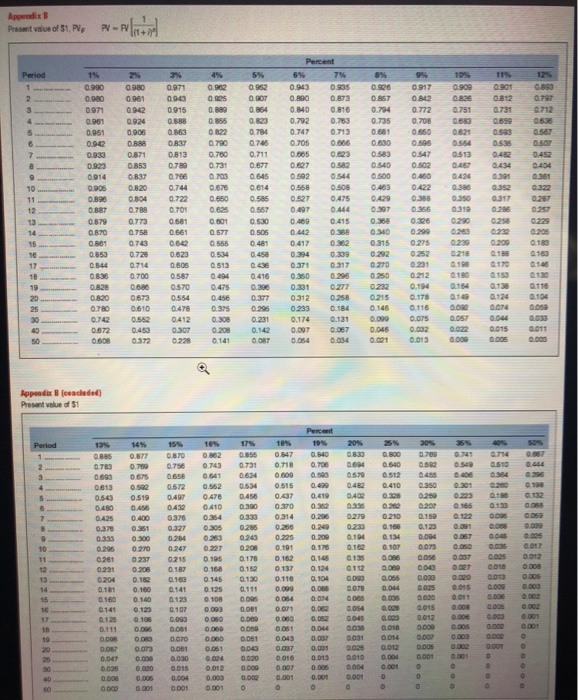

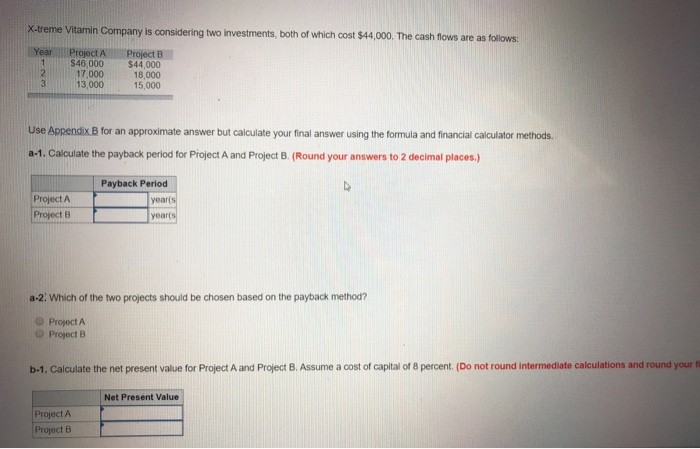

Appendix B Present value of S1, PV PV - vit +7 3 11% 0 0699 0.590 0.482 OSO 0.452 0.404 0.351 1% 0.990 0.980 0.971 0.961 0.951 0902 0.933 0.923 0.914 0.906 0.896 0.887 0.879 0.870 O 01 0.853 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 2% 0.980 0.961 0962 0.924 0.006 O 0871 0.853 0.37 0.8.20 0.804 0.788 0.773 0.758 0743 0.728 0.714 0.700 0.68 0673 0.610 0552 0.453 0.372 Percent 4 % 5% 6% 7% 0.971 0.92 0 9520.043 095 0043 0.05 0.97 0. 0.873 0.915 0.889 0.864 0840 0.816 0.88 0.855 0.823 0.792 0.783 0. 3 0.22 0.75 0.747 0.713 OB 0.790 0.75 0.705 0.006 0.813 0.700 0.711 0.005 0. 3 0.789 0.731 0.677 0.07 0.766 0.703 0.645 0.592 0544 0.744 0.678 0.614 0.558 0.508 0.722 0.650 0.585 0.527 0.475 0.701 0.025 0.567 0497 0.464 0.681 0 601 050 049 0.415 0.661 05770 505 0.2 0 050 0555 0.481 0.417 032 0623 0.5340.4530 394 009 0.605 0.513 0.45 0.371 0.317 0.587 0.64 0.416 0 .350 0.296 0.475 0.398 0.331 0.277 0.5540 456 0.377 0312 0.258 0.478 0.375 0.296 0.233 0.184 0.412 0308 0.231 0.174 0.131 0.307 0.20 0.142 0.097 0.228 0.141 087 0.054 0.034 0.391 0.352 0317 8% 9% 10% 096 0917 01909 0857 0.8420 826 0.794 0 .772 0 751 .735 0.708 0653 0681 0.650 0.621 06300505 0.564 0.583 0.547 0513 0. 0 0.502 0457 000 0.250 0.426 0.453 0422 0.388 0.429 0.388 0350 0.397 0.356 0.319 01 10 0290 0.20 0.299 0.263 0315 0275 0.229 0.22 0.252 0218 0270 0.23 0.10 0.250 0.212 180 0.232 0.194 0154 0215 0.178 0.10 0.146 0.000 0.075 QUOST 0.032 0.022 0787 0257 0229 0.205 183 0.163 0106 0.250 0.222 0.200 188 0.170 153 0.138 .124 0.014 10 0570 0 011 0.015 DOGS Appendiceacaded Present value of $1 50% 687 0.059 0.099 135 145 155 165 175 0.885 0.877 0.870 0.862 0856 0.855 0783 0.750 0.750 0.73 0.731 0.693 0675 0 658 0.64 0.624 0572 0.552 0.534 0. 53 0519 0.4970 .478 0.458 0480 046 0419 0 410 0. 30 0.425 0.4000376 0354 0.333 0.378 0.351 0.327 0.305 0.286 0.33 0.3000 .24 0.23 0.23 0.296 0270 0.247 0 227 0.20 0261 0237 0215 0.15 0.178 0231 0.205 0187 0168 0152 0.204 0.16 0.163 0145 0.130 0.181 0.16 0.141 0.125 0.111 0.16001400123 0108 009 0.141 0.123 0.107 0.003 0.001 0.125 0.106 0.093 0.00 0.00 0.11 0.005 0.06 0.00 0. 00 0.00 0.00 0. 00 0.00 0.051 0.057 0.073 0.061 0.051 0.043 0.047 0.008 0.030 0.024 0.020 0.026 . 00 0.015 0.012 0.000 0.008 0.005 0.004 0.003 0.002 0002 0.001000100010 18% 0.547 0.847 0.718 0.609 0.515 0.437 0.370 0.314 0.28 0.225 0.19 0.162 0137 0 116 0099 0064 0.07 0.00 0.05 0.043 0.037 .016 0.007 0.001 19% 20% 25% 30% 35% 40% 0940 0.540 0.833 GB00 0 709 0.741 0.706 06940.6400502 5 90151 0.53 0579 52 495 0.400. 