000. The relevant interest rate for investing the same amount of money in an interest-bearing account was 5 percent for the first three years and 3 percent for all subsequent years. (d) Compute the value of the contributions made on your policy at the end of the third, sixth and tenth year in the case where they would have been invested in an interest- bearing account instead of the insurance policy. (9 marks) Determine and discuss whether the policy was worth buying. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started