Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apple Inc designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories and provides a variety of related services such as an App

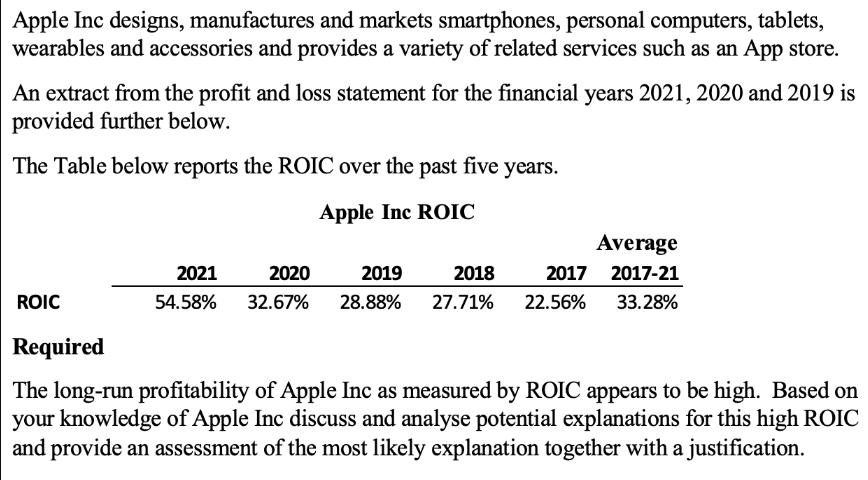

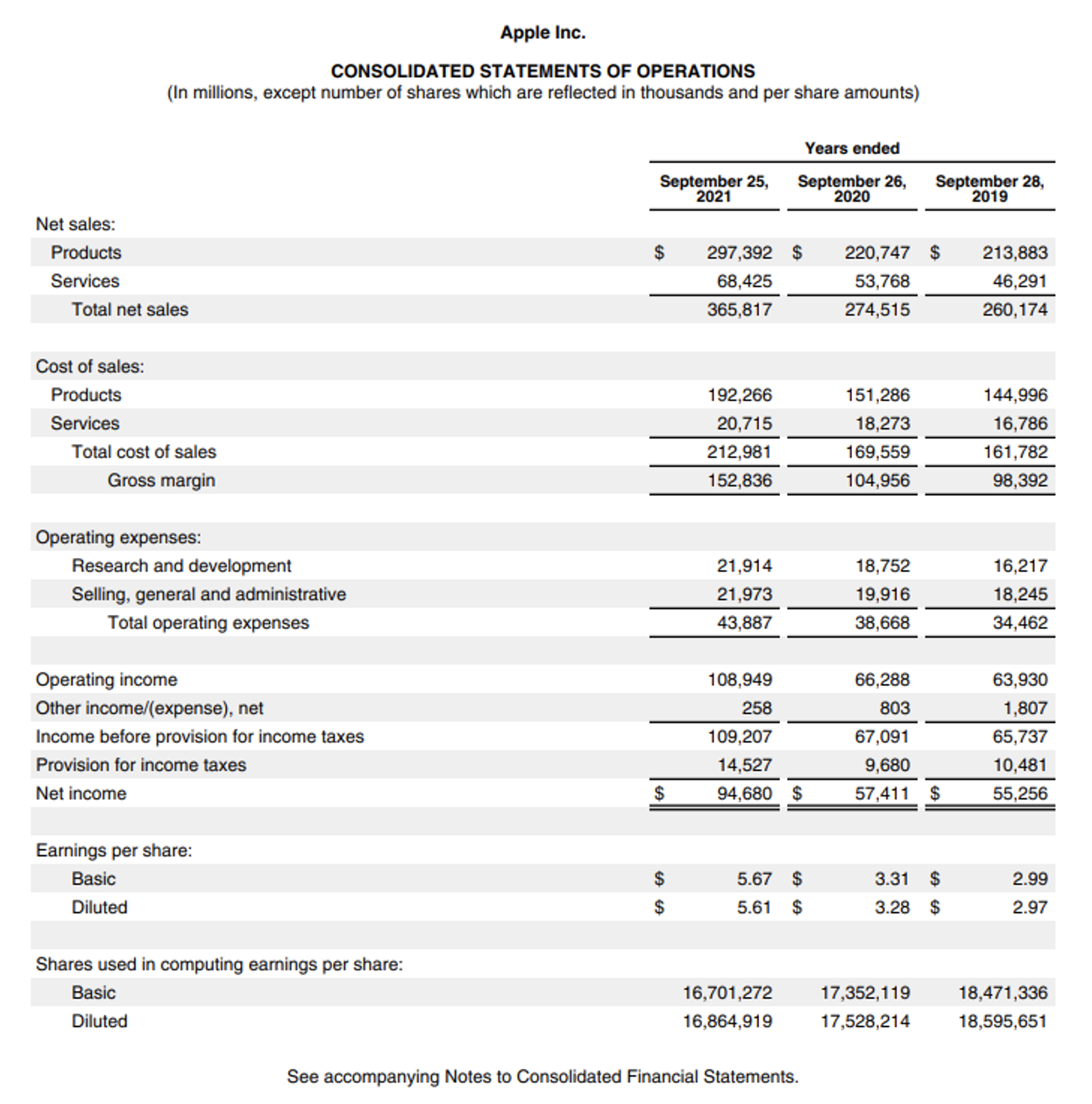

Apple Inc designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories and provides a variety of related services such as an App store. An extract from the profit and loss statement for the financial years 2021, 2020 and 2019 is provided further below. The Table below reports the ROIC over the past five years. Apple Inc ROIC Average ROIC 2021 54.58% 2020 32.67% 2019 28.88% 27.71% 2018 22.56% 2017 2017-21 33.28% Required The long-run profitability of Apple Inc as measured by ROIC appears to be high. Based on your knowledge of Apple Inc discuss and analyse potential explanations for this high ROIC and provide an assessment of the most likely explanation together with a justification. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Net sales: Products Services Total net sales Cost of sales: Products Services Total cost of sales Gross margin Operating expenses: Years ended September 25, 2021 September 26, 2020 September 28, 2019 $ 297,392 $ 68,425 365,817 220,747 $ 213,883 53,768 46,291 274,515 260,174 192,266 151,286 144,996 20,715 18,273 16,786 212,981 169,559 161,782 152,836 104,956 98,392 Research and development 21,914 18,752 16,217 Selling, general and administrative 21,973 19,916 18,245 Total operating expenses 43,887 38,668 34,462 Operating income 108,949 66,288 63,930 Other income/(expense), net 258 803 1,807 Income before provision for income taxes 109,207 67,091 65,737 Provision for income taxes 14,527 9,680 10,481 Net income $ 94,680 $ 57,411 $ 55,256 Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted 6969 $ 5.67 $ $ 5.61 $ 3.31 $ 3.28 $ 2.99 2.97 16,701,272 16,864,919 17,352,119 17,528,214 18,471,336 18,595,651 See accompanying Notes to Consolidated Financial Statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started