Answered step by step

Verified Expert Solution

Question

1 Approved Answer

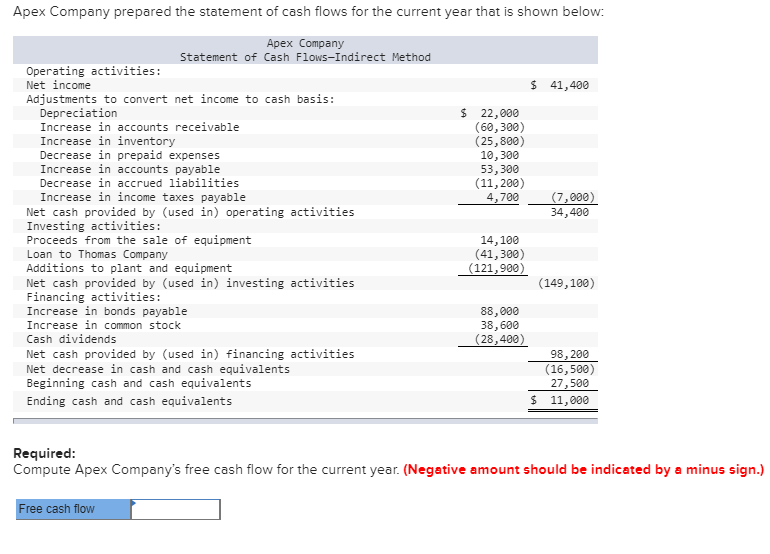

Apex Company prepared the statement of cash flows for the current year that is shown below: $ 41,400 $ 22,000 (60,300) (25, 800) 10,300 53,300

