Answered step by step

Verified Expert Solution

Question

1 Approved Answer

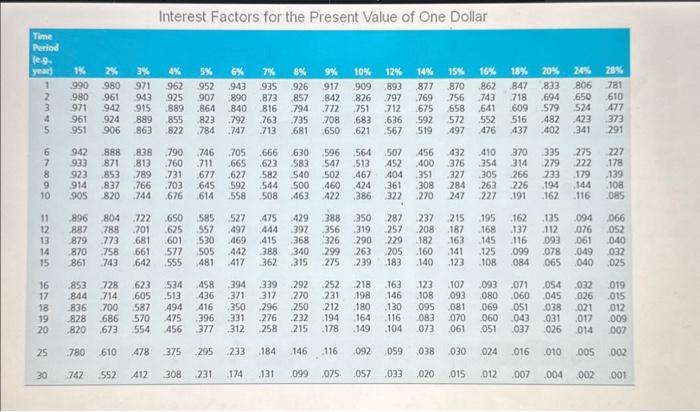

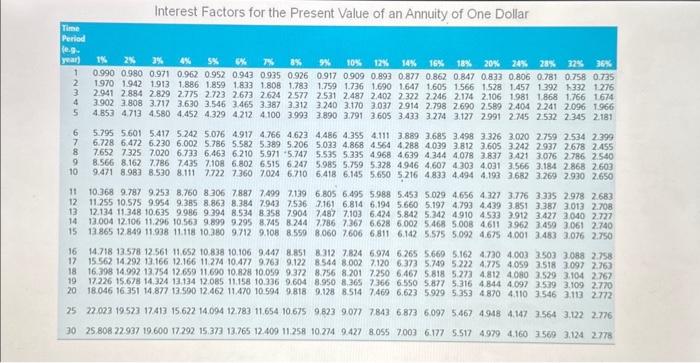

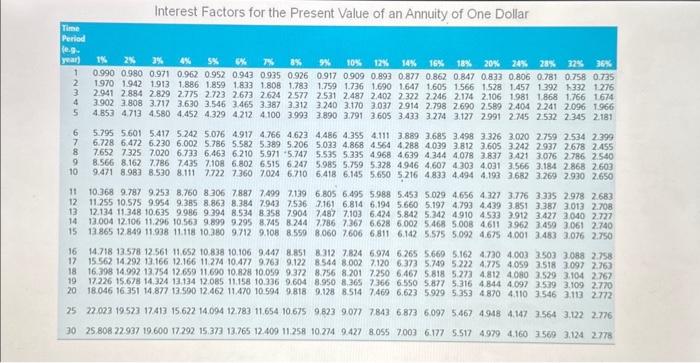

Appendix B Appendix D A firm must choose between two investment alternatives, each costing $105,000. The first alternative generates $35,000 a year for four years.

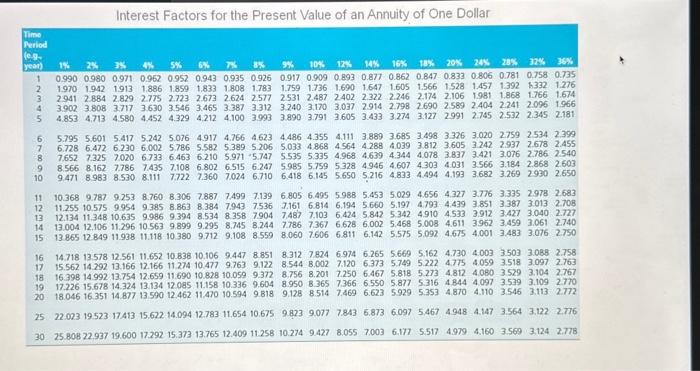

Appendix B

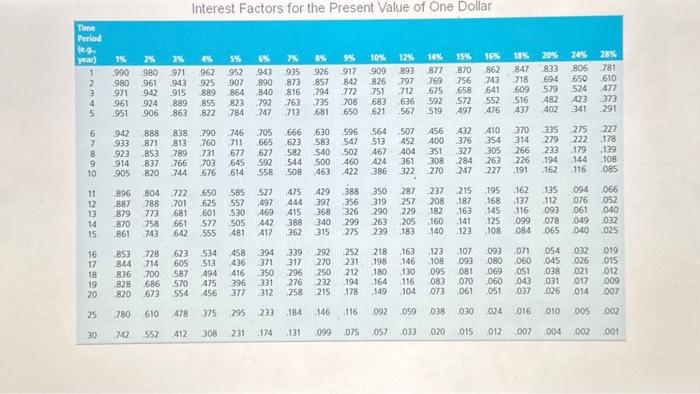

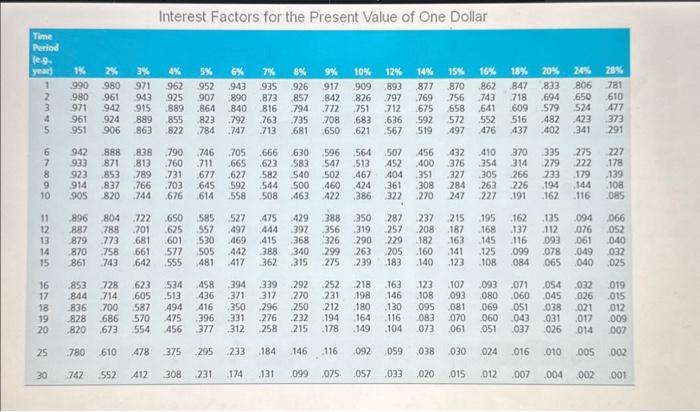

Appendix D

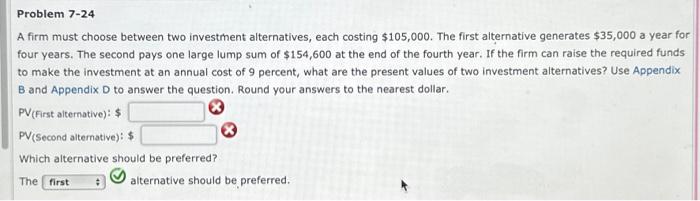

A firm must choose between two investment alternatives, each costing $105,000. The first alternative generates $35,000 a year for four years. The second pays one large lump sum of $154,600 at the end of the fourth year. If the firm can raise the required funds to make the investment at an annual cost of 9 percent, what are the present values of two investment alternatives? Use Appendix B and Appendix D to answer the question. Round your answers to the nearest dollar. PV(First alternative): \$ PV(Second alternative): $ Which alternative should be preferred? The aiternative should be preferred. A firm must choose between two investment alternatives, each costing $105,000. The first alternative generates $35,000 a year for four years. The second pays one large lump sum of $154,600 at the end of the fourth year. If the firm can raise the required funds to make the investment at an annual cost of 9 percent, what are the present values of two investment alternatives? Use Appendix B and Appendix D to answer the question. Round your answers to the nearest dollar. PV(First alternative): \$ PV(Second alternative): $ Which alternative should be preferred? The aiternative should be preferred. A firm must choose between two investment alternatives, each costing $105,000. The first alternative generates $35,000 a year for four years. The second pays one large lump sum of $154,600 at the end of the fourth year. If the firm can raise the required funds to make the investment at an annual cost of 9 percent, what are the present values of two investment alternatives? Use Appendix B and Appendix D to answer the question. Round your answers to the nearest dollar. PV(First alternative): \$ PV(Second alternative): $ Which alternative should be preferred? The aiternative should be preferred. A firm must choose between two investment alternatives, each costing $105,000. The first alternative generates $35,000 a year for four years. The second pays one large lump sum of $154,600 at the end of the fourth year. If the firm can raise the required funds to make the investment at an annual cost of 9 percent, what are the present values of two investment alternatives? Use Appendix B and Appendix D to answer the question. Round your answers to the nearest dollar. PV(First alternative): \$ PV(Second alternative): $ Which alternative should be preferred? The aiternative should be preferred. Interest Factors for the Present Value of an Annuity of One Dollar \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline TimeReriod(cogs.year) & 18: & 25 & 3 & 4. & 5x & 6% & & x & 9% & 10% & 125. & & 16% & 12x & 20x & 245 & 20x & 324. & 35 \\ \hline 1 & 0.990 & 0980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.893 & 0.877 & 0.862 & 0.847 & 0.833 & 0.806 & 0.781 & 0.758 & 0.735 \\ \hline 2 & 1970 & 1.942 & 1913 & 1.886 & 1.859 & 1.833 & 1.808 & 1.783 & 1.759 & 1.736 & 1.690 & 1.647 & 1.605 & 1.566 & 1.528 & 1.457 & 1.392 & 5332 & 1.276 \\ \hline 3 & 2941 & 2.884 & 2.829 & 2775 & 2723 & 2.673 & 2.624 & 2577 & 2531 & 2.487 & 2402 & 2.322 & 2.246 & 2.174 & 2.106 & 1981 & 1.868 & 1.766 & 1.674 \\ \hline 4 & 3.902 & 3.808 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3240 & 3.170 & 3.037 & 2.914 & 2.798 & 2690 & 2589 & 2.404 & 2241 & 2096 & 1966 \\ \hline 5 & 4.853 & 4.713 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 & 3.791 & 3.605 & 3.433 & 3.274 & 3,127 & 2991 & 2.745 & 2.532 & 2.345 & 2.181 \\ \hline 6 & 5.795 & 5.601 & 5.417 & 5.242 & 5.076 & 4917 & 4.766 & 4.623 & 4.486 & 4.355 & 4.111 & 3.889 & 3.685 & 3,498 & 3326 & 3.020 & 2759 & 2534 & 2.399 \\ \hline 7 & 6.728 & 6.472 & 6.230 & 6.002 & 5.786 & 5.582 & 5.389 & 5.206 & 5.033 & 4.868 & 4564 & 4.288 & 4.039 & 3.812 & 3.605 & 3.242 & 2.937 & 2.678 & 2.455 \\ \hline 8 & 7.652 & 7.325 & 7020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.747 & 5.535 & 5.335 & 4.968 & 4.639 & 4. 344 & 4.078 & 3.837 & 3.421 & 3.076 & 2786 & 2540 \\ \hline 9 & 8.566 & 8.162 & 7.786 & 7.435 & 7.108 & 6.802 & 6.515 & 6.247 & 5.985 & 5.759 & 5328 & 4946 & 4.607 & 4303 & 4.031 & 3566 & 3.184 & 2.868 & 2.603 \\ \hline 10 & 9.471 & 8983 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 & 6.145 & 5.650 & 5.216 & 4.833 & 4.494 & 4.193 & 3.682 & 3.269 & 2930 & 2.650 \\ \hline 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7,499 & 7.139 & 6.805 & 6.495 & 5988 & 5.453 & 5.029 & 4.656 & 4.327 & 3.776 & 3.335 & 2978 & 2.683 \\ \hline 12 & 11.255 & 10.575 & 9954 & 9.385 & 8.863 & 8.384 & 7.943 & 7536 & 7.161 & 6.814 & 6.194 & 5.660 & 5.197 & 4793 & 4.439 & 3.851 & 3,387 & 3.013 & 2.708 \\ \hline 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.534 & 8.358 & 7904 & 7,487 & 7.103 & 6.424 & 5.842 & 5342 & 4910 & 4.533 & 3.912 & 3.427 & 3.040 & 2.727 \\ \hline 14 & 13.004 & 12.106 & 11.296 & 10.563 & 9.899 & 9.295 & 8.745 & 8.244 & 7.786 & 7.367 & 6.628 & 6.002 & 5.468 & 5.008 & 4.611 & 3962 & 3.459 & 3.061 & 2.740 \\ \hline 15 & 13865 & 12849 & 11.938 & 11.118 & 10.380 & 9.712 & 9.108 & 8559 & 8.060 & 7.606 & 6811 & 6,142 & 5.575 & 5.092 & 4.675 & 4.001 & 3.483 & 3.076 & 2750 \\ \hline 16 & 14.718 & 13. & 12.561 & 11.652 & 10.8 & 10.106 & 9.447 & 8.851 & 8.312 & 7824 & 6974 & 6.265 & 5669 & 5.162 & 4.730 & 4.003 & 3503 & 3.088 & 2.758 \\ \hline 17 & 15.562 & 14.2 & 13.166 & 12.166 & 11.274 & 10.477 & 9.763 & 9.122 & 8.544 & 8.002 & 7.120 & 6.373 & 5.749 & 5.222 & 4.775 & 4059 & 3.518 & 3.097 & 2.763 \\ \hline 18 & 16.398 & 14992 & 13.754 & 12.659 & 11.690 & 10.828 & 10.059 & 9.372 & 8.756 & 8.201 & 7.250 & 6.467 & 5.818 & 5.273 & 4.812 & 4.060 & 3529 & 3.104 & 2767 \\ \hline 19 & & 15.678 & 14.324 & 13.134 & 12085 & 11.158 & 10.336 & 9.604 & 8.950 & 8.365 & 7.366 & 6550 & 5.877 & 5.316 & 4.844 & 4.097 & 3539 & 3.109 & 2770 \\ \hline 20 & 18.046 & 16.351 & 14.877 & 13590 & 12.462 & 11.470 & 10.594 & 9818 & 9.128 & 8.514 & 7.469 & 6.623 & 5929 & 5.353 & 4.870 & 4.110 & 3546 & 3.113 & 2.772 \\ \hline 25 & 22.023 & 19.523 & 17413 & 15.622 & 14.094 & 12.783 & 11.654 & 10.675 & 9823 & 9.077 & 7.843 & 5.873 & 6.097 & 5,467 & 4948 & 4.147 & 3.564 & 3.122 & 2.776 \\ \hline 30 & 25.8082 & 22.937 & 19.600 & 17.292 & 15.373 & 13.765 & 12.409 & 11.258 & 10.274 & 9.427 & 8.055 & 7.003 & 6.177 & 5.517 & 4.979 & 4.160 & 3.569 & 3,124 & 2.778 \\ \hline \end{tabular} Interest Factors for the Present Value of an Annuity of One Dollar \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline TimeReriod(cogs.year) & 18: & 25 & 3 & 4. & 