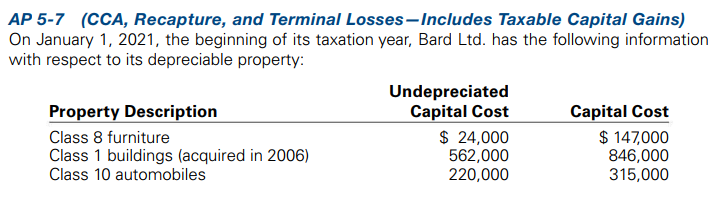

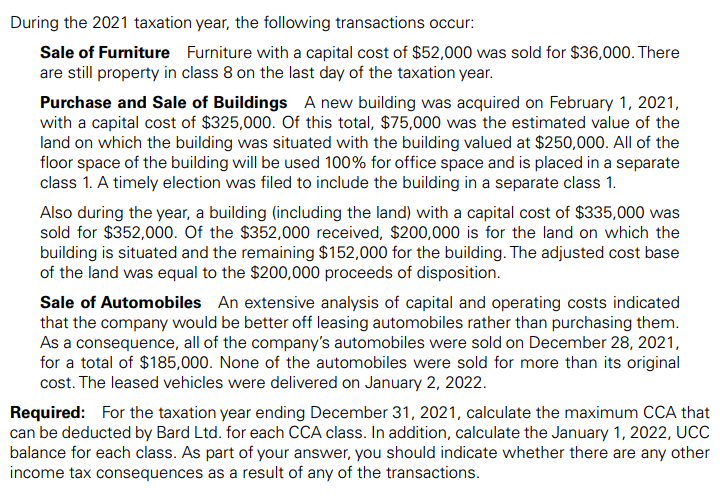

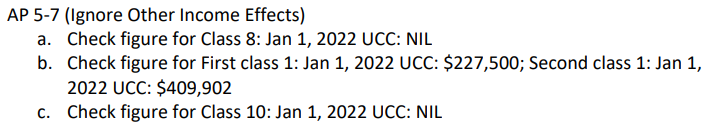

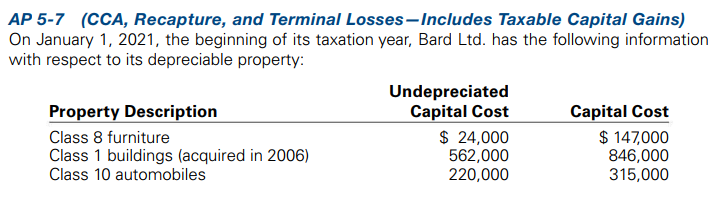

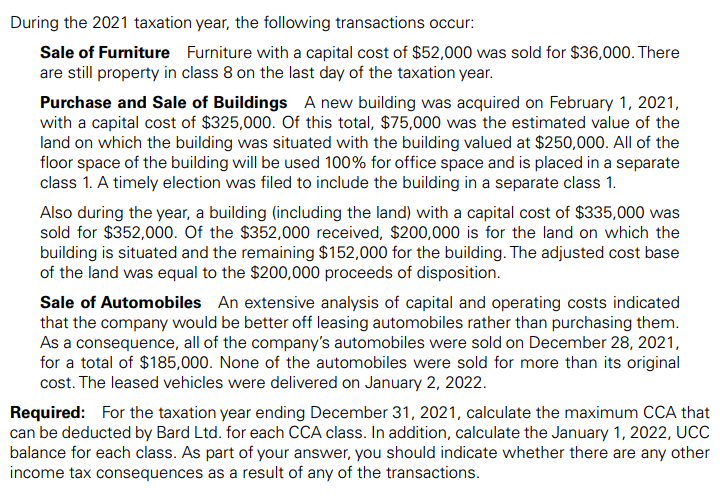

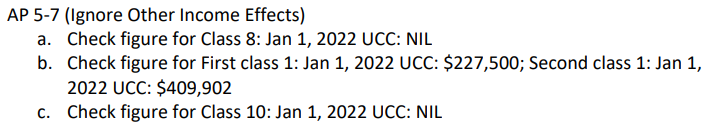

AP 5-7 (CCA, Recapture, and Terminal Losses-Includes Taxable Capital Gains) On January 1, 2021, the beginning of its taxation year, Bard Ltd. has the following information with respect to its depreciable property: Undepreciated Property Description Capital Cost Capital Cost Class 8 furniture $ 24,000 $ 147,000 Class 1 buildings (acquired in 2006) 562,000 846,000 Class 10 automobiles 220,000 315,000 During the 2021 taxation year, the following transactions occur: Sale of Furniture Furniture with a capital cost of $52,000 was sold for $36,000. There are still property in class 8 on the last day of the taxation year. Purchase and Sale of Buildings A new building was acquired on February 1, 2021, with a capital cost of $325,000. Of this total, $75,000 was the estimated value of the land on which the building was situated with the building valued at $250,000. All of the floor space of the building will be used 100% for office space and is placed in a separate class 1. A timely election was filed to include the building in a separate class 1. Also during the year, a building (including the land) with a capital cost of $335,000 was sold for $352,000. Of the $352,000 received, $200,000 is for the land on which the building is situated and the remaining $152,000 for the building. The adjusted cost base of the land was equal to the $200,000 proceeds of disposition. Sale of Automobiles An extensive analysis of capital and operating costs indicated that the company would be better off leasing automobiles rather than purchasing them. As a consequence, all of the company's automobiles were sold on December 28, 2021, for a total of $185,000. None of the automobiles were sold for more than its original cost. The leased vehicles were delivered on January 2, 2022. Required: For the taxation year ending December 31, 2021, calculate the maximum CCA that can be deducted by Bard Ltd. for each CCA class. In addition, calculate the January 1, 2022, UCC balance for each class. As part of your answer, you should indicate whether there are any other income tax consequences as a result of any of the transactions. AP 5-7 (Ignore Other Income Effects) a. Check figure for Class 8: Jan 1, 2022 UCC: NIL b. Check figure for First class 1: Jan 1, 2022 UCC: $227,500; Second class 1: Jan 1, 2022 UCC: $409,902 C. Check figure for Class 10: Jan 1, 2022 UCC: NIL