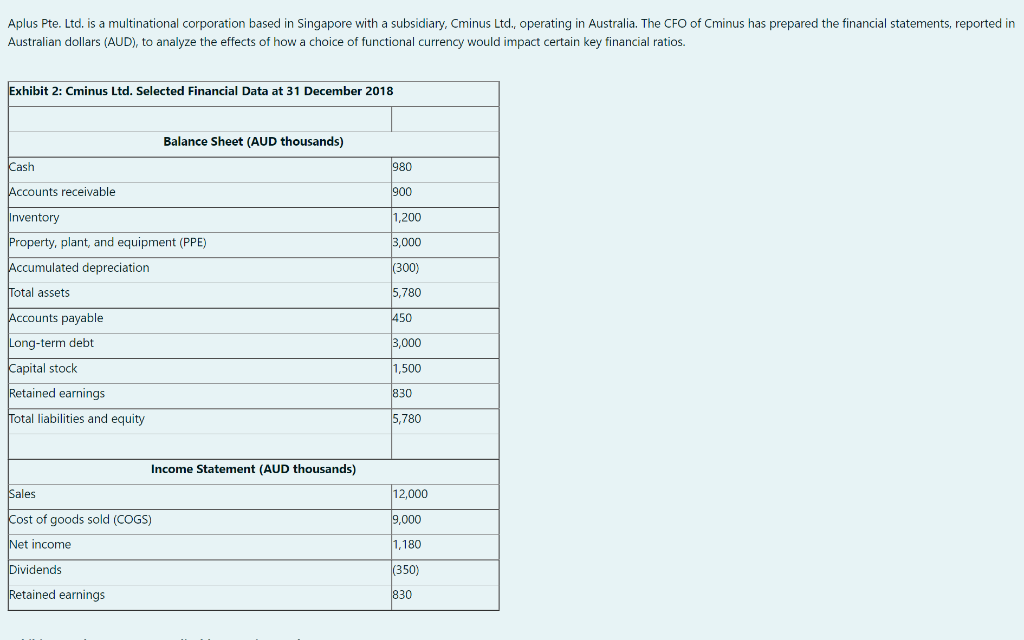

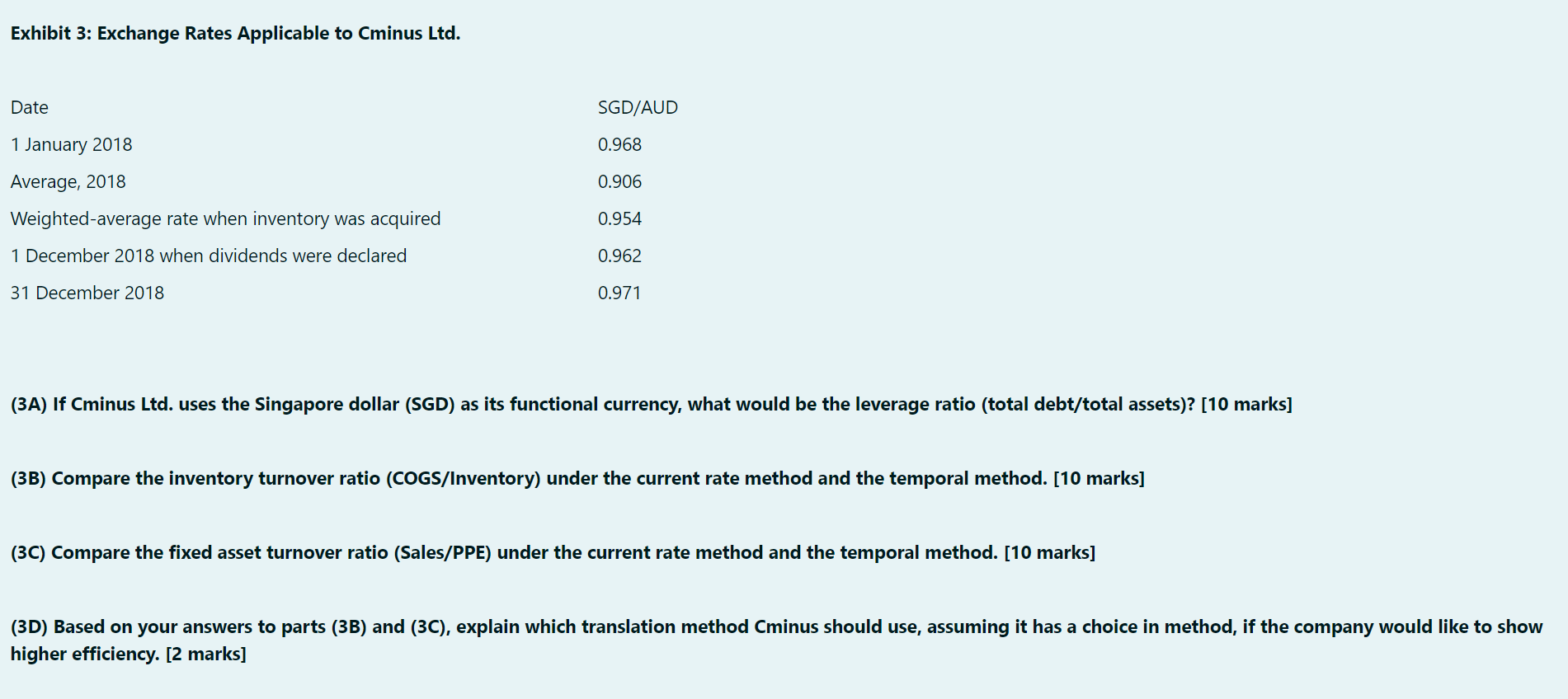

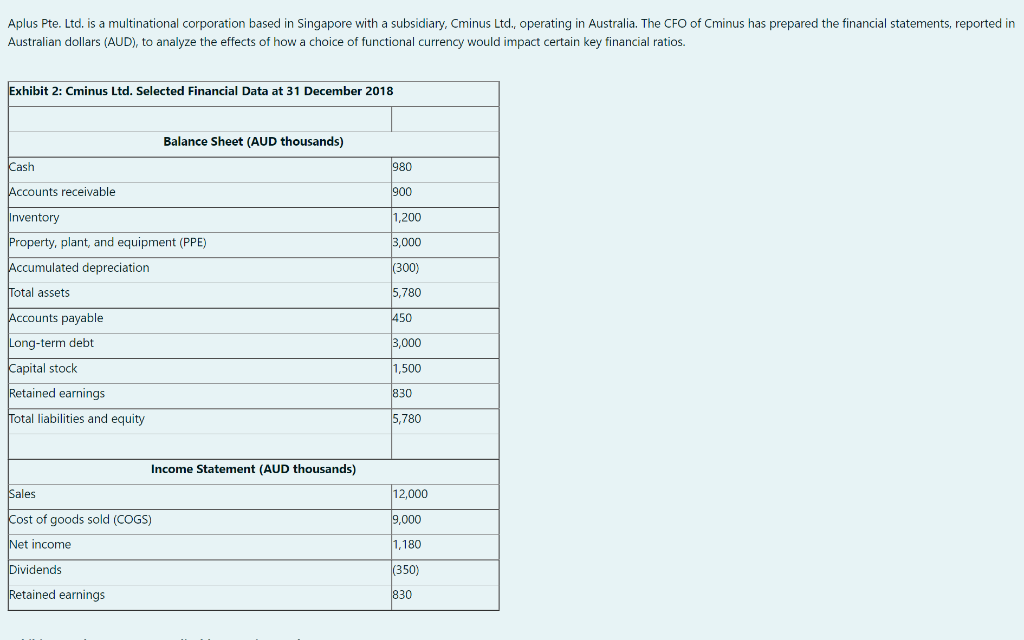

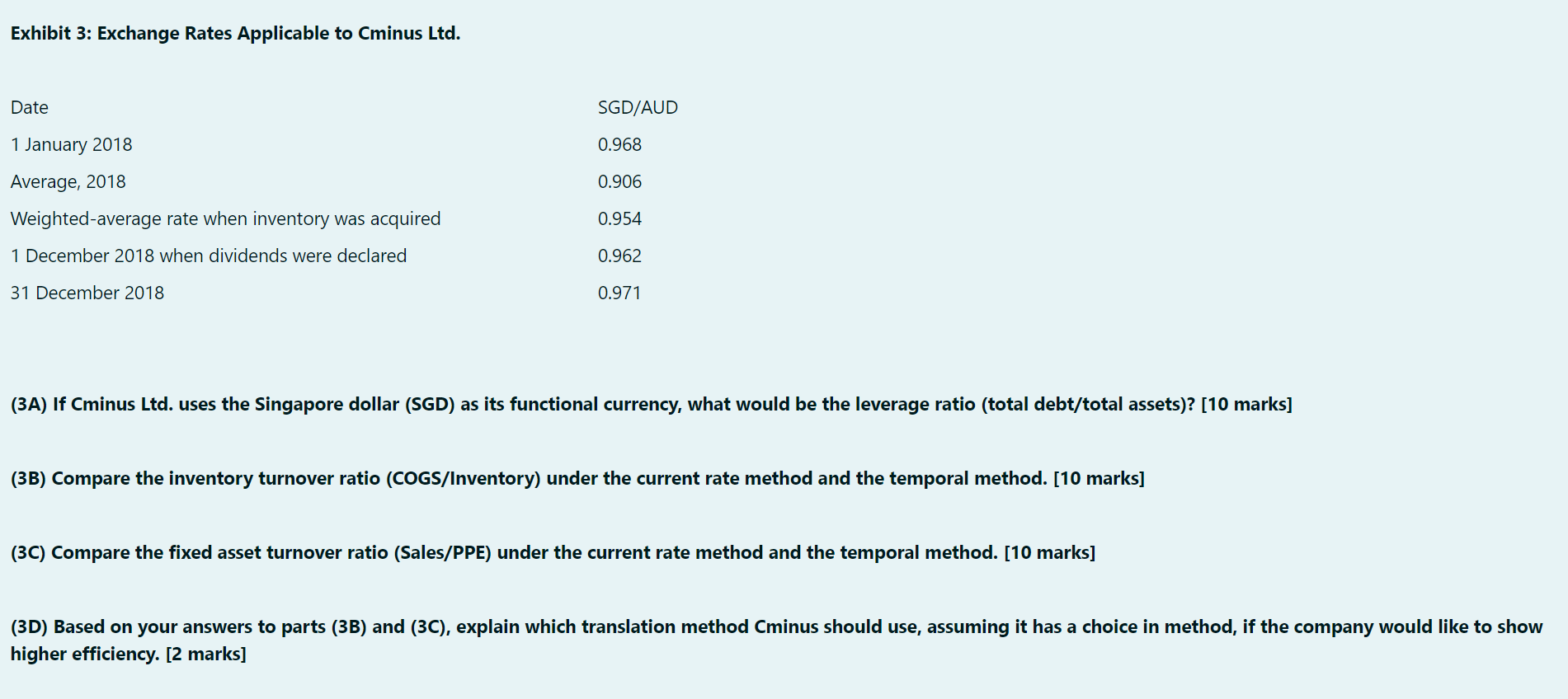

Aplus Pte. Ltd. is a multinational corporation based in Singapore with a subsidiary, Cminus Ltd., operating in Australia. The CFO of Cminus has prepared the financial statements, reported in Australian dollars (AUD), to analyze the effects of how a choice of functional currency would impact certain key financial ratios. Exhibit : Cminus Ltd. Selected Financial Data at 31 December 2018 Balance Sheet (AUD thousands) Cash 980 Accounts receivable 900 Inventory 1,200 Property, plant, and equipment (PPE) 3,000 Accumulated depreciation (300) Total assets 5,780 Accounts payable 450 Long-term debt 3,000 Capital stock 1,500 Retained earnings 830 Total liabilities and equity 5,780 Sales 12,000 Cost of goods sold (COGS) 9,000 Net income 1,180 Dividends (350) Retained earnings 830 Income Statement (AUD thousands) Exhibit 3: Exchange Rates Applicable to Cminus Ltd. Date SGD/AUD 1 January 2018 0.968 Average, 2018 0.906 Weighted-average rate when inventory was acquired 0.954 1 December 