Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume as in the previous question that your year-end receivables are $250,000 and you are considering factoring the receivables to raise cash to help finance

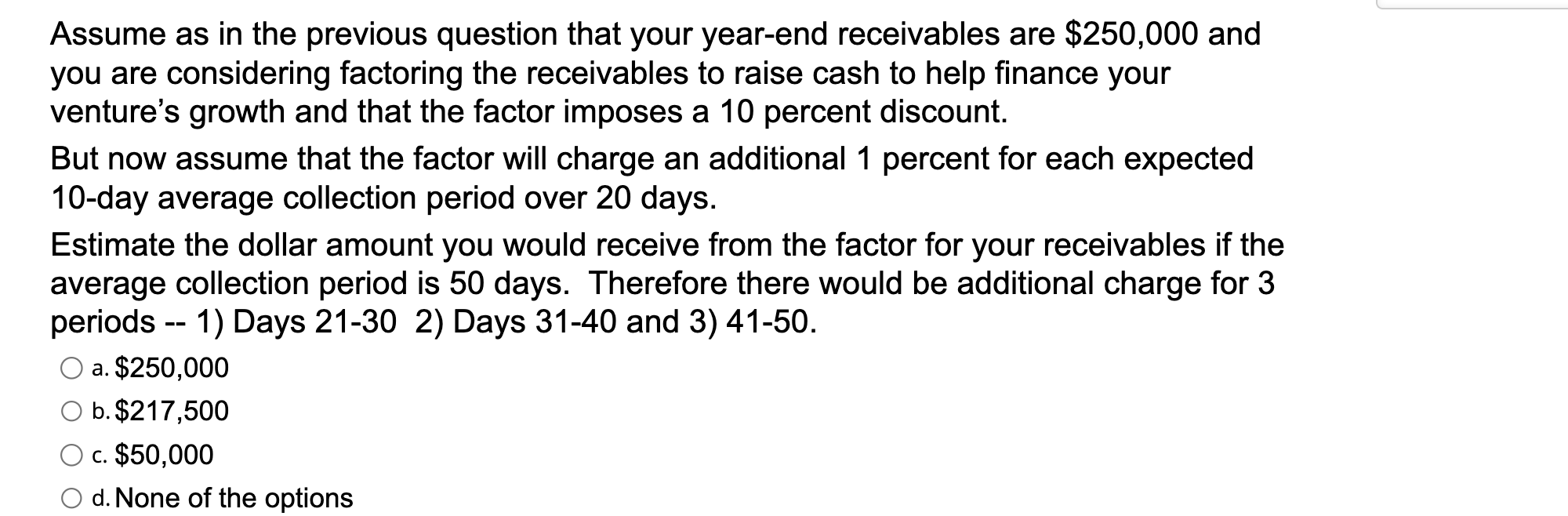

Assume as in the previous question that your year-end receivables are $250,000 and you are considering factoring the receivables to raise cash to help finance your venture's growth and that the factor imposes a 10 percent discount. But now assume that the factor will charge an additional 1 percent for each expected 10-day average collection period over 20 days. Estimate the dollar amount you would receive from the factor for your receivables if the average collection period is 50 days. Therefore there would be additional charge for 3 periods -- 1) Days 21-30 2) Days 31-40 and 3) 41-50. a. $250,000 b. $217,500 c. $50,000 d. None of the options

Assume as in the previous question that your year-end receivables are $250,000 and you are considering factoring the receivables to raise cash to help finance your venture's growth and that the factor imposes a 10 percent discount. But now assume that the factor will charge an additional 1 percent for each expected 10-day average collection period over 20 days. Estimate the dollar amount you would receive from the factor for your receivables if the average collection period is 50 days. Therefore there would be additional charge for 3 periods -- 1) Days 21-30 2) Days 31-40 and 3) 41-50. a. $250,000 b. $217,500 c. $50,000 d. None of the options Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started