Anyone know how to start the financials on this for excel?

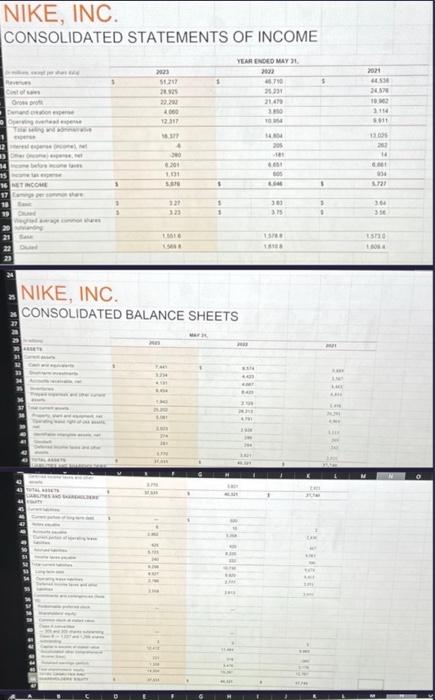

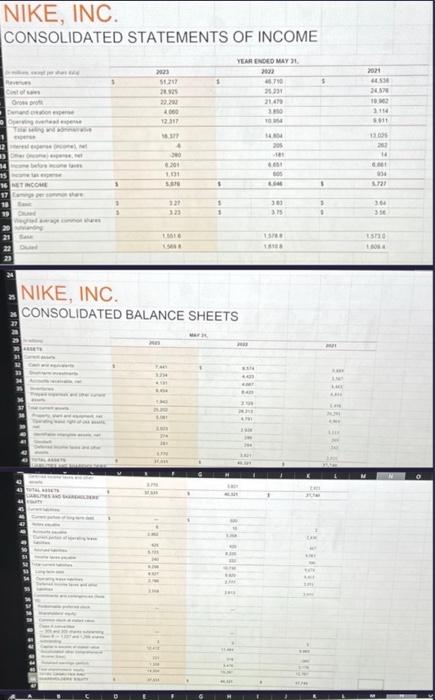

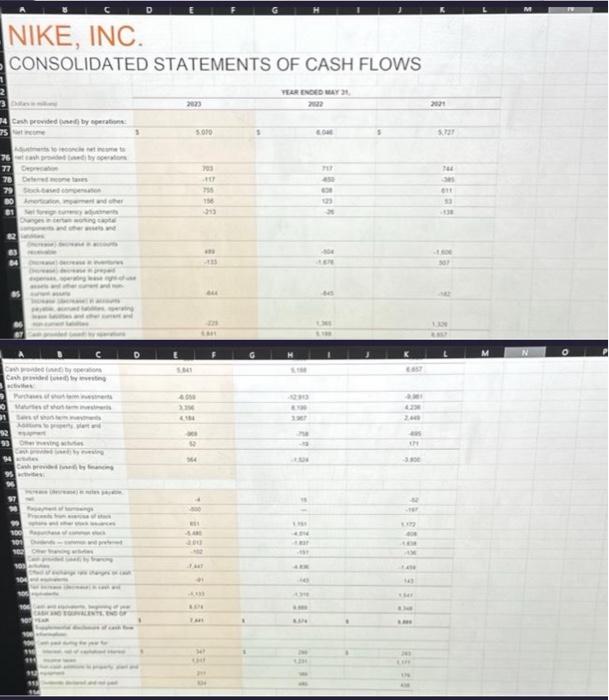

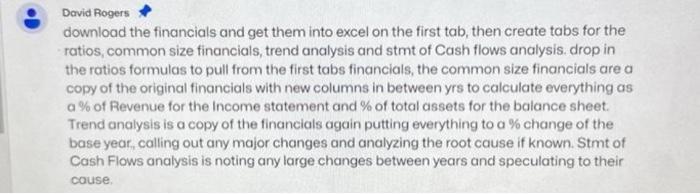

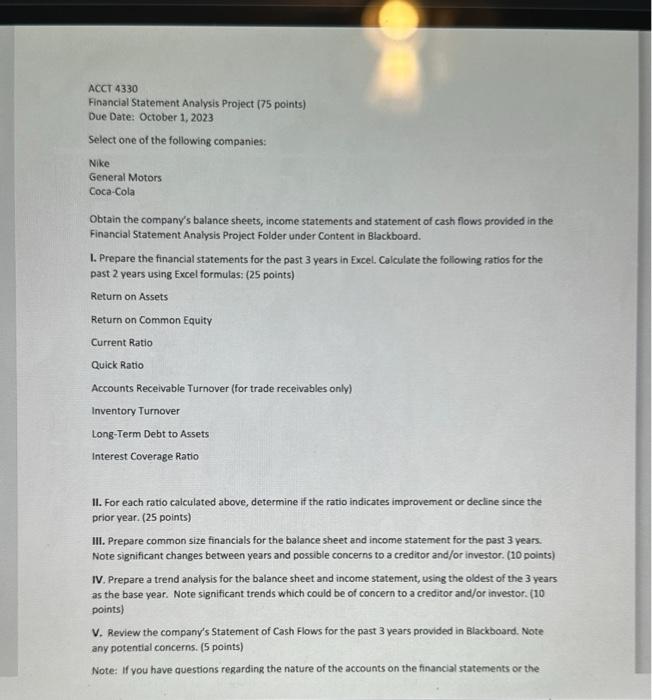

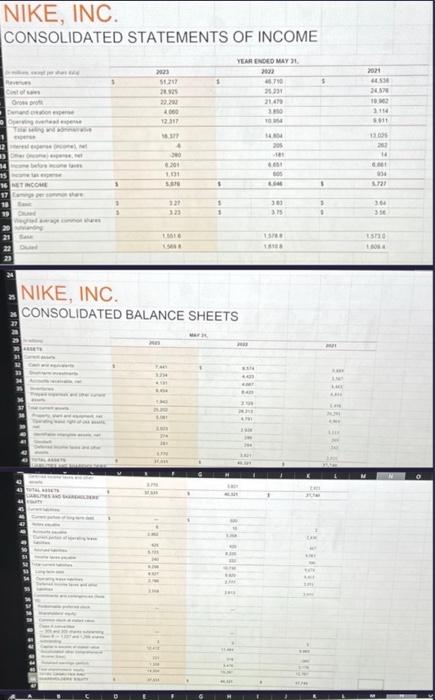

CONSOLIDATED STATEMENTS OF CASH FLOWS Nike General Motors Coca-Cola Obtain the company's balance sheets, income statements and statement of cash flows provided in the Financial Statement Analysis Project Folder under Content in Btackboard. 1. Prepare the financial statements for the past 3 years in ExceL. Calculate the following ratios for the past 2 years using Excel formulas: (25 points) Return on Assets Return on Common Equity Current Ratio Quick Ratio Accounts Receivable Turnover (for trade receivables only) Inventory Turnover Long-Term Debt to Assets Interest Coverage Ratio 11. For each ratio calculated above, determine if the ratio indicates improvement or decline since the prior year. (25 points) III. Prepare common size financials for the balance sheet and income statement for the past 3 years. Note significant changes between years and possible concerns to a creditor and/or investor. (10 points) IV. Prepare a trend analysis for the balance sheet and income statement, using the oldest of the 3 years as the base year. Note significant trends which could be of concern to a creditor and/or investor. (10 points) David Rogers download the financials and get them into excel on the first tab, then create tabs for the ratios, common size financials, trend analysis and stmt of Cash flows analysis. drop in the ratios formulas to pull from the first tabs financials, the common size financials are a copy of the original financials with new columns in between yrs to calculate everything as a \% of Revenue for the Income statement and \% of total assets for the balance sheet. Trend analysis is a copy of the financials again putting everything to a % change of the base year, calling out any major changes and analyzing the root cause if known. Stmt of Cash Flows analysis is noting any