5x & 6% & & x & 9% & 10% & 125. & & 16% & 12x & 20x & 245 & 20x & 324. & 35 \\ \hline 1 & 0.990 & 0980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.893 & 0.877 & 0.862 & 0.847 & 0.833 & 0.806 & 0.781 & 0.758 & 0.735 \\ \hline 2 & 1970 & 1.942 & 1913 & 1.886 & 1.859 & 1.833 & 1.808 & 1.783 & 1.759 & 1.736 & 1.690 & 1.647 & 1.605 & 1.566 & 1.528 & 1.457 & 1.392 & 5332 & 1.276 \\ \hline 3 & 2941 & 2.884 & 2.829 & 2775 & 2723 & 2.673 & 2.624 & 2577 & 2531 & 2.487 & 2402 & 2.322 & 2.246 & 2.174 & 2.106 & 1981 & 1.868 & 1.766 & 1.674 \\ \hline 4 & 3.902 & 3.808 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3240 & 3.170 & 3.037 & 2.914 & 2.798 & 2690 & 2589 & 2.404 & 2241 & 2096 & 1966 \\ \hline 5 & 4.853 & 4.713 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 & 3.791 & 3.605 & 3.433 & 3.274 & 3,127 & 2991 & 2.745 & 2.532 & 2.345 & 2.181 \\ \hline 6 & 5.795 & 5.601 & 5.417 & 5.242 & 5.076 & 4917 & 4.766 & 4.623 & 4.486 & 4.355 & 4.111 & 3.889 & 3.685 & 3,498 & 3326 & 3.020 & 2759 & 2534 & 2.399 \\ \hline 7 & 6.728 & 6.472 & 6.230 & 6.002 & 5.786 & 5.582 & 5.389 & 5.206 & 5.033 & 4.868 & 4564 & 4.288 & 4.039 & 3.812 & 3.605 & 3.242 & 2.937 & 2.678 & 2.455 \\ \hline 8 & 7.652 & 7.325 & 7020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.747 & 5.535 & 5.335 & 4.968 & 4.639 & 4. 344 & 4.078 & 3.837 & 3.421 & 3.076 & 2786 & 2540 \\ \hline 9 & 8.566 & 8.162 & 7.786 & 7.435 & 7.108 & 6.802 & 6.515 & 6.247 & 5.985 & 5.759 & 5328 & 4946 & 4.607 & 4303 & 4.031 & 3566 & 3.184 & 2.868 & 2.603 \\ \hline 10 & 9.471 & 8983 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 & 6.145 & 5.650 & 5.216 & 4.833 & 4.494 & 4.193 & 3.682 & 3.269 & 2930 & 2.650 \\ \hline 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7,499 & 7.139 & 6.805 & 6.495 & 5988 & 5.453 & 5.029 & 4.656 & 4.327 & 3.776 & 3.335 & 2978 & 2.683 \\ \hline 12 & 11.255 & 10.575 & 9954 & 9.385 & 8.863 & 8.384 & 7.943 & 7536 & 7.161 & 6.814 & 6.194 & 5.660 & 5.197 & 4793 & 4.439 & 3.851 & 3,387 & 3.013 & 2.708 \\ \hline 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.534 & 8.358 & 7904 & 7,487 & 7.103 & 6.424 & 5.842 & 5342 & 4910 & 4.533 & 3.912 & 3.427 & 3.040 & 2.727 \\ \hline 14 & 13.004 & 12.106 & 11.296 & 10.563 & 9.899 & 9.295 & 8.745 & 8.244 & 7.786 & 7.367 & 6.628 & 6.002 & 5.468 & 5.008 & 4.611 & 3962 & 3.459 & 3.061 & 2.740 \\ \hline 15 & 13865 & 12849 & 11.938 & 11.118 & 10.380 & 9.712 & 9.108 & 8559 & 8.060 & 7.606 & 6811 & 6,142 & 5.575 & 5.092 & 4.675 & 4.001 & 3.483 & 3.076 & 2750 \\ \hline 16 & 14.718 & 13. & 12.561 & 11.652 & 10.8 & 10.106 & 9.447 & 8.851 & 8.312 & 7824 & 6974 & 6.265 & 5669 & 5.162 & 4.730 & 4.003 & 3503 & 3.088 & 2.758 \\ \hline 17 & 15.562 & 14.2 & 13.166 & 12.166 & 11.274 & 10.477 & 9.763 & 9.122 & 8.544 & 8.002 & 7.120 & 6.373 & 5.749 & 5.222 & 4.775 & 4059 & 3.518 & 3.097 & 2.763 \\ \hline 18 & 16.398 & 14992 & 13.754 & 12.659 & 11.690 & 10.828 & 10.059 & 9.372 & 8.756 & 8.201 & 7.250 & 6.467 & 5.818 & 5.273 & 4.812 & 4.060 & 3529 & 3.104 & 2767 \\ \hline 19 & & 15.678 & 14.324 & 13.134 & 12085 & 11.158 & 10.336 & 9.604 & 8.950 & 8.365 & 7.366 & 6550 & 5.877 & 5.316 & 4.844 & 4.097 & 3539 & 3.109 & 2770 \\ \hline 20 & 18.046 & 16.351 & 14.877 & 13590 & 12.462 & 11.470 & 10.594 & 9818 & 9.128 & 8.514 & 7.469 & 6.623 & 5929 & 5.353 & 4.870 & 4.110 & 3546 & 3.113 & 2.772 \\ \hline 25 & 22.023 & 19.523 & 17413 & 15.622 & 14.094 & 12.783 & 11.654 & 10.675 & 9823 & 9.077 & 7.843 & 5.873 & 6.097 & 5,467 & 4948 & 4.147 & 3.564 & 3.122 & 2.776 \\ \hline 30 & 25.8082 & 22.937 & 19.600 & 17.292 & 15.373 & 13.765 & 12.409 & 11.258 & 10.274 & 9.427 & 8.055 & 7.003 & 6.177 & 5.517 & 4.979 & 4.160 & 3.569 & 3,124 & 2.778 \\ \hline \end{tabular} Interest Factors for the Present Value of One Dollar Interest Factors for the Present Value of One Dollar Interest Factors for the Present Value of an Annuity of One Dollar \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline TimeReriod(cogs.year) & 18: & 25 & 3 & 4. & 5x & 6% & & x & 9% & 10% & 125. & & 16% & 12x & 20x & 245 & 20x & 324. & 35 \\ \hline 1 & 0.990 & 0980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.893 & 0.877 & 0.862 & 0.847 & 0.833 & 0.806 & 0.781 & 0.758 & 0.735 \\ \hline 2 & 1970 & 1.942 & 1913 & 1.886 & 1.859 & 1.833 & 1.808 & 1.783 & 1.759 & 1.736 & 1.690 & 1.647 & 1.605 & 1.566 & 1.528 & 1.457 & 1.392 & 5332 & 1.276 \\ \hline 3 & 2941 & 2.884 & 2.829 & 2775 & 2723 & 2.673 & 2.624 & 2577 & 2531 & 2.487 & 2402 & 2.322 & 2.246 & 2.174 & 2.106 & 1981 & 1.868 & 1.766 & 1.674 \\ \hline 4 & 3.902 & 3.808 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3240 & 3.170 & 3.037 & 2.914 & 2.798 & 2690 & 2589 & 2.404 & 2241 & 2096 & 1966 \\ \hline 5 & 4.853 & 4.713 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 & 3.791 & 3.605 & 3.433 & 3.274 & 3,127 & 2991 & 2.745 & 2.532 & 2.345 & 2.181 \\ \hline 6 & 5.795 & 5.601 & 5.417 & 5.242 & 5.076 & 4917 & 4.766 & 4.623 & 4.486 & 4.355 & 4.111 & 3.889 & 3.685 & 3,498 & 3326 & 3.020 & 2759 & 2534 & 2.399 \\ \hline 7 & 6.728 & 6.472 & 6.230 & 6.002 & 5.786 & 5.582 & 5.389 & 5.206 & 5.033 & 4.868 & 4564 & 4.288 & 4.039 & 3.812 & 3.605 & 3.242 & 2.937 & 2.678 & 2.455 \\ \hline 8 & 7.652 & 7.325 & 7020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.747 & 5.535 & 5.335 & 4.968 & 4.639 & 4. 344 & 4.078 & 3.837 & 3.421 & 3.076 & 2786 & 2540 \\ \hline 9 & 8.566 & 8.162 & 7.786 & 7.435 & 7.108 & 6.802 & 6.515 & 6.247 & 5.985 & 5.759 & 5328 & 4946 & 4.607 & 4303 & 4.031 & 3566 & 3.184 & 2.868 & 2.603 \\ \hline 10 & 9.471 & 8983 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 & 6.145 & 5.650 & 5.216 & 4.833 & 4.494 & 4.193 & 3.682 & 3.269 & 2930 & 2.650 \\ \hline 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7,499 & 7.139 & 6.805 & 6.495 & 5988 & 5.453 & 5.029 & 4.656 & 4.327 & 3.776 & 3.335 & 2978 & 2.683 \\ \hline 12 & 11.255 & 10.575 & 9954 & 9.385 & 8.863 & 8.384 & 7.943 & 7536 & 7.161 & 6.814 & 6.194 & 5.660 & 5.197 & 4793 & 4.439 & 3.851 & 3,387 & 3.013 & 2.708 \\ \hline 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.534 & 8.358 & 7904 & 7,487 & 7.103 & 6.424 & 5.842 & 5342 & 4910 & 4.533 & 3.912 & 3.427 & 3.040 & 2.727 \\ \hline 14 & 13.004 & 12.106 & 11.296 & 10.563 & 9.899 & 9.295 & 8.745 & 8.244 & 7.786 & 7.367 & 6.628 & 6.002 & 5.468 & 5.008 & 4.611 & 3962 & 3.459 & 3.061 & 2.740 \\ \hline 15 & 13865 & 12849 & 11.938 & 11.118 & 10.380 & 9.712 & 9.108 & 8559 & 8.060 & 7.606 & 6811 & 6,142 & 5.575 & 5.092 & 4.675 & 4.001 & 3.483 & 3.076 & 2750 \\ \hline 16 & 14.718 & 13. & 12.561 & 11.652 & 10.8 & 10.106 & 9.447 & 8.851 & 8.312 & 7824 & 6974 & 6.265 & 5669 & 5.162 & 4.730 & 4.003 & 3503 & 3.088 & 2.758 \\ \hline 17 & 15.562 & 14.2 & 13.166 & 12.166 & 11.274 & 10.477 & 9.763 & 9.122 & 8.544 & 8.002 & 7.120 & 6.373 & 5.749 & 5.222 & 4.775 & 4059 & 3.518 & 3.097 & 2.763 \\ \hline 18 & 16.398 & 14992 & 13.754 & 12.659 & 11.690 & 10.828 & 10.059 & 9.372 & 8.756 & 8.201 & 7.250 & 6.467 & 5.818 & 5.273 & 4.812 & 4.060 & 3529 & 3.104 & 2767 \\ \hline 