Question

Apache Airlines, a privately held firm, is looking to buy additional gates at its home airport for $800,000 Apache has $240,000 in the bank but

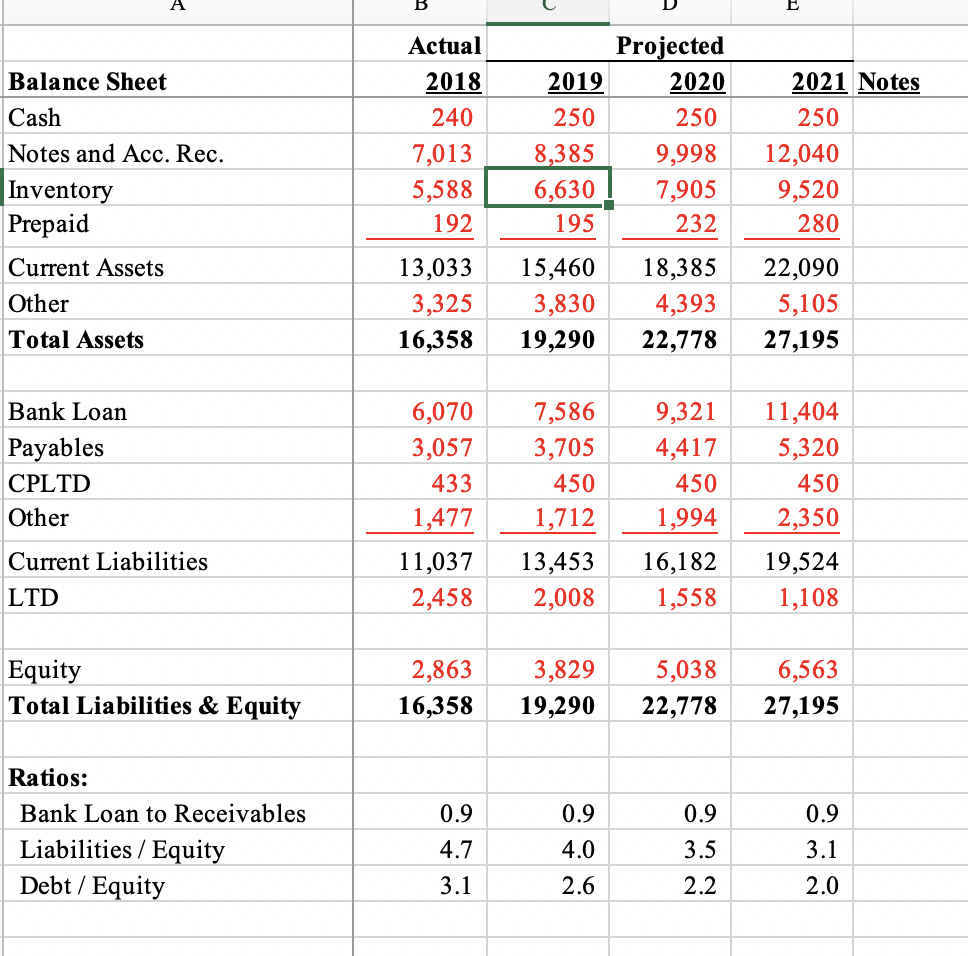

Apache Airlines, a privately held firm, is looking to buy additional gates at its home airport for $800,000 Apache has $240,000 in the bank but that money may not be spent as it is used to pay salaries, suppliers, and equipment Apache asked its bank for a loan but the bank refused saying that Apache's interest-bearing debt to equity was too high at 3.1 The bank said that Apache needed to lower that ratio below 2.3 in order to get the loan Separately, SkyBlue Airlines has approached Apache to see if Apache will buy it.

1. Finally, the CFO wants to know if the consolidated balance sheet's Debt/Equity ratio is below 2.5 if so, it will allow Apache to buy the gates Is Apache's ratio low enough that they can borrow to buy the gates? Show equations used and fill in below,.

| Actual | Projected | |||

| Balance Sheet | 2018 | 2019 | 2020 | 2021 |

| Cash | ||||

| Notes and Acc. Rec. | ||||

| Inventory | ||||

| Prepaid | ||||

| Current Assets | ||||

| Other | ||||

| Total Assets | ||||

| Bank Loan | ||||

| Payables | ||||

| CPLTD | ||||

| Other | ||||

| Current Liabilities | ||||

| LTD | ||||

| Equity | ||||

| Total Liabilities & Equity | ||||

| Ratios: | ||||

| Bank Loan to Receivables | ||||

| Liabilities / Equity | ||||

| Debt / Equity | ||||

Balance Sheet

Balance Sheet Cash Notes and Acc. Rec. Inventory Prepaid Current Assets Other Total Assets Bank Loan Payables CPLTD Other Current Liabilities LTD Equity Total Liabilities & Equity Ratios: Bank Loan to Receivables Liabilities/ Equity Debt/Equity B Actual 2018 240 7,013 5,588 192 13,033 3,325 16,358 6,070 3,057 433 1,477 11,037 2,458 2,863 16,358 0.9 4.7 3.1 2019 250 8,385 6,630 195 15,460 3,830 19,290 7,586 3,705 450 1,712 Projected 2020 250 9,998 7,905 232 0.9 4.0 2.6 18,385 4,393 22,778 9,321 4,417 450 1,994 3,829 5,038 19,290 22,778 0.9 3.5 13,453 16,182 19,524 2,008 1,558 1,108 33 2021 Notes 250 2.2 12,040 9,520 280 22,090 5,105 27,195 11,404 5,320 450 2,350 6,563 27,195 0.9 3.1 2.0

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The calculation details are mentioned below Price to be paid to Sky blue 25 times of Skyblues Net ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started