AP 4.8

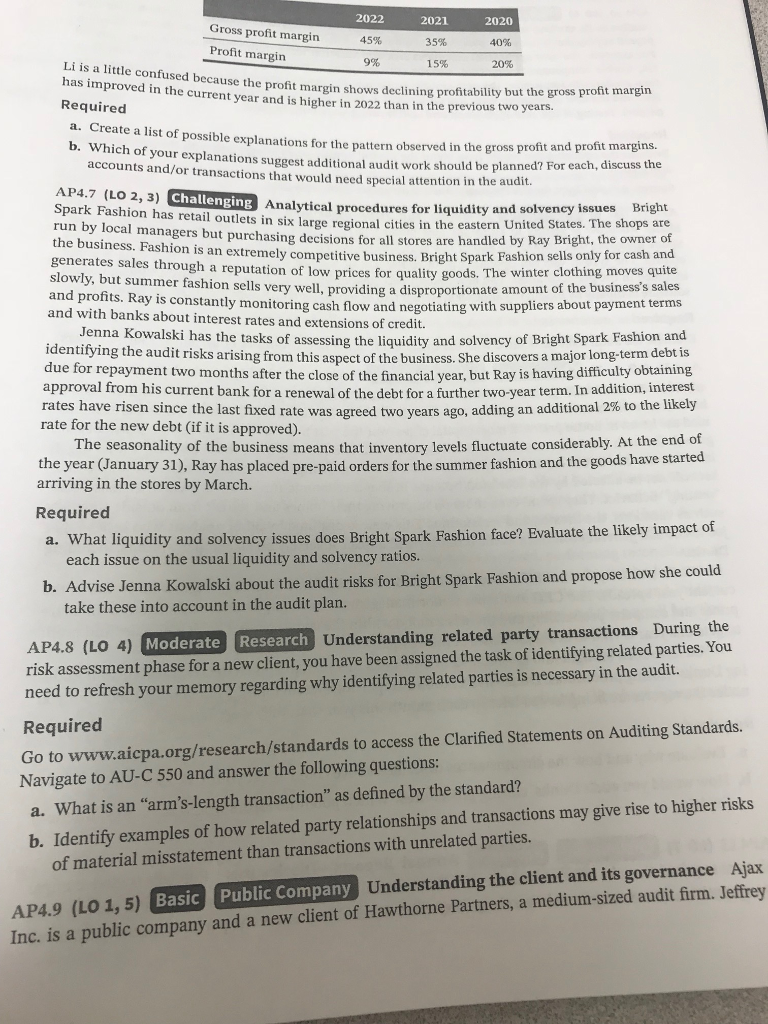

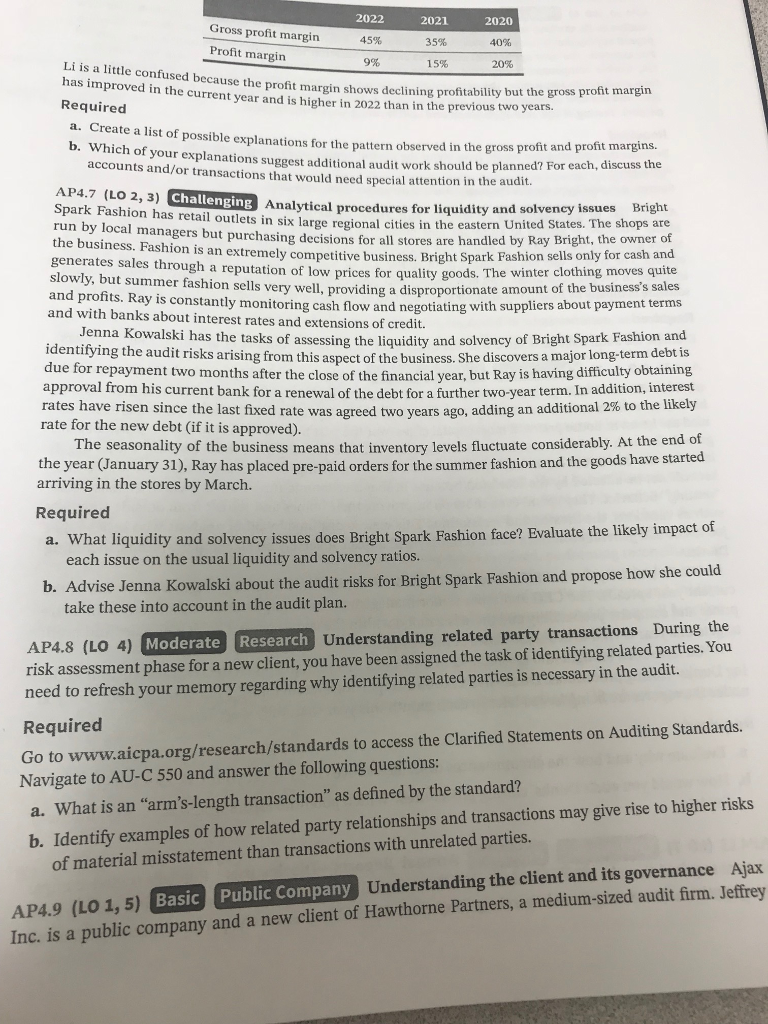

2022 2021 2020 Gross profit margin Profit margin 40% 9% Li is a little confused because the has improved in the current year and is higher in 2022 than in the previous two years. profit margin shows declining profitability but the gross profit margin shows declin Required a. Create a list of possible explanations for the pattern observed in the gross profit and pro b. Which of your explanations suggest additional audit work should be planned? accounts and/or transactions that would need special attention in the audit. For each, discuss the AP4.7 (LO 2, 3) Challenging Spark Fashion has retail run by local managers but purchasing decisions for all stores are handled by the business. Fashion is an extremely competitive business. Bright Spark Fashion se generates sales through a reputation of low prices for quality goods. The winter clothin slowly, but summer fashion sells very well, provid Analytical procedures for liquidity and solvency issues Bright outlets in six large regional cities in the eastern United States. The shops are Ray Bright, the owner of sells only for cash and g moves quite ing a disproportionate amount of the business's sales tomts. ray is constantly monitoring cash flow and negotiating with suppliers about payment terms and with banks about interest rates and extensions of credit. Jenna Kowalski has the tasks of assessing the liquidity and solvency o f Bright Spark Fashion and dentitying the audit risks arising from this aspect of the business. She discovers a major long-term debt is due for repayment two months after the close of the financial year, but Ray is