19 & & 15.678 & 14.324 & 13.134 & 12085 & 11.158 & 10.336 & 9.604 & 8.950 & 8.365 & 7.366 & 6550 & 5.877 & 5.316 & 4.844 & 4.097 & 3539 & 3.109 & 2770 \\ \hline 20 & 18.046 & 16.351 & 14.877 & 13590 & 12.462 & 11.470 & 10.594 & 9818 & 9.128 & 8.514 & 7.469 & 6.623 & 5929 & 5.353 & 4.870 & 4.110 & 3546 & 3.113 & 2.772 \\ \hline 25 & 22.023 & 19.523 & 17413 & 15.622 & 14.094 & 12.783 & 11.654 & 10.675 & 9823 & 9.077 & 7.843 & 5.873 & 6.097 & 5,467 & 4948 & 4.147 & 3.564 & 3.122 & 2.776 \\ \hline 30 & 25.8082 & 22.937 & 19.600 & 17.292 & 15.373 & 13.765 & 12.409 & 11.258 & 10.274 & 9.427 & 8.055 & 7.003 & 6.177 & 5.517 & 4.979 & 4.160 & 3.569 & 3,124 & 2.778 \\ \hline \end{tabular} Interest Factors for the Present Value of an Annuity of One Dollar \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline TimeReriod(cogs.year) & 18: & 25 & 3 & 4. & 5x & 6% & & x & 9% & 10% & 125. & & 16% & 12x & 20x & 245 & 20x & 324. & 35 \\ \hline 1 & 0.990 & 0980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.893 & 0.877 & 0.862 & 0.847 & 0.833 & 0.806 & 0.781 & 0.758 & 0.735 \\ \hline 2 & 1970 & 1.942 & 1913 & 1.886 & 1.859 & 1.833 & 1.808 & 1.783 & 1.759 & 1.736 & 1.690 & 1.647 & 1.605 & 1.566 & 1.528 & 1.457 & 1.392 & 5332 & 1.276 \\ \hline 3 & 2941 & 2.884 & 2.829 & 2775 & 2723 & 2.673 & 2.624 & 2577 & 2531 & 2.487 & 2402 & 2.322 & 2.246 & 2.174 & 2.106 & 1981 & 1.868 & 1.766 & 1.674 \\ \hline 4 & 3.902 & 3.808 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3240 & 3.170 & 3.037 & 2.914 & 2.798 & 2690 & 2589 & 2.404 & 2241 & 2096 & 1966 \\ \hline 5 & 4.853 & 4.713 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 & 3.791 & 3.605 & 3.433 & 3.274 & 3,127 & 2991 & 2.745 & 2.532 & 2.345 & 2.181 \\ \hline 6 & 5.795 & 5.601 & 5.417 & 5.242 & 5.076 & 4917 & 4.766 & 4.623 & 4.486 & 4.355 & 4.111 & 3.889 & 3.685 & 3,498 & 3326 & 3.020 & 2759 & 2534 & 2.399 \\ \hline 7 & 6.728 & 6.472 & 6.230 & 6.002 & 5.786 & 5.582 & 5.389 & 5.206 & 5.033 & 4.868 & 4564 & 4.288 & 4.039 & 3.812 & 3.605 & 3.242 & 2.937 & 2.678 & 2.455 \\ \hline 8 & 7.652 & 7.325 & 7020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.747 & 5.535 & 5.335 & 4.968 & 4.639 & 4. 344 & 4.078 & 3.837 & 3.421 & 3.076 & 2786 & 2540 \\ \hline 9 & 8.566 & 8.162 & 7.786 & 7.435 & 7.108 & 6.802 & 6.515 & 6.247 & 5.985 & 5.759 & 5328 & 4946 & 4.607 & 4303 & 4.031 & 3566 & 3.184 & 2.868 & 2.603 \\ \hline 10 & 9.471 & 8983 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 & 6.145 & 5.650 & 5.216 & 4.833 & 4.494 & 4.193 & 3.682 & 3.269 & 2930 & 2.650 \\ \hline 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7,499 & 7.139 & 6.805 & 6.495 & 5988 & 5.453 & 5.029 & 4.656 & 4.327 & 3.776 & 3.335 & 2978 & 2.683 \\ \hline 12 & 11.255 & 10.575 & 9954 & 9.385 & 8.863 & 8.384 & 7.943 & 7536 & 7.161 & 6.814 & 6.194 & 5.660 & 5.197 & 4793 & 4.439 & 3.851 & 3,387 & 3.013 & 2.708 \\ \hline 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.534 & 8.358 & 7904 & 7,487 & 7.103 & 6.424 & 5.842 & 5342 & 4910 & 4.533 & 3.912 & 3.427 & 3.040 & 2.727 \\ \hline 14 & 13.004 & 12.106 & 11.296 & 10.563 & 9.899 & 9.295 & 8.745 & 8.244 & 7.786 & 7.367 & 6.628 & 6.002 & 5.468 & 5.008 & 4.611 & 3962 & 3.459 & 3.061 & 2.740 \\ \hline 15 & 13865 & 12849 & 11.938 & 11.118 & 10.380 & 9.712 & 9.108 & 8559 & 8.060 & 7.606 & 6811 & 6,142 & 5.575 & 5.092 & 4.675 & 4.001 & 3.483 & 3.076 & 2750 \\ \hline 16 & 14.718 & 13. & 12.561 & 11.652 & 10.8 & 10.106 & 9.447 & 8.851 & 8.312 & 7824 & 6974 & 6.265 & 5669 & 5.162 & 4.730 & 4.003 & 3503 & 3.088 & 2.758 \\ \hline 17 & 15.562 & 14.2 & 13.166 & 12.166 & 11.274 & 10.477 & 9.763 & 9.122 & 8.544 & 8.002 & 7.120 & 6.373 & 5.749 & 5.222 & 4.775 & 4059 & 3.518 & 3.097 & 2.763 \\ \hline 18 & 16.398 & 14992 & 13.754 & 12.659 & 11.690 & 10.828 & 10.059 & 9.372 & 8.756 & 8.201 & 7.250 & 6.467 & 5.818 & 5.273 & 4.812 & 4.060 & 3529 & 3.104 & 2767 \\ \hline 19 & & 15.678 & 14.324 & 13.134 & 12085 & 11.158 & 10.336 & 9.604 & 8.950 & 8.365 & 7.366 & 6550 & 5.877 & 5.316 & 4.844 & 4.097 & 3539 & 3.109 & 2770 \\ \hline 20 & 18.046 & 16.351 & 14.877 & 13590 & 12.462 & 11.470 & 10.594 & 9818 & 9.128 & 8.514 & 7.469 & 6.623 & 5929 & 5.353 & 4.870 & 4.110 & 3546 & 3.113 & 2.772 \\ \hline 25 & 22.023 & 19.523 & 17413 & 15.622 & 14.094 & 12.783 & 11.654 & 10.675 & 9823 & 9.077 & 7.843 & 5.873 & 6.097 & 5,467 & 4948 & 4.147 & 3.564 & 3.122 & 2.776 \\ \hline 30 & 25.8082 & 22.937 & 19.600 & 17.292 & 15.373 & 13.765 & 12.409 & 11.258 & 10.274 & 9.427 & 8.055 & 7.003 & 6.177 & 5.517 & 4.979 & 4.160 & 3.569 & 3,124 & 2.778 \\ \hline \end{tabular} A firm must choose between two investment alternatives, each costing $105,000. The first alternative generates $35,000 a year for four years. The second pays one large lump sum of $154,600 at the end of the fourth year. If the firm can raise the required funds to make the investment at an annual cost of 9 percent, what are the present values of two investment alternatives? Use Appendix B and Appendix D to answer the question. Round your answers to the nearest dollar. PV(First alternative): \$ PV(Second alternative): $ Which alternative should be preferred? The aiternative should be preferred. Interest Factors for the Present Value of One Dollar \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline TrenePeriad(eg)(eas) & w & 25 & 3x & 43 & 5% & 5x & x & ex & 28 & 10% & 12 & 16% & 15% & & 18% & 20% & 24 & 28% \\ \hline 1 & 990 & 980 & 971 & 962 & 952 & 943 & 935 & 926 & 917 & 909 & 893 & .877 & 870 & 862 & 847 & 833 & 806 & 781 \\ \hline 2 & 980 & 961 & 943 & 925 & 907 & 890 & 873 & 857 & & & 797 & 769 & 756 & 743 & 718 & 694 & 650 & 610 \\ \hline 3 & 971 & 942 & 915 & 889 & 864 & 84 & 8 & 794 & m & 751 & 712 & 675 & 658 & .641 & 609 & 579 & 524 & A77 \\ \hline 4 & 961 & 924 & 889 & 855 & 823 & 792 & 763 & 735 & 708 & 683 & 636 & 592 & 5n & 552 & 516 & 482 & 423 & 373 \\ \hline 5 & 951 & 906 & & .822 & 784 & 747 & 713 & 681 & 650 & .621 & .567 & 519 & 497 & 476 & 437 & 402 & 341 & 291 \\ \hline 6 & 942 & 888 & 838 & .790 & .746 & 705 & 666 & 630 & 596 & 564 & 507 & 456 & 432 & 410 & 370 & 335 & 275 & 227 \\ \hline 7 & 933 & 87 & 813 & 76 & 7 & 6 & 623 & 5 & 547 & 5 & 452 & 400 & 375 & 354 & 314 & 279 & 222 & .178 \\ \hline 8 & 923 & 853 & 789 & 731 & 677 & .627 & .582 & 540 & 502 & 467 & 404 & 351 & 327 & 305 & 266 & 233 & 179 & .139 \\ \hline 9 & 914 & 837 & 766 & 703 & 645 & 592 & 544 & 50 & 460 & 47 & 361 & 308 & 284 & 263 & 226 & 194 & 144 & 108 \\ \hline 10 & 905 & 820 & 744 & .676 & 614 & 558 & 508 & 463 & 422 & 386 & 322 & 270 & 247 & .227 & 191 & .162 & .116 & 085 \\ \hline 11 & 896 & 804 & 722 & .650 & 585 & 527 & 475 & 42 & 388 & 350 & 287 & 237 & 215 & 195 & .162 & .135 & .094 & .066 \\ \hline 12 & 88 & 78 & 701 & 6 & 557 & 49 & 444 & 391 & .35 & 31 & 257 & 208 & .187 & 168 & 137 & 112 & 076 & .052 \\ \hline 13 & 879 & 773 & 681 & .601 & 530 & 469 & 41 & 368 & 326 & 290 & 229 & 182 & .163 & is & .116 & .093 & .061 & .040 \\ \hline 14 & 870 & 758 & 661 & 577 & 505 & 442 & 388 & 340 & 