Answered step by step

Verified Expert Solution

Question

1 Approved Answer

anyway to do this problem without a solver? A corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost

anyway to do this problem without a solver?

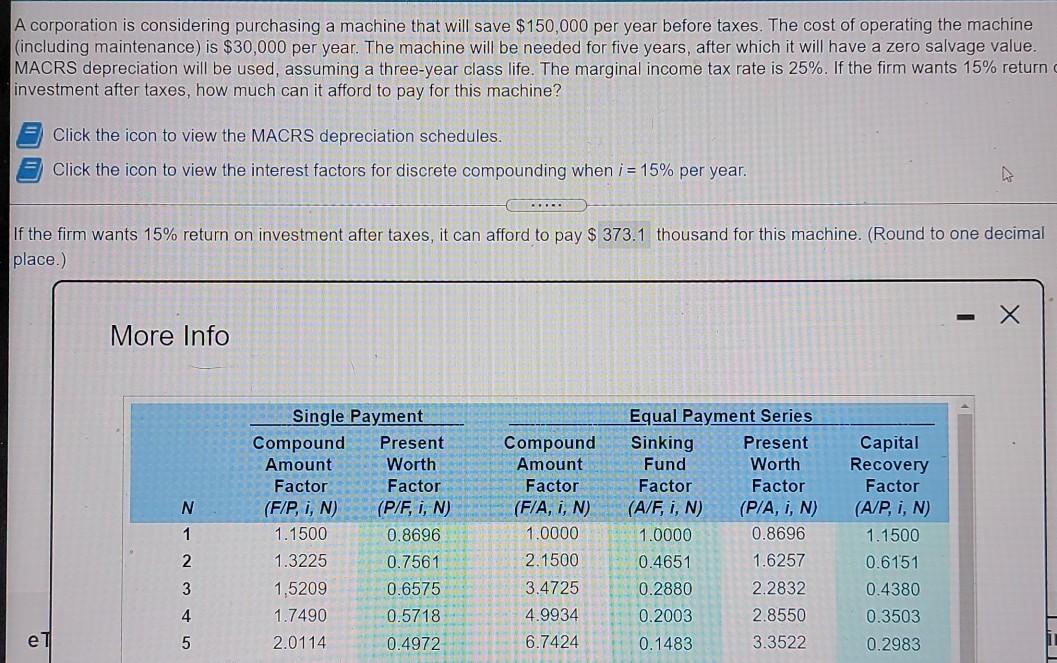

A corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return investment after taxes, how much can it afford to pay for this machine? Click the icon to view the MACRS depreciation schedules. Click the icon to view the interest factors for discrete compounding when i = 15% per year. If the firm wants 15% return on investment after taxes, it can afford to pay $ 373.1 thousand for this machine. (Round to one decimal place.) More Info N 1 Single Payment Compound Present Amount Worth Factor Factor (F/P, i, N) (P/F, i, N) 1.1500 0.8696 1.3225 0.7561 1,5209 0.6575 1.7490 0.5718 2.0114 0.4972 Compound Amount Factor (F/A, i, N) 1.0000 2.1500 3.4725 4.9934 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, i, N) (P/A, i, N) 1.0000 0.8696 0.4651 1.6257 0.2880 2.2832 0.2003 2.8550 0.1483 3.3522 Capital Recovery Factor (A/P, i, N) 1.1500 0.6151 0.4380 0.3503 0.2983 2 3 4 el e 5 6.7424

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started