Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Appalachian Mountain Water Company The incredible sales success of Perrier bottled water in the U.S. beverage market prompted Elvin Vernal to look into the possibility

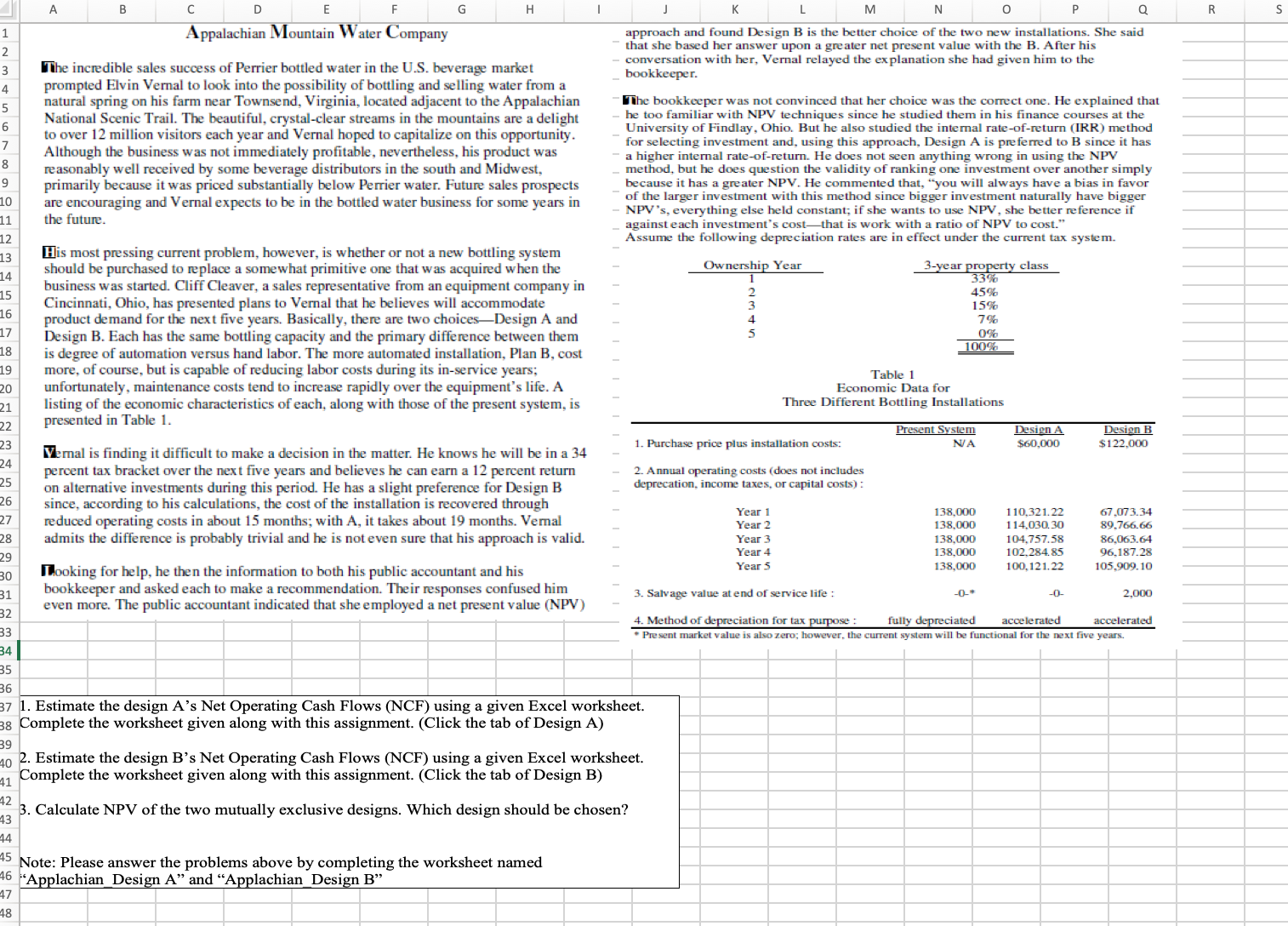

Appalachian Mountain Water Company The incredible sales success of Perrier bottled water in the U.S. beverage market prompted Elvin Vernal to look into the possibility of bottling and selling water from a natural spring on his farm near Townsend, Virginia, located adjacent to the Appalachian National Scenic Trail. The beautiful, crystal-clear streams in the mountains are a delight to over 12 million visitors each year and Vernal hoped to capitalize on this opportunity. Although the business was not immediately profitable, nevertheless, his product was reasonably well received by some beverage distributors in the south and Midwest, primarily because it was priced substantially below Perrier water. Future sales prospects are encouraging and Vernal expects to be in the bottled water business for some years in the future. Wis most pressing current problem, however, is whether or not a new bottling system should be purchased to replace a somewhat primitive one that was acquired when the business was started. Cliff Cleaver, a sales representative from an equipment company in Cincinnati, Ohio, has presented plans to Vernal that he believes will accommodate product demand for the next five years. Basically, there are two choices-Design A and Design B. Each has the same bottling capacity and the primary difference between them is degree of automation versus hand labor. The more automated installation, Plan B, cost more, of course, but is capable of reducing labor costs during its in-service years; unfortunately, maintenance costs tend to increase rapidly over the equipment's life. A listing of the economic characteristics of each, along with those of the present system, is presented in Table 1. Vy.mal is finding it difficult to make a decision in the matter. He knows he will be in a 34 percent tax bracket over the next five years and believes he can earn a 12 percent return on alternative investments during this period. He has a slight preference for Design B since, according to his calculations, the cost of the installation is recovered through reduced operating costs in about 15 months; with A, it takes about 19 months. Vernal admits the difference is probably trivial and he is not even sure that his approach is valid. Thooking for help, he then the information to both his public accountant and his bookkeeper and asked each to make a recommendation. Their responses confused him even more. The public accountant indicated that she employed a net present value (NPV) approach and found Design B is the better choice of the two new installations. She said that she based her answer upon a greater net present value with the B. After his - conversation with her, Vernal relayed the explanation she had given him to the bookkeeper. Whe bookkeeper was not convinced that her choice was the correct one. He explained that - he too familiar with NPV techniques since he studied them in his finance courses at the University of Findlay, Ohio. But he also studied the internal rate-of-return (IRR) method for selecting investment and, using this approach, Design A is preferred to B since it has - a higher internal rate-of-return. He does not seen anything wrong in using the NPV - method, but he does question the validity of ranking one investment over another simply because it has a greater NPV. He commented that, "you will always have a bias in favor of the larger investment with this method since bigger investment naturally have bigger - NPV's, everything else held constant; if she wants to use NPV, she better reference if against each investment's cost-that is work with a ratio of NPV to cost." Assume the following depreciation rates are in effect under the current tax system. Table 1 Economic Data for Three Different Bottling Installations 1. Estimate the design A's Net Operating Cash Flows (NCF) using a given Excel worksheet. Complete the worksheet given along with this assignment. (Click the tab of Design A) 2. Estimate the design B's Net Operating Cash Flows (NCF) using a given Excel worksheet. Complete the worksheet given along with this assignment. (Click the tab of Design B) 3. Calculate NPV of the two mutually exclusive designs. Which design should be chosen? Note: Please answer the problems above by completing the worksheet named "Applachian_Design A" and "Applachian_Design B

