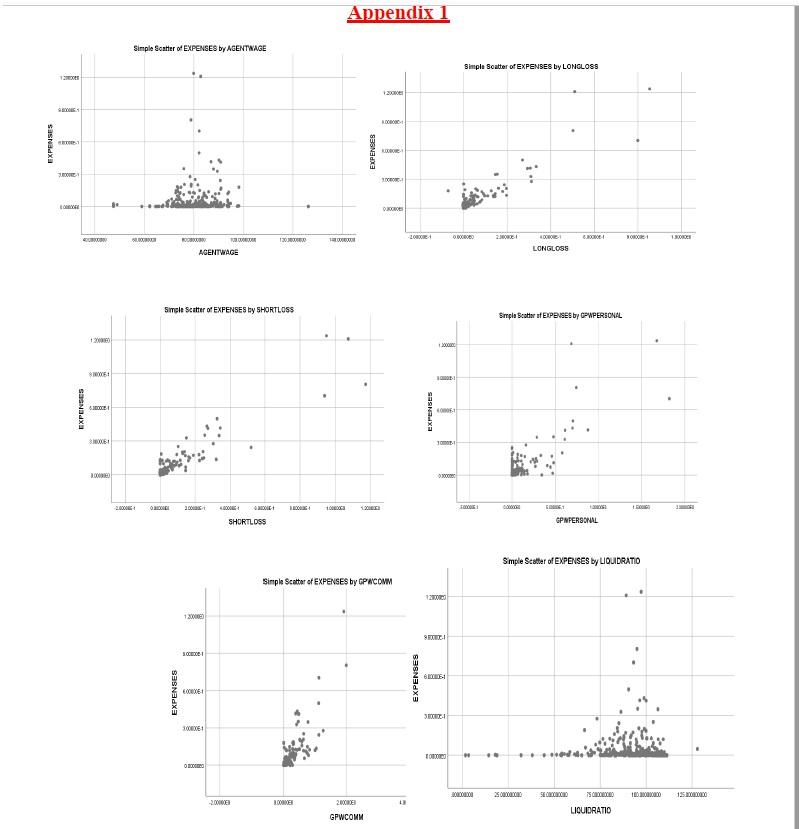

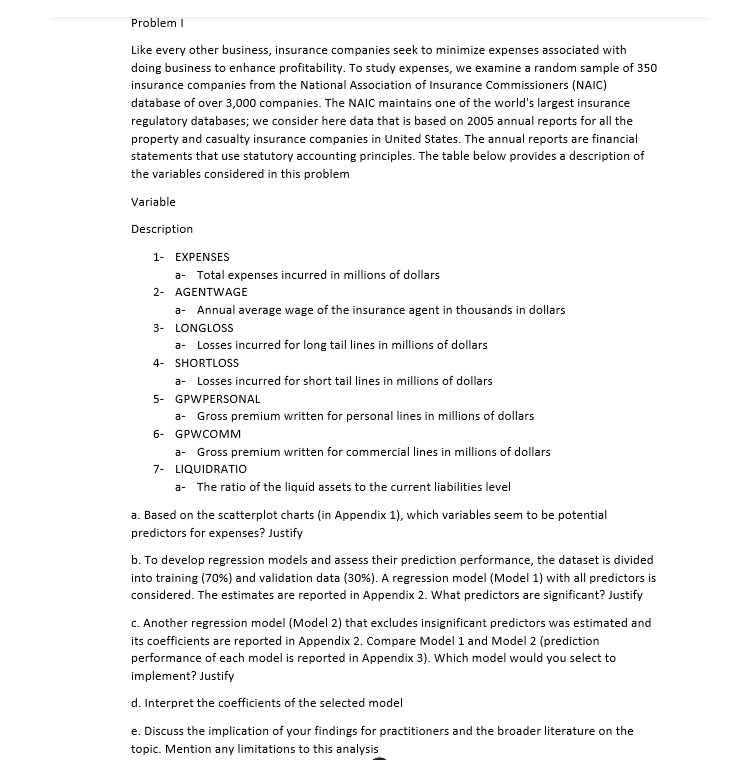

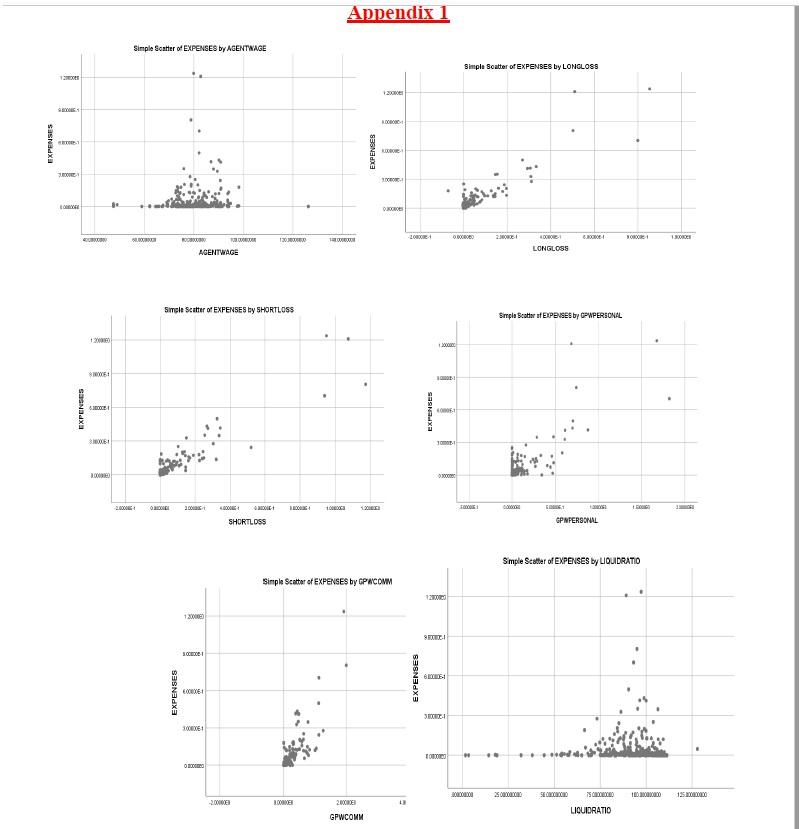

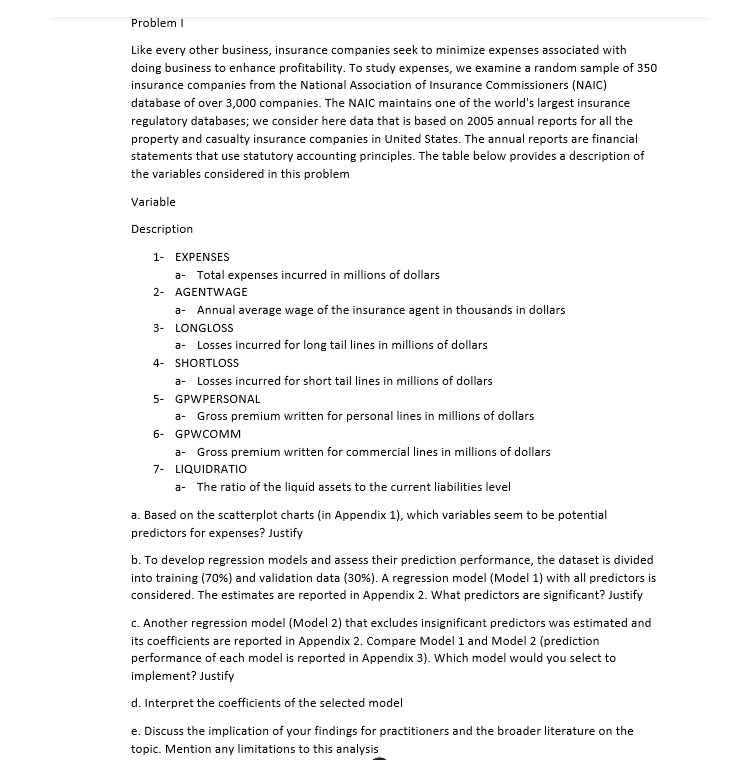

Appendix 1 Simple Scatter of EXPENSES by AGENTWAGE Simple Scatter of EXPENSES by LONGLOSS EXPENSES EXPENSES LOOR LE DES -20 CORO HORO ISOJE 12 2. DOO LONGLOSS AGENTWAGE Simple Scatter of EXPENSES by SHORTL085 Simple Scatter of ExperSeS by CPWPERSONAL 000 EXPENSES 6.00CE I EXPENSES WEI 10 . 10010 100 12 T1 30 SHORTLOSS GPNPERSONAL Simple Statter of EXPENSES DY LIQUIDRATIO Simple Scatter of EXPENSES by GPWCOMM 122000 1 TI SI EXPENSES EXPENSES BE E61 31 31 TOUCO OB BOB. 250.000 SCHLECCIO 125.000000 -2.000000 1.000 2000MER LIQUIDRATIO GPWCOMM Problem Like every other business, insurance companies seek to minimize expenses associated with doing business to enhance profitability. To study expenses, we examine a random sample of 350 insurance companies from the National Association of Insurance Commissioners (NAIC) database of over 3,000 companies. The NAIC maintains one of the world's largest insurance regulatory databases; we consider here data that is based on 2005 annual reports for all the property and casualty insurance companies in United States. The annual reports are financial statements that use statutory accounting principles. The table below provides a description of the variables considered in this problem Variable Description a- 1- EXPENSES a- Total expenses incurred in millions of dollars 2- AGENTWAGE a- Annual average wage of the insurance agent in thousands in dollars 3- LONGLOSS a- Losses incurred for long tail lines in millions of dollars 4- SHORTLOSS Losses incurred for short tail lines in millions of dollars 5- GPWPERSONAL a- Gross premium written for personal lines in millions of dollars 6- GPWCOMM a- Gross premium written for commercial lines in millions of dollars 7- LIQUIDRATIO a- The ratio of the liquid assets to the current liabilities level a. Based on the scatterplot charts (in Appendix 1), which variables seem to be potential predictors for expenses? Justify b. To develop regression models and assess their prediction performance, the dataset is divided into training (70%) and validation data (30%). A regression model (Model 1) with all predictors is considered. The estimates are reported in Appendix 2. What predictors are significant? Justify c. Another regression model (Model 2) that excludes insignificant predictors was estimated and its coefficients are reported in Appendix 2. Compare Model 1 and Model 2 (prediction performance of each model is reported in Appendix 3). Which model would you select to implement? Justify d. Interpret the coefficients of the selected model e. Discuss the implication of your findings for practitioners and the broader literature on the topic. Mention any limitations to this analysis