42 0.410 3500 301 2 0.419 0.402 0 308 0.362 0.33 0.20 0.20 0.165 0.133 0.296 0279 0.2100.1500 122 0.249 0233 0.18 0.123 0.200 0.14 0.14 0.04 0.057 0.0 0.17 0.162 0.107 0073 0.148 135 0.066 0.056 0.037 0.1240112 0.0000043 0.104 0 .003 0.055 0.033 0.020 0.058 0.078 0.044 0.025 0.01$ 0.00 0.074 0.005 0.005 0.020 011 000E 0.02 0.054 0.008 0.015 0.02 0.045 0.003 0012 0.000 0.003 0.044 0.038 0 018 0.000 0.00 0.000 0.037 0031 0.014 0.00 0.00 0.002 0.001 0.025 0.012 0005 0.02 0.013 0.010 0004 0.001 0.001 0.005 0004 0.001 0 0 0.001 0.001 0 0.00 0.000 0.002 0 X-treme Vitamin Company is considering two investments, both of which cost $44,000. The cash flows are as follows: Project S46,000 17.000 13,000 Project B $44,000 18.000 15,000 Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a-1. Calculate the payback period for Project A and Project B. (Round your answers to 2 decimal places.) Payback Period years Project A Project B years a-2. Which of the two projects should be chosen based on the payback method? Project A Project B 5.1. Calculate the net present value for Project A and Project B. Assume a cost of capital of 8 percent. (Do not round intermediate calculations and round your Net Present Value Project A Project B b-2. Which of the two projects should be chosen based on the net present value method? e. Project B Project A C. Should a firm normally have more confidence in the payback method or the net present value method? Net present value method Payback method Appendix B Present value of S1, PV PV - vit +7 3 11% 0 0699 0.590 0.482 OSO 0.452 0.404 0.351 1% 0.990 0.980 0.971 0.961 0.951 0902 0.933 0.923 0.914 0.906 0.896 0.887 0.879 0.870 O 01 0.853 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 2% 0.980 0.961 0962 0.924 0.006 O 0871 0.853 0.37 0.8.20 0.804 0.788 0.773 0.758 0743 0.728 0.714 0.700 0.68 0673 0.610 0552 0.453 0.372 Percent 4 % 5% 6% 7% 0.971 0.92 0 9520.043 095 0043 0.05 0.97 0. 0.873 0.915 0.889 0.864 0840 0.816 0.88 0.855 0.823 0.792 0.783 0. 3 0.22 0.75 0.747 0.713 OB 0.790 0.75 0.705 0.006 0.813 0.700 0.711 0.005 0. 3 0.789 0.731 0.677 0.07 0.766 0.703 0.645 0.592 0544 0.744 0.678 0.614 0.558 0.508 0.722 0.650 0.585 0.527 0.475 0.701 0.025 0.567 0497 0.464 0.681 0 601 050 049 0.415 0.661 05770 505 0.2 0 050 0555 0.481 0.417 032 0623 0.5340.4530 394 009 0.605 0.513 0.45 0.371 0.317 0.587 0.64 0.416 0 .350 0.296 0.475 0.398 0.331 0.277 0.5540 456 0.377 0312 0.258 0.478 0.375 0.296 0.233 0.184 0.412 0308 0.231 0.174 0.131 0.307 0.20 0.142 0.097 0.228 0.141 087 0.054 0.034 0.391 0.352 0317 8% 9% 10% 096 0917 01909 0857 0.8420 826 0.794 0 .772 0 751 .735 0.708 0653 0681 0.650 0.621 06300505 0.564 0.583 0.547 0513 0. 