299 & 263 & 205 & 160 & 141 & 125 & .099 & .078 & 049 & .032 \\ \hline 15 & 861 & 743 & .642 & .555 & 481 & 417 & 362 & 315 & 275 & 239 & .183 & .140 & 123 & 108 & 084 & .065 & 040 & 025 \\ \hline 16 & BS & 728 & 623 & 534 & 45 & 39 & 339 & 29 & 25 & 21 & .16 & .12 & 107 & 09 & .071 & .054 & .032 & 019 \\ \hline & B4 & 71 & 60 & 5 & 43 & 371 & 317 & 270 & 231 & 198 & .146 & 108 & 093 & 080 & .060 & .045 & 026 & 015 \\ \hline 18 & 836 & 700 & 587 & 494 & 416 & 350 & 296 & 250 & 212 & 180 & .130 & .095 & OB1 & 069 & 051 & .038 & .021 & .012 \\ \hline 19 & 82 & 686 & 57 & 47 & 39 & 33 & 27 & 23 & 194 & 16 & .116 & 083 & .070 & .060 & .043 & 031 & 017 & 009 \\ \hline 20 & 820 & 673 & 554 & .456 & 37 & 312 & 258 & 215 & 178 & 149 & .104 & 073 & .061 & .051 & .037 & .026 & .014 & 007 \\ \hline 25 & 780 & .610 & 478 & 375 & 295 & 233 & .184 & 146 & 116 & .092 & .059 & .038 & .030 & .024 & .016 & 010 & .005 & 002 \\ \hline 30 & 742 & 552 & 412 & 308 & 231 & 174 & 131 & .099 & .075 & 057 & 033 & 020 & .015 & .012 & .007 & .004 & .002 & 001 \\ \hline \end{tabular} Interest Factors for the Present Value of One Dollar \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline TrenePeriad(eg)(eas) & w & 25 & 3x & 43 & 5% & 5x & x & ex & 28 & 10% & 12 & 16% & 15% & & 18% & 20% & 24 & 28% \\ \hline 1 & 990 & 980 & 971 & 962 & 952 & 943 & 935 & 926 & 917 & 909 & 893 & .877 & 870 & 862 & 847 & 833 & 806 & 781 \\ \hline 2 & 980 & 961 & 943 & 925 & 907 & 890 & 873 & 857 & & & 797 & 769 & 756 & 743 & 718 & 694 & 650 & 610 \\ \hline 3 & 971 & 942 & 915 & 889 & 864 & 84 & 8 & 794 & m & 751 & 712 & 675 & 658 & .641 & 609 & 579 & 524 & A77 \\ \hline 4 & 961 & 924 & 889 & 855 & 823 & 792 & 763 & 735 & 708 & 683 & 636 & 592 & 5n & 552 & 516 & 482 & 423 & 373 \\ \hline 5 & 951 & 906 & & .822 & 784 & 747 & 713 & 681 & 650 & .621 & .567 & 519 & 497 & 476 & 437 & 402 & 341 & 291 \\ \hline 6 & 942 & 888 & 838 & .790 & .746 & 705 & 666 & 630 & 596 & 564 & 507 & 456 & 432 & 410 & 370 & 335 & 275 & 227 \\ \hline 7 & 933 & 87 & 813 & 76 & 7 & 6 & 623 & 5 & 547 & 5 & 452 & 400 & 375 & 354 & 314 & 279 & 222 & .178 \\ \hline 8 & 923 & 853 & 789 & 731 & 677 & .627 & .582 & 540 & 502 & 467 & 404 & 351 & 327 & 305 & 266 & 233 & 179 & .139 \\ \hline 9 & 914 & 837 & 766 & 703 & 645 & 592 & 544 & 50 & 460 & 47 & 361 & 308 & 284 & 263 & 226 & 194 & 144 & 108 \\ \hline 10 & 905 & 820 & 744 & .676 & 614 & 558 & 508 & 463 & 422 & 386 & 322 & 270 & 247 & .227 & 191 & .162 & .116 & 085 \\ \hline 11 & 896 & 804 & 722 & .650 & 585 & 527 & 475 & 42 & 388 & 350 & 287 & 237 & 215 & 195 & .162 & .135 & .094 & .066 \\ \hline 12 & 88 & 78 & 701 & 6 & 557 & 49 & 444 & 391 & .35 & 31 & 257 & 208 & .187 & 168 & 137 & 112 & 076 & .052 \\ \hline 13 & 879 & 773 & 681 & .601 & 530 & 469 & 41 & 368 & 326 & 290 & 229 & 182 & .163 & is & .116 & .093 & .061 & .040 \\ \hline 14 & 870 & 758 & 661 & 577 & 505 & 442 & 388 & 340 & 299 & 263 & 205 & 160 & 141 & 125 & .099 & .078 & 049 & .032 \\ \hline 15 & 861 & 743 & .642 & .555 & 481 & 417 & 362 & 315 & 275 & 239 & .183 & .140 & 123 & 108 & 084 & .065 & 040 & 025 \\ \hline 16 & BS & 728 & 623 & 534 & 45 & 39 & 339 & 29 & 25 & 21 & .16 & .12 & 107 & 09 & .071 & .054 & .032 & 019 \\ \hline & B4 & 71 & 60 & 5 & 43 & 371 & 317 & 270 & 231 & 198 & .146 & 108 & 093 & 080 & .060 & .045 & 026 & 015 \\ \hline 18 & 836 & 700 & 587 & 494 & 416 & 350 & 296 & 250 & 212 & 180 & .130 & .095 & OB1 & 069 & 051 & .038 & .021 & .012 \\ \hline 19 & 82 & 686 & 57 & 47 & 39 & 33 & 27 & 