Question

a.On January 1, 2014, Fishbone Corporation sold a building that cost $267,800 and that had accumulated depreciation of $101,500 on the date of sale. Fishbone

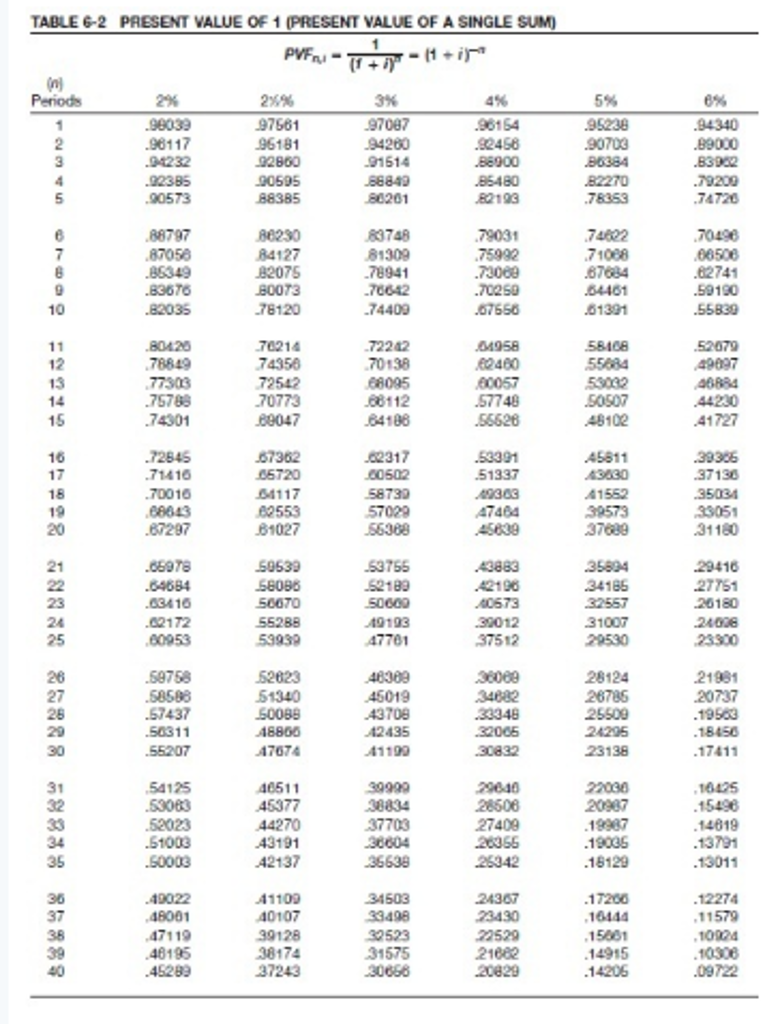

a.On January 1, 2014, Fishbone Corporation sold a building that cost $267,800 and that had accumulated depreciation of $101,500 on the date of sale. Fishbone received as consideration a $256,900 non-interest-bearing note due on January 1, 2017. There was no established exchange price for the building, and the note had no ready market. The prevailing rate of interest for a note of this type on January 1, 2014, was 10%. At what amount should the gain from the sale of the building be reported?

b.On January 1, 2014, Fishbone Corporation purchased 340 of the $1,000 face value, 10%, 10-year bonds of Walters Inc. The bonds mature on January 1, 2024, and pay interest annually beginning January 1, 2015. Fishbone purchased the bonds to yield 11%. How much did Fishbone pay for the bonds?

c.Fishbone Corporation bought a new machine and agreed to pay for it in equal annual installments of $4,360 at the end of each of the next 10 years. Assuming that a prevailing interest rate of 10% applies to this contract, how much should Fishbone record as the cost of the machine?

d.Fishbone Corporation purchased a special tractor on December 31, 2014. The purchase agreement stipulated that Fishbone should pay $21,630 at the time of purchase and $5,740 at the end of each of the next 9 years. The tractor should be recorded on December 31, 2014, at what amount, assuming an appropriate interest rate of 10%?

e.Fishbone Corporation wants to withdraw $122,500 (including principal) from an investment fund at the end of each year for 11 years. What should be the required initial investment at the beginning of the first year if the fund earns 11%?