having difficulty obtaining approval from his current bank for a renewal of the debt for a further two-year term. In addition, interest rates have risen since the last fixed rate was agreed two years ago, adding an additional 2% to the likely rate for the new debt (if it is approved) The seasonality of the business means that inventory levels fluctuate considerably. At the end o the year (January 31), Ray has placed pre-paid orders for the summer fashion and the goods have started arriving in the stores by Marclh Required a. What liquidity and solvency issues does right Spark Fashion face? Evaluate the likely impact of each issue on the usual liquidity and solvency ratio b. Adv ise Jenna Kowalski about the audit risks for Bright Spark Fashion and propose how she could take these into account in the audit plan Moderate Research Understanding related party transactions During the AP4.8 (LO 4) risk assessment phase for a new client, you have been assigned the task of identifying related parties. You need to refresh your memory regarding why identifying related parties is necessary in the audit. Required Go to www.aicpa.org/research/standards to access the Clarified Statements on Auditing Standards. Navigate to AU-C 550 and answer the following questions: a. What is an "arm's-length transaction" as defined by the standard? b. Identify examples of how related party relationships and transactions may give rise to higher risks of material misstatement than transactions with unrelated parties. Understanding the client and its governance Ajax any and a new client of Hawthorne Partners, a medium-sized audit firm. Jeffrey Basic Public Company AP4.9 (LO 1, 5) Inc. is a public comp