Question

anyone who is an HR major - please help me out on this! thanks Given the percentage of employees receiving the 4 different levels of

anyone who is an HR major - please help me out on this! thanks

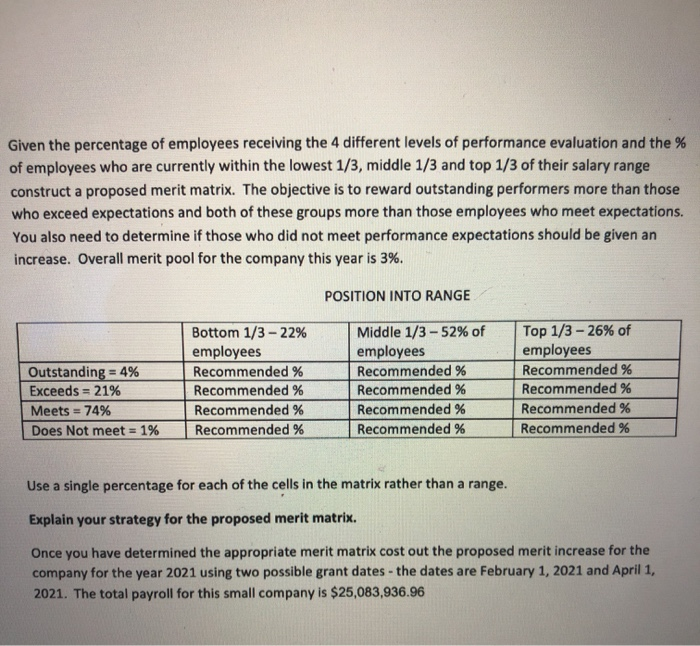

Given the percentage of employees receiving the 4 different levels of performance evaluation and the % of employees who are currently within the lowest 1/3, middle 1/3 and top 1/3 of their salary range construct a proposed merit matrix. The objective is to reward outstanding performers more than those who exceed expectations and both of these groups more than those employees who meet expectations. You also need to determine if those who did not meet performance expectations should be given an increase. Overall merit pool for the company this year is 3%.

Use a single percentage for each of the cells in the matrix rather than a range.

Explain your strategy for the proposed merit matrix.

Once you have determined the appropriate merit matrix cost out the proposed merit increase for the company for the year 2021 using two possible grant dates - the dates are February 1, 2021 and April 1, 2021. The total payroll for this small company is $25,083,936.96

Given the percentage of employees receiving the 4 different levels of performance evaluation and the % of employees who are currently within the lowest 1/3, middle 1/3 and top 1/3 of their salary range construct a proposed merit matrix. The objective is to reward outstanding performers more than those who exceed expectations and both of these groups more than those employees who meet expectations. You also need to determine if those who did not meet performance expectations should be given an increase. Overall merit pool for the company this year is 3%. POSITION INTO RANGE Outstanding = 4% Exceeds = 21% Meets = 74% Does Not meet = 1% Bottom 1/3 - 22% employees Recommended % Recommended % Recommended % Recommended % Middle 1/3 -52% of employees Recommended % Recommended % Recommended % Recommended % Top 1/3 - 26% of employees Recommended % Recommended % Recommended % Recommended % Use a single percentage for each of the cells in the matrix rather than a range. Explain your strategy for the proposed merit matrix. Once you have determined the appropriate merit matrix cost out the proposed merit increase for the company for the year 2021 using two possible grant dates - the dates are February 1, 2021 and April 1, 2021. The total payroll for this small company is $25,083,936.96 Given the percentage of employees receiving the 4 different levels of performance evaluation and the % of employees who are currently within the lowest 1/3, middle 1/3 and top 1/3 of their salary range construct a proposed merit matrix. The objective is to reward outstanding performers more than those who exceed expectations and both of these groups more than those employees who meet expectations. You also need to determine if those who did not meet performance expectations should be given an increase. Overall merit pool for the company this year is 3%. POSITION INTO RANGE Outstanding = 4% Exceeds = 21% Meets = 74% Does Not meet = 1% Bottom 1/3 - 22% employees Recommended % Recommended % Recommended % Recommended % Middle 1/3 -52% of employees Recommended % Recommended % Recommended % Recommended % Top 1/3 - 26% of employees Recommended % Recommended % Recommended % Recommended % Use a single percentage for each of the cells in the matrix rather than a range. Explain your strategy for the proposed merit matrix. Once you have determined the appropriate merit matrix cost out the proposed merit increase for the company for the year 2021 using two possible grant dates - the dates are February 1, 2021 and April 1, 2021. The total payroll for this small company is $25,083,936.96Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started