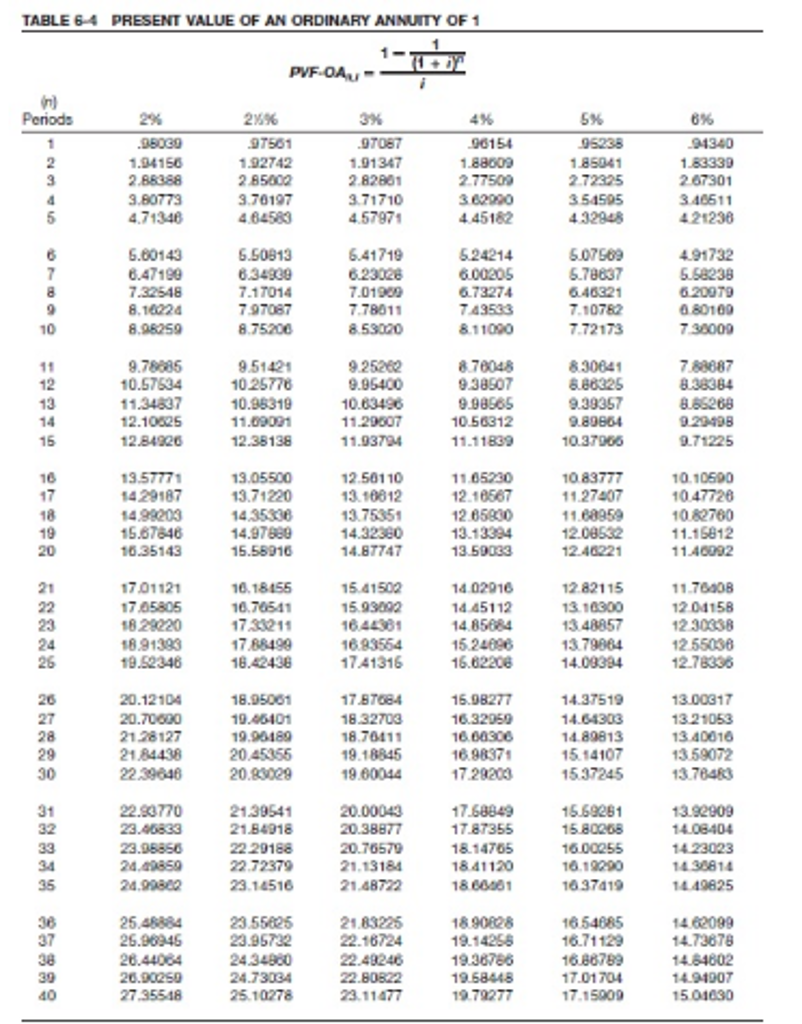

TABLE 64 PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 25% 97561 96154 94340 97087 .91347 2.82801 371710 4.5797 1.85041 2 72325 3 54595 1.94156 2 85000 70197 3 3.46611 421236 445182 524214 73274 8 11000 8 70048 .50813 6.34939 7.17014 797087 6.41719 6.23028 7.01900 .78011 5.07969 5.78837 646321 7.10782 4.91732 8.47199 7.32548 8.16024 8.98259 80169 5142 10 2577 0.96319 9 25262 10.8349 1.93794 250110 8 30641 8.88325 9.39357 9.89864 7.88687 9.38907 0.57534 11.34837 2.1052 2.84220 865268 929498 9.71225 0.56312 2.38138 11.11839 3.05500 13.71220 10 83777 1.27407 4 29187 12.65800 3.133 3.59033 10.82760 15.87646 6.35143 14.97889 15.58916 14.8774 12.40221 1.70408 1204158 701121 7 05806 33693554 6.62208 2.82115 16.70541 5 9309 14.45112 14.85684 15 24696 16.20 79423033 7 8849 18.42438 26 17.41316 121 20.70600 21.2812 18.95061 19.46101 9.90189 7.87684 8.32703 18.70411 4.3751 3 21053 4.89813 514107 20.8-19 18845 16.60306 14.64303 00317 19.60044 30 7 29203 22.93770 21.39541 21.84918 22 20188 22.72379 14516 20.00043 20.38877 20.76570 21.13184 15.69281 15.80268 6.00255 13.92909 787355 18.14705 18.41120 4 23023 4 30814 4 49825 34 35 24.4850 24 9980O 1637419 2548884 239573224824 9584817.1500 23.55625 18 90828 16724 14.73878 16.86789 17.01704 38 20.90250 27 35548 24.73034 25.10278 14 94907 5 04630 22.80822 40 979277Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started