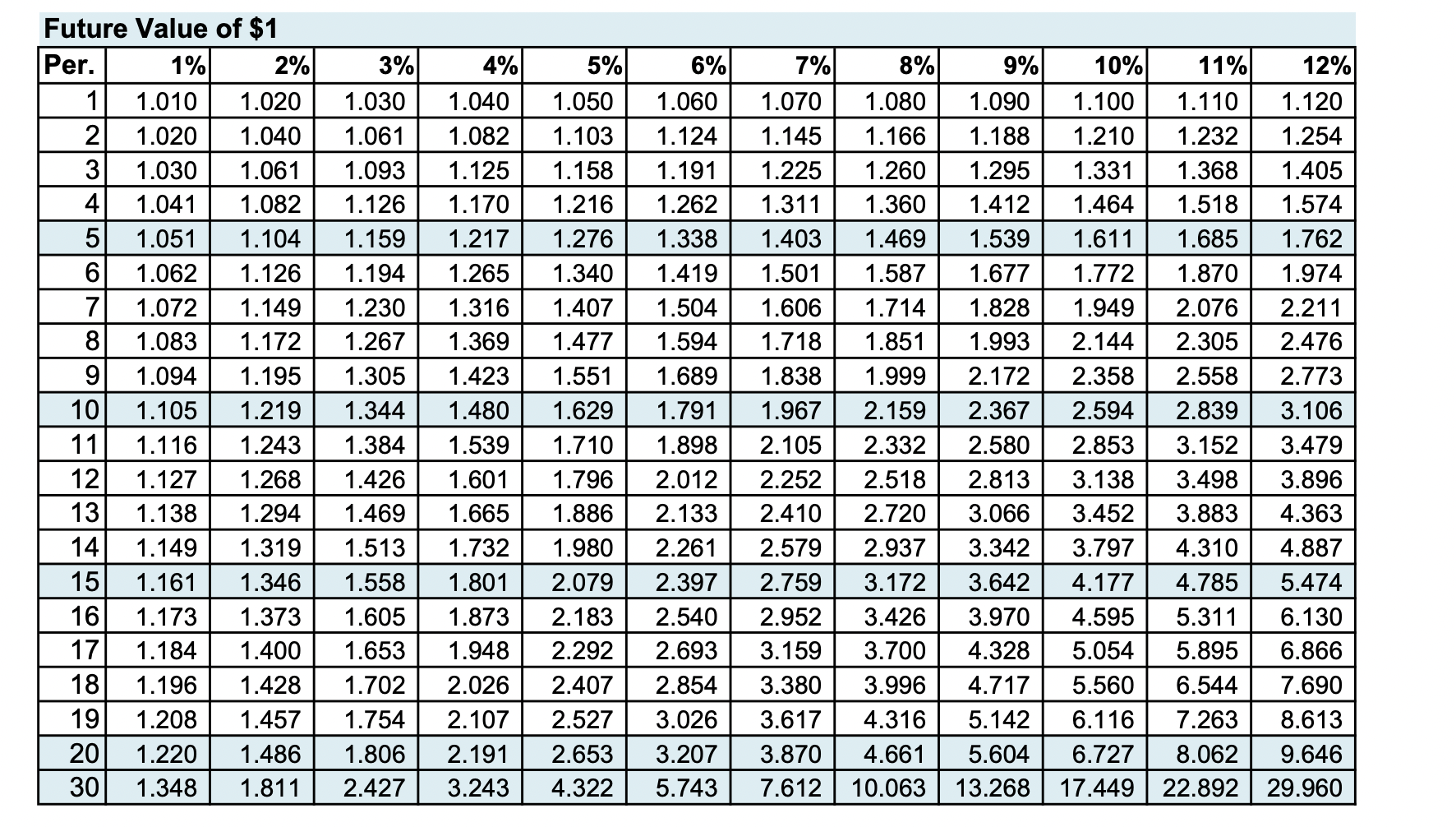

Appendix G Worksheet: Online Use Future Value and Present Value Tables 1. Cathy Lumbattis inherited $140,000 from an aunt. If Cathy decides not to spend her inheritance but to leave the money in her saving account until she retires in 15 years, how much money will she have, assuming an annual interest rate of 8% compounded semiannually. 2. LuAnn Bean will receive $7,000 in 7 years. What is the present value at 7% compounded annually? 3. A bank is willing to lend money at 6% interest, compounded annually. How much would the bank be willing to loan you in exchange for a payment of $600 4 years from now? 4. Ed Walker wants to save some money so that he can make a down payment of $3,000 on a car when he graduates from college in 4 years. If Ed opens a savings account and earns 3% on his money, compounded annually, how much will he have to invest now?