2018 when dividends were declared 0.962 31 December 2018 0.971 (3A) If Cminus Ltd. uses the Singapore dollar (SGD) as its functional currency, what would be the leverage ratio (total debt/total assets)? [10 marks] (3B) Compare the inventory turnover ratio (COGS/Inventory) under the current rate method and the temporal method. [10 marks] (3C) Compare the fixed asset turnover ratio (Sales/PPE) under the current rate method and the temporal method. [10 marks] (3D) Based on your answers to parts (3B) and (3C), explain which translation method Cminus should use, assuming it has a choice in method, if the company would like to show higher efficiency. [2 marks] Aplus Pte. Ltd. is a multinational corporation based in Singapore with a subsidiary, Cminus Ltd., operating in Australia. The CFO of Cminus has prepared the financial statements, reported in Australian dollars (AUD), to analyze the effects of how a choice of functional currency would impact certain key financial ratios. Exhibit : Cminus Ltd. Selected Financial Data at 31 December 2018 Balance Sheet (AUD thousands) Cash 980 Accounts receivable 900 Inventory 1,200 Property, plant, and equipment (PPE) 3,000 Accumulated depreciation (300) Total assets 5,780 Accounts payable 450 Long-term debt 3,000 Capital stock 1,500 Retained earnings 830 Total liabilities and equity 5,780 Sales 12,000 Cost of goods sold (COGS) 9,000 Net income 1,180 Dividends (350) Retained earnings 830 Income Statement (AUD thousands) Exhibit 3: Exchange Rates Applicable to Cminus Ltd. Date SGD/AUD 1 January 2018 0.968 Average, 2018 0.906 Weighted-average rate when inventory was acquired 0.954 1 December 2018 when dividends were declared 0.962 31 December 2018 0.971 (3A) If Cminus Ltd. uses the Singapore dollar (SGD) as its functional currency, what would be the leverage ratio (total debt/total assets)? [10 marks] (3B) Compare the inventory turnover ratio (COGS/Inventory) under the current rate method and the temporal method. [10 marks] (3C) Compare the fixed asset turnover ratio (Sales/PPE) under the current rate method and the temporal method. [10 marks] (3D) Based on your answers to parts (3B) and (3C), explain which translation method Cminus should use, assuming it has a choice in method, if the company would like to show higher efficiency. [2 marks]