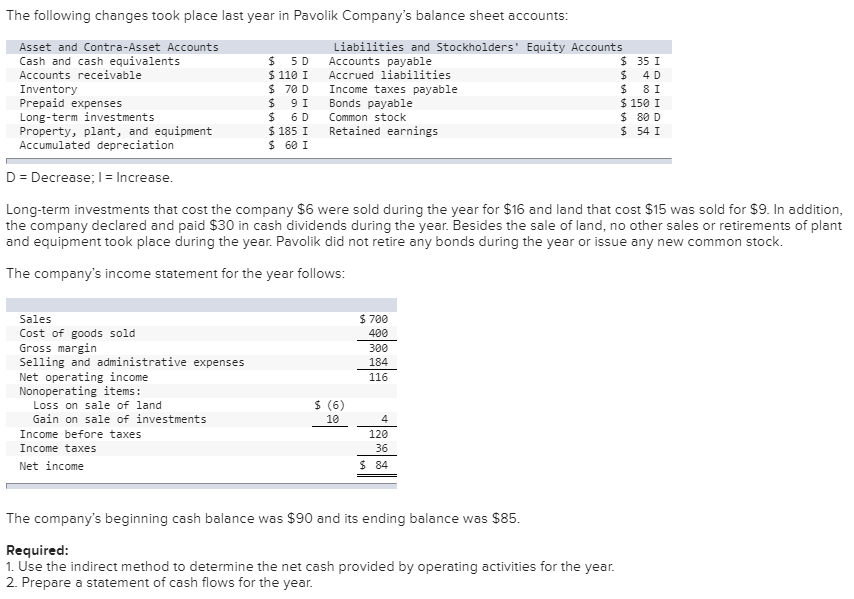

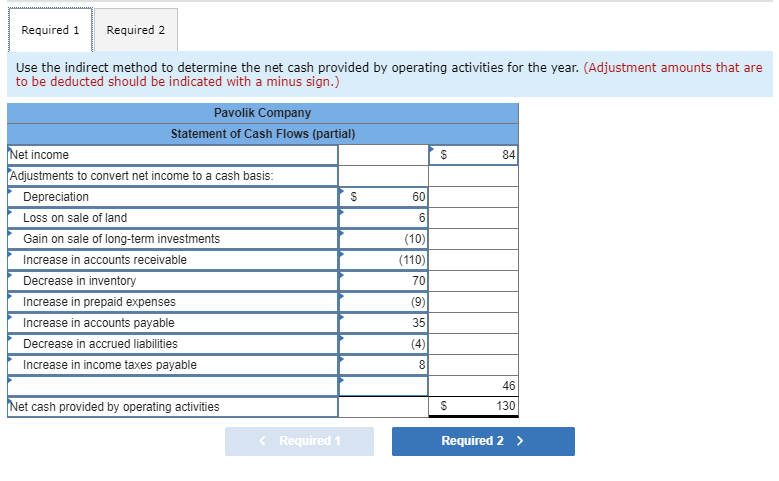

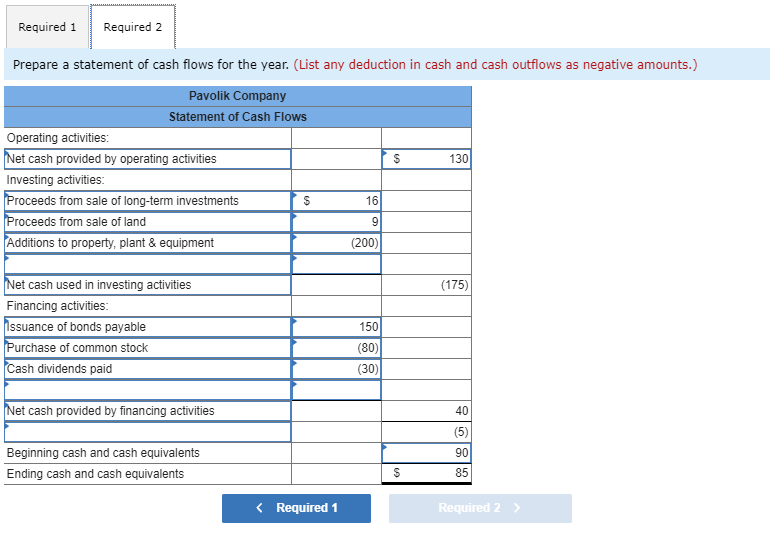

Apex Company prepared the statement of cash flows for the current year that is shown below: $ 41,400 $ 22,000 (60,300) (25, 800) 10,300 53,300 (11,200) 4,700 (7,000) 34,400 Apex Company Statement of Cash Flows-Indirect Method Operating activities: Net income Adjustments to convert net income to cash basis: Depreciation Increase in accounts receivable Increase in inventory Decrease in prepaid expenses Increase in accounts payable Decrease in accrued liabilities Increase in income taxes payable Net cash provided by used in) operating activities Investing activities: Proceeds from the sale of equipment Loan to Thomas Company Additions to plant and equipment Net cash provided by (used in) investing activities Financing activities: Increase in bonds payable Increase in common stock Cash dividends Net cash provided by (used in) financing activities Net decrease in cash and cash equivalents Beginning cash and cash equivalents Ending cash and cash equivalents 14,100 (41,300) (121,900) (149, 100) 88,000 38,600 (28,400) 98,200 (16,500) 27,500 11,000 $ Required: Compute Apex Company's free cash flow for the current year. (Negative amount should be indicated by a minus sign.) Free cash flow The following changes took place last year in Pavolik Company's balance sheet accounts: Asset and Contra-Asset Accounts Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Long-term investments Property, plant, and equipment Accumulated depreciation $ 5D $ 110 I $ 70 D $ 9I $ 6D $ 185 I $ 60 I Liabilities and Stockholders' Equity Accounts Accounts payable $ 35 I Accrued liabilities $ 4D Income taxes payable $ 81 Bonds payable $ 150 I Common stock $ 80 D Retained earnings $ 54 I D = Decrease; I = Increase. Long-term investments that cost the company $6 were sold during the year for $16 and land that cost $15 was sold for $9. In addition, the company declared and paid $30 in cash dividends during the year. Besides the sale of land, no other sales or retirements of plant and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock. The company's income statement for the year follows: $ 700 400 300 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Loss on sale of land Gain on sale of investments Income before taxes Income taxes Net income The company's beginning cash balance was $90 and its ending balance was $85. Required: 1. Use the indirect method to determine the net cash provided by operating activities for the year. 2. Prepare a statement of cash flows for the year. Required 1 Required 2 Use the indirect method to determine the net cash provided by operating activities for the year. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) IS Pavolik Company Statement of Cash Flows (partial) Net income Adjustments to convert net income to a cash basis: Depreciation Loss on sale of land Gain on sale of long-term investments Increase in accounts receivable Decrease in inventory Increase in prepaid expenses Increase in accounts payable 60 6 (10) (110) 70 (9) 35 Decrease in accrued liabilities Increase in income taxes payable Net cash provided by operating activities 130 Required 1 Required 2 > Required 1 Required 2 Prepare a statement of cash flows for the year. (List any deduction in cash and cash outflows as negative amounts.) Pavolik Company Statement of Cash Flows Operating activities: Net cash provided by operating activities Investing activities: Proceeds from sale of long-term investments $ Proceeds from sale of land Additions to property, plant & equipment 9 (200) Net cash used in investing activities Financing activities: Issuance of bonds payable Purchase of common stock Cash dividends paid 150 (80) 30) Net cash provided by financing activities 90 Beginning cash and cash equivalents Ending cash and cash equivalents S 85

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started