Anyone can help to answer part d i and ii?

Anyone can help to answer part d i and ii?

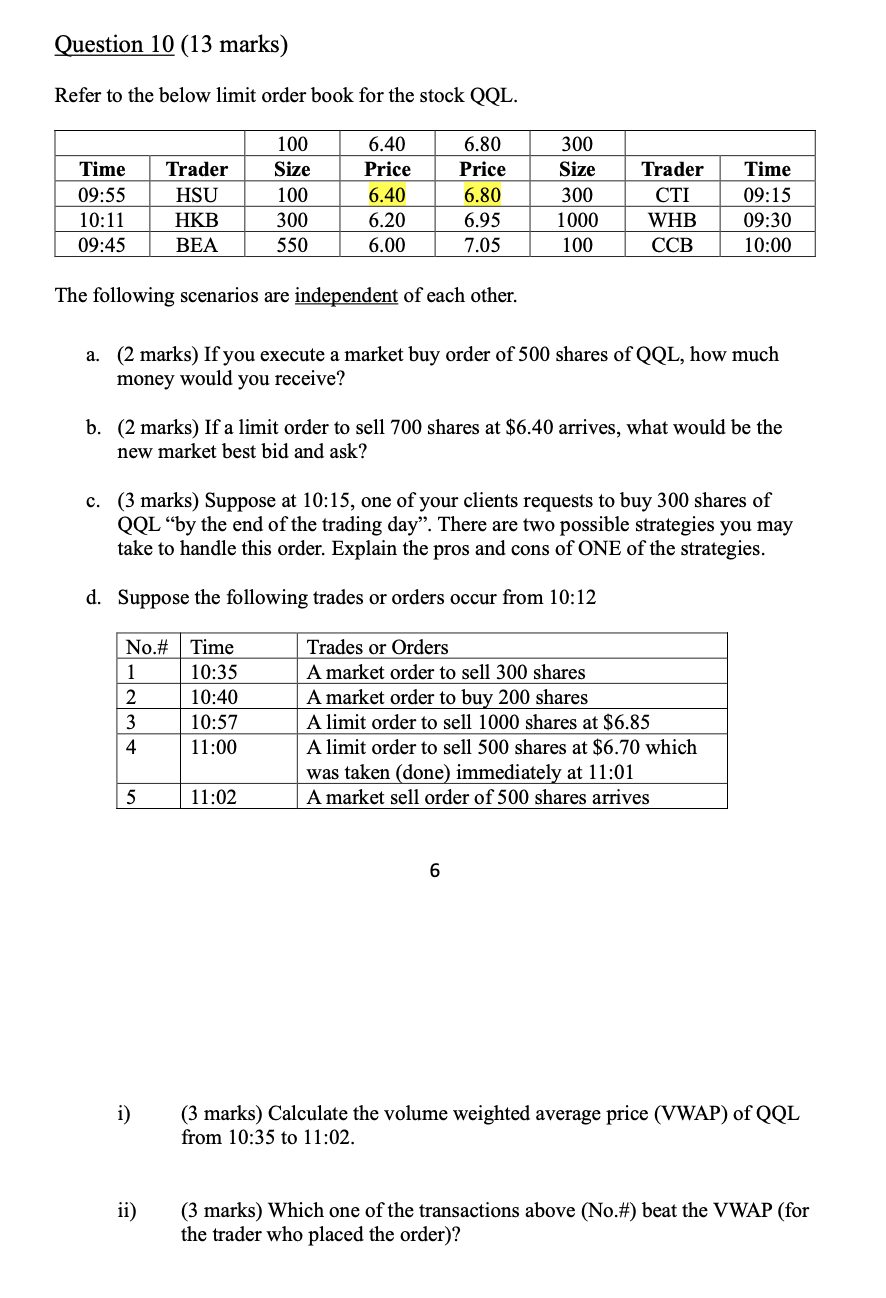

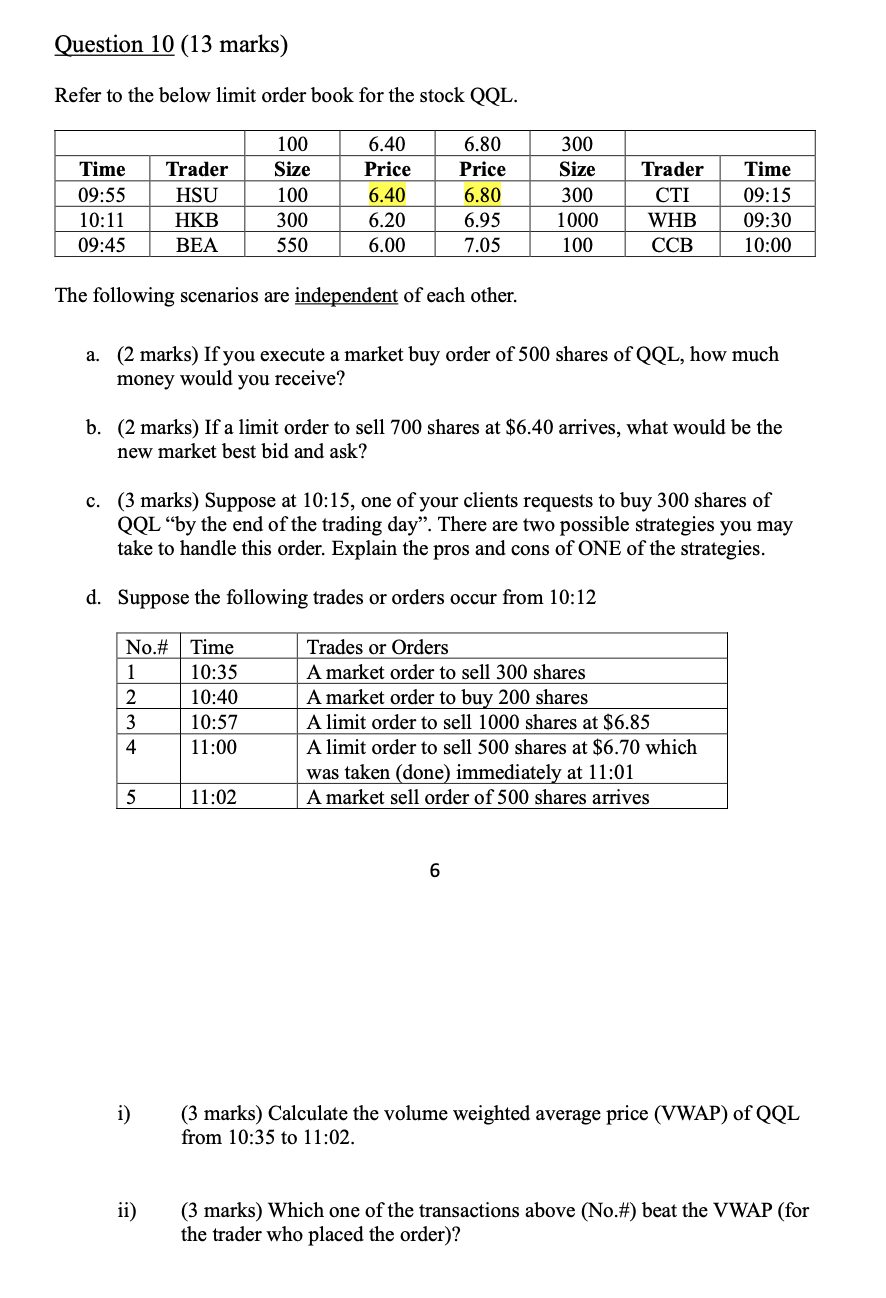

Question 10 (13 marks) Refer to the below limit order book for the stock QQL. Time 09:55 10:11 09:45 Trader HSU HKB BEA 100 Size 100 300 550 6.40 Price 6.40 6.20 6.00 6.80 Price 6.80 6.95 7.05 300 Size 300 1000 100 Trader WHB CCB Time 09:15 09:30 10:00 The following scenarios are independent of each other. a. (2 marks) If you execute a market buy order of 500 shares of QQL, how much money would you receive? b. (2 marks) If a limit order to sell 700 shares at $6.40 arrives, what would be the new market best bid and ask? c. (3 marks) Suppose at 10:15, one of your clients requests to buy 300 shares of QQL by the end of the trading day. There are two possible strategies you may take to handle this order. Explain the pros and cons of ONE of the strategies. d. Suppose the following trades or orders occur from 10:12 No.# 1 2 3 4 Time 10:35 10:40 10:57 11:00 Trades or Orders A market order to sell 300 shares A market order to buy 200 shares A limit order to sell 1000 shares at $6.85 A limit order to sell 500 shares at $6.70 which was taken (done immediately at 11:01 A market sell order of 500 shares arrives 5 11:02 6 i) (3 marks) Calculate the volume weighted average price (VWAP) of QQL from 10:35 to 11:02. ii) (3 marks) Which one of the transactions above (No.