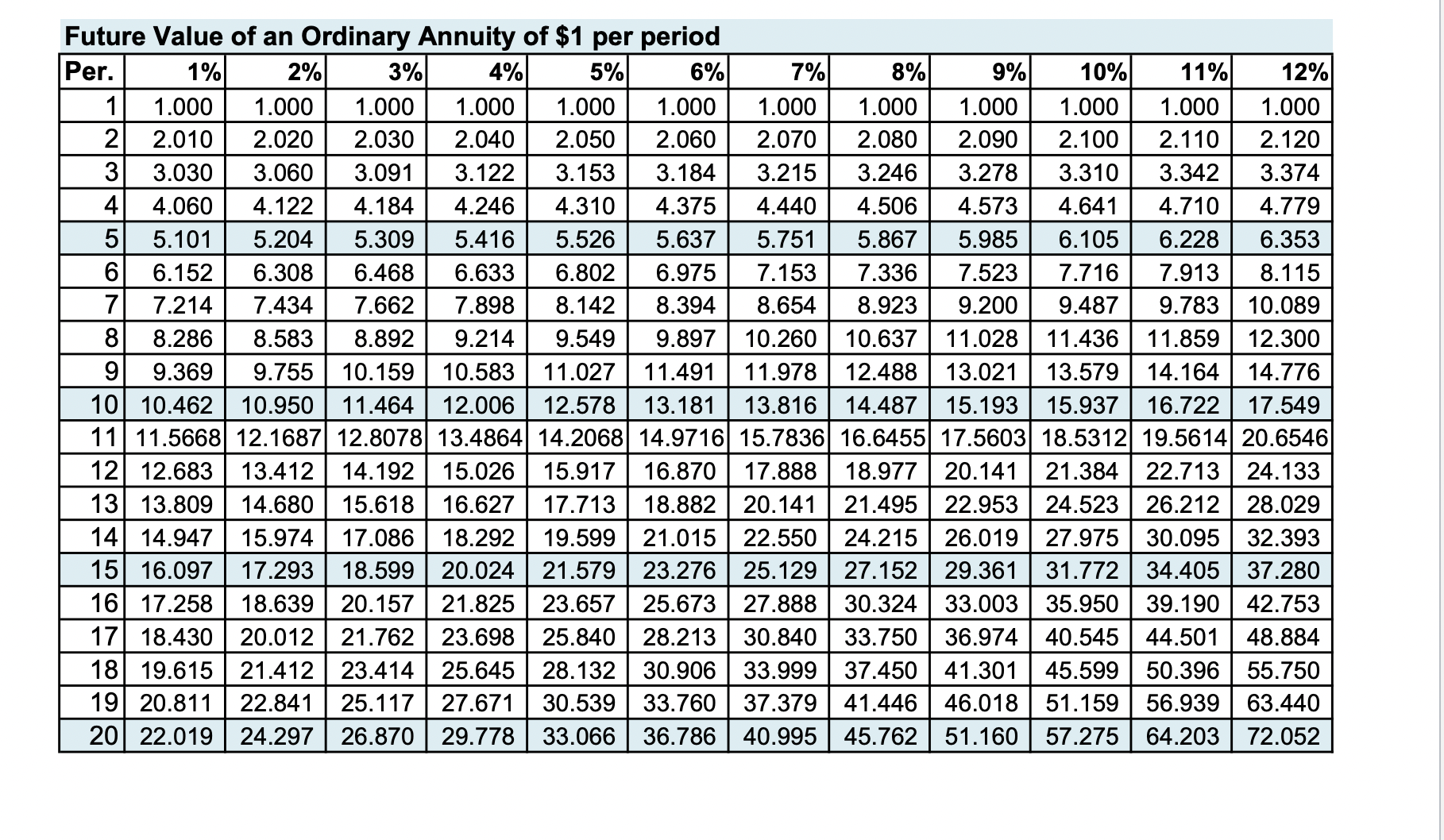

2 5. Kristen Quinn makes equal deposits of $500 semiannually for 4 years. What is the future value at 8%? 6. Chuck Russo, a high school math teacher, wants to set up an IRA account into which he will deposit $2,000 per year. He plans to teach for 20 more years and then retire. If the interest on his account is 7% compounded annually, how much will be in his account when he retires? 7. Larson Lumber makes annual deposits of $500 at 6% compounded annually for 3 years. What is the future value of these deposits? 8. Michelle McFeaters can earn 6%. How much would have to be deposited in a savings account in order for Michelle to be able to make equal annual withdrawals of $200 at the end of each of 10 years? The balance at the end of the last year would be zero. 9. Barb Muller wins the lottery. She wins $20,000 per year to be paid for 10 years. The state offers her the choice of a cash settlement now instead of the annual payments for 10 years. If the interest rate is 6%, what is the amount the state will offer for a settlement today?

