Question

Apache: Days cash on hand Apache Corporation is an independent energy company that explores, develops, and produces oil and gas products. Apache operates worldwide, including

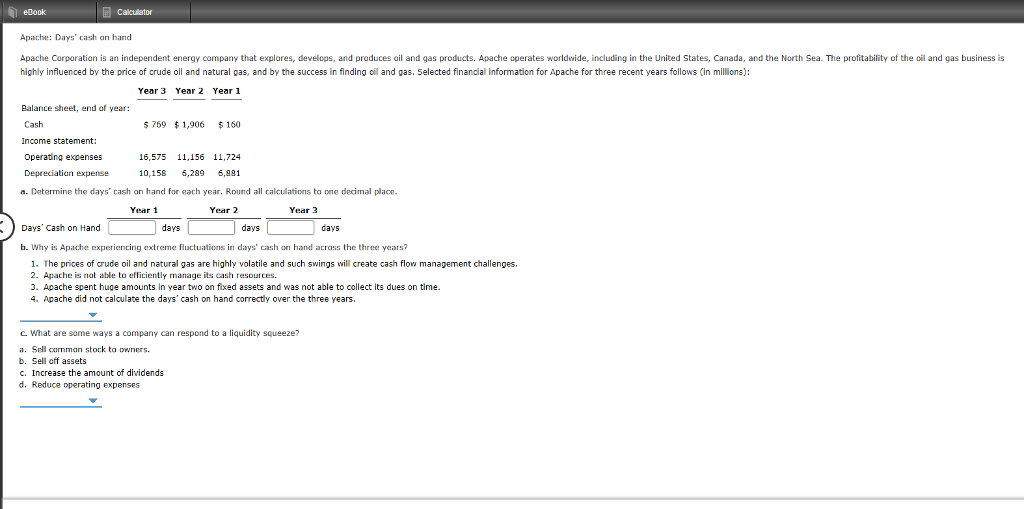

Apache: Days cash on hand

Apache Corporation is an independent energy company that explores, develops, and produces oil and gas products. Apache operates worldwide, including in the United States, Canada, and the North Sea. The profitability of the oil and gas business is highly influenced by the price of crude oil and natural gas, and by the success in finding oil and gas. Selected financial information for Apache for three recent years follows (in millions):

| Year 3 | Year 2 | Year 1 | ||||

| Balance sheet, end of year: | ||||||

| Cash | $ 769 | $ 1,906 | $ 160 | |||

| Income statement: | ||||||

| Operating expenses | 16,575 | 11,156 | 11,724 | |||

| Depreciation expense | 10,158 | 6,289 | 6,881 |

a. Determine the days cash on hand for each year. Round all calculations to one decimal place.

| Year 1 | Year 2 | Year 3 | ||||

| Days Cash on Hand | ___days _____ | days | _____days |

b. Why is Apache experiencing extreme fluctuations in days' cash on hand across the three years?

The prices of crude oil and natural gas are highly volatile and such swings will create cash flow management challenges.

Apache is not able to efficiently manage its cash resources.

Apache spent huge amounts in year two on fixed assets and was not able to collect its dues on time.

Apache did not calculate the days cash on hand correctly over the three years.______1,2,3,4?

c. What are some ways a company can respond to a liquidity squeeze?

Sell common stock to owners.

Sell off assets

Increase the amount of dividends

Reduce operating expenses___________________________

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started