Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apex Limited has been considering the possibility of diversifying its operations. Following detailed research and initial screening of several proposals, the company's management have

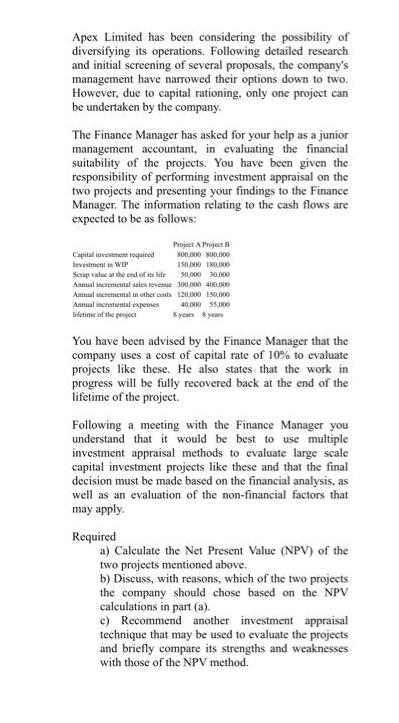

Apex Limited has been considering the possibility of diversifying its operations. Following detailed research and initial screening of several proposals, the company's management have narrowed their options down to two. However, due to capital rationing, only one project can be undertaken by the company. The Finance Manager has asked for your help as a junior management accountant, in evaluating the financial suitability of the projects. You have been given the responsibility of performing investment appraisal on the two projects and presenting your findings to the Finance Manager. The information relating to the cash flows are expected to be as follows: Project A Project B 800,000 800,000 150,000 180.000 50.000 30.000 300,000 400,000 120,000 150,000 40,000 $5,000 Capital investment required Investment in WIP Scrap value at the end of its life Annual incremental sales revenue Annual incremental in other costs Anmal incremental expenses lifetime of the project * years 8 years You have been advised by the Finance Manager that the company uses a cost of capital rate of 10% to evaluate projects like these. He also states that the work in progress will be fully recovered back at the end of the lifetime of the project. Required Following a meeting with the Finance Manager you understand that it would be best to use multiple investment appraisal methods to evaluate large scale capital investment projects like these and that the final decision must be made based on the financial analysis, as well as an evaluation of the non-financial factors that may apply. a) Calculate the Net Present Value (NPV) of the two projects mentioned above. b) Discuss, with reasons, which of the two projects the company should chose based on the NPV calculations in part (a). c) Recommend another investment appraisal technique that may be used to evaluate the projects and briefly compare its strengths and weaknesses with those of the NPV method.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

c Another investment appraisal technique that may be used to evaluate the projects is t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started