Answered step by step

Verified Expert Solution

Question

1 Approved Answer

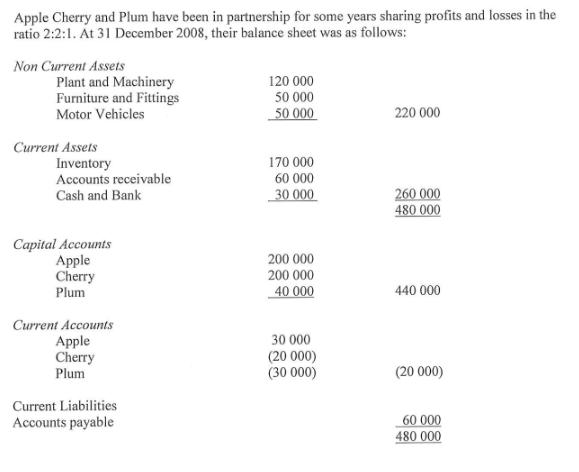

Apple Cherry and Plum have been in partnership for some years sharing profits and losses in the ratio 2:2:1. At 31 December 2008, their

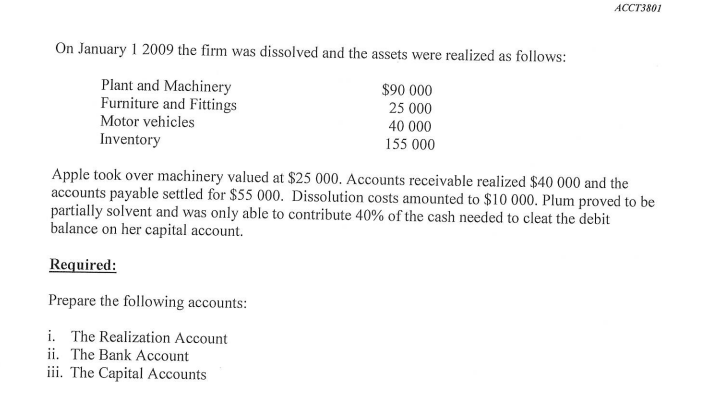

Apple Cherry and Plum have been in partnership for some years sharing profits and losses in the ratio 2:2:1. At 31 December 2008, their balance sheet was as follows: Non Current Assets Plant and Machinery 120 000 Furniture and Fittings 50 000 Motor Vehicles 50 000 220 000 Current Assets Inventory 170 000 Accounts receivable 60 000 Cash and Bank 30 000 260 000 480.000 Capital Accounts Apple Cherry 200 000 200 000 Plum 40 000 440 000 Current Accounts Apple 30 000 Cherry Plum (20 000) (30 000) (20 000) Current Liabilities Accounts payable 60 000 480 000 On January 1 2009 the firm was dissolved and the assets were realized as follows: Plant and Machinery Furniture and Fittings Motor vehicles Inventory $90.000 25 000 40 000 155 000 ACCT3801 Apple took over machinery valued at $25 000. Accounts receivable realized $40 000 and the accounts payable settled for $55 000. Dissolution costs amounted to $10 000. Plum proved to be partially solvent and was only able to contribute 40% of the cash needed to cleat the debit balance on her capital account. Required: Prepare the following accounts: i. The Realization Account ii. The Bank Account iii. The Capital Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started