Answered step by step

Verified Expert Solution

Question

1 Approved Answer

anyone know how to do this? thanks Question 1 (5 points) Consider a portfolio with a 65% allocation to stocks and 35% to bonds. The

anyone know how to do this? thanks

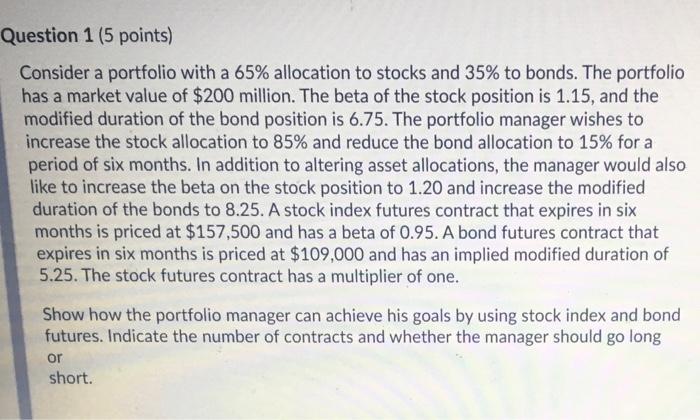

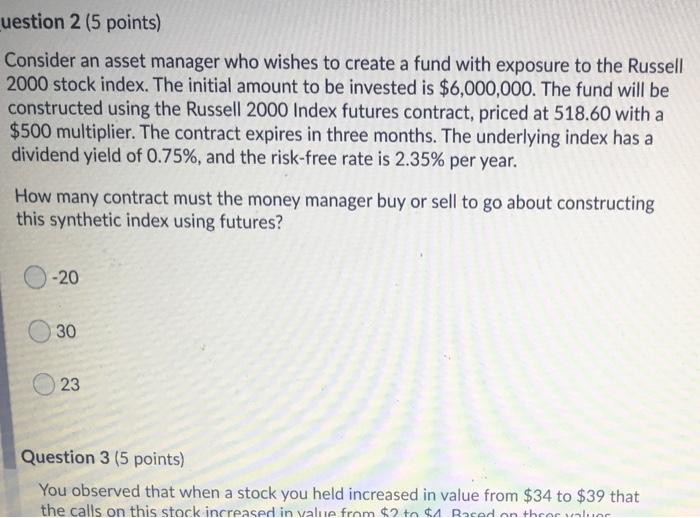

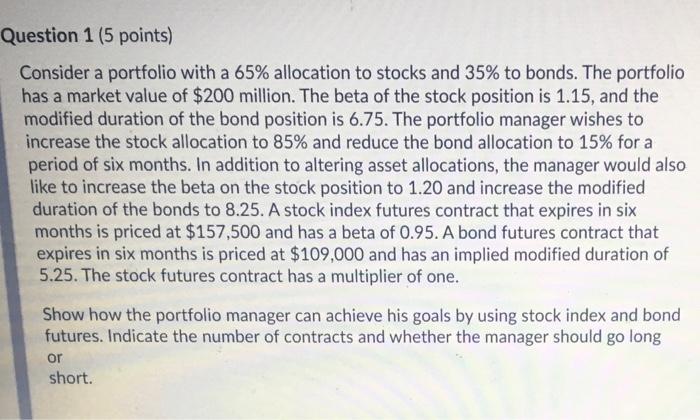

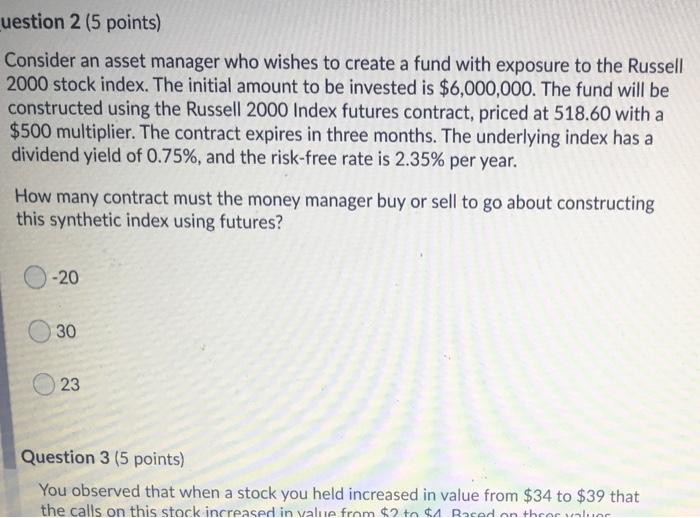

Question 1 (5 points) Consider a portfolio with a 65% allocation to stocks and 35% to bonds. The portfolio has a market value of $200 million. The beta of the stock position is 1.15, and the modified duration of the bond position is 6.75. The portfolio manager wishes to increase the stock allocation to 85% and reduce the bond allocation to 15% for a period of six months. In addition to altering asset allocations, the manager would also like to increase the beta on the stock position to 1.20 and increase the modified duration of the bonds to 8.25. A stock index futures contract that expires in six months is priced at $157,500 and has a beta of 0.95. A bond futures contract that expires in six months is priced at $109,000 and has an implied modified duration of 5.25. The stock futures contract has a multiplier of one. Show how the portfolio manager can achieve his goals by using stock index and bond futures. Indicate the number of contracts and whether the manager should go long or short. uestion 2 (5 points) Consider an asset manager who wishes to create a fund with exposure to the Russell 2000 stock index. The initial amount to be invested is $6,000,000. The fund will be constructed using the Russell 2000 Index futures contract, priced at 518.60 with a $500 multiplier. The contract expires in three months. The underlying index has a dividend yield of 0.75%, and the risk-free rate is 2.35% per year. How many contract must the money manager buy or sell to go about constructing this synthetic index using futures? -20 30 23 Question 3 (5 points) You observed that when a stock you held increased in value from $34 to $39 that the calls on this stock increased in value from $2 to 4 Raced on the runne

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started