Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anyone help with this please ACC 1101: Assignment: Account Receivable (8 ticks / 2= 4 marks) Multiple Choice questions (1-3) 1 tick for each correct

Anyone help with this please

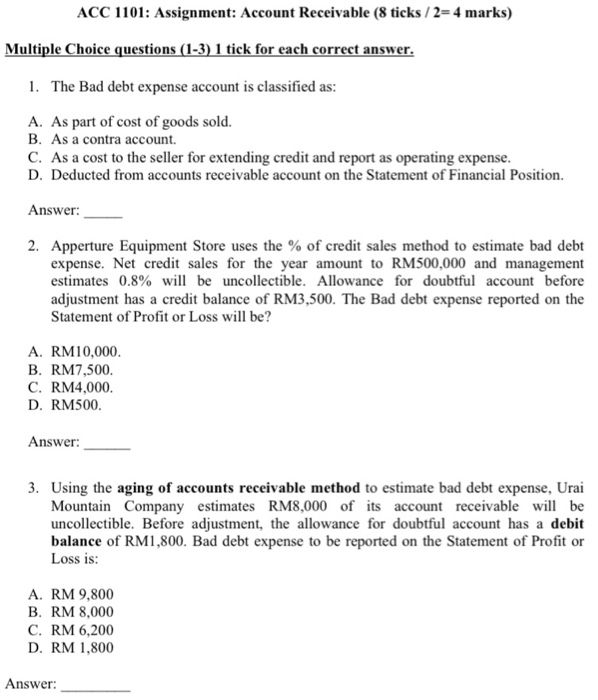

ACC 1101: Assignment: Account Receivable (8 ticks / 2= 4 marks) Multiple Choice questions (1-3) 1 tick for each correct answer. 1. The Bad debt expense account is classified as: A. As part of cost of goods sold. B. As a contra account. C. As a cost to the seller for extending credit and report as operating expense. D. Deducted from accounts receivable account on the Statement of Financial Position. Answer: 2. Apperture Equipment Store uses the % of credit sales method to estimate bad debt expense. Net credit sales for the year amount to RM500,000 and management estimates 0.8% will be uncollectible. Allowance for doubtful account before adjustment has a credit balance of RM3,500. The Bad debt expense reported on the Statement of Profit or Loss will be? A. RM10,000. B. RM7,500. C. RM4,000. D. RM500. Answer: 3. Using the aging of accounts receivable method to estimate bad debt expense, Urai Mountain Company estimates RM8,000 of its account receivable will be uncollectible. Before adjustment, the allowance for doubtful account has a debit balance of RM1,800. Bad debt expense to be reported on the Statement of Profit or Loss is: A. RM 9,800 B. RM 8,000 C. RM 6,200 D. RM 1,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started