Question

Appendix A: Case Study of Brexit and the car industry In 2016, the UK voted to exit the EU, with withdrawal to be completed by

Appendix A: Case Study of Brexit and the car industry

In 2016, the UK voted to exit the EU, with withdrawal to be completed by March 2019. This caused great uncertainty and consternation in the UK car industry, which feared major adverse changes to its external environment. UK membership of the single market led foreign MNCs to use it as a platform for exporting barrier-free to other EU markets. Following the vote to withdraw, the car industry demanded unrestricted access to the single market with no new barriers to trade or restrictions in the free movement of workers.

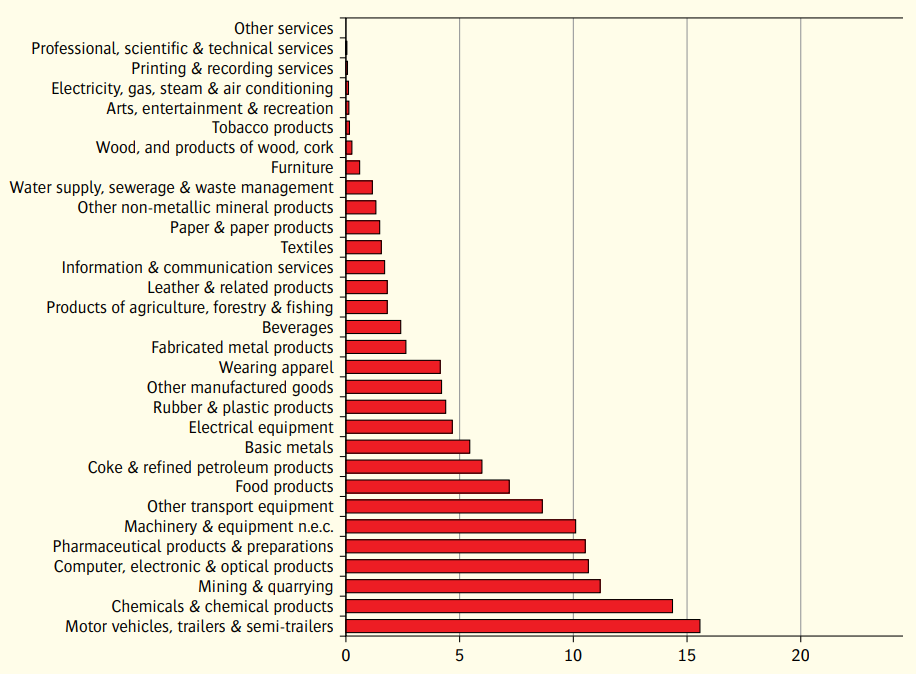

The possible introduction of tariff and non-tariff barriers created great concern in the car industry because the EU took 57 per cent of UK car exports. The body representing the industry, the Society of Motor Manufacturers and Traders (SMMT) (2016), warned that, after withdrawal from the EU, the introduction of tariffs on exports of cars and imports of components would cause a fall in sales and employment in the industry and could add 1,500 to the cost of cars sold in the UK (The Guardian 26 January 2017). If withdrawal were to lead to car firms operating on WTO trading arrangements, a 10 per cent tariff would be imposed on automotive exports and imports at a cost of 1.8 billion on the former and 2.7 billion on the latter. The UK economy could be badly affected, given that the industry was a major contributor to the UK with an annual turnover of around 72 billion and investment of 2.5 billion (SMMT 2017, Brexit Position Paper). As can be seen from Figure 1.17, the automotive sector is a major source of export earnings for the UK.

Big MNCs such as Nissan, Ford, Peugeot, and BMW had complex supply chains across the EU. For example, components from BMWs Mini travel thousands of miles, crisscrossing EU borders. The crankshaft is cast in France, milled into shape in the UK, inserted into the engine in Germany, and finally installed in the car back in the UK. The car can then be exported to the continent. Annually, Ford make 2 million engines in the UK, exports them to it is plants in the EU, installs them, and then imports the cars back to the UK. Less than half of car components are made in the UK. Nissan claims to import 5 million parts per day from Japan, China, and Europe. Dhingra et al. (n.d.) point out that withdrawal from the single market would make it more difficult and costlier to manage what were already complex supply chains. The UK chancellor of the exchequer tried to reassure the car industry:

. . . we should take particular note of those sectors with complex pan-European supply chains where often components and self-assemblies move backwards and forwards across European borders several times before they get incorporated into a final product . . . (Reuters 19 October 2016)

Car firms were also concerned that withdrawal would make it more difficult to recruit staff in the EU and transfer them across borders. Some 10 per cent of employees in the UK industry are EU nationals.

In 2016, the Japanese company Nissan was choosing a production location for the new Qashqai model. The company, fearing the imposition of tariffs on its exports to the EU, demanded compensation from the UK government, threatening that the new model would be made elsewhere if that did not happen. The Japanese government waded in by sending a 15-page list of demands on behalf of Japanese business operating in the UK warning of great turmoil and of Japanese companies exiting the UK (The Telegraph 13 November 2016). In response, Nissans CEO was invited to see the UK Prime Minister while the UK Business Secretary went to Japan to meet car company executives from Nissan, Toyota, and Honda to reassure them about Brexit. Nissan subsequently announced that the new model would be built in the UK. The UK government refused to make public the terms of the deal with Nissan. Subsequently, when the UK announced that it would leave the single market, the CEO of Nissan stated that the competitiveness of its UK plant would be under review when the new trade deal with the EU was struck. While Nissan adopted an aggressive approach, Toyotas was very different. It pledged to continue operating in the UK and announced 240 million of investment supported by 21.3 million of government support. However, Japanese companies continuing concerns were expressed by the Japanese ambassador in 2018. He stated that Japanese firm companies had invested in the UK to gain free access to EU markets, and that they could therefore be closed if market access were to be restricted and profitability reduced (Financial Times 8 February 2018).

Other car firms were concerned that Nissan was being given favorable treatment. Ford, the giant US-based car maker with extensive operations in the EU, pointed out that with 15,000 UK employees, it employed more workers than Nissan. PA (2016), the consultancy firm, suggested that car companies would respond differently to the prospect of the UK exit from the EU. It divided the industry into three categories:

firms likely to leave after UK withdrawal from the EU because of their dependence on relatively low profit exports to the EUthese included Toyota and Honda; those who might, or might not, move out of the UK BMWs Mini production, Nissan and Peugeots subsidiary, Vauxhall who were well established in the UK but could move operations to the EU; and,

Tatas Jaguar Land Rover and VWs Bentley, whose well-known British brands sold well in the EU and in global markets

Questions 1. Discuss the uncertainties for car firms caused by Brexit and why would car firms locate their car production in the UK.

Question 2. Justify car industry claims that unrestricted access [foreign direct investment] to the single market is in the best interest of the UK economy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started