Answered step by step

Verified Expert Solution

Question

1 Approved Answer

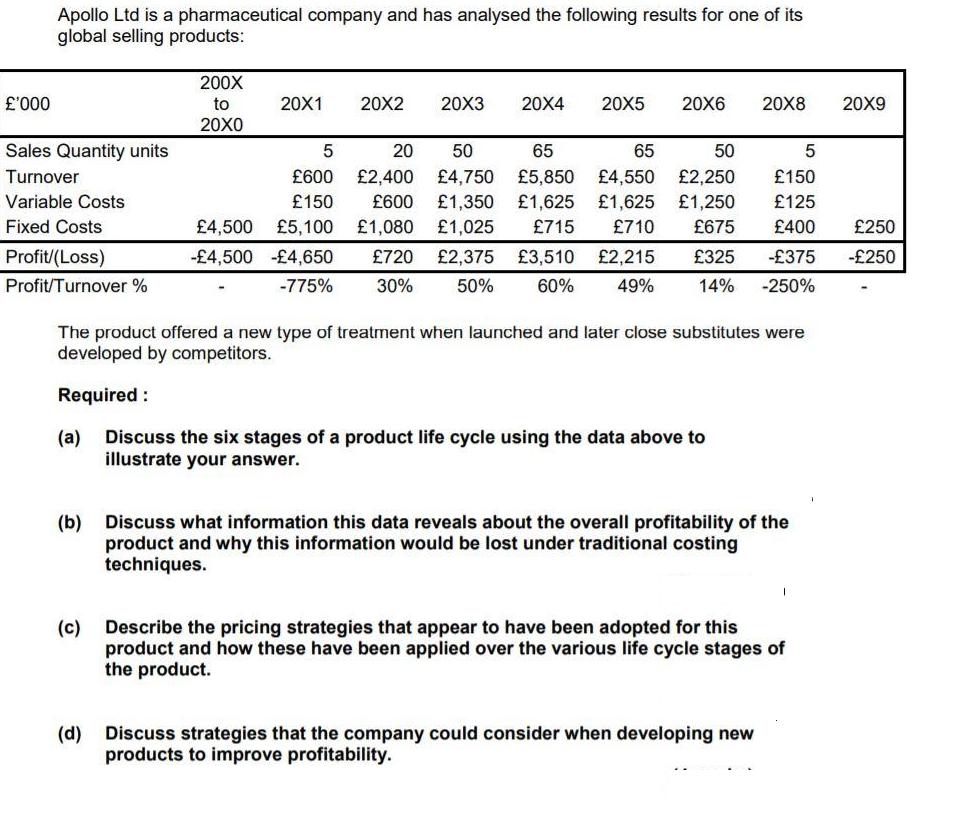

Apollo Ltd is a pharmaceutical company and has analysed the following results for one of its global selling products: 200X '000 to 20X1 20X2

Apollo Ltd is a pharmaceutical company and has analysed the following results for one of its global selling products: 200X '000 to 20X1 20X2 20X3 20X4 20X5 20X6 20X8 20X9 20X0 Sales Quantity units 20 50 65 65 50 Turnover 600 2,400 4,750 5,850 4,550 2,250 150 Variable Costs 150 600 1,350 1,625 1,625 1,250 125 Fixed Costs 4,500 5,100 1,080 1,025 715 710 675 400 250 Profit/(Loss) -4,500 -4,650 720 2,375 3,510 2,215 325 -375 -250 Profit/Turnover % -775% 30% 50% 60% 49% 14% -250% The product offered a new type of treatment when launched and later close substitutes were developed by competitors. Required : (a) Discuss the six stages of a product life cycle using the data above to illustrate your answer. (b) Discuss what information this data reveals about the overall profitability of the product and why this information would be lost under traditional costing techniques. Describe the pricing strategies that appear to have been adopted for this product and how these have been applied over the various life cycle stages of the product. (c) (d) Discuss strategies that the company could consider when developing new products to improve profitability.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Discuss the six stages of a product life cycle using the data above to illustrate your answer The six stages of a product life cycle are 1 Introduction The introduction stage is when a new product i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started