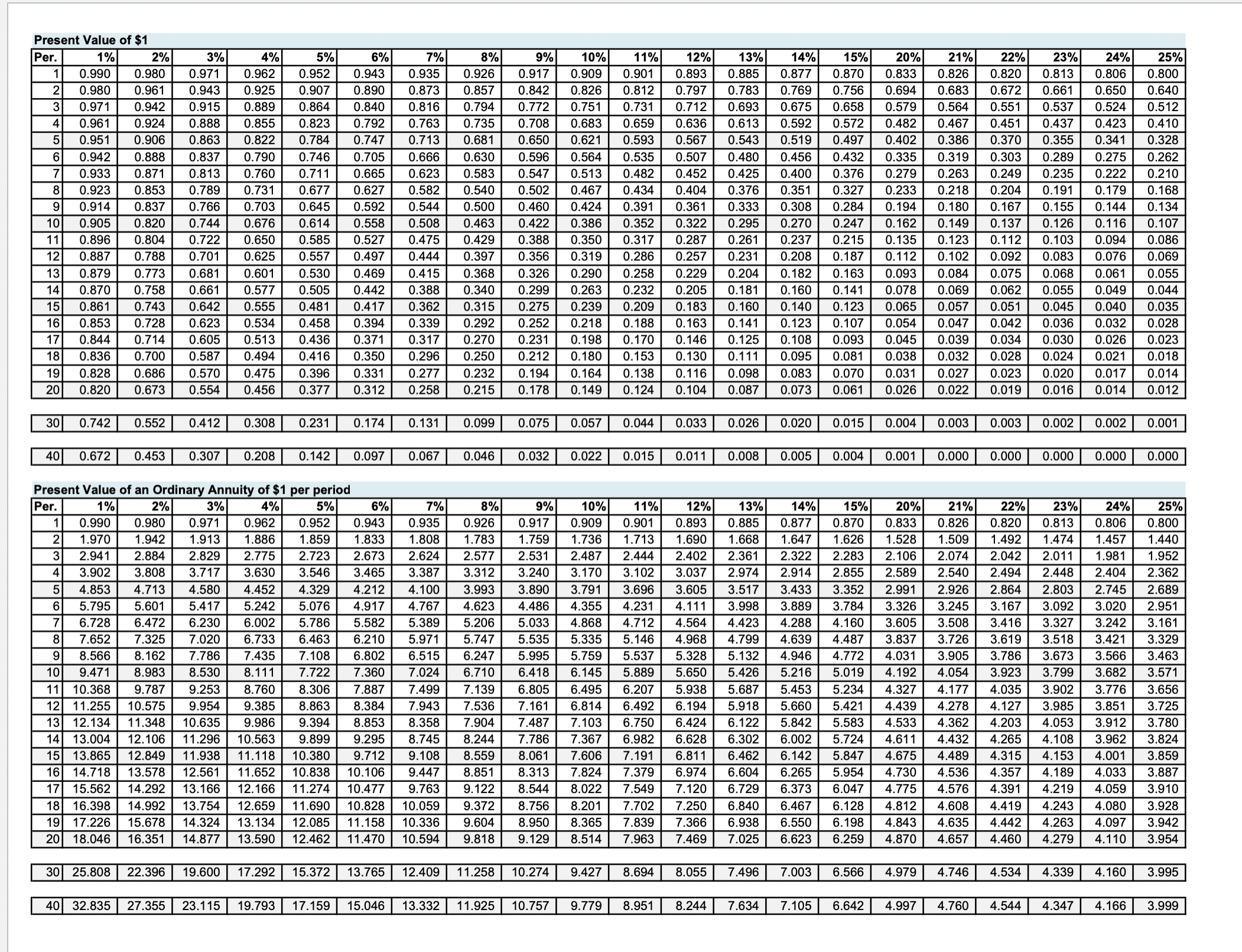

Present Value of $1 Per. 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 1 0.990 0.980 0.971 15% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.980 0.826 0.961 0.943 0.925 0.907 0.890 0.873 0.820 0.813 0.806 0.800 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.694 0.683 0.672 0.971 0.942 0.661 0.650 0.640 0.915 0.889 0.864 0.840 0.816 0.855 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.579 0.564 0.551 0.537 0.524 0.512 4 0.961 0.924 0.888 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.951 0.906 0.451 5 0.863 0.822 0.482 0.467 0.437 0.784 0.747 0.423 0.410 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.402 0.386 0.370 6 0.355 0.341 0.328 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 7 0.933 0.871 0.813 0.480 0.456 0.432 0.335 0.319 0.303 0.289 0.275 0.262 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 8 0.923 0.853 0.789 0.452 0.425 0.400 0.376 0.279 0.263 0.249 0.235 0.222 0.210 0.731 0.677 0.582 0.540 0.502 0.467 0.404 0.376 0.351 0.327 9 0.233 0.218 0.204 0.191 0.179 0.914 0.837 0.766 0.703 0.645 0.592 0.168 0.544 0.500 0.460 0.424 0.391 0.361 10 0.333 0.308 0.284 0.905 0.820 0.744 0.676 0.614 0.558 0.194 0.180 0.167 0.155 0.144 0.134 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.162 11 0.896 0.804 0.722 0.149 0.137 0.650 0.585 0.527 0.126 0.116 0.107 0.475 0.429 0.388 0.350 0.317 0 0.287 0.261 12 0.237 0.215 0.135 0.123 0.887 0.112 0.103 0.094 0.086 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 13 0.208 0.187 0.112 0.879 0.773 0.681 0.601 0.530 0.469 0.102 0.092 0.083 0.076 0.069 0.415 0.368 14 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.093 0.084 0.075 0.068 0.061 0.055 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 15 0.160 0.141 0.078 0.069 0.861 0.743 0.062 0.055 0.049 0.044 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0. 160 0.140 0.123 16 0.853 0.728 0.065 0.057 0.623 0.051 0.045 0.040 0.035 0.534 0.458 0.394 0. 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.844 0.714 0.054 0.047 0.042 0.036 0.032 0.028 0.605 0.513 0.436 0.371 0.317 0.270 18 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.045 0.039 0.836 0.700 0.587 0.034 0.030 0.026 0.023 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 19 0.038 0.828 0.686 0.570 0.475 0.032 0.028 0.024 0.021 0.018 0.396 0.331 0.277 0.232 0. 