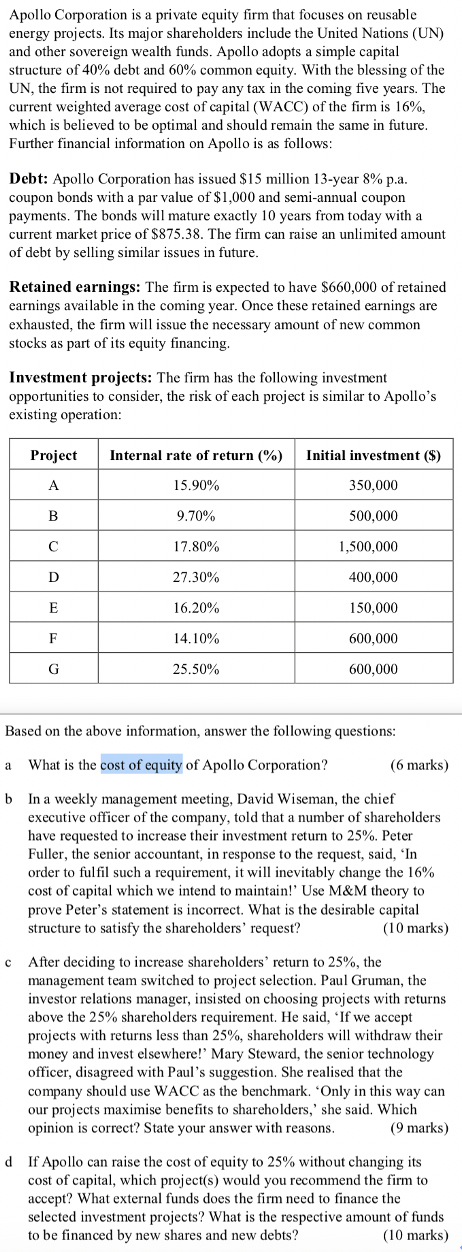

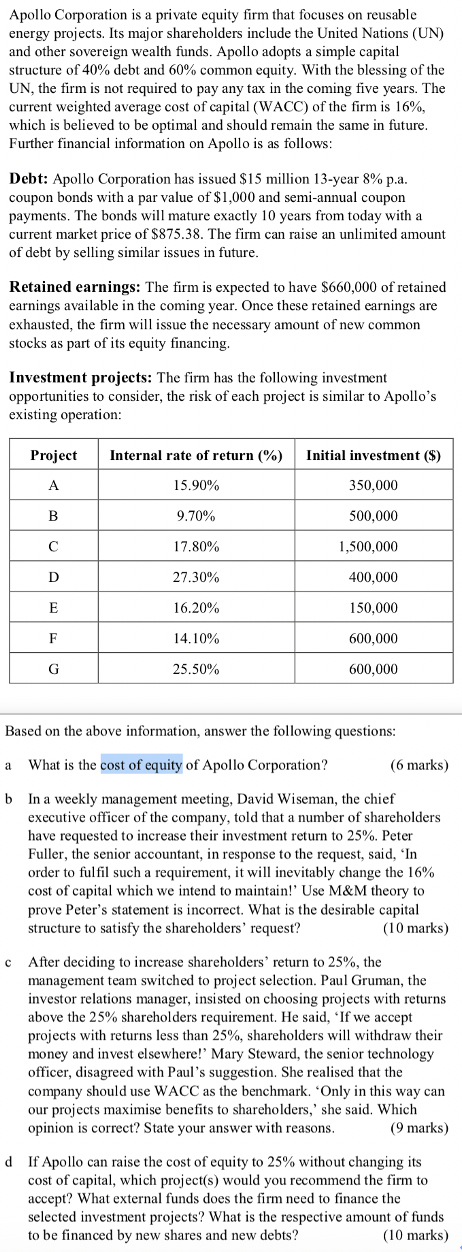

Apollo Corporation is a private equity firm that focuses on reusable energy projects. Its major shareholders include the United Nations (UN) and other sovereign wealth funds. Apollo adopts a simple capital structure of 40% debt and 60% common equity. With the blessing of the UN, the firm is not required to pay any tax in the coming five years. The current weighted average cost of capital (WACC) of the firm is 16%, which is believed to be optimal and should remain the same in future. Further financial information on Apollo is as follows: Debt: Apollo Corporation has issued $15 million 13-year 8% p.a. coupon bonds with a par value of $1,000 and semi-annual coupon payments. The bonds will mature exactly 10 years from today with a current market price of $875.38. The firm can raise an unlimited amount of debt by selling similar issues in future. Retained earnings: The firm is expected to have $660,000 of retained earnings available in the coming year. Once these retained earnings are exhausted, the firm will issue the necessary amount of new common stocks as part of its equity financing. Investment projects: The firm has the following investment opportunities to consider, the risk of each project is similar to Apollo's existing operation: Based on the above information, answer the following questions: a What is the cost of equity of Apollo Corporation? ( 6 marks) b In a weekly management meeting, David Wiseman, the chief executive officer of the company, told that a number of shareholders have requested to increase their investment return to 25%. Peter Fuller, the senior accountant, in response to the request, said, 'In order to fulfil such a requirement, it will inevitably change the 16% cost of capital which we intend to maintain!' Use M\&M theory to prove Peter's statement is incorrect. What is the desirable capital structure to satisfy the shareholders' request? (10 marks) c After deciding to increase shareholders' return to 25%, the management team switched to project selection. Paul Gruman, the investor relations manager, insisted on choosing projects with returns above the 25% shareholders requirement. He said, 'If we accept projects with returns less than 25%, shareholders will withdraw their money and invest elsewhere!' Mary Steward, the senior technology officer, disagreed with Paul's suggestion. She realised that the company should use WACC as the benchmark. 'Only in this way can our projects maximise benefits to shareholders,' she said. Which opinion is correct? State your answer with reasons. (9 marks) d If Apollo can raise the cost of equity to 25% without changing its cost of capital, which project(s) would you recommend the firm to accept? What external funds does the firm need to finance the selected investment projects? What is the respective amount of funds to be financed by new shares and new debts? (10 marks)