0 0.502 0457 000 0.250 0.426 0.453 0422 0.388 0.429 0.388 0350 0.397 0.356 0.319 01 10 0290 0.20 0.299 0.263 0315 0275 0.229 0.22 0.252 0218 0270 0.23 0.10 0.250 0.212 180 0.232 0.194 0154 0215 0.178 0.10 0.146 0.000 0.075 QUOST 0.032 0.022 0787 0257 0229 0.205 183 0.163 0106 0.250 0.222 0.200 188 0.170 153 0.138 .124 0.014 10 0570 0 011 0.015 DOGS Appendiceacaded Present value of $1 50% 687 0.059 0.099 135 145 155 165 175 0.885 0.877 0.870 0.862 0856 0.855 0783 0.750 0.750 0.73 0.731 0.693 0675 0 658 0.64 0.624 0572 0.552 0.534 0. 53 0519 0.4970 .478 0.458 0480 046 0419 0 410 0. 30 0.425 0.4000376 0354 0.333 0.378 0.351 0.327 0.305 0.286 0.33 0.3000 .24 0.23 0.23 0.296 0270 0.247 0 227 0.20 0261 0237 0215 0.15 0.178 0231 0.205 0187 0168 0152 0.204 0.16 0.163 0145 0.130 0.181 0.16 0.141 0.125 0.111 0.16001400123 0108 009 0.141 0.123 0.107 0.003 0.001 0.125 0.106 0.093 0.00 0.00 0.11 0.005 0.06 0.00 0. 00 0.00 0.00 0. 00 0.00 0.051 0.057 0.073 0.061 0.051 0.043 0.047 0.008 0.030 0.024 0.020 0.026 . 00 0.015 0.012 0.000 0.008 0.005 0.004 0.003 0.002 0002 0.001000100010 18% 0.547 0.847 0.718 0.609 0.515 0.437 0.370 0.314 0.28 0.225 0.19 0.162 0137 0 116 0099 0064 0.07 0.00 0.05 0.043 0.037 .016 0.007 0.001 19% 20% 25% 30% 35% 40% 0940 0.540 0.833 GB00 0 709 0.741 0.706 06940.6400502 5 90151 0.53 0579 52 495 0.400. 42 0.410 3500 301 2 0.419 0.402 0 308 0.362 0.33 0.20 0.20 0.165 0.133 0.296 0279 0.2100.1500 122 0.249 0233 0.18 0.123 0.200 0.14 0.14 0.04 0.057 0.0 0.17 0.162 0.107 0073 0.148 135 0.066 0.056 0.037 0.1240112 0.0000043 0.104 0 .003 0.055 0.033 0.020 0.058 0.078 0.044 0.025 0.01$ 0.00 0.074 0.005 0.005 0.020 011 000E 0.02 0.054 0.008 0.015 0.02 0.045 0.003 0012 0.000 0.003 0.044 0.038 0 018 0.000 0.00 0.000 0.037 0031 0.014 0.00 0.00 0.002 0.001 0.025 0.012 0005 0.02 0.013 0.010 0004 0.001 0.001 0.005 0004 0.001 0 0 0.001 0.001 0 0.00 0.000 0.002 0 X-treme Vitamin Company is considering two investments, both of which cost $44,000. The cash flows are as follows: Project S46,000 17.000 13,000 Project B $44,000 18.000 15,000 Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a-1. Calculate the payback period for Project A and Project B. (Round your answers to 2 decimal places.) Payback Period years Project A Project B years a-2. Which of the two projects should be chosen based on the payback method? Project A Project B 5.1. Calculate the net present value for Project A and Project B. Assume a cost of capital of 8 percent. (Do not round intermediate calculations and round your Net Present Value Project A Project B b-2. Which of the two projects should be chosen based on the net present value method? e. Project B Project A C. Should a firm normally have more confidence in the payback method or the net present value method? Net present value method Payback method