23 & 194 & 16 & .116 & 083 & .070 & .060 & .043 & 031 & 017 & 009 \\ \hline 20 & 820 & 673 & 554 & .456 & 37 & 312 & 258 & 215 & 178 & 149 & .104 & 073 & .061 & .051 & .037 & .026 & .014 & 007 \\ \hline 25 & 780 & .610 & 478 & 375 & 295 & 233 & .184 & 146 & 116 & .092 & .059 & .038 & .030 & .024 & .016 & 010 & .005 & 002 \\ \hline 30 & 742 & 552 & 412 & 308 & 231 & 174 & 131 & .099 & .075 & 057 & 033 & 020 & .015 & .012 & .007 & .004 & .002 & 001 \\ \hline \end{tabular} Interest Factors for the Present Value of One Dollar \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline TrenePeriad(eg)(eas) & w & 25 & 3x & 43 & 5% & 5x & x & ex & 28 & 10% & 12 & 16% & 15% & & 18% & 20% & 24 & 28% \\ \hline 1 & 990 & 980 & 971 & 962 & 952 & 943 & 935 & 926 & 917 & 909 & 893 & .877 & 870 & 862 & 847 & 833 & 806 & 781 \\ \hline 2 & 980 & 961 & 943 & 925 & 907 & 890 & 873 & 857 & & & 797 & 769 & 756 & 743 & 718 & 694 & 650 & 610 \\ \hline 3 & 971 & 942 & 915 & 889 & 864 & 84 & 8 & 794 & m & 751 & 712 & 675 & 658 & .641 & 609 & 579 & 524 & A77 \\ \hline 4 & 961 & 924 & 889 & 855 & 823 & 792 & 763 & 735 & 708 & 683 & 636 & 592 & 5n & 552 & 516 & 482 & 423 & 373 \\ \hline 5 & 951 & 906 & & .822 & 784 & 747 & 713 & 681 & 650 & .621 & .567 & 519 & 497 & 476 & 437 & 402 & 341 & 291 \\ \hline 6 & 942 & 888 & 838 & .790 & .746 & 705 & 666 & 630 & 596 & 564 & 507 & 456 & 432 & 410 & 370 & 335 & 275 & 227 \\ \hline 7 & 933 & 87 & 813 & 76 & 7 & 6 & 623 & 5 & 547 & 5 & 452 & 400 & 375 & 354 & 314 & 279 & 222 & .178 \\ \hline 8 & 923 & 853 & 789 & 731 & 677 & .627 & .582 & 540 & 502 & 467 & 404 & 351 & 327 & 305 & 266 & 233 & 179 & .139 \\ \hline 9 & 914 & 837 & 766 & 703 & 645 & 592 & 544 & 50 & 460 & 47 & 361 & 308 & 284 & 263 & 226 & 194 & 144 & 108 \\ \hline 10 & 905 & 820 & 744 & .676 & 614 & 558 & 508 & 463 & 422 & 386 & 322 & 270 & 247 & .227 & 191 & .162 & .116 & 085 \\ \hline 11 & 896 & 804 & 722 & .650 & 585 & 527 & 475 & 42 & 388 & 350 & 287 & 237 & 215 & 195 & .162 & .135 & .094 & .066 \\ \hline 12 & 88 & 78 & 701 & 6 & 557 & 49 & 444 & 391 & .35 & 31 & 257 & 208 & .187 & 168 & 137 & 112 & 076 & .052 \\ \hline 13 & 879 & 773 & 681 & .601 & 530 & 469 & 41 & 368 & 326 & 290 & 229 & 182 & .163 & is & .116 & .093 & .061 & .040 \\ \hline 14 & 870 & 758 & 661 & 577 & 505 & 442 & 388 & 340 & 299 & 263 & 205 & 160 & 141 & 125 & .099 & .078 & 049 & .032 \\ \hline 15 & 861 & 743 & .642 & .555 & 481 & 417 & 362 & 315 & 275 & 239 & .183 & .140 & 123 & 108 & 084 & .065 & 040 & 025 \\ \hline 16 & BS & 728 & 623 & 534 & 45 & 39 & 339 & 29 & 25 & 21 & .16 & .12 & 107 & 09 & .071 & .054 & .032 & 019 \\ \hline & B4 & 71 & 60 & 5 & 43 & 371 & 317 & 270 & 231 & 198 & .146 & 108 & 093 & 080 & .060 & .045 & 026 & 015 \\ \hline 18 & 836 & 700 & 587 & 494 & 416 & 350 & 296 & 250 & 212 & 180 & .130 & .095 & OB1 & 069 & 051 & .038 & .021 & .012 \\ \hline 19 & 82 & 686 & 57 & 47 & 39 & 33 & 27 & 23 & 194 & 16 & .116 & 083 & .070 & .060 & .043 & 031 & 017 & 009 \\ \hline 20 & 820 & 673 & 554 & .456 & 37 & 312 & 258 & 215 & 178 & 149 & .104 & 073 & .061 & .051 & .037 & .026 & .014 & 007 \\ \hline 25 & 780 & .610 & 478 & 375 & 295 & 233 & .184 & 146 & 116 & .092 & .059 & .038 & .030 & .024 & .016 & 010 & .005 & 002 \\ \hline 30 & 742 & 552 & 412 & 308 & 231 & 174 & 131 & .099 & .075 & 057 & 033 & 020 & .015 & .012 & .007 & .004 & .002 & 001 \\ \hline \end{tabular} Interest Factors for the Present Valtue of an Annuitv of One Dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started