194 0.164 0.138 0.116 0.098 0.083 0.070 0.031 0.027 0.023 0.020 0.017 0.014 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0. 124 0.104 0.087 0.073 0.061 0.026 0.022 0.019 0.016 0.014 0.012 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 0.004 0.003 0.003 0.002 0.002 0.001 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0. 0.015 0.011 0.008 0.005 0.004 0.001 0.000 0.000 0.000 0.000 0.000 Present Value of an Ordinary Annuity of $1 per period Per. 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 20%1 21% 22% 1 0.990 0.980 23% 24% 0.971 0.962 0 25% 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.833 0.826 0.820 0.813 0.806 0.800 2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 3 2.941 2.884 1.668 1.647 1.626 2.829 1.528 1.509 2.775 1.492 1.474 1.457 2.723 1.440 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 4 3.902 3.808 2.106 2.074 2.042 2.011 3.717 3.630 3.546 1.981 1.952 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.589 2.540 2.494 2.448 2.404 2.362 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.433 2.991 6 5.795 5.601 5.417 3.352 2.926 2.864 5.242 5.076 4.917 2.803 2.745 2.689 4.767 4.623 4.486 4.355 4.231 4. 111 3.998 3.889 3.784 7 3.326 3.245 3. 167 3.092 6.728 6.472 6.230 6.002 3.020 2.951 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4 4.564 4.423 4.288 4.160 3.605 8 7.652 7.325 7.020 6.733 3.508 3.416 3.327 3.242 3.161 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 9 4.639 4.487 8.566 3.837 8.162 7.786 3.726 3.619 3.518 3.421 3.329 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 10 9.471 8.983 4.031 3.905 8.530 8.111 3.786 3.673 3.566 3.463 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 11 10.368 9.787 4.192 4.054 3.923 3.799 3.682 3.571 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 12 11.255 10.575 9.954 4.327 4.177 4.035 3.902 9.385 8.863 8.384 7.943 3.776 3.656 7.536 7.161 6.814 6.492 6 6.194 5.918 5.660 5.421 13 12.134 11.348 10.635 9.986 4.439 4.278 4.127 3.985 3.851 3.725 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5.842 5.583 4.533 14 13.004 12.106 11.296 10.563 4.362 4.203 4.053 9.899 9.295 8.745 3.912 3.780 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 4.611 4.432 15 13.865 12.849 11.938 11.118 10.380 9.712 4.265 4.108 3.962 3.824 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 4.675 4.489 16 14.718 13.578 12.561 11.652 10.838 