Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AP 16-3 (ACB of Consideration and PUC) Lily Haring owns a property that is depreciable property that is the last property in its class. The

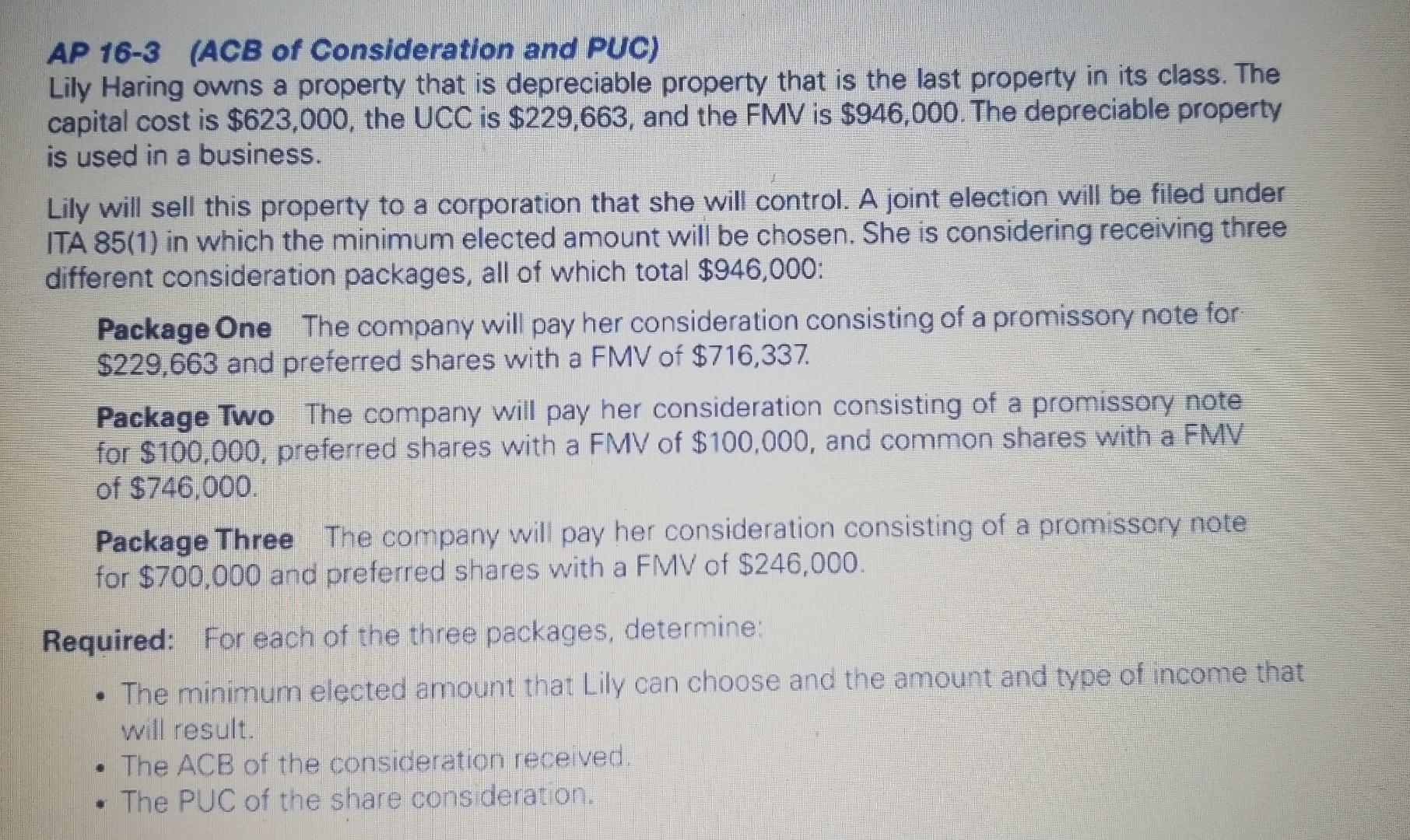

AP 16-3 (ACB of Consideration and PUC) Lily Haring owns a property that is depreciable property that is the last property in its class. The capital cost is $623,000, the UCC is $229,663, and the FMV is $946,000. The depreciable property is used in a business. Lily will sell this property to a corporation that she will control. A joint election will be filed under ITA 85(1) in which the minimum elected amount will be chosen. She is considering receiving three different consideration packages, all of which total $946,000 : Package One The company will pay her consideration consisting of a promissory note for $229,663 and preferred shares with a FMV of $716,337. Package Two The company will pay her consideration consisting of a promissory note for $100,000, preferred shares with a FMV of $100,000, and common shares with a FMV of $746,000. Package Three The company will pay her consideration consisting of a promissory note for $700,000 and preferred shares with a FMV of $246,000. Required: For each of the three packages, determine: - The minimum elected amount that Lily can choose and the amount and type of income that will result. - The ACB of the consideration received. - The PUC of the share consideration

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started