Question: Apollo Shoes is an audit case designed to introduce you to the entire audit process, from planning the engagement to drafting the final report. You

Apollo Shoes is an audit case designed to introduce you to the entire audit process, from planning the engagement to drafting the final report. You are asked to assume the role of a veteran of two-to-three “busy” seasons, “in-charging” for the first time. Communication between you and client personnel and other firm members takes the form of e-mail messages from the engagement partner (Arnold Anderson), the engagement manager (Darlene Wardlaw), an intern (Bradley Crumpler) assigned to do the “grunt work,” and the director of Apollo’s internal audit department (Karina Ramirez).

The information is sequential in nature. In other words, you must pay close attention to information disclosed early in the audit (for example, in the Board of Director’s minutes) as the information may play a role in subsequent audit work. Similarly, the bank cutoff statement in the cash workpapers and invoices used for valuing inventory may be useful later in the search for unrecorded liabilities. The bank confirmation contains information about long-term liabilities.

Detailed instructions regarding the information needed, as well as audit procedures you need to perform, can be found on Connect. The instructions are outlined in the form of emails from the audit manager.

4) Define what is meant by a relevant assertion. 1) List three relevant facts about Apollo Shoes that you think might have an impact on the financial statement audit.

2) Define what is meant by a significant account or disclosure.

3) Identify at least two significant accounts or disclosures from the financial statements of Apollo Shoes. What makes each item significant?

5) Identify at least one relevant assertion for each of the significant accounts or disclosures previously identified from the financial statements of Apollo Shoes. What makes each assertion relevant?

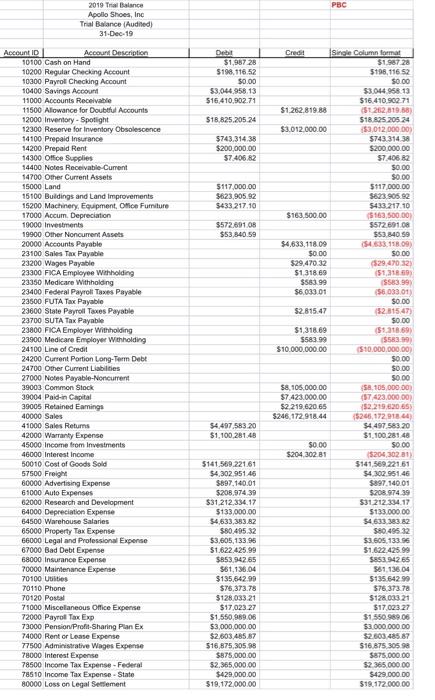

2019 Trial Balance PBC Apollo Shoes, Inc Trial Balance (Audited) 31-Dec-19 Account ID Account Description Debit $1,987.28 ISingie Column format $1.987.28 Credit 10100 Cash on Hand 10200 Regular Checking Account 10300 Payrol Checking Account 10400 Savings Account 11000 Accounts Receivable 11500 Allowance for Doubtful Accounts $198,116.52 $196,116.52 $0.00 $0.00 $3,044,958.13 $3.044.958.13 $16,410,902.71 $16.410 90271 $1.262,819.88 (S1.282,819.68) $18.825 205.24 (53,012 000.00) 12000 Inventory - Spotlight 12300 Reserve for Inventory Obsolescence 14100 Prepaid Insurance 14200 Prepaid Rent 14300 Office Supplies $18,825.205.24 $3.012.000.00 $743.314.38 $200,000.00 $743.314.38 $200,000.00 S7.406.82 $7.406 82 $0.00 S0.00 14400 Notes Receivabie-Cumrent 14700 Other Current Assets $17,000.00 $623,905.92 15000 Land $117,000.00 S623.905.92 15100 Buldings and Land Improvements 15200 Machinery, Equipment, Ofice Fumiture 17000 Accum. Depreciation 19000 Investments $433.217.10 $433,217.10 ($163,500.00) $572.691.08 $53.840.59 $163,500.00 $572.691.08 19900 Other Noncurrent Assets $53,840.59 20000 Accounts Payable 23100 Sales Tax Payabie 23200 Wages Payable 23300 FICA Employee Wihholding 23350 Medicare Withholding 23400 Federal Payroli Taxes Payable 23500 FUTA Tax Payable 23600 State Payrol Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 24100 Line of Credit $4,633,118.09 (S4.633.118.09) $0.00 $29,470.32 $1,318.69 $583. 99 $6.033.01 S0.00 $29,470 32) (51,318 69) (SS83.99) ($6.033.01) $0.00 (52.815.47) $0.00 (S1.318.69) (S583.90) (S10.000.000.00) $2.815.47 $1,318.69 $583.99 $10.000.000.00 24200 Current Portion Long-Term Debt 24700 Other Current Liabilties 27000 Notes Payable-Noncurent 39003 Common Stock $0.00 S0.00 50.00 $8, 105.000.00 (58,105,000 .00) (57.423.000.00) (52,219.620.6s) (5246,172.918.44) $4.497,583.20 $1,100,281 48 39004 Paid-in Capital 39005 Retained Eamings $7.423.000.00 $2.219,620.65 40000 Sales $246,172.918.44 $4,497,583.20 $1,100,281.48 41000 Sales Returns 42000 Warranty Expense 45000 Income from Investments 46000 Interest Income $0.00 S0.00 $204.302.81 (S204,302 81) 50010 Cost of Goods Sold 57500 Freight 60000 Advertising Expense 61000 Auto Expenses 62000 Research and Development 64000 Depreciation Expense $141.569.221.61 $141,569.221.61 $4,302.951.46 $897,140.01 $4.302.951.46 S897,140.01 $208.97439 $31.212.334.17 $133,000.00 $4,633,383.82 $80.495.32 $3,605,133.96 $S208.974.39 S31212.334.17 $133.000.00 $4.633.383.82 64500 Warehouse Salaries 65000 Property Tax Expense 66000 Legal and Professional Expense 67000 Bad Debt Expense 68000 Insurance Expense 70000 Maintenance Expense S80.495.32 $3.605,133.96 $1.622.425.99 $1.622.425.99 $853,942.65 S853.94265 S61,136.04 $61,136.04 70100 Utities 70110 Phone $135,642.99 $76,373.78 $135.642.99 S76,373.78 70120 Postal 71000 Miscellaneous Office Expense 72000 Payrol Tax Exp 73000 Pension/Profit-Sharing Plan Ex 74000 Rent or Lease Expense 77500 Administrative Wages Expense 78000 Interest Expense 78500 Income Tax Expense - Federal 78510 Income Tax Expense - State 80000 Loss on Legal Settement $128,033.21 $17,023.27 $1.550,989.06 $128.033.21 $17.023.27 $1.550.989.06 $3,000,000.00 $2,603,485.87 $3.000.000 00 $2.603,485 87 $16,875,305.98 $875,000.00 $16.875.305.98 S875.000.00 $2.365,000.00 $429,000.00 $2.365.000.00 $429.000.00 $19.172.000.00 $19,172,000.00

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

1 Relevant facts that have an impact on financial statement audit are i Accuracy All information disclosed is in the correct amounts and which reflect ... View full answer

Get step-by-step solutions from verified subject matter experts