#) beat the VWAP (for the trader who placed the order)? Question 10 (13 marks) Refer to the below limit order book for the stock QQL. Time 09:55 10:11 09:45 Trader HSU HKB BEA 100 Size 100 300 550 6.40 Price 6.40 6.20 6.00 6.80 Price 6.80 6.95 7.05 300 Size 300 1000 100 Trader WHB CCB Time 09:15 09:30 10:00 The following scenarios are independent of each other. a. (2 marks) If you execute a market buy order of 500 shares of QQL, how much money would you receive? b. (2 marks) If a limit order to sell 700 shares at $6.40 arrives, what would be the new market best bid and ask? c. (3 marks) Suppose at 10:15, one of your clients requests to buy 300 shares of QQL by the end of the trading day. There are two possible strategies you may take to handle this order. Explain the pros and cons of ONE of the strategies. d. Suppose the following trades or orders occur from 10:12 No.# 1 2 3 4 Time 10:35 10:40 10:57 11:00 Trades or Orders A market order to sell 300 shares A market order to buy 200 shares A limit order to sell 1000 shares at $6.85 A limit order to sell 500 shares at $6.70 which was taken (done immediately at 11:01 A market sell order of 500 shares arrives 5 11:02 6 i) (3 marks) Calculate the volume weighted average price (VWAP) of QQL from 10:35 to 11:02. ii) (3 marks) Which one of the transactions above (No.#) beat the VWAP (for the trader who placed the order)

Anyone can help to answer part d i and ii?

Anyone can help to answer part d i and ii?