Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apple Inc. is contemplating the acquisition of Blackberry Ltd. Information for the two companies is given in the table below. Blackberry has many patents that

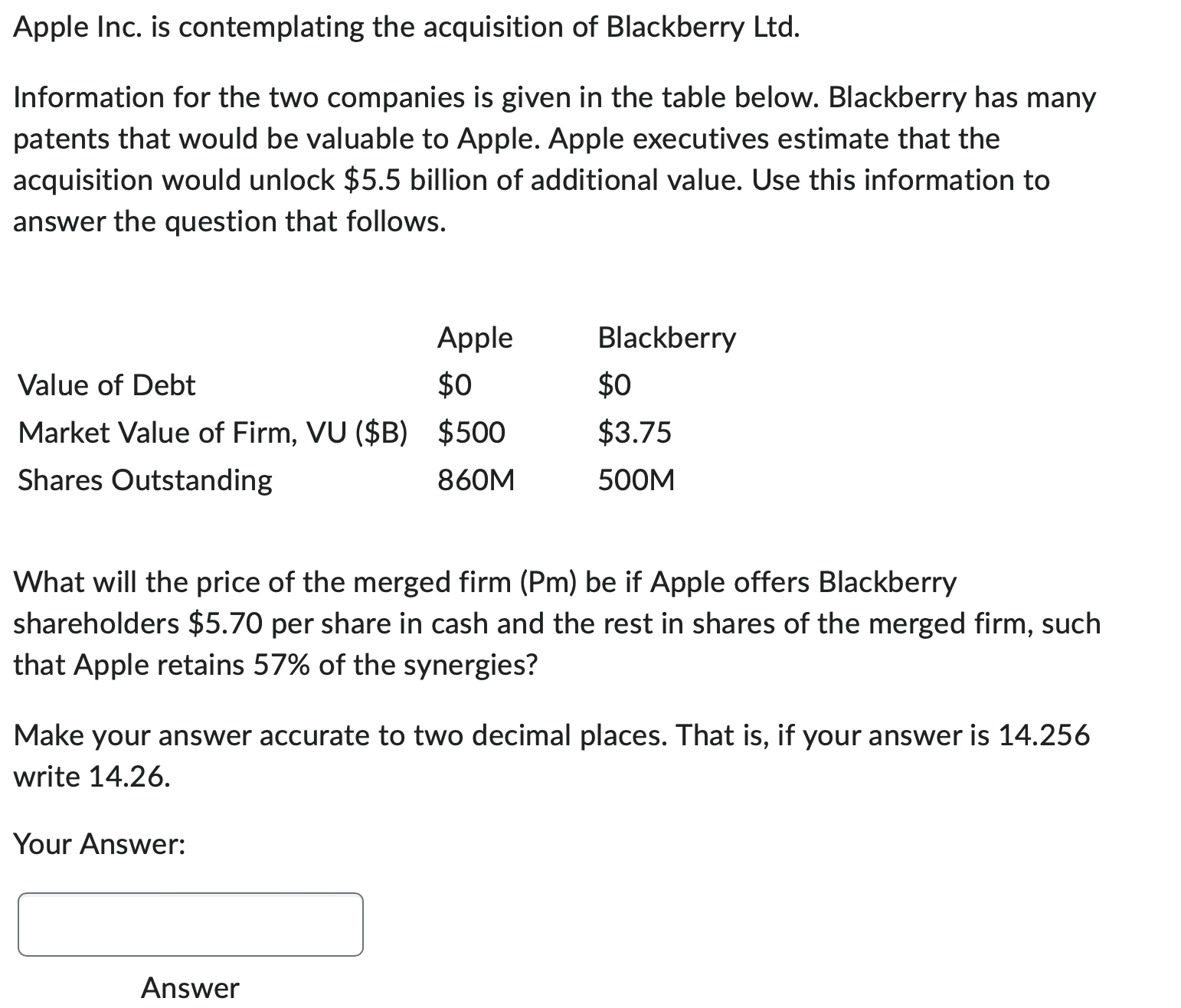

Apple Inc. is contemplating the acquisition of Blackberry Ltd. Information for the two companies is given in the table below. Blackberry has many patents that would be valuable to Apple. Apple executives estimate that the acquisition would unlock $5.5 bilion of additional value. Use this information to answer the question that follows. What will the price of the merged firm (Pm) be if Apple offers Blackberry shareholders $5.70 per share in cash and the rest in shares of the merged firm, such that Apple retains 57% of the synergies? Make your answer accurate to two decimal places. That is, if your answer is 14.256 write 14.26. Your Answer: Answer Apple Inc. is contemplating the acquisition of Blackberry Ltd. Information for the two companies is given in the table below. Blackberry has many patents that would be valuable to Apple. Apple executives estimate that the acquisition would unlock $5.5 bilion of additional value. Use this information to answer the question that follows. What will the price of the merged firm (Pm) be if Apple offers Blackberry shareholders $5.70 per share in cash and the rest in shares of the merged firm, such that Apple retains 57% of the synergies? Make your answer accurate to two decimal places. That is, if your answer is 14.256 write 14.26. Your

Apple Inc. is contemplating the acquisition of Blackberry Ltd. Information for the two companies is given in the table below. Blackberry has many patents that would be valuable to Apple. Apple executives estimate that the acquisition would unlock $5.5 bilion of additional value. Use this information to answer the question that follows. What will the price of the merged firm (Pm) be if Apple offers Blackberry shareholders $5.70 per share in cash and the rest in shares of the merged firm, such that Apple retains 57% of the synergies? Make your answer accurate to two decimal places. That is, if your answer is 14.256 write 14.26. Your Answer: Answer Apple Inc. is contemplating the acquisition of Blackberry Ltd. Information for the two companies is given in the table below. Blackberry has many patents that would be valuable to Apple. Apple executives estimate that the acquisition would unlock $5.5 bilion of additional value. Use this information to answer the question that follows. What will the price of the merged firm (Pm) be if Apple offers Blackberry shareholders $5.70 per share in cash and the rest in shares of the merged firm, such that Apple retains 57% of the synergies? Make your answer accurate to two decimal places. That is, if your answer is 14.256 write 14.26. Your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started