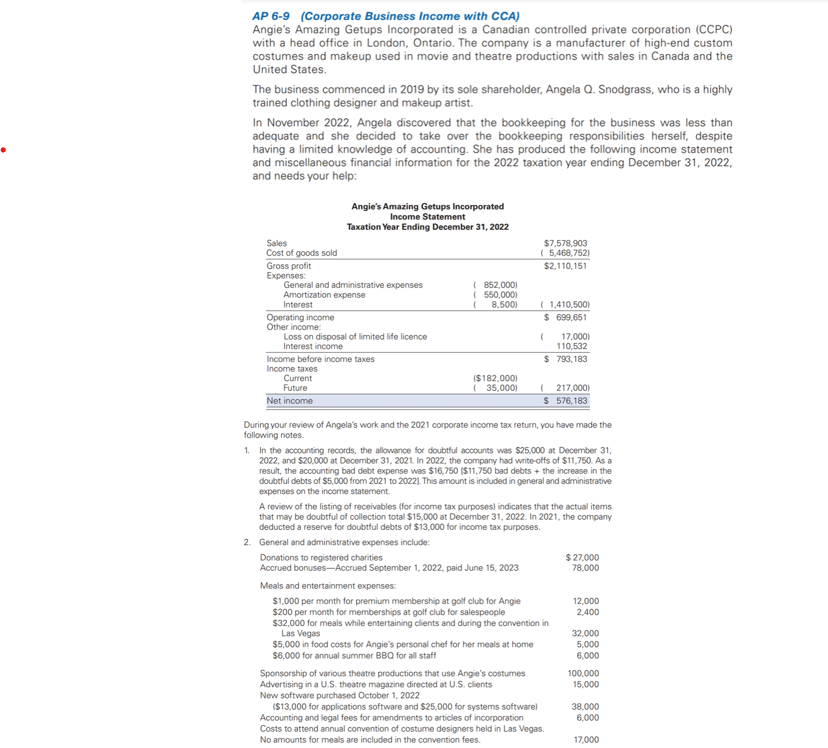

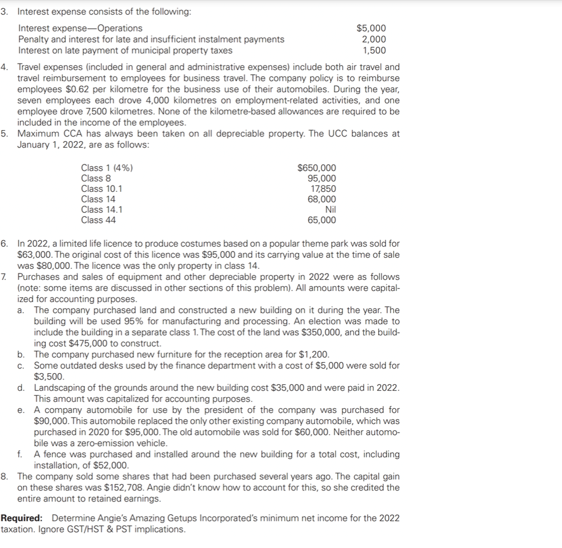

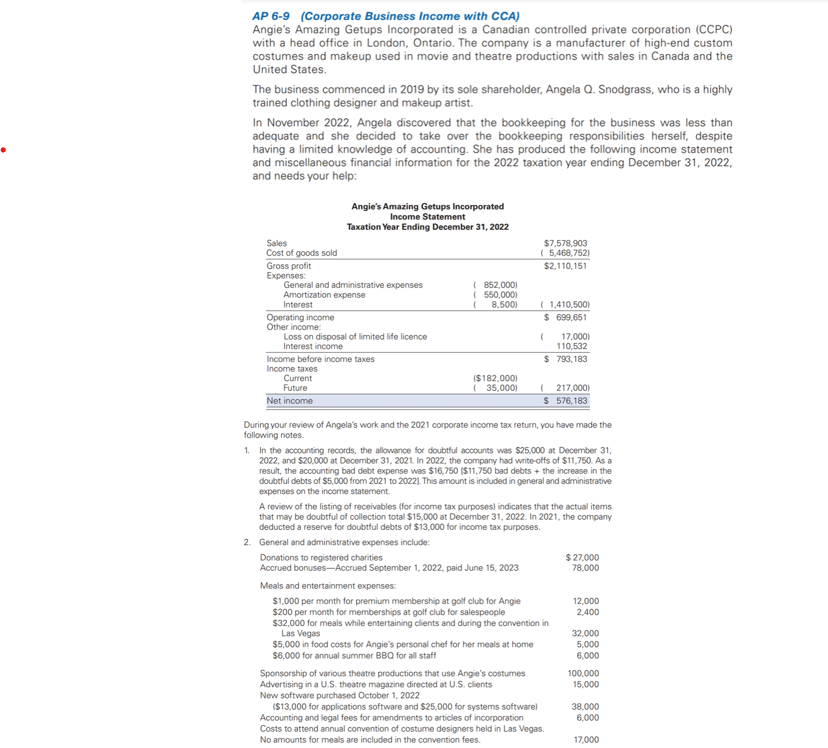

AP 6-9 (Corporate Business Income with CCA) Angie's Amazing Getups Incorporated is a Canadian controlled private corporation (CCPC) with a head office in London, Ontario. The company is a manufacturer of high-end custom costumes and makeup used in movie and theatre productions with sales in Canada and the United States. The business commenced in 2019 by its sole shareholder, Angela Q. Snodgrass, who is a highly trained clothing designer and makeup artist. In November 2022, Angela discovered that the bookkeeping for the business was less than adequate and she decided to take over the bookkeeping responsibilities herself, despite having a limited knowledge of accounting. She has produced the following income statement and miscellaneous financial information for the 2022 taxation year ending December 31, 2022, and needs your help: During your review of Angela's work and the 2021 corporate income tax return, you have made the following notes. 1. In the accounting records, the allowance for doubttul accounts was $25.000 at December 31 , 2022 , and $20,000 at December 31, 2021. In 2022, the company had write-offs of $11,750. As a result, the accounting bad debt expense was $16,750 I $11,750 bad debts + the increase in the doubtful debts of $5,000 from 2021 to 2022). This amount is included in general and administrative expenses on the income statement. A review of the listing of receivables (for income tax purposes) indicates that the actual items that may be doubtful of collection total $15,000 at December 31, 2022. In 2021, the company deducted a reserve for doubtful debts of $13,000 for income tax purposes. 4. Travel expenses (included in general and administrative expenses) include both air travel and travel reimbursement to employees for business travel. The company policy is to reimburse employees $0.62 per kilometre for the business use of their automobiles. During the year, seven employees each drove 4,000 kilometres on employment-related activities, and one employee drove 7,500 kilometres. None of the kilometre-based allowances are required to be included in the income of the employees. 