large changes between years and speculating to their cause. NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME NIIKE, INC. CONSOLIDATED BALANCE SHEETS CONSOLIDATED STATEMENTS OF CASH FLOWS Nike General Motors Coca-Cola Obtain the company's balance sheets, income statements and statement of cash flows provided in the Financial Statement Analysis Project Folder under Content in Btackboard. 1. Prepare the financial statements for the past 3 years in ExceL. Calculate the following ratios for the past 2 years using Excel formulas: (25 points) Return on Assets Return on Common Equity Current Ratio Quick Ratio Accounts Receivable Turnover (for trade receivables only) Inventory Turnover Long-Term Debt to Assets Interest Coverage Ratio 11. For each ratio calculated above, determine if the ratio indicates improvement or decline since the prior year. (25 points) III. Prepare common size financials for the balance sheet and income statement for the past 3 years. Note significant changes between years and possible concerns to a creditor and/or investor. (10 points) IV. Prepare a trend analysis for the balance sheet and income statement, using the oldest of the 3 years as the base year. Note significant trends which could be of concern to a creditor and/or investor. (10 points) David Rogers download the financials and get them into excel on the first tab, then create tabs for the ratios, common size financials, trend analysis and stmt of Cash flows analysis. drop in the ratios formulas to pull from the first tabs financials, the common size financials are a copy of the original financials with new columns in between yrs to calculate everything as a \% of Revenue for the Income statement and \% of total assets for the balance sheet. Trend analysis is a copy of the financials again putting everything to a % change of the base year, calling out any major changes and analyzing the root cause if known. Stmt of Cash Flows analysis is noting any large changes between years and speculating to their cause. NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME NIIKE, INC. CONSOLIDATED BALANCE SHEETS