Appendix B:

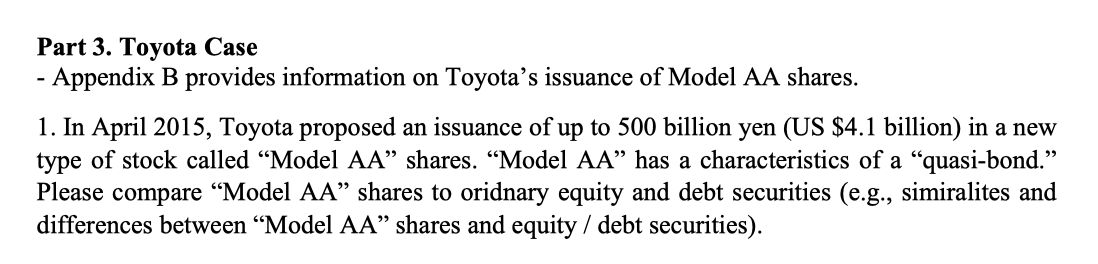

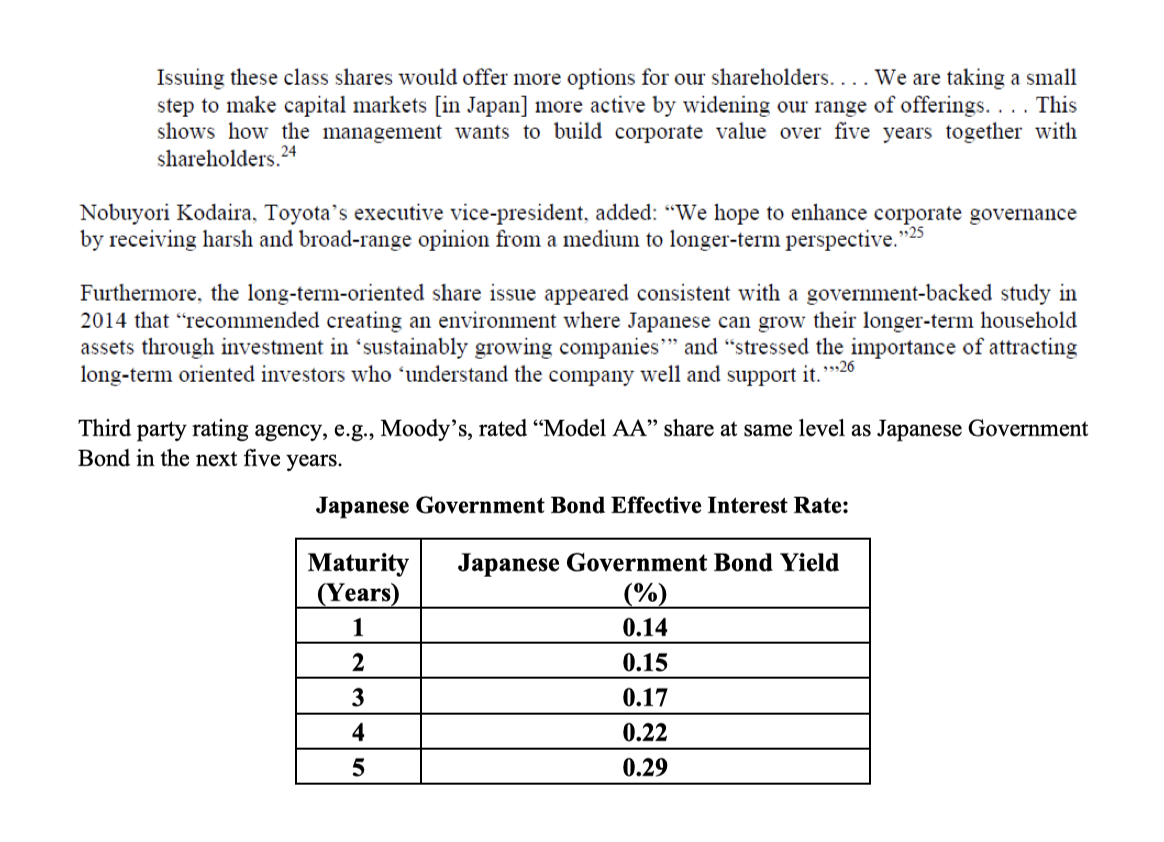

Part 3. Toyota Case - Appendix B provides information on Toyota's issuance of Model AA shares. 1. In April 2015, Toyota proposed an issuance of up to 500 billion yen (US $4.1 billion) in a new type of stock called Model AA shares. Model AA has a characteristics of a quasi-bond. Please compare Model AA shares to oridnary equity and debt securities (e.g., simiralites and differences between Model AA shares and equity / debt securities). APPENDIX B. TOYOTA'S "MODEL AA" SHARE ISSUE PROPOSAL Basics In April 2015, Toyota proposed an issue of up to 500 billion (US$4.1 billion)20 in a new type of stock called Model AA Class Shares (named after Toyota's first passenger car). Based on the Toyota Global Vision announced in March 2011, Toyota was committed to solidifying a foundation that supported the manufacturing of ever-better cars," further enhancing its competitiveness in manufacturing for sustainable growth, and simultaneously pursuing and creating cutting-edge innovative technologies. Through these efforts, Toyota undertook the challenge of the future for a better car society" by growing steadily, year by year, towards the realization of the Toyota Global Vision. As it pursued the manufacturing of ever-better cars, Toyota believed that it was imperative to pass on to the next generation its founding philosophy and spirit of manufacturing it inherited from its pioneers. It was necessary to make company-wide efforts in research and innovation, and to continue to produce cutting- edge technologies for society and the environment in order to achieve sustainable growth as well as to enhance its medium- to long-term corporate value. The automotive industry began from product planning and development and progressed through to manufacturing and sales, which required and operated on a long term business cycle. Moreover, as innovation in the industry progressed, it was essential to fully undertake research and development, as well as development of infrastructure, in order to achieve the next generation of innovations that would support the industry's future and Toyota's Global Vision. In order to conduct medium- to long-term research and development, Toyota announced the issuance of shares. These shares provided opportunities to invest and exercise shareholder rights with a medium-to long-term perspective, while matching the interests of business and shareholding cycles in order to balance funding more effectively These innovative shares would be unlisted and untradeable with a perpetual transfer restriction that assumed a medium- to long-term holding period. However, after five-years from issuance investors could convert them to tradable ordinary shares in principle, one common share would be delivered for each "Model AA" class share this formula was to be specified in the Issuance Resolution) or sell them back to Toyota at the issue