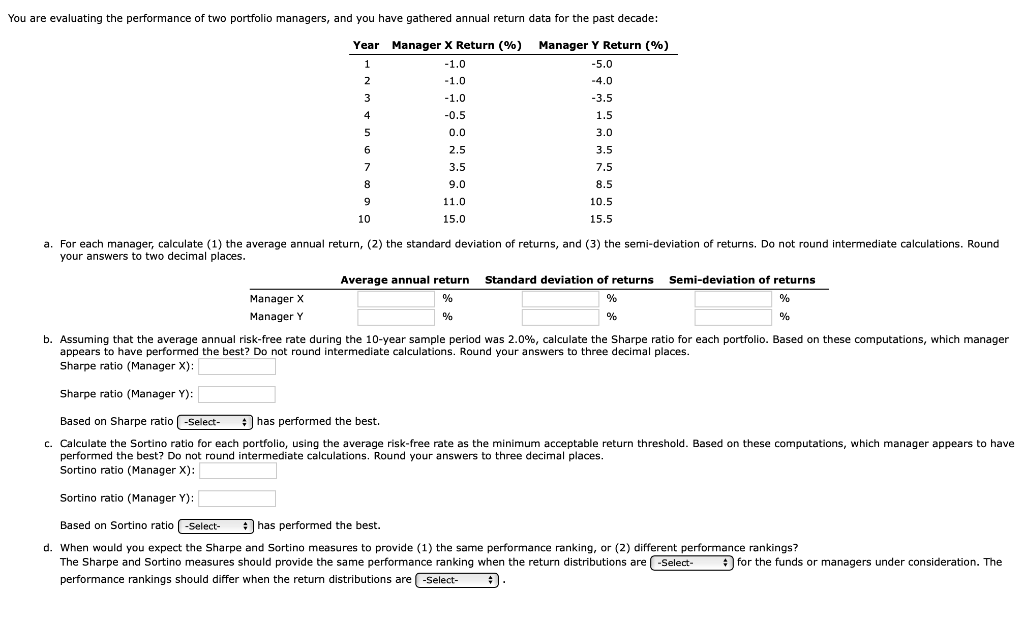

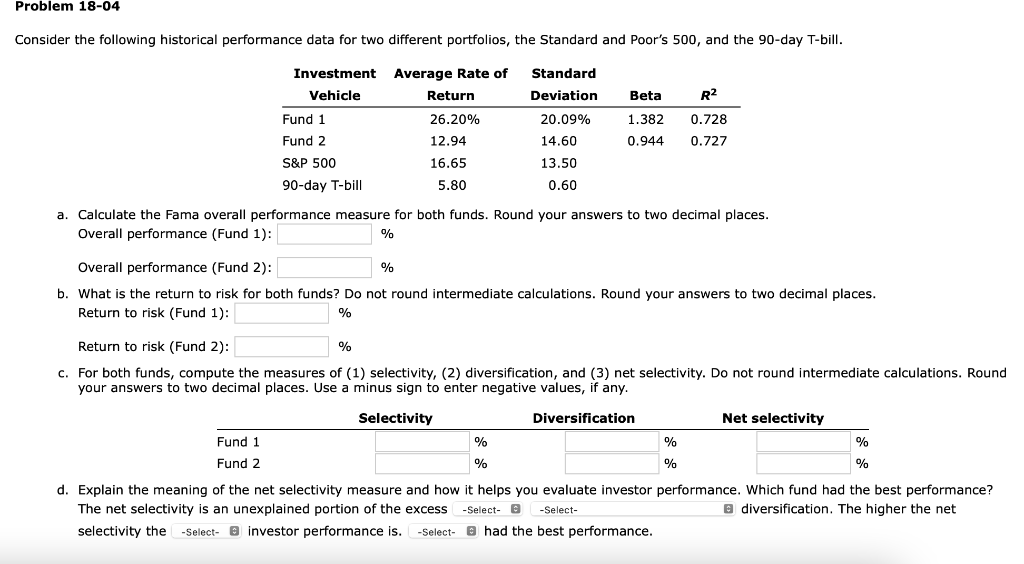

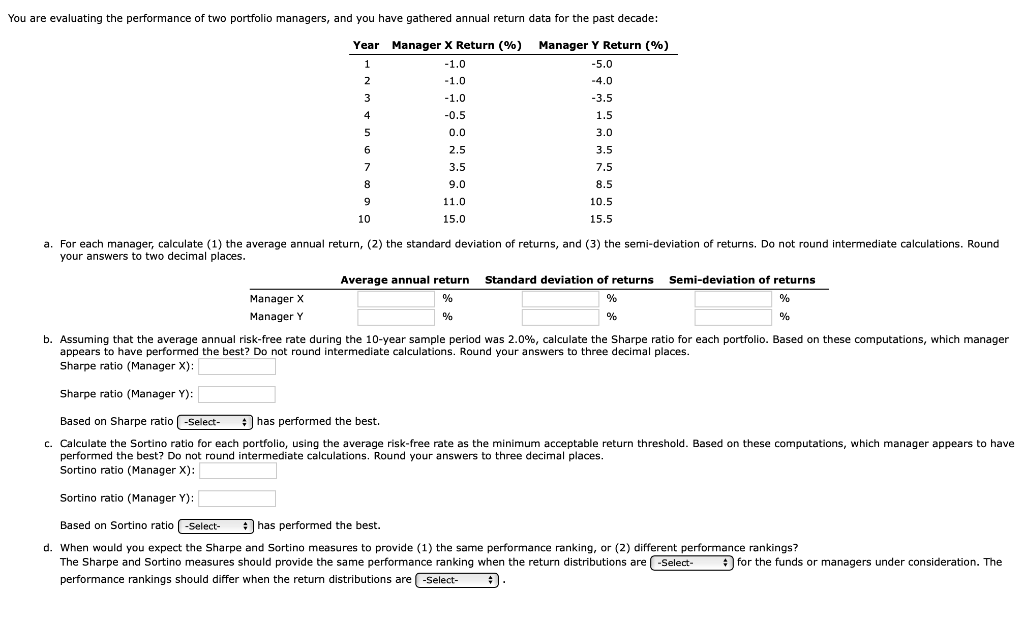

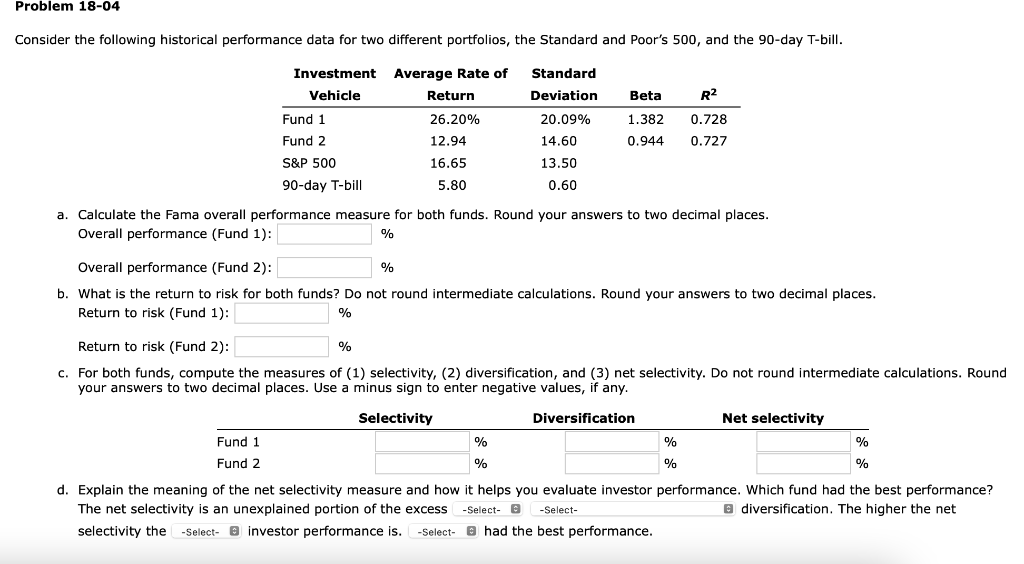

appears to have performed the best? Do not round intermediate calculations. Round your answers to three decimal places. Sharpe ratio (Manager X): Sharpe ratio (Manager Y): Based on Sharpe ratio has performed the best. performed the best? Do not round intermediate calculations. Round your answers to three decimal places. Sortino ratio (Manager X ): Sortino ratio (Manager Y): Based on Sortino ratio has performed the best. d. When would you expect the Sharpe and Sortino measures to provide (1) the same performance ranking, or ( 2 ) different performance rankings? performance rankings should differ when the return distributions are Problem 18-04 Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill. a. Calculate the Fama overall performance measure for both funds. Round your answers to two decimal places. Overall performance (Fund 1): % Overall performance (Fund 2): 0/0 b. What is the return to risk for both funds? Do not round intermediate calculations. Round your answers to two decimal places. Return to risk (Fund 1): % Return to risk (Fund 2): % c. For both funds, compute the measures of (1) selectivity, (2) diversification, and (3) net selectivity. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. The net selectivity is an unexplained portion of the excess I diversification. The higher the net selectivity the investor performance is. had the best performance. appears to have performed the best? Do not round intermediate calculations. Round your answers to three decimal places. Sharpe ratio (Manager X): Sharpe ratio (Manager Y): Based on Sharpe ratio has performed the best. performed the best? Do not round intermediate calculations. Round your answers to three decimal places. Sortino ratio (Manager X ): Sortino ratio (Manager Y): Based on Sortino ratio has performed the best. d. When would you expect the Sharpe and Sortino measures to provide (1) the same performance ranking, or ( 2 ) different performance rankings? performance rankings should differ when the return distributions are Problem 18-04 Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill. a. Calculate the Fama overall performance measure for both funds. Round your answers to two decimal places. Overall performance (Fund 1): % Overall performance (Fund 2): 0/0 b. What is the return to risk for both funds? Do not round intermediate calculations. Round your answers to two decimal places. Return to risk (Fund 1): % Return to risk (Fund 2): % c. For both funds, compute the measures of (1) selectivity, (2) diversification, and (3) net selectivity. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. The net selectivity is an unexplained portion of the excess I diversification. The higher the net selectivity the investor performance is. had the best performance