5. Maximum CCA has always been taken on all depreciable property. The UCC balances at January 1, 2022, are as follows: 6. In 2022, a limited life licence to produce costumes based on a popular theme park was sold for $63,000. The original cost of this licence was $95,000 and its carrying value at the time of sale was $80,000. The licence was the only property in class 14 . 7. Purchases and sales of equipment and other depreciable property in 2022 were as follows (note: some items are discussed in other sections of this problem). All amounts were capitalized for accounting purposes. a. The company purchased land and constructed a new building on it during the year. The building will be used 95% for manufacturing and processing. An election was made to include the building in a separate class 1. The cost of the land was $350,000, and the building cost $475,000 to construct. b. The company purchased new furniture for the reception area for $1,200. c. Some outdated desks used by the finance department with a cost of $5,000 were sold for $3,500. d. Landscaping of the grounds around the new building cost $35,000 and were paid in 2022. This amount was capitalized for accounting purposes. e. A company automobile for use by the president of the company was purchased for $90,000. This automobile replaced the only other existing company automobile, which was purchased in 2020 for $95,000. The old automobile was sold for $60,000. Neither automobile was a zero-emission vehicle. f. A fence was purchased and installed around the new building for a total cost, including installation, of $52,000. 8. The company sold some shares that had been purchased several years ago. The capital gain on these shares was $152,708. Angie didn't know how to account for this, so she credited the entire amount to retained earnings. Required: Determine Angie's Amazing Getups Incorporated's minimum net income for the 2022 taxation, Ignore GST/HST \& PST implications