Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apex Fitness Club uses straight-line depreciation for a machine costing $26,200, with an estimated four-year life and a $2,050 salvage value. At the beginning of

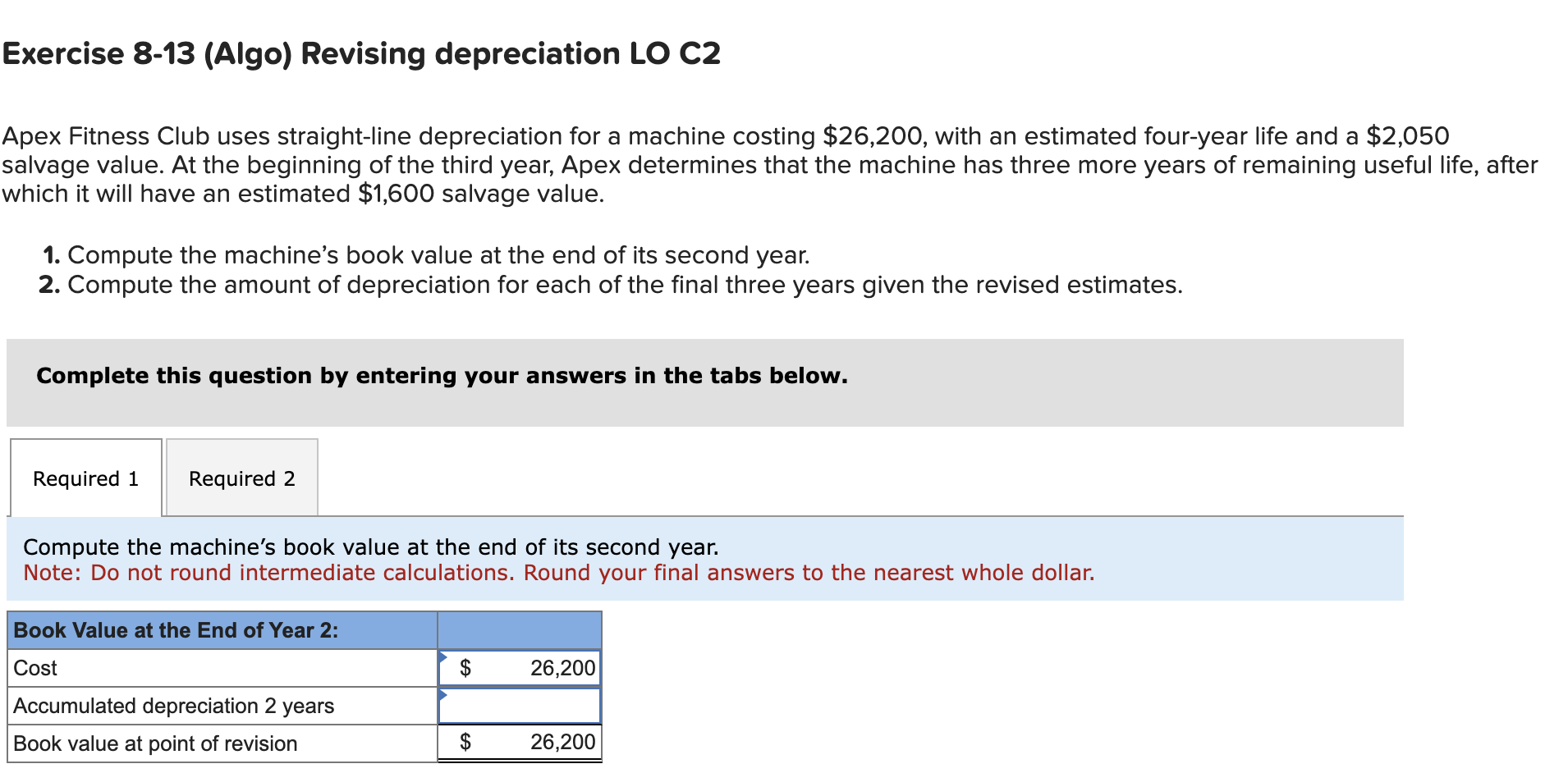

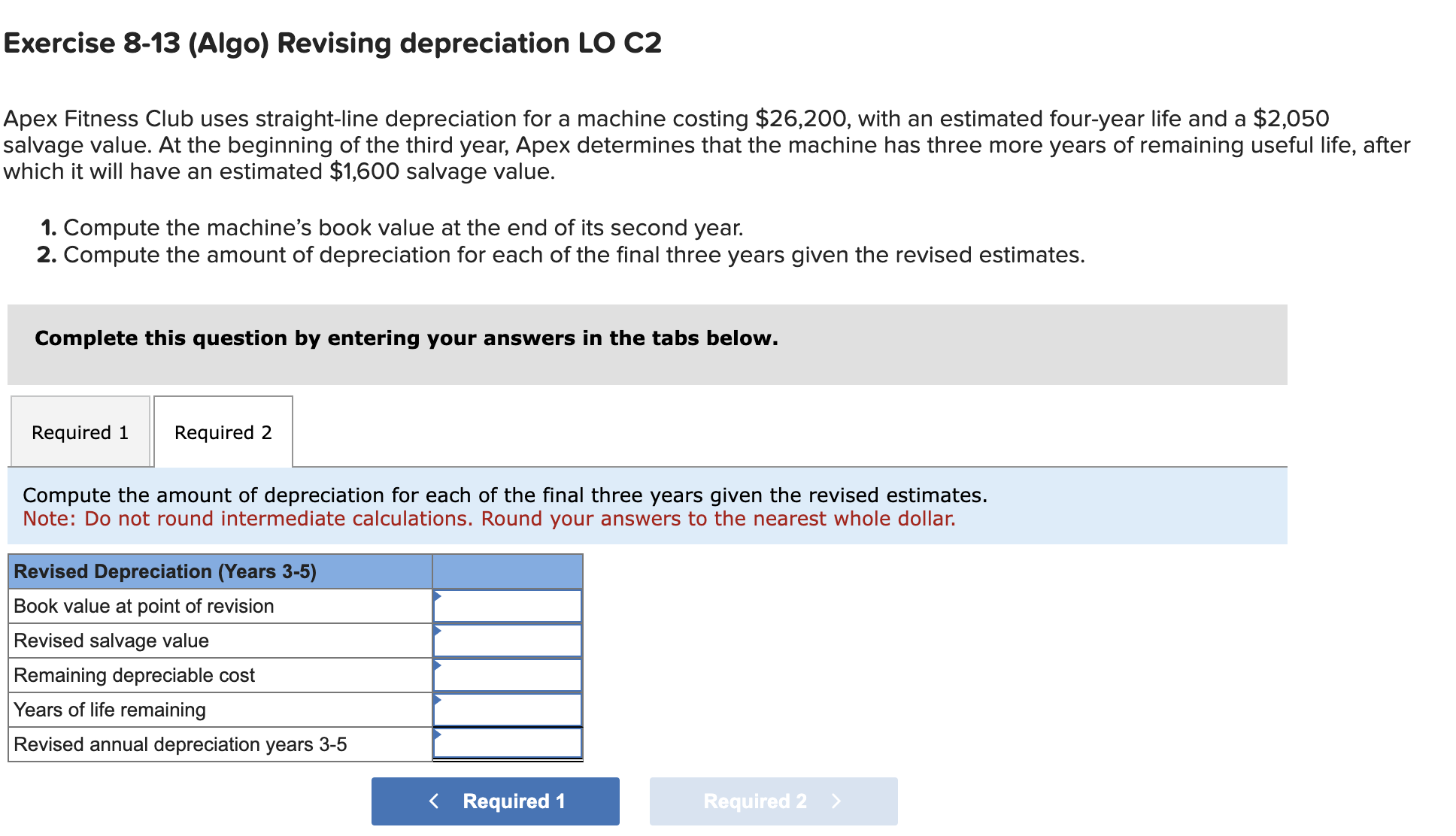

Apex Fitness Club uses straight-line depreciation for a machine costing $26,200, with an estimated four-year life and a $2,050 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,600 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Compute the machine's book value at the end of its second year. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Exercise 8-13 (Algo) Revising depreciation LO C2 Apex Fitness Club uses straight-line depreciation for a machine costing $26,200, with an estimated four-year life and a $2,050 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,600 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Compute the amount of depreciation for each of the final three years given the revised estimates. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started