price. Toyota's executives chose a five-year "lock-up" period to align the shareholding horizon with the horizon for the research projects that would be financed with the proceeds.21 The shares would have voting rights and would be offered under domestic offering format. Key consumers of this offering were supposed to be Japanese retail and institutional investors. This implied that foreign investors would be able to buy them only through intermediaries. Therefore, it seemed that "Model AA" shares were aimed at Japanese retail investors. Toyota's retail investors owned slightly more than 10 per cent of the company, but substantially less than the 20 per cent retail ownership that was typical of a Japanese company. In comparison, foreign institutions owned roughly 31 per cent of Toyota. 22 The shares would pay dividends that would be lower than ordinary dividends and steadily increasing every year. Specifically, the amount of annual dividends would be the product of the issue price and the following annual dividend rate: 0.5 per cent in 2016, 1 per cent in 2017, 1.5 per cent in 2018, 2 per cent in 2019, and 2.5 per cent in 2020.23 The "Model AA shares were proposed to be priced at a minimum of 120 per cent of the price of ordinary shares. In order to avoid dilution among common shares, Toyota planned to buy back up to 600 billion worth of stock Toyota believed that new technologies would require a massive investment over a number of years. In contrast, stock investors had increasingly become oriented to the short term. Investor short-termism conflicted with the long-term research emphasis and could potentially create investor instability. Hence, Toyota decided to match the long-term needs of its research and development to the investor horizons through the innovative share issue. Toyoda said that: Issuing these class shares would offer more options for our shareholders. ... We are taking a small step to make capital markets [in Japan] more active by widening our range of offerings. . . . This shows how the management wants to build corporate value over five years together with shareholders. 24 Nobuyori Kodaira, Toyota's executive vice-president, added: We hope to enhance corporate governance by receiving harsh and broad-range opinion from a medium to longer-term perspective. "325 Furthermore, the long-term-oriented share issue appeared consistent with a government-backed study in 2014 that recommended creating an environment where Japanese can grow their longer-term household assets through investment in 'sustainably growing companies and stressed the importance of attracting long-term oriented investors who understand the company well and support it. 26 Third party rating agency, e.g., Moody's, rated Model AA share at same level as Japanese Government Bond in the next five years. Japanese Government Bond Effective Interest Rate: Maturity (Years) 1 Japanese Government Bond Yield (%) 0.14 2 0.15 3 0.17 4 0.22 5 0.29