10.106 4.315 4.153 4.001 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 4.730 4.536 4.357 4.189 4.033 3.887 9.122 8.544 8.022 7.549 7.120 6.729 6 6.373 6.047 4.775 4.576 4.391 4.219 4.059 3.910 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 4.812 4.608 4.419 4.243 4.080 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 4.843 4.635 4.442 4.263 4.097 3.942 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 7.025 6.623 6.259 4.870 4.657 4.460 4.279 4.110 3.954 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 4.979 4.746 4.534 4.339 4.160 3.995 40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 7.634 7.105 6.642 4.997 4.760 4.544 4.347 4.166 3.999\fFuture Value of an Ordinary Annuity of $1 per period 2% 3/ 6% 7% 8% 1.000 1.000 1.000 1.000 1.000 2.020 2.030 2.060 2.070 2.080 3.060 3.091 3.184 3.215 3.246 4.122 4.184 4.375 4.440 4.506 5.204 5.309 5.637 5.751 5.867 6.308 6.468 6.975 7.153 7.336 7.434 7.662 8.394 8.654 8.923 8.583 8.892 9.897 10.260 10.637 9.755 10.159 11.491 11.978 12.488 10.950 11.464 13.181 13.816 14.487 15.193 12.1687 12.8078 14.971 15.7836 16.6455 17.5603 13.412 14.192 16.87 17.888 18.977 20.141 14.680 15.618 18.882 20.141 21.495 22.953 15.974 17.086 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 32.393 1 16.097 17.293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 37.280 16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 42.753 17 18.430 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 48.884 1 19.615 21.412 23.414 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 55.750 1 20.811 22.841 25.117 27.671 30.539 33.760 37.379 41.446 46.018 51.159 56.939 63.440 20 22.019 24.297 26.870 29.778 33.066 36.786 40.995 45.762 51.160 57.275 64.203 72.052 9% 1.000 2.090 3.278 4.573 5.985 7.523 9.200 1 1.028 13.021 10% 11% 1.000 1.000 2.100 2.110 3.310 3.342 4.641 4.710 6.105 6.228 7.716 7.913 9.487 9.783 11.436 11.859 13.579 14.164 15.937 16.722 18.5312 19.5614 21.384 22.713 24.523 26.212 12% 1.000 2.120 3.374 4.779 6.353 8.1 15 10.089 12.300 14.776 17.549 20.6546 24.133 28.029 0 h b" o\\ _\\ 1.000 2.010 3.030 4.060 5.101 6.152 7.214 8.286 9.369 10.462 11.5668 12.683 13.809 14.947 1.000 2.040 3.122 4.246 5.416 6.633 7.898 9.214 10.583 12.006 13.4864 15.026 16.627 1.000 2.050 3.153 4.310 5.526 6.802 8.142 9.549 11.027 12.578 14.2068 15.917 17.713 1 _\\. 1 A 4; IRE! - .3 .3 m - - - U1 ax"