Appalachian Mountain Water Company The incredible sales success of Perrier bottled water in the U.S. beverage market prompted Elvin Vernal to look into the possibility of bottling and selling water from a natural spring on his farm near Townsend, Virginia, located adjacent to the Appalachian National Scenic Trail. The beautiful, crystal-clear streams in the mountains are a delight to over 12 million visitors each year and Vernal hoped to capitalize on this opportunity. Although the business was not immediately profitable, nevertheless, his product was reasonably well received by some beverage distributors in the south and Midwest, primarily because it was priced substantially below Perrier water. Future sales prospects are encouraging and Vernal expects to be in the bottled water business for some years in the future. Wis most pressing current problem, however, is whether or not a new bottling system should be purchased to replace a somewhat primitive one that was acquired when the business was started. Cliff Cleaver, a sales representative from an equipment company in Cincinnati, Ohio, has presented plans to Vernal that he believes will accommodate product demand for the next five years. Basically, there are two choices-Design A and Design B. Each has the same bottling capacity and the primary difference between them is degree of automation versus hand labor. The more automated installation, Plan B, cost more, of course, but is capable of reducing labor costs during its in-service years; unfortunately, maintenance costs tend to increase rapidly over the equipment's life. A listing of the economic characteristics of each, along with those of the present system, is presented in Table 1. Vy.mal is finding it difficult to make a decision in the matter. He knows he will be in a 34 percent tax bracket over the next five years and believes he can earn a 12 percent return on alternative investments during this period. He has a slight preference for Design B since, according to his calculations, the cost of the installation is recovered through reduced operating costs in about 15 months; with A, it takes about 19 months. Vernal admits the difference is probably trivial and he is not even sure that his approach is valid. Thooking for help, he then the information to both his public accountant and his bookkeeper and asked each to make a recommendation. Their responses confused him even more. The public accountant indicated that she employed a net present value (NPV) approach and found Design B is the better choice of the two new installations. She said that she based her answer upon a greater net present value with the B. After his - conversation with her, Vernal relayed the explanation she had given him to the bookkeeper. Whe bookkeeper was not convinced that her choice was the correct one. He explained that - he too familiar with NPV techniques since he studied them in his finance courses at the University of Findlay, Ohio. But he also studied the internal rate-of-return (IRR) method for selecting investment and, using this approach, Design A is preferred to B since it has - a higher internal rate-of-return. He does not seen anything wrong in using the NPV - method, but he does question the validity of ranking one investment over another simply because it has a greater NPV. He commented that, "you will always have a bias in favor of the larger investment with this method since bigger investment naturally have bigger - NPV's, everything else held constant; if she wants to use NPV, she better reference if against each investment's cost-that is work with a ratio of NPV to cost." Assume the following depreciation rates are in effect under the current tax system. Table 1 Economic Data for Three Different Bottling Installations 1. Estimate the design A's Net Operating Cash Flows (NCF) using a given Excel worksheet. Complete the worksheet given along with this assignment. (Click the tab of Design A) 2. Estimate the design B's Net Operating Cash Flows (NCF) using a given Excel worksheet. Complete the worksheet given along with this assignment. (Click the tab of Design B) 3. Calculate NPV of the two mutually exclusive designs. Which design should be chosen? Note: Please answer the problems above by completing the worksheet named "Applachian_Design A" and "Applachian_Design B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started